Why the Employee Retention Credit Specialist Makes All the Difference

An Employee Retention Credit specialist is a tax professional with crucial expertise in navigating the post-filing landscape of the ERC—a refundable federal payroll tax credit that was worth up to $26,000 per employee. With the filing deadlines now passed, these specialists focus on helping businesses substantiate their claims, ensure compliance, and provide robust audit defense. Their role is essential for protecting businesses from costly IRS penalties and repayment demands.

Key reasons to work with an Employee Retention Credit specialist in the post-filing era:

- Navigating complex eligibility rules – Proving your business qualified correctly is the cornerstone of audit defense.

- Claim substantiation – Specialists ensure your calculations and documentation can withstand IRS scrutiny.

- Audit protection – With the IRS ramping up audits, professional representation is critical. As of late 2023, the IRS had initiated 301 criminal investigations into ERC claims totaling over $3.4 billion.

- Risk mitigation – Avoid penalties, interest, and repayment demands from claims the IRS deems improper.

- Resolving claim issues – Specialists help address IRS inquiries and steer the long processing backlog.

The COVID-19 pandemic devastated American businesses. The U.S. Bureau of Labor Statistics reported a record unemployment rate of 14.7% in April 2020—the highest in over five decades. In response, the CARES Act created the Employee Retention Credit as an economic lifeline for businesses that retained employees through shutdowns and revenue losses.

But the ERC journey is far from over, even after a claim has been filed.

The IRS has issued repeated warnings about aggressive promoters misleading businesses about eligibility. Many companies have filed improper claims and now face audits, penalties, and demands to repay credits they received. Others have left money on the table by not understanding the full scope of their eligibility or how to properly calculate qualified wages.

This is where specialized expertise becomes essential.

A qualified Employee Retention Credit specialist does more than just review old forms. They analyze your original claim, stress-test it against the latest IRS guidance, and build a defensive file of documentation designed to withstand scrutiny. They become your partner in defending one of the most complex and scrutinized tax credits in recent history.

I’m Santino Battaglieri, and I’ve led SFG Capital through the funding and purchase of over $500 million in ERC claims, working alongside experienced tax professionals and qualified legal counsel to help businesses steer this complex credit with a compliance-first approach. As an Employee Retention Credit specialist, I’ve seen how proper guidance protects businesses while maximizing their recovery.

Understanding the Employee Retention Credit (ERC): A Lifeline for Businesses

The Employee Retention Credit (ERC) was a crucial component of the government’s response to the economic upheaval caused by the COVID-19 pandemic. It was designed to encourage businesses to keep employees on their payrolls even when facing significant financial hardship or operational disruptions. This refundable tax credit provided a much-needed lifeline, helping countless businesses, including those right here in Travis County, Austin TX, weather the storm.

What is the ERC and Who Qualifies?

At its core, the ERC is a refundable tax credit against certain employment taxes. This means that if the credit amount exceeds a business’s tax liability, the IRS sends a refund for the difference. It was established under the CARES Act in March 2020 and later expanded and extended by the Consolidated Appropriations Act in 2021. The program’s creation acknowledged that the pandemic “impacted the payroll of 45.3% of companies with employees” in 2020, with 39.2% reducing hours, benefits, or pay.

To qualify for the ERC, businesses generally needed to meet one of two primary criteria for the eligible quarters in 2020 and 2021:

-

Significant Decline in Gross Receipts:

- For 2020: A business qualified if its gross receipts for a calendar quarter were less than 50% of its gross receipts for the same calendar quarter in 2019.

- For 2021: A business qualified if its gross receipts for a calendar quarter were less than 80% of its gross receipts for the same calendar quarter in 2019. Businesses could also elect to look back to the immediately preceding calendar quarter to determine eligibility.

-

Full or Partial Suspension of Operations:

- A business qualified if its operations were fully or partially suspended due to government orders limiting commerce, travel, or group meetings because of COVID-19. This includes orders from federal, state, or local authorities that affected a business’s ability to operate, even if only partially. For businesses in Austin, TX, this could have included capacity restrictions on restaurants, mandatory closures of non-essential businesses, or limitations on events.

- This criterion is often more subjective and complex to prove, requiring thorough documentation of the specific government orders and their direct impact on operations.

In addition to these criteria, employee count thresholds played a role. For 2020, businesses generally needed to have had 100 or fewer full-time employees in 2019 to claim the credit for all employees. For 2021, this threshold increased to 500 or fewer full-time employees. For businesses above these thresholds, the credit was only available for wages paid to employees who were not providing services.

