Why Understanding Employee Retention Credit Help Matters Now

Employee retention credit help is critical for businesses navigating the complex and scrutinized pandemic-era tax program. With the IRS suspending new claims and intensifying reviews, business owners face confusion about eligibility, audits, and potential disallowances.

Quick Answer: What You Need to Know About Employee Retention Credit Help

- What It Is: The ERC is a refundable tax credit for businesses that kept employees on payroll during COVID-19, worth up to $26,000 per employee

- Current Status: The IRS has issued over $242 billion in credits but suspended new claims and is actively auditing existing ones

- Who Needs Help: Businesses with pending claims, those facing audits, companies unsure about eligibility, or anyone who received aggressive marketing about the credit

- Key Risks: Improper claims can result in repayment demands, penalties, interest, and lengthy IRS disputes

- Available Solutions: Claim withdrawal, audit representation, professional review, and funding options to access capital while waiting for IRS processing

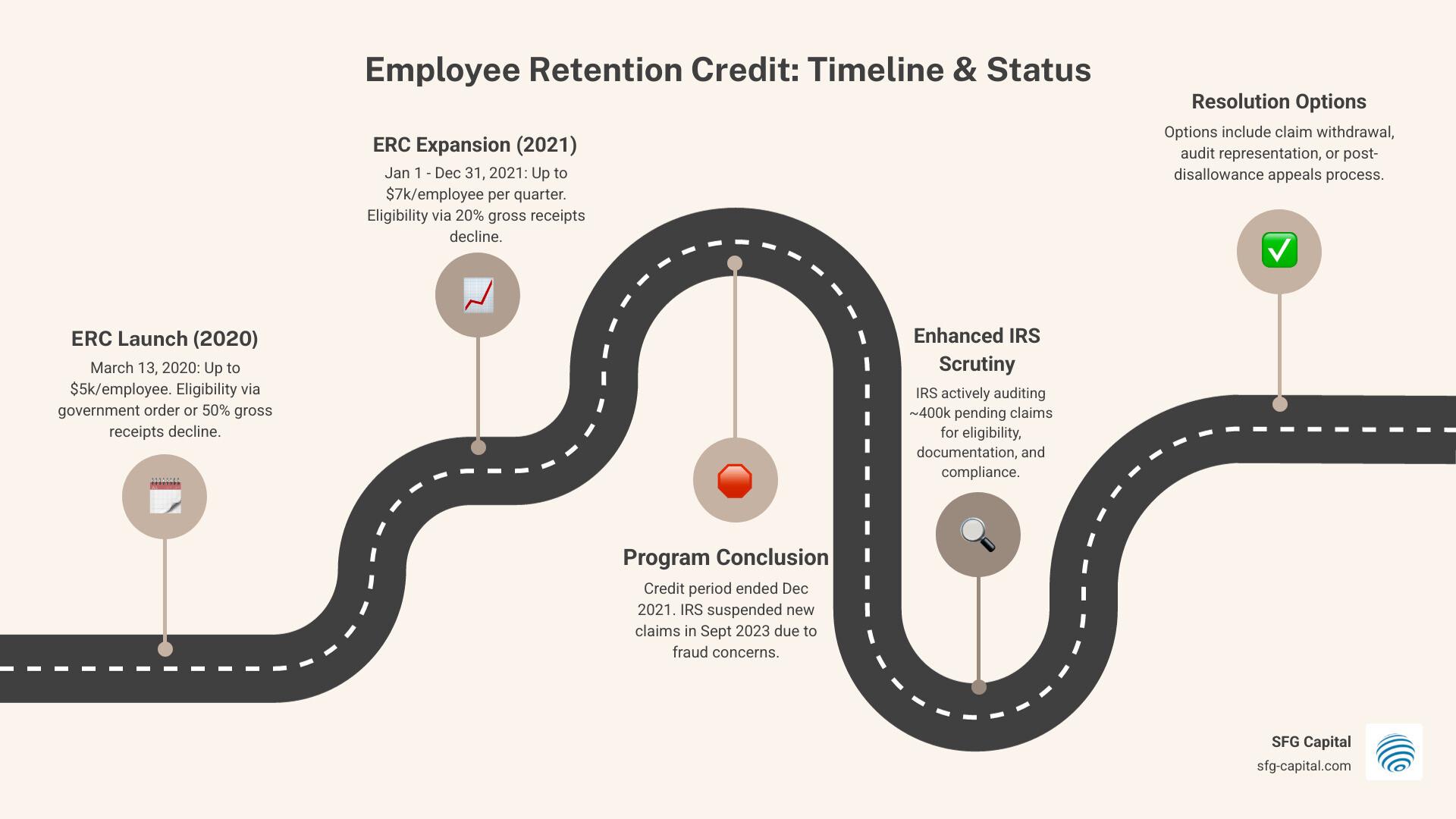

The ERC was designed as COVID-19 relief for employers who retained workers during shutdowns or revenue declines, covering wages from March 13, 2020, to December 31, 2021. While valuable, the program has become very complicated.

The problem? Aggressive promoters making misleading claims led to a wave of potentially fraudulent submissions. In response, the IRS halted new claims and increased scrutiny on the 400,000 pending claims worth about $10 billion.

Legitimate businesses are now caught in unexpected audits, facing confusing disallowances, or waiting months (or years) for needed refunds.

This guide explains eligibility, audit triggers, scam protection, and what to do if your claim is disallowed. We’ll also cover the claim withdrawal process, official IRS resources, and when to seek professional help.

As someone who has managed over $500 million in ERC transactions at SFG Capital, I’ve seen how critical proper employee retention credit help is for businesses navigating IRS scrutiny, funding delays, and complex compliance requirements. Our compliance-driven approach prioritizes documentation integrity and regulatory alignment to help businesses access their legitimate credits while protecting against audit risk.

What is the ERC and Who Qualifies?

