Why Understanding ERC Loan Options Matters for Your Business

The term ERC loan describes services that help businesses access their Employee Retention Credit refunds quickly. It’s not a loan, but an advance or buyout of your future tax credit. Here’s what you need to know:

Quick Answer: What is an “ERC Loan”?

- Not Actually a Loan: An “ERC loan” is an advance where a company buys your pending ERC refund, giving you cash now instead of waiting for the IRS.

- No Monthly Payments: Unlike traditional loans, there are no monthly interest payments or debt obligations.

- Typical Payout: You receive 80-90% of your expected ERC refund within 1-3 weeks.

- The Trade-off: You get immediate cash but receive less than the full refund amount.

- Why It Exists: The IRS typically takes 6-12 months (or longer) to process ERC claims, creating cash flow problems.

The Employee Retention Credit, a COVID-19 relief program, has cost over $300 billion, far exceeding initial estimates. While it helped employers keep staff on payroll, the IRS backlog has left many businesses waiting months for their refunds.

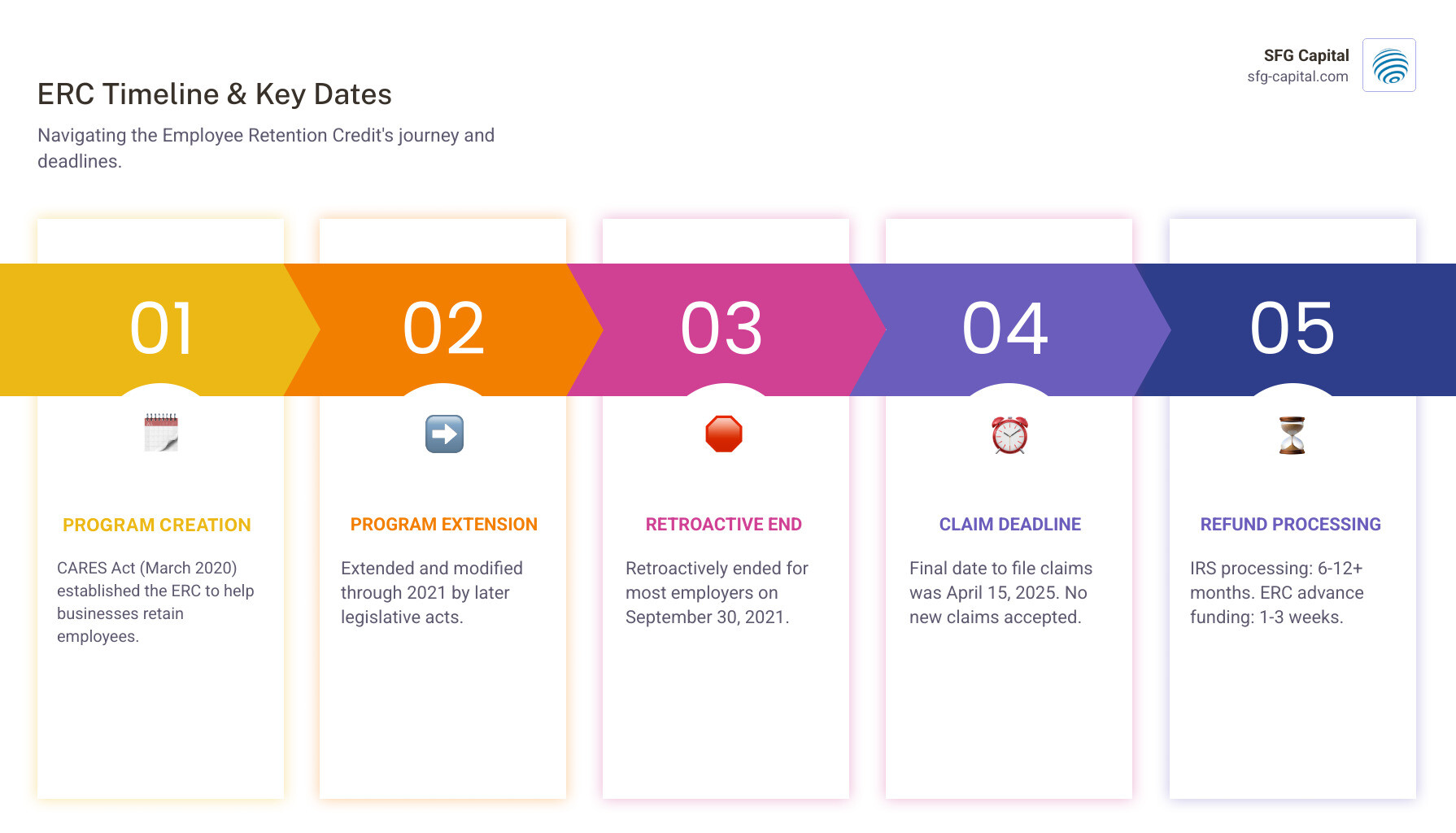

The program ended for most employers on September 30, 2021, and the final deadline to file claims was April 15, 2025. No new claims can be filed, but the IRS is still processing hundreds of thousands of existing ones.

I’m Santino Battaglieri of SFG Capital. We’ve helped businesses steer the ERC loan landscape by funding over $500 million in ERC claims, providing immediate liquidity. Our experience shows how critical proper eligibility analysis and documentation are in this complex process.

This guide covers everything from ERC eligibility to advance funding options so you can make informed decisions about accessing your refund.

What is the Employee Retention Credit (ERC)? A Deep Dive

The Employee Retention Credit (ERC) was a vital lifeline for businesses during the COVID-19 pandemic. It’s not a traditional ERC loan, but a refundable tax credit designed to encourage employers to keep their workforce employed. You can learn more in our ERC Credit Complete Guide.

The Origins and Evolution of the ERC

The ERC was created by the CARES Act in March 2020 and evolved through subsequent legislation, making it more generous but also more complex. Key changes include:

