Understanding ERC Funds: What They Are and Why They Matter

Use ERC funds however you need—that’s the single most important thing to understand about the Employee Retention Credit. Unlike other pandemic relief programs such as the Paycheck Protection Program (PPP), the ERC is a refundable tax credit, not a loan. This means you don’t need to apply for forgiveness, follow strict spending rules, or worry about government oversight on how you spend your money.

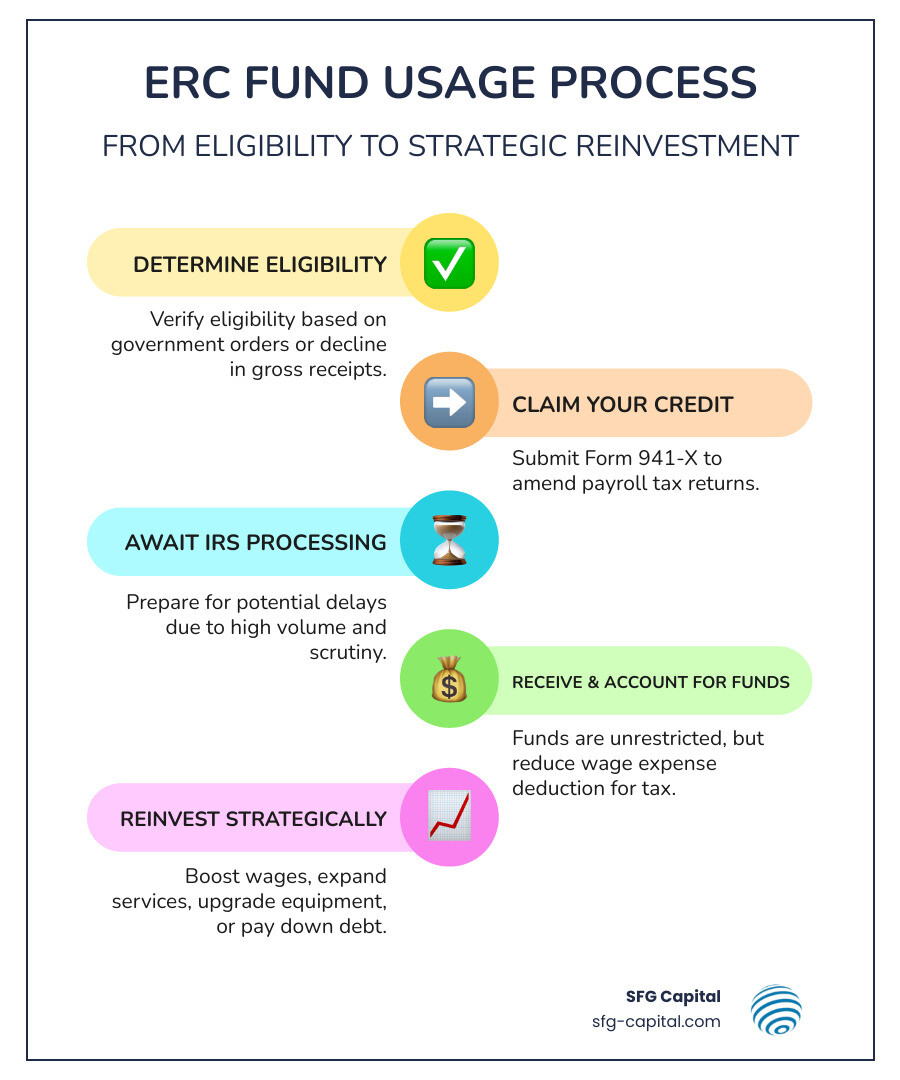

Quick Answer: How to Use ERC Funds

- No restrictions: ERC funds can be used for any business purpose

- Common uses: Increase wages, rehire staff, expand services, upgrade equipment, pay down debt, or increase marketing

- Key difference from PPP: ERC is your money (a tax refund), not a loan with forgiveness requirements

- Tax impact: The only limitation is that you must reduce your wage expense deduction on your income tax return by the credit amount

- Timing: Funds are available once the IRS processes your Form 941-X (though delays are common)

The Employee Retention Credit was created as part of the CARES Act to help businesses that kept employees on payroll during the COVID-19 pandemic. If your business was shut down due to a government order or experienced a significant decline in gross receipts during 2020 or 2021, you may be eligible for this credit. The refund can be substantial—up to $5,000 per employee for 2020 and up to $21,000 per employee for the first three quarters of 2021.

