What is ERC Funding and Why Does It Matter?

What is ERC funding? In the United States, ERC funding refers to the Employee Retention Credit (ERC), a refundable tax credit designed to help businesses that kept employees on payroll during the COVID-19 pandemic. If your business was affected by government shutdowns or experienced significant revenue declines in 2020 or 2021, you may have been eligible for thousands of dollars per employee in tax refunds.

Quick Answer:

- ERC (Employee Retention Credit) is a federal tax credit for US businesses

- Available for wages paid between March 13, 2020, and December 31, 2021

- Businesses can receive up to $26,000 per employee

- You qualified if your operations were suspended by government order OR you experienced a significant decline in gross receipts

- The credit is claimed by filing amended payroll tax returns (Form 941-X)

- Note: “ERC” can also refer to European Research Council funding, which is completely different—this article focuses on the US Employee Retention Credit

Why This Still Matters:

While the deadlines to claim the ERC have passed, the program’s impact is far from over. Many businesses that filed claims are still waiting for their refunds. With IRS processing delays stretching 12-18 months or longer, thousands of business owners are stuck in a queue for money they’ve already earned. This creates cash flow problems exactly when businesses need working capital most.

The stakes are high. The average ERC refund ranges from $50,000 to over $250,000, depending on business size. That’s real money that could cover payroll, equipment upgrades, or expansion costs.

But there’s also risk. The IRS has flagged thousands of fraudulent ERC claims, and aggressive “ERC mills” have pushed ineligible businesses to file bad claims. Getting it wrong means penalties, interest, and potential audits.

As Santino Battaglieri, I’ve spent years helping businesses steer what is ERC funding through SFG Capital, where we’ve purchased and funded over $500 million in ERC claims while maintaining strict compliance standards. Understanding the eligibility and documentation requirements that were in place is critical to substantiating your claim and accessing these funds safely.

