What You Need to Know About ERC Funding Requirements

ERC funding requirements are the criteria for the Employee Retention Credit, a refundable tax credit from the CARES Act for businesses impacted by COVID-19. Although the credit only applies to wages paid in 2020 and 2021, businesses in 2026 can still work with previously filed or amended payroll tax returns and, in some cases, deal with ongoing IRS processing and compliance questions related to existing ERC claims.

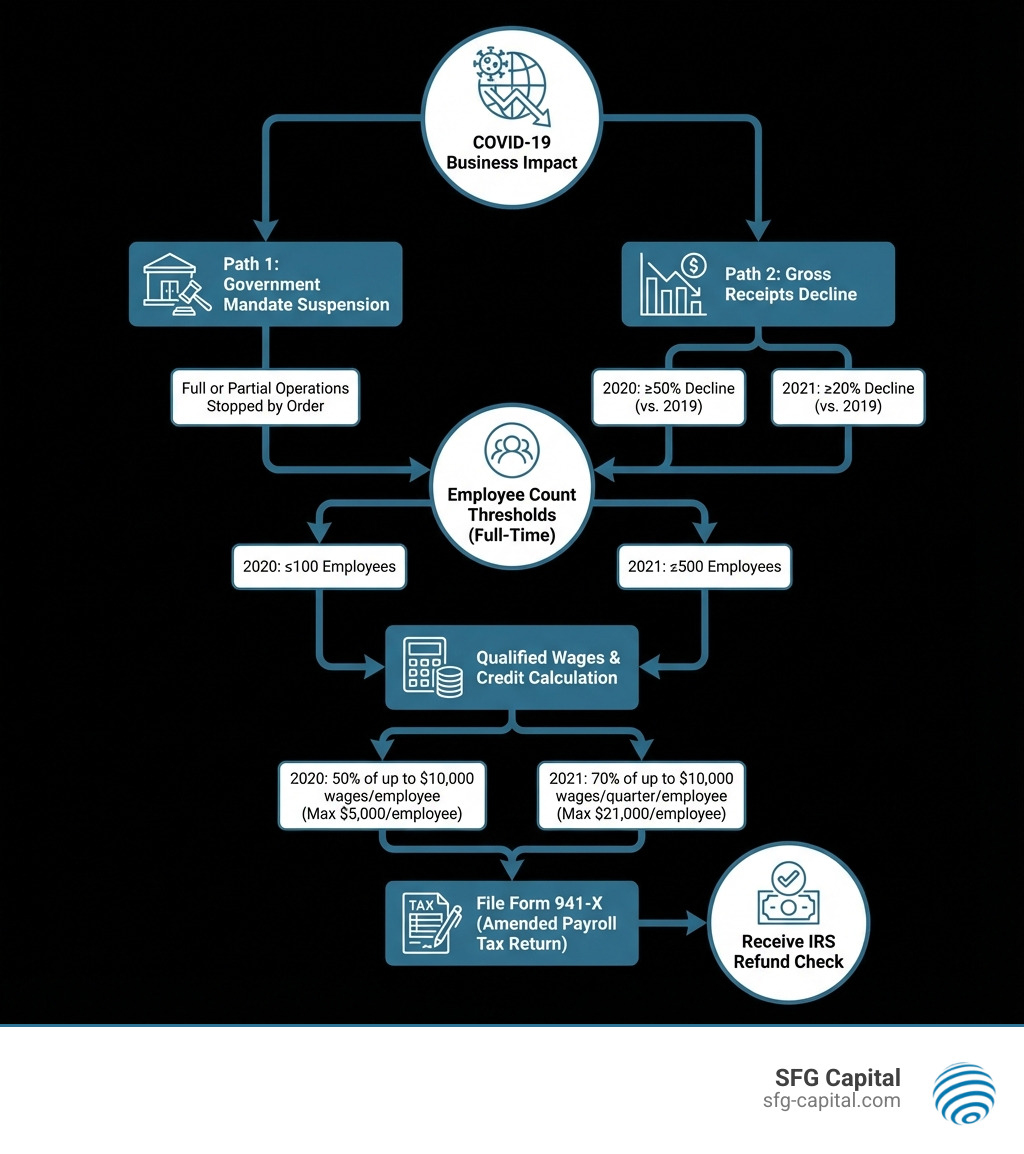

To qualify for the ERC for those past years, your business must have met ONE of the following primary requirements for the relevant quarter:

Primary Requirements (you only need ONE):

- Government Mandate Impact – Your business operations were fully or partially suspended by a government order due to COVID-19.