- The Consolidated Appropriations Act (2021): Extended the ERC and, crucially, allowed businesses with Paycheck Protection Program (PPP) loans to also claim the credit.

- The American Rescue Plan Act (ARPA) of 2021: Further expanded the credit, extended it through the end of 2021, and introduced rules for certain startup businesses.

- The Infrastructure Investment and Jobs Act (IIJA) of 2021: Retroactively ended the ERC for most employers for wages paid after September 30, 2021.

Understanding the ERC’s Purpose and Tax Impact

The ERC’s core purpose was to incentivize businesses to keep employees on payroll. It provided a direct financial injection as a refundable tax credit, not a loan. A critical aspect is its tax impact: when you claim the ERC, you must reduce your wage deduction on your income tax return by the credit amount. For example, a $50,000 ERC reduces your deductible wage expense by $50,000, often requiring an amended income tax return. This is crucial for tax compliance.

Key Differences: 2020 vs. 2021 Rules

The ERC rules varied significantly between 2020 and 2021. The 2021 rules were far more generous.

| Feature | 2020 ERC Rules | 2021 ERC Rules (Q1-Q3) |

|---|---|---|

| Credit Percentage | 50% of qualified wages | 70% of qualified wages |

| Maximum Qualified Wages | Up to $10,000 per employee for the entire year | Up to $10,000 per employee per quarter |

| Maximum Credit | $5,000 per employee for the year | $7,000 per employee per quarter |

| Gross Receipts Decline | 50% decline compared to same quarter in 2019 | 20% decline compared to same quarter in 2019 (or prior Q) |

| Employer Size (Large) | More than 100 full-time employees (FTEs) | More than 500 full-time employees (FTEs) |

This evolution meant many businesses might have been eligible for substantial credits in 2021 even if they didn’t qualify in 2020. This complexity underscores why expert guidance is so important.

Are You Eligible? Navigating ERC Qualification Requirements

ERC eligibility follows two primary paths, plus a special rule for new businesses. Understanding these criteria is crucial to avoid issues, as claiming the ERC incorrectly can lead to significant problems. Our Employee Retention Credit Specialist Guide offers deeper insights.