But here’s where many business owners get stuck: the IRS is currently processing over 400,000 claims worth about $10 billion, leading to significant delays. Additionally, the IRS has raised concerns about a large number of improper claims and is closely reviewing all submissions. This makes it critical to not only understand your eligibility but also plan ahead for how you’ll use these funds once they arrive.

Unlike the PPP loan, which required you to spend at least 60% on payroll costs to qualify for forgiveness, the ERC has no such restrictions. The funds are essentially a payroll tax refund—money you overpaid to the government. Because it’s your money being returned to you, the government cannot dictate how you spend it. Many businesses are using ERC funds to reinvest in their operations, whether that’s increasing employee wages, expanding product lines, upgrading technology, or simply improving cash flow.

That said, receiving an ERC refund does have one important tax implication: you must reduce your wage expense deduction on your income tax return by the amount of the credit. This can increase your taxable income, so it’s important to work with a tax professional to understand the full impact. Additionally, with increased IRS scrutiny and scam warnings, you need to ensure your claim is legitimate and properly documented.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer the ERC process and use ERC funds strategically by purchasing and funding over $500 million in ERC claims. My experience working with tax professionals and qualified legal counsel has shown me that the businesses that plan ahead for their refund see the greatest long-term benefits.

Understanding the Employee Retention Credit (ERC): Eligibility and Claiming

This section explains the foundational aspects of the ERC, from what it is to how a business can claim it, setting the stage for how to use the funds once received.

What is the ERC and How Does it Work?

The Employee Retention Credit (ERC), often referred to as the Employee Retention Tax Credit (ERTC), is a refundable tax credit designed to encourage employers to keep employees on their payroll during the economic disruption caused by the COVID-19 pandemic. It’s a key part of the CARES Act and subsequent legislation, providing a financial lifeline to businesses in Austin, Travis County, and across the United States.

Unlike a traditional tax deduction that reduces your taxable income, the ERC is a refundable credit. This means that if the credit amount exceeds your payroll tax liability, the IRS sends you the difference as a refund check. Essentially, it’s a direct cash injection for your business. The ERC is a payroll tax refund, not income, and its purpose was to help businesses offset the costs of retaining employees during unprecedented times.

Who is Eligible? A Breakdown by Year

Eligibility for the ERC is nuanced and depends heavily on specific criteria met during different periods in 2020 and 2021. It’s not a one-size-fits-all situation, and the rules changed between the two years.

Generally, businesses and tax-exempt organizations in the U.S. that qualify are those that:

- Were suspended by a government order due to the COVID-19 pandemic during 2020 or the first three calendar quarters of 2021. This refers to full or partial suspension of business operations due to governmental orders limiting commerce, travel, or group meetings.

- Experienced a required decline in gross receipts during 2020 or the first three calendar quarters of 2021.

- For 2020: A significant decline in gross receipts means gross receipts for a calendar quarter were less than 50% of gross receipts for the same calendar quarter in 2019.

- For 2021: A decline in gross receipts means gross receipts for a calendar quarter were less than 80% of gross receipts for the same calendar quarter in 2019. Businesses can also elect to use the immediately preceding calendar quarter to determine their gross receipts decline.

- Qualified as a recovery startup business for the third or fourth quarters of 2021. This applies to businesses that began operations after February 15, 2020, had average annual gross receipts not exceeding $1 million, and met certain other criteria.

It’s crucial to understand the interaction with PPP loans: employers cannot claim the ERC on wages that were reported as payroll costs for Paycheck Protection Program loan forgiveness. While both were pandemic relief programs, you couldn’t double-dip on the same wages. We always advise businesses to carefully review their eligibility using official IRS resources. For a detailed breakdown, we recommend checking the Employee Retention Credit Eligibility Checklist: Help understanding this complex credit.

How to Claim the Credit and What to Expect

If you determine your business is eligible, the next step is to claim the credit. Eligible businesses that didn’t claim the credit when they filed their original employment tax return can claim it by filing adjusted employment tax returns. The primary form used for this is Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. Depending on your business structure, other forms like Form 943-X, Form 944-X, or Form CT-1X might be applicable.

The process involves amending your payroll tax returns for the relevant quarters. This is where the role of a tax professional becomes invaluable. They can help ensure accurate calculations of qualified wages, steer the complex eligibility rules, and correctly fill out the necessary forms. Given the IRS’s concern about improper claims, having expert assistance can significantly reduce the risk of future issues.