- Decline in Gross Receipts – Your business experienced a significant revenue drop compared to 2019:

- For 2020: 50% or more decline in any quarter.

- For 2021: 20% or more decline in any quarter.

Additional Requirements:

- Must have W-2 employees on payroll.

- Employee threshold: 100 or fewer full-time employees (2020) or 500 or fewer (2021).

- Maximum credit: Up to $5,000 per employee for 2020, up to $21,000 per employee for 2021.

- Can claim ERC even if you received a PPP loan (rules changed in 2021).

The Employee Retention Credit is not a loan. It was structured as a refundable payroll tax credit you don’t have to repay. For 2020, businesses could receive 50% of the first $10,000 in qualified wages per employee. For 2021, it increased to 70% of the first $10,000 per quarter, meaning up to $7,000 per employee for the first three quarters.

The ERC rewarded businesses for keeping employees on payroll. Unlike the Paycheck Protection Program (PPP) loan, the ERC is a direct refund on payroll taxes. Many businesses mistakenly believed they did not qualify due to strong revenue or not being fully shut down, but expanded rules meant that a large share of businesses were eligible and may still be able to amend returns or need help with existing claims today.

I’m Santino Battaglieri of SFG Capital. I’ve helped businesses steer ERC funding requirements to access over $500 million in claims through a compliance-driven approach. My financial services background has shown me that understanding eligibility is the first step to open uping this valuable refund, even now as companies in Austin, Travis County, and across the U.S. work through remaining opportunities and IRS follow-up on prior-year claims.

Understanding the Core ERC Funding Requirements

The Employee Retention Credit (ERC), established by the CARES Act and later expanded, offered a refundable tax credit to employers who kept employees on payroll during the pandemic. For businesses in Austin and across the U.S., eligibility hinges on one of two primary pathways: a significant decline in gross receipts or a full or partial suspension of operations due to a government order. A business only needs to meet one of these criteria for any given quarter to qualify.

Primary ERC Funding Requirements: The Two Main Pathways

Your business generally qualifies for the ERC if it meets one of these two conditions:

- Government Mandate Impact (Full or Partial Suspension): Your operations were fully or partially suspended due to government orders limiting commerce, travel, or group meetings. This includes capacity restrictions, supply chain disruptions, or reduced operating hours that had a significant impact.

- Decline in Gross Receipts: Your business saw a significant reduction in gross receipts during a calendar quarter in 2020 or 2021 compared to the same quarter in 2019. This offers a clear, quantifiable metric for eligibility.

It’s also crucial to remember that the ERC is for businesses with W-2 employees. The credit is a payroll tax credit, offsetting certain payroll taxes, with any excess refunded to the employer.

If you’re unsure if your business qualifies, our team at SFG Capital specializes in navigating these complex rules for businesses in Travis County and beyond. Learn more on our Our Services page.

Who Qualifies Based on a Significant Decline in Gross Receipts?

The “decline in gross receipts” test is a common way to meet ERC funding requirements. It involves comparing your quarterly gross receipts in 2020 and 2021 to the same quarter in 2019.

Here’s the breakdown:

- For 2020: Your business qualifies if gross receipts for a 2020 quarter were less than 50% of the same quarter in 2019. Eligibility continues for the subsequent quarter, ending when your gross receipts exceed 80% of the corresponding 2019 quarter.

- For 2021: The rules became more generous. Your business qualifies if gross receipts for a 2021 quarter were less than 80% (a 20% decline) of the same quarter in 2019. You can also elect to use the immediately preceding quarter to determine eligibility.

“Gross receipts” generally refers to total income from all sources before deducting costs. Aggregation rules may apply if you’re part of a controlled group, meaning you might need to combine gross receipts from related entities.