The Two Primary Paths to Qualification

An employer generally qualified for the ERC if they experienced one of the following:

-

Significant Decline in Gross Receipts:

- For 2020: Gross receipts for a quarter were less than 50% of the same quarter in 2019.

- For 2021: Gross receipts for a quarter were less than 80% of the same quarter in 2019. An alternative was to compare the immediately preceding quarter to the corresponding quarter in 2019.

-

Full or Partial Suspension of Operations Due to Governmental Orders:

- Business operations were fully or partially suspended due to a government order limiting commerce, travel, or group meetings. The order must have had a “more than nominal” effect, meaning it impacted at least 10% of your 2019 gross receipts or 10% of your employees’ total hours.

- Examples include orders limiting indoor dining or capacity. Many businesses mistakenly claim this test due to supply chain issues or economic slowdowns, not direct government orders, which is a common area for IRS scrutiny.

Special Eligibility Rules and Limitations

Other important considerations include:

- Recovery Startup Business: For Q3 and Q4 of 2021, a business that began after February 15, 2020, with average annual gross receipts under $1 million could qualify for up to $50,000 per quarter, even without meeting the other tests.

- Interaction with PPP Loans: You can claim both the ERC and a PPP loan, but the same wages cannot be used for both PPP loan forgiveness and the ERC. This “no double-dipping” rule is crucial.

- Other Grants: Wages used for Shuttered Venue Operator Grants or the Restaurant Revitalization Fund cannot be used for the ERC.

The IRS provides an Employee Retention Credit Eligibility Checklist, but expert advice is often invaluable.

How to Claim the Credit and Amend Returns

To claim the ERC for past quarters, you must file Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to amend your original Form 941. The IRS provides guidance on How to Claim the Employee Retention Credit.

The Statute of Limitations: The final deadline to file amended returns for the ERC was April 15, 2025. If you haven’t filed by then, you have missed the opportunity.

The “ERC Loan”: Bridging the Gap with Advance Funding

After filing an ERC claim, many businesses face an agonizing wait for their IRS refund. This is where an ERC loan, or more accurately, an ERC advance buyout service, comes into play. For more on how we can help, check out our ERC Bridge Loans and ERC Funding Solutions.

What is an ERC Advance or Buyout Service?

An ERC loan isn’t a traditional loan. It’s a financial service where a provider like SFG Capital purchases your anticipated ERC refund at a discount. You receive a large portion of your refund in weeks, avoiding the long wait for the IRS to process your claim. Learn more about What is ERC Funding?.

- Not a Debt Instrument: An ERC advance is a sale of your future refund, not a debt you repay. There are no monthly interest payments.

- Bypassing IRS Delays: The primary driver for these services is the IRS backlog, with processing times of 6-12 months or longer. An advance provides immediate liquidity, bridging this gap.

The Pros and Cons of an ERC Loan Advance

Opting for an ERC loan advance has clear benefits and drawbacks:

Benefits:

- Immediate Cash Access: Get a large portion of your refund in 1-3 weeks.

- No Monthly Payments: Since it’s not a loan, there are no repayment schedules.

- Risk Mitigation: The risk of IRS processing delays typically shifts to the funding provider.

- Liquidity: Frees up capital that would otherwise be tied up with the IRS.

Drawbacks:

- Discounted Refund Amount: You won’t receive 100% of your refund. This is the cost for speed and convenience.

- Fees and Transparency: It’s essential to understand all fees. Reputable providers are transparent about their pricing.

- Choosing a Provider: It’s vital to work with a trusted partner with a proven track record.

How the ERC Advance Process Works

A typical ERC advance process with a provider like SFG Capital follows these steps:

- Application: Submit your ERC claim documents and business information.

- Due Diligence: Our team verifies your claim’s eligibility and accuracy.

- Term Sheet: If verified, you receive a term sheet with the advance amount and discount rate.

- Funding: Once you agree, funds are transferred to your account within days.

- IRS Payment: The IRS refund check is sent to the provider to settle the transaction.

Our transparent process helps businesses get the cash they need without unnecessary delays. For more details, see our page on ERC Advance Funding.