The Employee Retention Credit (ERC), or ERTC, is a refundable tax credit from the CARES Act designed to help businesses keep employees on payroll during the COVID-19 pandemic. It’s a credit against employment taxes, not a loan, that reduces tax liability or provides a refund. The IRS has issued over $242 billion in ERC, showing its significant impact.

The first step is understanding eligibility. The ERC is for businesses and tax-exempt organizations (but not household employers) that paid qualified wages between March 13, 2020, and December 31, 2021.

To qualify, businesses must meet one of three main eligibility tests for the specific calendar quarters they are claiming:

- Full or Partial Suspension of Operations Due to a Government Order: Your business operations were fully or partially suspended due to a government order limiting commerce, travel, or group meetings due to COVID-19. This means an official order, not just guidance or recommendations.

- Significant Decline in Gross Receipts: Your business experienced a significant decline in gross receipts compared to a corresponding quarter in 2019. The definition of “significant decline” varies between 2020 and 2021.

- Recovery Startup Business (for Q3 and Q4 2021 only): For the third and fourth quarters of 2021, a business could qualify as a “Recovery Startup Business” if it began operations after February 15, 2020, had average annual gross receipts of $1 million or less, and did not meet the other eligibility tests. Recovery Startup Businesses are limited to a maximum credit of $50,000 per quarter.

These criteria are complex and vary by period. For more details, see our ERC Credit Complete Guide.

ERC Eligibility Rules for 2020 vs. 2021

The ERC rules for 2020 and 2021 differ, affecting eligibility and credit amounts. Understanding these distinctions is crucial for your claim.

2020 Eligibility (March 13 – December 31, 2020):

- Gross Receipts Test: A business qualified if quarterly gross receipts were less than 50% of the same quarter in 2019. Eligibility ended once receipts exceeded 80% of the 2019 comparative quarter.

- Maximum Credit: Up to 50% of qualified wages, capped at $10,000 in wages per employee for the entire year, for a maximum credit of $5,000 per employee.

- Employee Count Threshold: For employers with over 100 full-time employees (in 2019), only wages paid to non-working employees qualified. For those with 100 or fewer, all employee wages qualified.