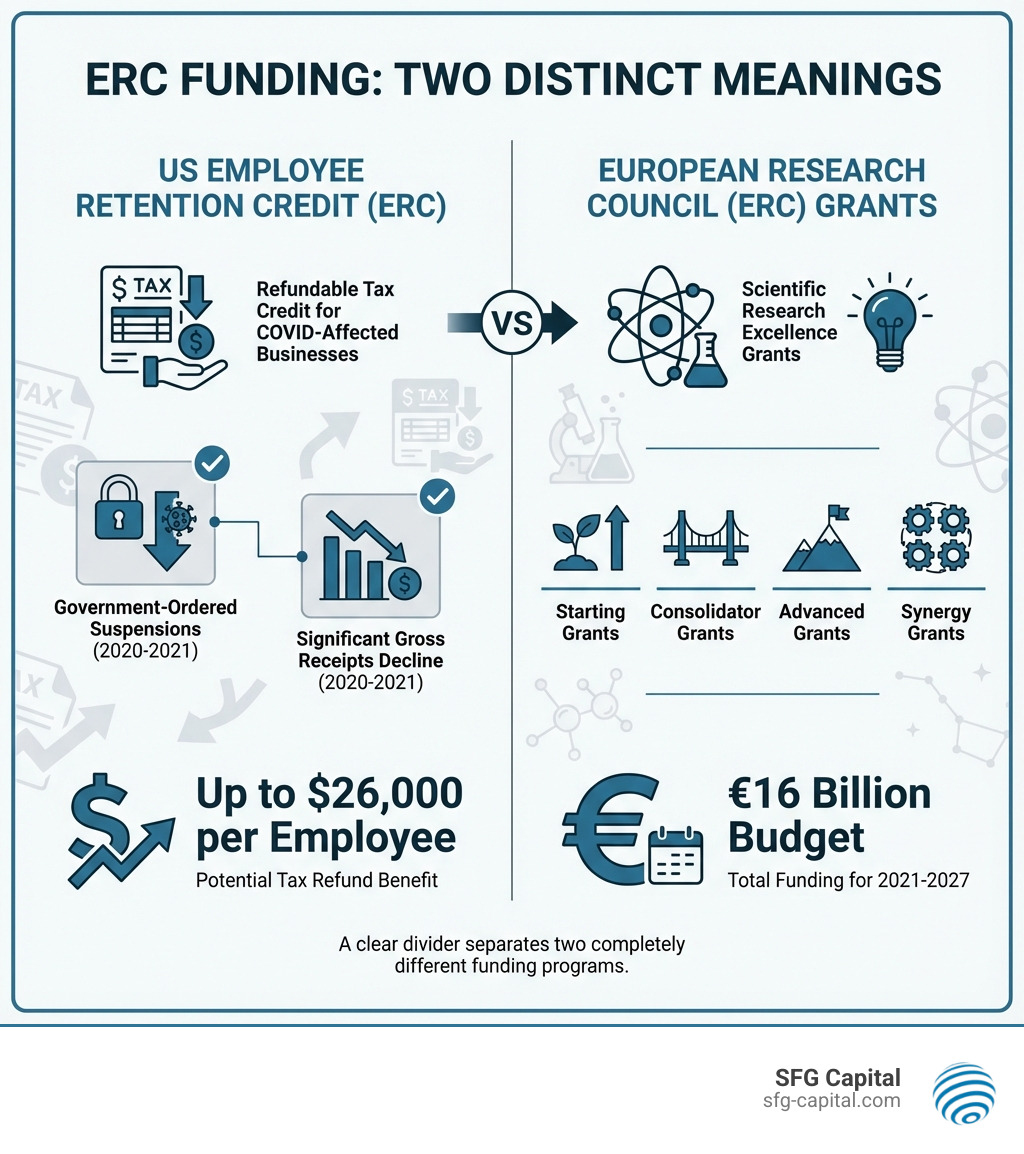

The Two Meanings of “ERC Funding”: A Quick Clarification

When we talk about “ERC funding,” it’s easy to get confused because the acronym “ERC” actually refers to two completely different funding initiatives. One impacts businesses right here in the US, offering a refundable tax credit. The other is a major scientific research grant program across Europe. For the purposes of helping businesses like yours in Travis County, TX, we’re primarily focused on the former: the US Employee Retention Credit. However, let’s take a moment to clarify the distinction.

European Research Council (ERC) Funding

Across the Atlantic, the European Research Council (ERC) is a premier European funding organization dedicated to excellent frontier research. Established by the EU in 2007, its primary mission is to encourage the highest quality research in Europe through competitive funding, supporting investigator-driven research across all fields based on scientific excellence.

The ERC operates under Horizon Europe’s Pillar I – ‘Excellent Science’, aiming to promote scientific excellence and attract highly-skilled researchers and innovators to Europe. It offers various grants, including:

- Starting Grants: For early-career researchers (2-7 years post-PhD).

- Consolidator Grants: For researchers consolidating their team and program (7-12 years post-PhD).

- Advanced Grants: For established, leading principal investigators with a strong track record.

- Synergy Grants: For groups of 2-4 researchers collaborating on ambitious projects.

- Proof of Concept Grants: For existing ERC grantees to explore the commercial or societal potential of their research.

The overall budget for the ERC from 2021 to 2027 is more than €16 billion, which is about 17% of the total Horizon Europe budget. Since its inception, the ERC has funded over 17,000 projects and supported more than 10,000 researchers, leading to significant scientific achievements, including Nobel Prizes, Fields Medals, and numerous patents and start-ups. Each grantee, on average, employs seven team members, fostering a vibrant research ecosystem.

While incredibly impactful for the global scientific community, this type of ERC funding is distinctly separate from the tax credit available to US businesses. You can learn more about the European Research Council at their official website: European Research Council.

What is ERC Funding for US Businesses? (The Employee Retention Credit)

Now, let’s shift our focus to what is ERC funding for businesses in the United States, which is the core of our discussion and SFG Capital’s expertise. The Employee Retention Credit (ERC), sometimes called the ERTC, is a refundable tax credit. It was established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 to encourage businesses to keep employees on their payrolls during the economic disruptions caused by the COVID-19 pandemic.