A special category, Recovery Startup Businesses, was also introduced for the third and fourth quarters of 2021. These businesses qualified if they:

- Began operations after February 15, 2020.

- Had average annual gross receipts not exceeding $1,000,000.

- Did not meet the gross receipts decline or government shutdown criteria.

Understanding these nuances is where an Employee Retention Credit specialist truly shines. For more detailed information on how we can help determine your eligibility, you can explore More info about our services.

Calculating Your Potential Credit and Key Deadlines

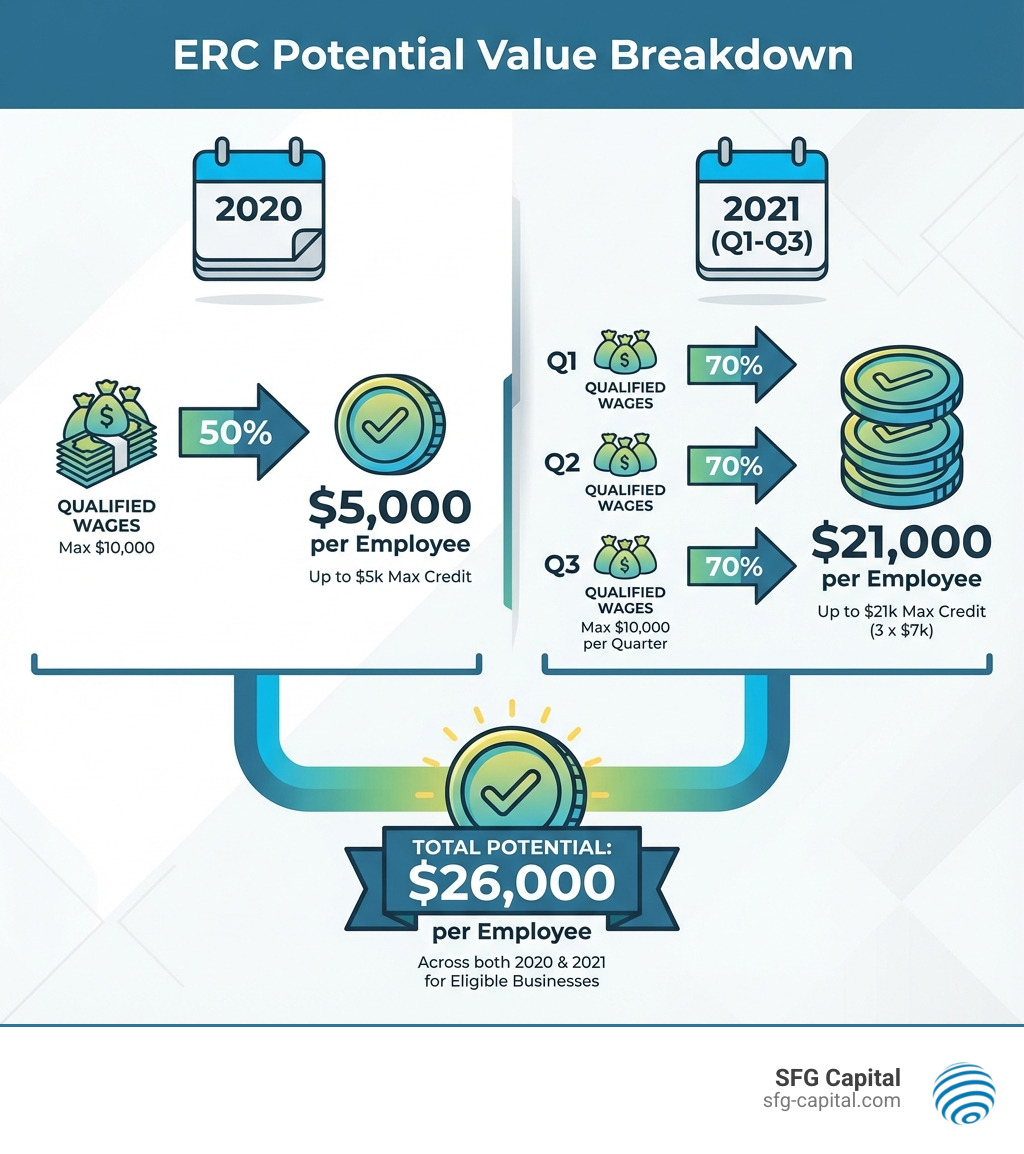

The financial benefits of the ERC are substantial, offering up to $26,000 per employee across the eligible periods. Let’s break down the maximum credit amounts:

- For 2020: The credit was 50% of the first $10,000 in qualified wages per employee for the year, meaning a maximum of $5,000 per employee.