The IRS Crackdown: Navigating Audits, Scams, and Claim Issues

The ERC program has become a magnet for fraudulent claims, leading to significant IRS scrutiny. This increased vigilance makes it crucial for businesses to ensure their claims are legitimate and to be wary of anything that seems too good to be true.

Why the ERC Program is Under Scrutiny

The program’s cost ballooned to over $300 billion, far exceeding the initial $78 billion estimate, which drew immense IRS attention. This was caused by a flood of questionable claims, often from aggressive promoters. In response, the IRS has taken several actions:

- Moratorium on New Claims: The IRS halted processing new claims from September 2023 to August 2024, creating a massive backlog.

- Increased Audits: The IRS is now conducting more rigorous audits and has extended the statute of limitations for auditing ERC claims to five or six years.

For businesses waiting for refunds, this means longer wait times and a higher chance of scrutiny. We understand The Waiting Game: Understanding and Overcoming ERC Refund Delays.

Red Flags: How to Spot and Avoid ERC Scams

The promise of large credits attracted “ERC mills” that aggressively market services with false promises. It’s vital to recognize these warning signs:

- Unsolicited calls, emails, or ads promoting ERC services.

- Large upfront fees or contingency fees that incentivize inflated claims.

- Guarantees of eligibility without a thorough review of your situation.

- Pressure to sign documents quickly or claims that “every business qualifies.”

- Lack of requests for detailed financial records and payroll data.

You are ultimately responsible for the accuracy of your tax filings.

What to Do If You Filed an Ineligible Claim

If you think you filed an incorrect ERC claim, act swiftly. The IRS offers options to correct mistakes and avoid harsh penalties.

- Claim Withdrawal Process: If your claim hasn’t been paid, you may be able to withdraw it to avoid future audits, repayment, and penalties.

- Voluntary Disclosure Program (ERC-VDP): The IRS offered a VDP (now closed) that allowed employers to repay 80% of an ineligible credit to avoid penalties and interest.

- Penalties and Interest: Incorrectly claiming the ERC can lead to substantial penalties (20-75%) and interest on the amount owed.

We’re here to offer Employee Retention Credit Help and guide you through these complex situations.

Frequently Asked Questions about the ERC and ERC Loans

Here are answers to common questions about the ERC and ERC loan options.

How long does it take to get an ERC refund from the IRS?

The IRS typically takes 6 to 12 months or longer to process ERC claims due to a substantial backlog. This long wait is why ERC advance services exist. For more on this, check out Expediting Your ERC Refund: What You Need to Know.

Can I still claim the ERC?

No, the claim period for the Employee Retention Credit ended on April 15, 2025. The IRS is no longer accepting new claims and is focused on processing its existing backlog.

Is an erc loan the same as a PPP loan?

No. They are fundamentally different COVID-19 relief programs:

- ERC Loan (Advance): This is not a loan but a sale of your future ERC tax credit for immediate cash. You don’t repay it, and there’s no interest. The ERC itself is a refundable tax credit.

- PPP Loan: This was a government-backed, forgivable loan designed to cover payroll costs. If not forgiven, it had to be repaid with interest.

In short, the ERC is a tax credit, while a PPP loan was a loan. An ERC loan is simply a way to get your tax credit funds faster.

Conclusion

The Employee Retention Credit was a complex but vital program to support businesses during the pandemic. Its journey has been marked by legislative changes, cost overruns, and fraud concerns, leading to an IRS crackdown.

While the opportunity to file new claims has passed, many businesses are still navigating the process. The IRS’s increased scrutiny and lengthy processing times have created a challenging environment for those awaiting refunds. This is where the value of an ERC loan advance service from SFG Capital becomes clear. By providing immediate access to your anticipated ERC refund, we bridge the gap created by IRS delays, offering vital liquidity without the burdens of a traditional loan.

Navigating the ERC program requires expert guidance. We at SFG Capital are committed to helping businesses in Travis County access their ERC funds efficiently and compliantly. Explore how Funding Growth: How ERC Can Power Your Business Forward can be achieved with the right support.