2021 Eligibility (January 1 – September 30, 2021, with Recovery Startup Business extending to December 31, 2021):

- Gross Receipts Test: A business qualified if quarterly gross receipts were less than 80% of the same quarter in 2019. An alternative lookback to the prior quarter was also available.

- Maximum Credit: Up to 70% of qualified wages, capped at $10,000 in wages per employee per quarter, for a potential maximum of $21,000 per employee for the first three quarters.

- Employee Count Threshold: The threshold increased to 500 full-time employees. For employers over this limit, only wages for non-working employees qualified. For those with 500 or fewer, all employee wages qualified.

Here’s a simplified comparison:

| Feature | 2020 ERC Rules | 2021 ERC Rules (Q1-Q3) |

|---|---|---|

| Gross Receipts Decline | < 50% of 2019 comparative quarter | < 80% of 2019 comparative quarter (or prior quarter) |

| Credit Rate | 50% of qualified wages | 70% of qualified wages |

| Wage Cap | $10,000 per employee for the year | $10,000 per employee per quarter |

| Maximum Credit | $5,000 per employee | $7,000 per employee per quarter (up to $21,000) |

| Employee Threshold | 100 full-time employees (for “working” wages) | 500 full-time employees (for “working” wages) |

| Recovery Startup Bus. | Not applicable | Applicable for Q3 & Q4 2021 (max $50k/quarter) |

We strongly encourage businesses to use the official IRS tools to assess their situation. You can check the IRS eligibility checklist for detailed guidance.

Understanding Qualified Wages

“Qualified wages” are the wages and compensation eligible for the credit, but the definition is nuanced. For both 2020 and 2021, this includes cash payments and a portion of employer-provided healthcare costs. Which employees’ wages qualify depends on your business size (100 employees for 2020, 500 for 2021).

A critical point is the interaction with other relief programs. You cannot claim the ERC on wages used for PPP loan forgiveness or other federal grants like the Shutter Venue Operator or Restaurant Revitalization Grants. This prevents “double-dipping.”

Meticulous documentation of wages, health plan costs, and their relation to other relief programs is essential for proving your claim during an IRS audit.

Navigating IRS Scrutiny and Avoiding Pitfalls

The ERC program faces unprecedented IRS scrutiny. Citing concerns over fraudulent claims, the IRS suspended new ERC applications on September 14, 2023, highlighting the high-risk environment. The IRS is processing a backlog of 400,000 claims worth about $10 billion, causing significant delays. Many businesses, especially those in Austin and Travis County, are in a “waiting game.” We’ve seen how these delays impact local businesses, which is why we offer solutions to bridge these gaps. For more on this, read The Waiting Game: Understanding and Overcoming ERC Refund Delays.

IRS audits verify claim accuracy. Triggers include discrepancies with IRS data, filing errors, or unusually high credit amounts. To protect yourself, maintain thorough documentation of eligibility and calculations, and stay informed on IRS updates. Our Employee Retention Credit Specialist Guide offers further insights.

Be aware of the statute of limitations. The IRS generally has three years to audit a return, but for the ERC, this period is extended to five years for certain quarters. This gives the agency more time to review claims, making robust documentation even more critical.

How to Identify and Avoid ERC Scams

Aggressive marketing has led to numerous ERC scams. The IRS warns against these promoters who misrepresent eligibility and put businesses at risk.

Here are common warning signs of ERC scams to watch out for:

- Unsolicited Advertisements: Unexpected calls, emails, or mail promising quick, easy ERC money.

- Guaranteed Eligibility: Promoters who claim “every business qualifies” without reviewing your specific financial situation.

- Large Upfront Fees or Contingency Fees: Predatory firms often use these structures to profit from incorrect claims.

- Pressure to Act Quickly: Scammers create a sense of urgency to prevent due diligence.

- Lack of Transparency: Unwillingness to explain eligibility criteria, calculations, or documentation.

- No Discussion of Your Tax Situation: Qualifying you before discussing your business operations, gross receipts, and government orders.