- For 2021: The credit was increased to 70% of the first $10,000 in qualified wages per employee per quarter for the first three quarters (Q1, Q2, Q3). This could amount to a maximum of $7,000 per employee per quarter, or up to $21,000 per employee for the year.

Combining 2020 and 2021, an eligible business could receive up to $26,000 per W-2 employee. This credit does not have to be repaid and has no restrictions on how the funds can be used, providing flexible relief for businesses.

Many businesses also participated in the Paycheck Protection Program (PPP). Initially, businesses could not claim both PPP and ERC. However, subsequent legislation changed this, allowing businesses to qualify for both. The key is that the same wages cannot be used for both PPP loan forgiveness and ERC calculation. This interaction requires careful optimization, as specialists can help allocate wages strategically to maximize benefits from both programs.

While the ERC provided a critical lifeline, the deadlines for claiming it have now passed. The final deadlines to amend past payroll tax returns (Form 941-X) were:

- For 2020 wages: April 15, 2024.

- For 2021 wages: April 15, 2025.

With the filing window closed, the focus for businesses has shifted from claiming the credit to ensuring compliance and preparing for potential audits on claims already submitted. Understanding the original rules by reviewing Form 941-X is now more important than ever for defending your claim. Given the complexities, working with an experienced Employee Retention Credit specialist is crucial to ensure the accuracy of your past claim. Once you secure your credit, you can explore 5 Ways to Use ERC Funds to Strengthen Your Business.

The Risks of Going It Alone: Why You Need an Employee Retention Credit Specialist

While the ERC offered significant financial relief, the post-filing period is fraught with potential pitfalls for businesses with improperly filed claims. The IRS has been increasingly vocal about the risks associated with improper claims, making the guidance of a reputable Employee Retention Credit specialist more vital than ever for audit defense and compliance. Navigating the aftermath of an ERC claim without expert assistance can lead to severe consequences.

The Dangers of Improper Claims and Inadequate Guidance

The IRS has issued repeated warnings about third parties, often dubbed “ERC mills,” aggressively promoting the credit to ineligible businesses. The IRS warns of third parties offering to help businesses claim the ERC when they may not be eligible. These third parties may charge exorbitant up-front fees, mislead companies about their eligibility, the filing process, calculations, and income tax ramifications and solicit offers for tax savings …. These promoters may make “too good to be true” promises, charge high upfront fees, and lack the specialized tax and legal expertise needed to ensure compliance.

The risks of falling prey to such schemes or simply making an honest mistake when self-filing are substantial:

- IRS Audits: The IRS has significantly ramped up its audit activity concerning ERC claims. Discrepancies between claimed amounts and IRS data, obvious filing errors, or an inability to reconcile the credit with income tax can all trigger an audit.

- Penalties and Interest: Incorrectly claiming the ERC can result in hefty penalties and interest charges on the amount that was improperly claimed.

- Repayment of Credit: If an audit determines your business was ineligible or claimed too much, you will be required to repay the credit received, potentially with penalties and interest, which can cripple a business’s finances.

- Criminal Investigations: In severe cases of fraud or deliberate misrepresentation, the IRS has initiated criminal investigations. As of late 2023, the IRS had initiated 301 criminal investigations of ERC claims totaling over $3.4 billion.

These consequences underscore the importance of accurate claims and thorough documentation from the outset. Without specialized guidance, businesses in Austin, TX, risk turning a potential benefit into a costly liability.

What a Reputable Employee Retention Credit Specialist Provides

An Employee Retention Credit specialist offers a comprehensive suite of services designed to maximize your claim while ensuring strict compliance with IRS regulations. Unlike “ERC mills” or less experienced providers, a reputable specialist prioritizes accuracy and audit-readiness. Here’s what they bring to the table:

- Thorough Eligibility Analysis: We dig deep into your business’s financial records and operational history, scrutinizing gross receipts data and government orders to definitively establish eligibility. This includes complex scenarios like partial suspensions or supply chain disruptions.

- Optimized Credit Calculations: We accurately calculate qualified wages for each eligible quarter, considering the intricate rules around employee count thresholds and the interaction with other relief programs like PPP. Our goal is to maximize your legitimate credit.

- Robust Documentation Support: We guide you in gathering and organizing all necessary documentation, ensuring your claim is fully substantiated and prepared to withstand IRS scrutiny. This includes payroll records, general ledgers, government orders, and detailed narratives.