Unlike a loan that needs to be repaid, the ERC is a direct credit against certain employment taxes. This means that if the credit exceeds your tax liability, the IRS sends you the difference as a refund check. This credit was designed to provide crucial financial relief to businesses that faced challenges such as government-mandated shutdowns or significant drops in revenue.

The ERC applies to qualified wages paid between March 13, 2020, and December 31, 2021. This credit has been a lifeline for many employers, allowing them to retain staff, cover operational costs, and steer an unprecedented economic downturn.

For comprehensive information from the official source on the Employee Retention Credit, we recommend visiting the Employee Retention Credit | Internal Revenue Service page.

Were You Eligible for the Employee Retention Credit?

Understanding the original eligibility rules is the most critical step in substantiating your ERC claim. The rules were complex, and they changed between 2020 and 2021. However, the core idea remains: the credit was for businesses that were genuinely impacted by the pandemic and chose to retain their employees.

Generally, your business in Travis County, TX, was eligible if it met one of two primary criteria during 2020 or 2021:

- Full or Partial Suspension of Operations: Due to a government order limiting commerce, travel, or group meetings because of COVID-19.

- Significant Decline in Gross Receipts: Compared to a corresponding quarter in 2019.

There was also a third pathway for “Recovery Startup Businesses” in Q3 and Q4 2021, but the first two were the most common. Let’s dive deeper into these historical pathways.

Pathway 1: Suspension of Operations

This pathway applied if your business experienced a full or partial suspension of operations due to a government order related to COVID-19. This didn’t mean your business had to close completely. Even a partial suspension, or a modification of operations, could have qualified you.

For example, if your restaurant in Austin, TX, was forced to limit indoor dining capacity, implement social distancing, or switch to takeout-only service due to state or local government mandates, that could have constituted a partial suspension. Similarly, if a government order impacted your supply chain, making it impossible to obtain critical goods, and this forced a reduction in your operating hours or capacity, that might also have qualified.

The key was that the government order must have limited your business’s ability to operate in its normal course, and this limitation must have been due to COVID-19. This is where the details matter, and a thorough review of local and state orders from 2020 and 2021 is essential for defending a claim.

Pathway 2: Significant Decline in Gross Receipts

This pathway was typically more straightforward to quantify. It involved comparing your business’s gross receipts (total revenue) during eligible quarters in 2020 and 2021 to corresponding quarters in 2019.

-

For 2020: Your business qualified for the ERC if its gross receipts for a calendar quarter were less than 50% of its gross receipts for the same calendar quarter in 2019. Once this 50% threshold was met, you continued to qualify until the quarter following the one in which your gross receipts were greater than 80% of your gross receipts for the same calendar quarter in 2019.

-

For 2021: The rules became a bit more generous. Your business qualified if its gross receipts for a calendar quarter were less than 80% of its gross receipts for the same calendar quarter in 2019. You could also elect to use the immediately preceding calendar quarter to determine if you met the gross receipts test. For example, to determine eligibility for Q1 2021, you could have compared Q4 2020 gross receipts to Q4 2019 gross receipts.

This pathway allowed many businesses that weren’t directly shut down but still felt the economic pinch of the pandemic to qualify. For more detailed definitions and examples, the IRS provides extensive FAQs on the matter: Frequently asked questions about the Employee Retention Credit.

What were “Qualified Wages”?

Once a business determined its eligibility through one of the pathways, the next step was to calculate the credit based on “qualified wages.” These were the wages and compensation subject to FICA taxes (Social Security and Medicare), as well as qualified health plan expenses paid by the employer.

The definition of qualified wages depended on the size of your business and the specific period:

- For businesses with more than 100 full-time employees (FTEs) in 2019 (for 2020 claims) or more than 500 FTEs in 2019 (for 2021 claims): Qualified wages were generally those paid to employees not providing services due to the suspension or decline in gross receipts. Essentially, you received credit for paying employees who weren’t actively working.

- For businesses with 100 or fewer FTEs in 2019 (for 2020 claims) or 500 or fewer FTEs in 2019 (for 2021 claims): All wages paid to employees during the eligible period, regardless of whether they were providing services, generally counted as qualified wages. This was a significant relief for small and medium-sized businesses, allowing them to count wages paid to working employees.