Once submitted, businesses should be prepared for IRS processing delays. As mentioned, the IRS has a significant backlog of claims. While the ERC program was a lifeline, the wait for funds can be frustrating. However, once approved, the credit functions as a direct refund, providing capital that businesses can use ERC funds to recover and grow.

How to Use ERC Funds: A Guide to Maximizing Your Refund

This section directly addresses the primary keyword, detailing the flexibility of ERC funds and providing actionable ideas for reinvestment and business growth.

The Biggest Difference: ERC vs. PPP Fund Usage

One of the most significant advantages of the ERC over other pandemic relief programs, particularly the Paycheck Protection Program (PPP), lies in the flexibility of its funds. The ERC program was created at the same time as the PPP, but unlike the PPP loan, the ERC is a refundable tax credit, not a loan. This distinction is crucial:

- PPP loans were forgivable, but only if specific conditions were met, primarily that a certain percentage (at least 60%) of the funds were used for payroll costs. There were strict rules and oversight on how these funds could be spent to achieve forgiveness.

- ERC funds, on the other hand, are essentially a refund of payroll taxes you’ve already paid. Because it’s your money being returned to you by the government, there are no restrictions or limitations on how you can use ERC funds. There’s no government oversight dictating your spending, nor do you need to apply for “forgiveness.”

This means that once your business receives the ERC refund, that money becomes part of your general operating capital. It provides more freedom for business owners in Travis County, Austin, and beyond to allocate resources where they are most needed, whether for immediate operational costs or long-term strategic investments.

Smart Ways to Use ERC Funds for Business Growth

With no strings attached, businesses have a unique opportunity to strategically use ERC funds to foster recovery, improve stability, and drive future growth. While there are no rules on how to spend it, one of the smartest ways to leverage this capital is by reinvesting it back into your business. Here are some common and effective strategies:

- Increase Employee Wages: In today’s competitive job market, increasing wages can be a powerful tool for employee retention and attraction. This can help stabilize your workforce and improve morale.

- Rehire Staff: Many businesses had to downsize during the pandemic. ERC funds can facilitate rehiring employees who were previously let go, helping to rebuild your team and capacity.

- Expand Services or Products: If you’ve been considering diversifying your offerings or entering new markets, ERC funds can provide the capital needed for research, development, and launch.

- Increase Marketing Budget: To attract new clients and customers, a robust marketing strategy is essential. Investing in marketing can boost visibility and revenue.

- Invest in Training and Education: Equipping your employees with new skills and knowledge through training programs can improve productivity, innovation, and employee engagement. This also includes investing in personal development for business leaders.

- Upgrade Equipment or Technology: Modernizing your infrastructure can improve efficiency, reduce operational costs, and give you a competitive edge.

- Pay Down Debt: Reducing existing business debt can free up cash flow, lower interest expenses, and improve your company’s financial health.

- Improve Cash Flow: Sometimes, the best use of funds is simply to bolster your working capital, providing a cushion for unexpected expenses or to smooth out seasonal fluctuations.

These examples highlight how the ERC program encourages reinvestment into businesses, allowing for strategic decisions that benefit the company long-term.

The Freedom to Use ERC Funds: No Strings Attached?

Yes, it’s largely true: there are absolutely no rules or limits about what ERC money can be used for. The ERC is a refundable tax credit, not a loan. Because it’s essentially your money that you overpaid in payroll taxes, the government cannot dictate how you spend it. This makes the ERC fundamentally different from other pandemic relief programs like PPP, which had specific limitations and requirements for forgiveness.

The only “string” attached, as we briefly mentioned earlier, is an accounting and tax consideration: receiving the ERC requires you to reduce your deduction for wages on your income tax return by the amount of the credit. This means that while the credit itself is not taxable income, it can effectively increase your taxable income by reducing your deductible expenses. It’s a crucial point to discuss with your tax professional to understand the full financial impact on your business. Beyond this, however, businesses in Travis County are free to use ERC funds as they see fit to support their operations and growth.

Navigating ERC Compliance, Risks, and Accounting

Given the increased IRS scrutiny, this section covers the critical post-claim responsibilities, potential pitfalls, and accounting best practices for businesses that have received ERC funds.