- Proactive Audit Defense: A true specialist doesn’t just help you file; they help you prepare for a potential audit. This includes providing tax opinions, assisting with IRS inquiries, and representing your business during an audit.

- Transparent Fee Structures: Reputable specialists typically charge performance-based or contingency fees, meaning their success is tied to yours. This contrasts sharply with “ERC mills” that demand large, non-refundable upfront fees regardless of the outcome.

- Up-to-Date IRS Guidance: The ERC rules have evolved, and the IRS continues to issue new guidance. A specialist stays abreast of these changes, ensuring your claim adheres to the latest requirements.

The qualities to look for in a specialist include a deep understanding of payroll tax law, experience with IRS audits, and a commitment to transparent, ethical practices. We pride ourselves on offering top-level services at a competitive rate, ensuring you get the most optimized payout possible while remaining audit-proof.

The Value of Specialized ERC Expertise

The ERC is not a simple tax deduction; it’s a complex payroll tax credit governed by specific and often nuanced IRS guidance. General CPAs, while excellent at income tax, may not have the specialized knowledge required to steer the intricacies of the ERC, which involves payroll tax, labor law, and economic analysis. This is why a dedicated Employee Retention Credit specialist is invaluable.

Our specialized tax knowledge allows us to:

- Interpret complex IRS notices and FAQs (like IRS Notice 2021-65), applying them to your unique business situation.

- Strategically allocate wages between PPP forgiveness and ERC to ensure maximum benefit without double-dipping.

- Provide robust audit representation, leveraging our experience with IRS procedures to defend your claim effectively.

- Offer professional opinions and advice, giving you confidence in the legitimacy of your claim.

Here at SFG Capital, we understand that waiting for your ERC refund can be a significant challenge for businesses in Travis County. That’s why we don’t just help you file; we offer advances or buyouts on your approved ERC claims. This means you can bypass the often lengthy IRS processing delays and gain quick access to the funds your business needs to grow and thrive. Our performance-based fee structure ensures that our success is directly aligned with yours, providing expert claim assistance and expedited funding when you need it most.

Preparing for IRS Scrutiny: Audits, Documentation, and Compliance

The IRS has made it clear that ERC claims are a priority for compliance efforts. This means that businesses, even those that filed correctly, should be prepared for potential IRS scrutiny. Proactive preparation and meticulous documentation are your best defense.

Building an Audit-Proof ERC Claim: Essential Documentation

The foundation of any defensible ERC claim is thorough documentation and substantiation. This is not just about having the right forms; it’s about having a clear, auditable trail that supports every aspect of your eligibility and calculation. Here’s what you’ll need to support an ERC claim and prepare for potential audits:

- Payroll Records: Detailed payroll data (Forms 941, W-2s, payroll registers) for all eligible quarters, clearly showing qualified wages paid to employees.

- Gross Receipts Data: Quarterly income statements or other financial records comparing gross receipts for 2019, 2020, and 2021 to prove a significant decline.

- Government Shutdown Orders: Copies of specific federal, state, or local government orders (e.g., from the City of Austin or Travis County) that led to a full or partial suspension of your business operations. This should include effective dates and specific prohibitions.

- Proof of Impact from Suspension: Documentation showing how the government orders impacted your business. This could include reduced operating hours, capacity limits, inability to travel, or supply chain disruptions directly linked to government mandates.

- PPP Loan Documents: If you received a Paycheck Protection Program loan, documentation proving which wages were used for PPP forgiveness versus ERC.

- Employee Headcounts: Records of full-time employee counts for 2019, 2020, and 2021 to support the small employer definitions.

The importance of substantiation cannot be overstated. When the IRS audits, they will ask for this information, and having it readily available and organized can significantly streamline the process and strengthen your position. An Employee Retention Credit specialist will help you compile this “audit-ready” package.

Navigating IRS Audits and Recent Enforcement Initiatives

The IRS has significantly increased its focus on ERC compliance. In September 2023, the IRS announced a moratorium on processing new ERC claims filed on or after September 14, 2023, through at least the end of 2023. This was a direct response to a surge in questionable claims and aggressive marketing by “ERC mills.”

Key things businesses in Travis County should be aware of regarding IRS audits and initiatives:

- Increased Audit Activity: The IRS has thousands of audits and investigations underway, targeting potentially fraudulent claims. They are particularly focused on high-dollar claims and those filed by businesses that appear to be ineligible.

- Audit Triggers: Several factors can spark an ERC audit, including discrepancies in claimed amounts compared to IRS data, obvious filing errors (like no tax preparer signature), or an inability to reconcile the credit with your income tax returns.