The same wages could not be used for both the ERC and other federal programs, such as Paycheck Protection Program (PPP) loan forgiveness. This was known as the “no double-dipping” rule.

Understanding and properly documenting your qualified wages is crucial for determining the full extent of your ERC refund. These funds can be vital for strengthening your business’s financial health, as we discuss in our guide, 5 Ways to Use ERC Funds to Strengthen Your Business.

The ERC Claim Process and Navigating Delays

Once eligibility was established and qualified wages were calculated, the process of claiming the ERC involved filing amended tax returns. However, this hasn’t always been a smooth journey, especially with the current landscape of IRS processing delays.

How the ERC Was Claimed: Filing Form 941-X

The Employee Retention Credit was claimed by filing an amended payroll tax return, specifically Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form allowed businesses to correct errors on a previously filed Form 941 (Employer’s Quarterly Federal Tax Return) or claim a refund of overpaid taxes.

For each eligible quarter in 2020 and 2021, businesses needed to submit a separate Form 941-X. This form required detailed documentation, including:

- The original Form 941 for the quarter.

- Records of qualified wages paid.

- Proof of eligibility (e.g., government orders, gross receipts calculations).

- Calculations of the credit amount.

Given the complexity of tax law and the specific requirements for the ERC, working with a knowledgeable tax professional was highly recommended. Our team at SFG Capital ensures that all documentation is carefully prepared and compliant with IRS guidelines, minimizing the risk of errors or audits for our clients in Travis County, TX.

The Challenge: Navigating IRS Processing Delays

Here’s where many businesses face a significant hurdle. While the ERC offers substantial refunds, the IRS has been overwhelmed with the volume of claims. The result? Unprecedented processing delays.

Currently, the IRS is processing approximately 400,000 claims worth about $10 billion, but the backlog means that businesses are waiting 12-18 months, or even longer, to receive their refunds. For a business that needs capital now—whether for inventory, equipment, or expansion—waiting over a year for funds can be detrimental. This can create severe cash flow issues, hindering growth and stability.

At SFG Capital, we understand that waiting isn’t always an option. That’s why we specialize in providing ERC advances and buyouts, helping businesses in Austin, TX, bypass these lengthy IRS delays. We convert your pending refund into immediate working capital, allowing you to access your funds without the agonizing wait. You can learn more about how we help expedite your refund in our detailed guide, Expediting Your ERC Refund: What You Need to Know.

Warning Signs of ERC Scams

The popularity and complexity of the ERC have unfortunately attracted unscrupulous promoters, often referred to as “ERC mills.” These entities often make misleading claims, push ineligible businesses to apply, and charge exorbitant fees. The IRS has issued strong warnings about these scams, and we want to help you identify them. Here are key warning signs to look out for:

- Unsolicited Calls or Advertisements: Be wary of aggressive marketing from unknown third parties promising easy ERC money.

- Promises of Guaranteed Eligibility: No legitimate professional can guarantee your eligibility without a thorough review of your specific business circumstances. The ERC is complex, and eligibility is never a given.

- Large Upfront Fees: Scammers often demand significant fees before providing any services or even determining eligibility. Legitimate firms typically operate on a performance-based fee, only getting paid if you receive your refund.

- Fees Based on a Percentage of the Refund Without Support: While performance-based fees are common, be cautious of those charging a high percentage without providing comprehensive support, including meticulous documentation and audit protection.

- Pressure to Sign Quickly: If a promoter rushes you or pressures you into making a decision without adequate time for review, it’s a major red flag.

- Claims That “Every Business Qualifies”: This is simply untrue. Eligibility for the ERC was based on specific criteria related to government orders or gross receipts decline, which not every business met.

- Lack of Detailed Documentation Request: A reputable professional will ask for extensive financial records, payroll data, and details about your business operations during the pandemic. If they don’t, they might be cutting corners.

The IRS urges taxpayers to review their claims and quickly resolve incorrect ones. If you need help or advice about the credit or resolving an incorrect claim, the IRS urges you to seek out a reputable tax professional. We pride ourselves on transparent, compliant services designed to protect your business.