Who Qualifies Based on a Full or Partial Suspension of Operations?

Even without a steep revenue decline, you might meet ERC funding requirements through the “full or partial suspension” test. This applies if a governmental order limited your business and had more than a “nominal” impact on your operations.

A “governmental order” must be from a federal, state, or local authority. Recommendations from organizations like the CDC or OSHA don’t qualify unless incorporated into a mandatory order.

Examples of qualifying restrictions include:

- Capacity Restrictions: Mandated reductions in indoor dining or retail customer limits.

- Supply Chain Disruptions: A government order preventing you from obtaining critical goods, suspending a significant portion of your operations.

- Mandatory Closures: Non-essential businesses ordered to close.

- Restricted Travel: Prohibitions on travel or in-person events your business relies on.

The key is “more than a nominal impact,” which is a complex area. Our team is well-versed in interpreting these nuanced rules for Travis County businesses. For more details, check out More info about our process.

Can Businesses That Received a PPP Loan Still Qualify?

Yes. Initially, the CARES Act prohibited businesses with a Paycheck Protection Program (PPP) loan from claiming the ERC. However, the Consolidated Appropriations Act, 2021 retroactively allowed businesses to claim both.

The crucial caveat is you cannot “double-dip.” The same wages cannot be used for both PPP loan forgiveness and the ERC. You must carefully allocate qualified wages to maximize both benefits without violating IRS rules.

ERC in 2020 vs. 2021: Key Differences

The ERC funding requirements changed significantly between 2020 and 2021 due to new legislation, including the American Rescue Plan Act (ARPA) of 2021. These differences are vital for calculating your credit.

Here’s a quick overview of the key differences:

| Feature | 2020 ERC Rules | 2021 ERC Rules |

|---|---|---|

| Credit Rate | 50% of qualified wages | 70% of qualified wages |

| Qualified Wage Limit | Up to $10,000 per employee for the year | Up to $10,000 per employee per quarter |

| Maximum Credit | Up to $5,000 per employee | Up to $7,000 per employee per quarter (max $21,000 for Q1-Q3) |

| Employee Threshold | 100 or fewer full-time employees in 2019 | 500 or fewer full-time employees in 2019 |

| Gross Receipts Decline | 50% or more decline vs. same 2019 quarter | 20% or more decline vs. same 2019 quarter |

| Eligibility Period End | Wages paid after March 12, 2020, through Dec 31, 2020 | Wages paid after Dec 31, 2020, through Sept 30, 2021 (for most businesses) |

ERC Rules for 2020

For wages paid from March 13, 2020, to December 31, 2020, the ERC was based on these specifics:

- Credit Rate: 50% of qualified wages.

- Qualified Wage Limit: $10,000 per employee for the entire year, for a maximum credit of $5,000 per employee.

- Employee Threshold: For “small employers” (100 or fewer full-time employees in 2019), all wages qualified. For larger employers, only wages paid to non-working employees counted.

- Gross Receipts Decline: A 50% or more decline in gross receipts in a 2020 quarter compared to the same 2019 quarter.

ERC Rules for 2021

The 2021 rules made the ERC more valuable and accessible:

- Credit Rate: Increased to 70% of qualified wages.

- Qualified Wage Limit: Increased to $10,000 per quarter. This allowed for a credit of up to $7,000 per employee for each of the first three quarters, totaling $21,000 for the year.

- Employee Threshold: The “small employer” definition expanded to 500 or fewer full-time employees in 2019, allowing more businesses to count all wages paid.

- Gross Receipts Decline: The threshold was lowered to a 20% decline in a 2021 quarter compared to the same 2019 quarter. An alternative quarter election was also available.

While ARPA extended the ERC, the Infrastructure Investment and Jobs Act (IIJA) later retroactively ended it for most employers for wages paid after September 30, 2021.

Navigating the ERC Funding Requirements for Recovery Startup Businesses

A special category, “Recovery Startup Business,” helps businesses launched during the pandemic meet ERC funding requirements. This was beneficial for new ventures in areas like Austin, TX.

A business qualifies as a Recovery Startup Business if it:

- Began operating after February 15, 2020.