- What to Expect During an Audit: An IRS audit typically involves an initial interview with the business, followed by an Information Document Request (IDR) for supporting documentation. The IRS will review your records to verify eligibility and the accuracy of your credit calculation.

- Defending Your Claim: If selected for an audit, prompt and organized responses are crucial. Having an Employee Retention Credit specialist or tax attorney represent you can be invaluable. They can communicate directly with the IRS, provide the requested documentation, and articulate the legal and factual basis for your claim. If your claim is denied, you have the right to appeal the decision.

For further guidance, the IRS provides an Employee Retention Credit Eligibility Checklist: Help understanding this complex credit . Navigating an audit can be stressful and time-consuming, which is why we also offer insights on Expediting Your ERC Refund: What You Need to Know.

Correcting a Mistake: The IRS Withdrawal and Voluntary Disclosure Programs

Recognizing that many businesses were misled or made honest mistakes, the IRS introduced special programs to help them correct improper ERC claims. While the deadlines for these programs have passed, they highlight the agency’s focus on enforcement.

- ERC Claim Withdrawal Program: This program allows businesses that filed an ERC claim but have not yet received or deposited the refund to withdraw their claim. This is particularly useful for businesses that now realize they may not be eligible or that their claim was incorrect. Withdrawing the claim can help avoid penalties, interest, and potential criminal liability down the road.

- Voluntary Disclosure Program: For businesses that had already received an incorrect ERC refund, the IRS offered a limited-time Voluntary Disclosure Program. This program, which ended on March 22, 2024, allowed taxpayers to repay 80% of the credit received while avoiding other penalties and interest. Businesses that missed this deadline may now face standard IRS audit and collection procedures if their claim is found to be ineligible.

These past programs offered a critical opportunity for businesses to get right with the IRS and mitigate risks. A qualified Employee Retention Credit specialist can help you assess the strength of your past claim and prepare a defense strategy, ensuring that any corrections are made accurately and compliantly if an audit arises.

Frequently Asked Questions about the ERC

We often hear similar questions from businesses in Austin, TX, and Travis County regarding the Employee Retention Credit. Here are some of the most common ones:

Can I still claim the ERC if I received a PPP loan?

No, the deadlines to file new ERC claims have passed. However, the interaction between the ERC and your PPP loan remains one of the most critical areas of scrutiny during an IRS audit. You were not allowed to use the same wages for both PPP loan forgiveness and the ERC. If your business claimed both, an Employee Retention Credit specialist can review your original allocation to ensure it was done correctly and help you prepare the documentation to defend it, which is crucial for passing an audit.

What are the deadlines to file for the ERC?

The deadlines to file for the ERC have already passed. The program was retrospective for wages paid in 2020 and 2021, and the final deadlines to amend the corresponding payroll tax returns (Form 941-X) were:

- For 2020 wages: April 15, 2024.

- For 2021 wages: April 15, 2025.

No new claims can be submitted. The focus now for all businesses that filed a claim is on compliance and audit readiness.

How much does an Employee Retention Credit specialist charge?

Fee structures for Employee Retention Credit specialist services vary depending on the service. For claim filing, many reputable firms operated on a contingency fee model, where the fee was a percentage of the credit recovered. For post-filing services like audit defense and compliance reviews, fees may be structured differently, such as an hourly rate or a flat fee for representation. Our firm continues to offer performance-based fees for helping clients secure funds they are owed that are stuck in the IRS backlog. In any case, you should be wary of providers who charged large, non-refundable upfront fees for filing. A reputable specialist will always be transparent about their fee structure, whether it’s for filing assistance or audit defense.

Conclusion: Secure Your Credit and Your Business’s Future

The Employee Retention Credit represented a significant opportunity for businesses in Travis County, Austin TX, to recover from the pandemic’s financial impacts. Now, in the post-filing era, it represents a significant compliance risk for those who filed improperly. Given the complexity of the rules and the IRS’s heightened scrutiny, defending your claim alone is a risky endeavor. The value of an expert Employee Retention Credit specialist is now more critical than ever.

By partnering with a knowledgeable specialist, you can validate your claim, ensure compliance, and build a robust defense for a potential audit, giving you peace of mind. Our team at SFG Capital is dedicated to helping businesses steer the ERC post-filing landscape. For claims that were filed correctly but are stuck in the IRS processing backlog, we continue to offer advances to expedite funding, ensuring you get your money faster.

Don’t expose your business to unnecessary risk. To understand how a specialist can help you defend your claim and get your pending funds quickly, learn more about Our Process.