Frequently Asked Questions about ERC Funding

We hear a lot of questions about the Employee Retention Credit from business owners in Travis County, TX. Let’s tackle some of the most common ones to help clarify the process and its aftermath.

Is it too late to apply for the ERC?

Yes, unfortunately, the deadlines to file new claims for the Employee Retention Credit have passed. The statute of limitations for claiming the credit was generally three years from the date of the original tax filing.

This means:

- The deadline for claims related to 2020 wages was April 15, 2024.

- The deadline for claims related to 2021 wages was April 15, 2025.

While new claims are no longer being accepted, many businesses that filed before the deadlines are still navigating the process. This includes waiting for the IRS to process their refund, responding to information requests, or preparing for potential audits. Understanding the rules that were in place is now more important than ever for substantiating a claim that has already been filed.

Could I claim the ERC if I received a PPP loan?

This was a common question, and the answer was yes, with limitations! Initially, under the original CARES Act, businesses could not claim the ERC if they received a PPP loan. However, this was retroactively changed by the Consolidated Appropriations Act, 2021.

The new legislation allowed businesses to benefit from both programs. The key limitation was that the same wages could not be used to qualify for both PPP loan forgiveness and the ERC. In other words, there was no “double-dipping.”

When calculating the ERC, businesses had to exclude any wages that were used to achieve PPP loan forgiveness. This required careful planning and precise accounting to ensure compliance and maximize both benefits. Many businesses found that even after accounting for PPP wages, they still had substantial qualified wages eligible for the ERC, leading to significant additional refunds.

How was the ERC credit amount calculated?

The amount of the ERC a business could claim depended on the year and the qualified wages paid:

-

For 2020: The credit was equal to 50% of qualified wages paid. The maximum qualified wages per employee for the entire year was $10,000, making the maximum credit per employee for 2020 $5,000.

-

For 2021 (Q1, Q2, Q3): The credit became more generous. It was equal to 70% of qualified wages paid. The maximum qualified wages per employee was $10,000 per calendar quarter. This meant the maximum credit per employee for each eligible quarter in 2021 was $7,000. A business that qualified for all three available quarters in 2021 could claim up to $21,000 per employee for that year.

Combining these, an eligible business could potentially claim up to $26,000 per employee across both years ($5,000 for 2020 + $21,000 for 2021). The calculation required careful tracking of wages, health plan expenses, and PPP loan forgiveness details. This is why expert guidance was, and still is, crucial for ensuring the claim was calculated correctly and is defensible in an audit.

Conclusion: Power Your Business Forward with Your ERC Refund

Understanding what is ERC funding and navigating its complexities can seem daunting, but the potential benefits for your business in Travis County, TX, are too significant to ignore. The Employee Retention Credit was a vital lifeline designed to support employers who kept their teams together during the unprecedented challenges of the COVID-19 pandemic. For many, it represents tens or even hundreds of thousands of dollars in legitimate tax refunds.

These funds can be transformative. Imagine what an influx of capital could do for your business:

- Invest in Growth: Upgrade equipment, expand your services, or open new locations.

- Improve Operations: Improve cash flow, manage inventory more effectively, or invest in technology.

- Support Your Team: Provide bonuses, improve benefits, or hire additional staff to meet demand.

The biggest hurdle for many businesses today isn’t eligibility, but the excruciatingly long wait for the IRS to process their refunds. Months and even years of delays can stifle growth and create unnecessary financial strain. That’s where we come in.

At SFG Capital, we’re dedicated to helping businesses like yours overcome these delays. We provide ERC advances and buyouts, giving you immediate access to the funds you’ve earned, rather than waiting indefinitely for the IRS. Our performance-based fee structure ensures that we only succeed when you do, and our expert team carefully handles your claim with strict compliance, protecting you from future issues.

Don’t let your hard-earned refund gather dust at the IRS. Take control of your financial future and power your business forward. Explore how SFG Capital can help you open up your ERC funds today. Learn more about how we can help your business thrive by visiting our page on Funding Growth: How ERC Can Power Your Business Forward.