- Has average annual gross receipts not exceeding $1,000,000.

- Does not meet the gross receipts decline or government suspension tests.

Recovery Startup Businesses are eligible for the ERC for Q3 and Q4 of 2021, with a maximum credit of $50,000 per quarter. They qualify based on their start date and gross receipts, not a revenue decline or suspension.

How to Claim Your ERC Refund

If you’re eligible, you may still be able to claim the ERC retroactively for qualified wages paid in 2020 and 2021, depending on when you file and whether the statute of limitations has expired for a particular quarter. The process involves amending your previous payroll tax returns.

The Claiming Process and Required Forms

To claim the ERC, you must amend your previously filed payroll tax returns using Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. Businesses using other forms, like Form 943 or 944, would use the corresponding “X” form.

The process is as follows:

- Determine Eligibility: Confirm you meet the ERC funding requirements for each quarter.

- Calculate Qualified Wages: Identify wages paid to W-2 employees, excluding those used for PPP forgiveness. Include eligible employer-paid healthcare costs.

- Complete Form 941-X: Correct your previously filed Form 941 to claim the ERC.

- Submit to IRS: Mail the completed form to the IRS.

Given the complexities, many businesses work with a tax professional. Our team at About Us has extensive experience guiding Travis County businesses through this process to ensure accuracy and maximize the credit.

Essential Documentation to Support Your Claim

The IRS is scrutinizing ERC claims, so meticulous documentation is critical to avoid delays or disallowance.

Here’s a checklist of essential documents:

- Payroll Records: Detailed reports showing wages and employer-paid health plan expenses for each employee per quarter.

- Gross Receipts Data: Quarterly Profit & Loss (P&L) statements for 2019, 2020, and 2021.

- Governmental Orders: Copies of specific government orders that impacted your business.

- PPP Loan Forgiveness Documents: Records showing which wages were used for PPP forgiveness to avoid “double-dipping.”

- Employee Count Records: Documentation of your 2019 full-time employee count.

- Other Supporting Evidence: Records demonstrating COVID-19’s impact, such as communications about operational changes or supply chain issues.

Organized documentation makes the process smoother. We can help you compile and present this information effectively.

Deadlines and Claiming Timelines

While the ERC program ended for most on September 30, 2021, you can claim it only within the applicable statute of limitations for amending payroll tax returns. Historically, the IRS allowed amended filings up to three years after the original due date of the return, which meant:

- For 2020 Claims: Generally April 15, 2024.

- For 2021 Claims: Generally April 15, 2025.

Because the current year is now beyond some of those dates, businesses should consult up-to-date IRS guidance or a qualified professional to confirm whether specific quarters are still open for amendment. If you have already filed ERC claims and are waiting on the IRS, these deadlines do not cancel claims that were timely submitted.

It’s crucial to address any remaining ERC opportunities or IRS correspondence as soon as possible. The IRS has had a significant backlog, with wait times often stretching from six to nine months or longer. Filing timely and responding quickly to notices helps keep your refund or case moving.

We know waiting is challenging. SFG Capital offers solutions to bridge this gap. Learn more about getting faster access to your funds on our page about Expediting Your ERC Refund: What You Need to Know.

Navigating Post-Claim Scenarios and IRS Scrutiny

The IRS is increasing scrutiny of ERC claims to combat fraud. While most claims are legitimate, businesses should be aware of potential pitfalls and red flags.

Red Flags and Warning Signs of ERC Scams

The ERC’s popularity has attracted unscrupulous promoters. The IRS has warned about “ERC mills” making false promises. Watch for these red flags:

- Unsolicited Calls or Ads: Be wary of unexpected messages from unfamiliar companies.

- Large Upfront Fees: Reputable professionals don’t typically charge large fees upfront.

- Percentage-Based Fees: Be cautious if this is the only option or the percentage is excessively high.

- Guarantees of Eligibility: No one can guarantee eligibility without a thorough review.

- Pressure Tactics: Don’t be rushed into signing documents.

- Claims That “Every Business Qualifies”: This is false; eligibility is complex.

- Lack of Documentation Request: A promoter not asking for detailed records is cutting corners.