- Claiming Supply Chain Issues Alone Qualify You: A supply chain disruption by itself does not qualify you; it must be linked to a government order.

- Overly Aggressive Marketing: The IRS has flagged aggressive advertising and direct mail as concerns.

Report suspicious promoters to the IRS. Vigilance and seeking reputable sources for Employee retention credit help are key to protecting your business.

How to Get Employee Retention Credit Help to Protect Against Audits

With increased IRS scrutiny, preparing for a potential audit is a smart strategy. Proactive documentation is your best defense. This means having detailed records of:

- Government orders that impacted your operations.

- Quarterly gross receipts comparisons.

- Qualified wages paid, including healthcare costs.

- Proof that wages were not used for other relief programs like PPP.

- Calculations supporting your credit amount.

A professional pre-audit review can identify weaknesses in your claim and ensure your documentation is defensible. Should you receive an IRS audit notification, the process typically involves an interview and an Information Document Request (IDR), concluding with a report authorizing or disallowing the credit.

Professional representation during an audit is invaluable. An expert can manage IRS communications, respond to requests, represent you in interviews, and help expedite a resolution. Litigation can even be a powerful tool to expedite payment or challenge a disallowance. You can read about litigating and resolving claims for more in-depth information. For businesses in Travis County, local experts can make a significant difference.

Comprehensive Employee Retention Credit Help: Addressing Claim Issues

Even well-intentioned businesses face ERC claim issues. With the IRS actively reviewing claims, disallowances are a real risk, leading to repayment demands, penalties, and interest. This is where comprehensive Employee retention credit help is critical.

The IRS can also “recapture” (take back) funds it believes were issued in error. These actions may be open to legal challenges, so taxpayers should know their litigation options.

For businesses in Austin and Travis County experiencing refund delays, we understand the need for expedited capital. Our services are designed to provide Expediting Your ERC Refund: What You Need to Know.

Common Reasons for Disallowance and Potential Penalties

Increased IRS scrutiny puts any claim not meeting the precise criteria at risk. Common reasons for disallowance include:

- Ineligible Claims: The business didn’t meet the government order, gross receipts decline, or recovery startup criteria.

- Supply Chain Disruption Myths: Believing any supply chain disruption qualifies, when it must be tied to a specific government order.

- Lack of Government Order: Failing to provide an official government order that suspended operations.

- Insufficient Gross Receipts Decline: Not meeting the specific percentage decline required for the period.

- Overlapping Wages: Using the same wages for both ERC and PPP loan forgiveness.

- Incorrect Employee Count Threshold: Misapplying the 100 or 500 employee threshold.

- Poor Documentation: Insufficient records to substantiate the claim.

The risks of an incorrect claim are substantial. A disallowed claim could result in:

- Repayment of the Credit: Returning any funds received.

- Accuracy-Related Penalties: Up to 20% of the underpayment.

- Civil Fraud Penalties: As high as 75% of the underpayment for intentional misrepresentation.

- Interest: Accrued on the underpayment.

These penalties can make a disallowed claim far more costly than simply returning the credit.

What to Do After a Disallowance: Post-Claim Employee Retention Credit Help

Receiving an IRS disallowance notice (like Letter 105-C) is daunting, but you have options:

- Administrative Appeal: You can pursue an appeal within the IRS, presenting your case to an independent Appeals Officer.

- Filing a Lawsuit: Litigation may be an option, especially if appeals are unsuccessful. This requires experienced tax controversy attorneys.

- Adjusting Wage Expense Deductions: If your ERC claim is disallowed, you can generally increase your wage expense deduction on the income tax return for the year the disallowance is finalized. This corrects the expense since the expected ERC reimbursement was not received.

- Filing Amended Employment Tax Returns (Form 941-X): You may need to file an amended return to make adjustments to your employment taxes.

Navigating a disallowance requires professional guidance to ensure you take the correct steps and mitigate penalties.

The ERC Claim Withdrawal Process

The IRS introduced a special withdrawal process for businesses that filed an ineligible ERC claim. This helps them avoid future audits, penalties, and interest.

Who is eligible to withdraw? You can use the process if:

- You claimed the ERC on an adjusted employment tax return (e.g., Form 941-X).

- You filed the return only to claim the ERC.

- You want to withdraw the entire ERC claim.

- The IRS has not paid the claim, OR it has, but you have not cashed the check.

How to withdraw a claim: The process depends on whether you’ve been paid. If not, you fax a copy of the return marked “Withdrawn.” If you received a check but haven’t cashed it, you mail the voided check with a withdrawal request. If you are under audit, you must coordinate with your examiner.

After submission, the IRS will send a letter accepting or rejecting the request; the withdrawal is only effective upon acceptance. This is a vital tool for businesses misled by promoters. You can find the official IRS withdrawal process steps on their website.

Finding Official Guidance and Professional Support

The ERC’s complexity, evolving IRS rules, and prevalence of scams make expert guidance essential. For businesses in Austin and Travis County, professional support can be the difference between a valid refund and a costly audit.

We understand that navigating these waters can be overwhelming. That’s why we emphasize a clear and transparent Our Process to help you. And once you secure your legitimate ERC funds, knowing 5 Ways to Use ERC Funds to Strengthen Your Business can help you plan for the future.

Where to Find Official IRS Resources

The IRS website is the most reliable source for ERC information, with constant updates, guidance, and news. Key resources include:

- Employee Retention Credit Main Page: The central hub for all ERC information. Visit the Employee Retention Credit main page.

- Frequently Asked Questions (FAQs): Extensive FAQs that address common questions and provide detailed examples. Access them here: Frequently asked questions about the ERC.

- IRS Notices and Revenue Procedures: In-depth technical guidance and the legal framework for the credit (e.g., Notices 2021-20, 2021-49 and Rev Proc 2021-33).

- IRS Webinars: Interactive webinars and eligibility checklists to help employers.

Always prioritize information directly from the IRS to ensure accuracy and compliance.

The Role of Tax Professionals in ERC Claims

While IRS resources are helpful, the ERC’s nuances often require a seasoned tax professional. Their role is critical in providing effective Employee retention credit help.

A reputable tax professional can:

- Steer Complex Rules: They understand the intricate laws and IRS guidance to ensure your claim is legally sound.

- Ensure Compliance: They review your financials and operations to confirm eligibility, properly calculate the credit, and reduce audit risk.

- Provide Audit Representation: They can represent you before the IRS, managing communications and advocating on your behalf during an audit.

- Handle Claim Disputes: In case of a disallowance, they can help you with appeals or guide you through litigation.

- Maximize Legitimate Credits: They ensure you claim the full, correct credit amount you are entitled to.

For businesses in Austin and Travis County, partnering with a trusted advisor is an investment in both compliance and financial well-being. We encourage you to reach out to us for expert assistance. Visit our Contact Us page to learn more about how we can help.

Conclusion

The Employee Retention Credit has been a lifeline for countless businesses, but its journey from pandemic relief to highly scrutinized tax program has been anything but simple. The current environment, marked by an IRS moratorium on new claims, a backlog of existing claims, and heightened audit activity, underscores the critical need for reliable Employee retention credit help.

We’ve covered the essentials: from understanding who qualifies and the differing rules for 2020 and 2021, to navigating IRS scrutiny, identifying scams, and addressing claim disallowances. The key takeaways are clear: diligence, documentation, and expert guidance are your best allies.

For businesses in Austin and Travis County, the wait for ERC refunds can be financially challenging. That’s where we, at SFG Capital, come in. We offer ERC Advance Funding to help bridge the gap, providing you with immediate access to the capital you need while the IRS processes your legitimate claim. Our performance-based fee structure means we only succeed when you do, aligning our interests with yours.

Don’t let the complexity or the waiting game paralyze your business. Take control of your finances and ensure your ERC claim is handled with the expertise it deserves. Explore ERC Funding Solutions with us today.