- Failure to Explain the Rules: A legitimate expert should clearly explain why you qualify.

Seek advice from trusted tax professionals and find official guidance on the Employee Retention Credit | Internal Revenue Service website.

Penalties for Incorrectly Claiming the ERC

Submitting an incorrect ERC claim can lead to serious consequences:

- IRS Audits: Incorrect claims are a prime target for time-consuming audits.

- Repayment of Credit: If your claim is ineligible, you must repay the entire credit amount.

- Interest and Penalties: The IRS will assess interest and may impose penalties:

- Accuracy-Related Penalties: Up to 20% of the underpayment for negligence.

- Fraud Penalties: Up to 75% of the underpayment for fraudulent claims, plus potential criminal charges.

The best defense is an accurate, well-documented initial claim. The expertise of a professional who understands the intricate ERC funding requirements is invaluable.

What to Do If Your ERC Claim is Disallowed

If you receive an IRS notice (like Letter 105-C) disallowing your claim, don’t panic. You have options:

- Administrative Appeal: You generally have the right to appeal the decision by submitting a written protest to the IRS Appeals Office.

- Wage Expense Adjustment: If your ERC is disallowed, you must address the wage expense deduction on your income tax returns. You can either amend the original income tax return to deduct the wages or, in some cases, increase your wage expense on a later tax return. This rule can help avoid the complexity of amending old returns.

- Seek Professional Help: Engage a tax professional specializing in IRS disputes. They can help you understand the IRS’s reasoning and prepare a strong appeal.

Frequently Asked Questions about ERC Funding Requirements

Here are answers to common questions about ERC funding requirements.

How much can a business receive per employee?

The maximum ERC amount per employee depends on the year:

- For 2020: Up to 50% of the first $10,000 in annual qualified wages, for a maximum of $5,000 per employee.

- For 2021: Up to 70% of the first $10,000 in quarterly qualified wages. This means a potential maximum of $7,000 per employee per quarter for the first three quarters, totaling up to $21,000 per employee.

Combined, an eligible business could receive up to $26,000 per W-2 employee over both years, assuming the business met the ERC funding requirements for the relevant quarters and filed accurate, timely claims or amendments.

How long does it take to receive the ERC refund?

Due to a large volume of claims, the IRS has experienced significant delays and has adjusted its processes multiple times. It can still take six to twelve months, or even longer, to receive an ERC refund check, especially for claims filed closer to the statute of limitations or those selected for additional review.

Waiting for funds can be frustrating. SFG Capital offers solutions to help businesses access their funds sooner. You might find our article on 5 Ways to Use ERC Funds to Strengthen Your Business helpful for planning.

Can I still apply for the ERC?

In many cases, the ability to newly apply for or amend ERC claims depends on whether the statute of limitations has expired for the specific quarter and form you are trying to correct. Historically, the deadlines were:

- April 15, 2024, for claims related to 2020 wages.

- April 15, 2025, for claims related to 2021 wages.

Because we are now in 2026, some or all 2020 quarters may no longer be open for new ERC claims, while certain 2021 quarters may still be within the amendment window depending on the original filing dates and any IRS guidance updates.

It is crucial to speak with a knowledgeable tax professional or review the latest IRS instructions to confirm what is still possible for your situation. Acting quickly on any remaining opportunities, and carefully managing existing or pending claims, helps you avoid missing out on this valuable credit or running into preventable compliance issues.

Conclusion: Secure Your ERC Funds with Confidence

Navigating ERC funding requirements is the first step toward securing a significant tax credit for your business. The ERC rewards you for retaining employees during the pandemic, and understanding the rules is key to a successful claim.

We’ve covered the eligibility pathways, the differences between 2020 and 2021, the importance of documentation, and the looming deadlines. The ERC is a testament to your resilience, so don’t leave money on the table.

If you’re unsure where to start or believe your business qualifies, our team at SFG Capital is here to provide clear, compliant, and efficient assistance.

Ready to explore your eligibility? Contact Us today for a personalized assessment. Let us help you secure the funds your business deserves. Learn more about how the ERC can power your business by reading our article Funding Growth: How ERC Can Power Your Business Forward.