Accounting for Your ERC Refund

Proper accounting for your ERC refund is crucial for accurate financial reporting. Since U.S. GAAP (Generally Accepted Accounting Principles) does not provide specific guidance for accounting for ERC funds, they are generally treated as governmental grants. Businesses typically have two primary accounting models to choose from:

- IAS 20 Model (Accounting for Government Grants and Disclosure of Government Assistance): Under this model, income is recognized when there is reasonable assurance that conditions will be met and funds will be received. The earnings impact of the grants is then recognized over the periods in which the related expenses (the qualified wages) are incurred.

- ASC 958-605 Model (Not-for-Profit Entities: Revenue Recognition): This model recognizes income when qualifying expenses are incurred.

The timing of income recognition can vary significantly between these models and can impact your financial statements. If your business previously received PPP funds, it’s generally advisable to apply the same accounting model to your ERC funds, unless your PPP funds were accounted for under a debt model. Regardless of the model chosen, many businesses find it easiest to track ERC funds received in a separate general ledger account. We always recommend consulting with your CPA or financial advisor to determine the most appropriate accounting treatment for your specific situation and to discuss any complex timing considerations.

Red Flags: How to Spot and Avoid ERC Scams

The IRS has expressed significant concern about a large number of improper ERC claims and is actively reviewing tax returns that claim the credit. This scrutiny also comes with warnings about aggressive promoters and ERC scams. Protecting your business means being vigilant and informed. Here are some common warning signs of ERC scams:

- Unsolicited Advertisements: Be wary of calls, emails, or social media messages from unfamiliar companies promising large ERC refunds.

- Large Upfront Fees: Legitimate tax professionals typically charge for their services, not a percentage of your refund, or they may charge a reasonable upfront fee. Avoid those demanding large payments before any work is done.

- Aggressive Promoters: Pressure to sign contracts quickly, claims that “every business qualifies,” or statements like “nothing to lose” are major red flags.

- Quick Eligibility Promises: The ERC eligibility rules are complex. Any promoter claiming you qualify without a thorough review of your specific financial situation, payroll records, and government orders is likely making false promises.

- Fees Based on a Percentage of the Refund: While some legitimate firms may use this model, it’s also a common tactic for unscrupulous promoters who may inflate claims to increase their fee.

The IRS urges taxpayers to be cautious and seek advice from a reputable tax professional if they need help or advice about the credit or resolving an incorrect claim. We’ve seen the headaches these scams can cause. For more insights into protecting your business, you can Read more on our blog. Additionally, the IRS provides valuable information in its Frequently asked questions about the Employee Retention Credit.

What Happens if Your Claim is Ineligible or Disallowed?

Submitting an ineligible ERC claim can lead to significant consequences, including audits, repayment of the credit, and the imposition of penalties and interest. The IRS is actively reviewing claims, and if your claim is determined to be ineligible, you have options.

Employers that submitted an ineligible claim can avoid future issues by withdrawing an ERC claim. This IRS program can be used if the ERC hasn’t been paid yet, or if a check was received but not cashed or deposited. If the claim has already been paid and spent, or if you disagree with a disallowance, you may need to pursue an administrative appeal or even file suit.

A critical implication of an ERC disallowance relates to wage expense deductions. If your ERC was disallowed and you previously reduced your wage expense on your income tax return for the year the ERC was claimed, you don’t necessarily have to amend that original income tax return. Thanks to special statutory rules (Section 2301(e) of the CARES Act and Section 3134(e) of the Internal Revenue Code), you can increase your wage expense on your income tax return for the year the disallowance becomes final. For example, if your 2021 ERC claim was disallowed in 2024, you could increase your wage expense on your 2024 income tax return by the amount it was reduced in 2021. This treats the disallowed ERC as a failure to receive an expected reimbursement for qualified wage expense. It’s a procedural workaround that can save businesses the complexity of amending old returns, especially if the assessment period for the original year has expired.

Clarifying the “Other” ERC: US Tax Credit vs. European Research Grants

It’s important to clarify a common point of confusion: the acronym “ERC” is used for two very different programs. While our focus at SFG Capital and for businesses in the U.S. is on the Employee Retention Credit, there is also the European Research Council, which uses the same acronym. These are entirely separate entities with distinct purposes, eligibility, and governing bodies.

Two Programs, One Acronym

- US Employee Retention Credit (ERC): This is the federal tax credit we’ve been discussing, designed to provide economic relief to U.S. businesses during the COVID-19 pandemic by encouraging them to retain employees. It’s administered by the U.S. Internal Revenue Service (IRS).

- European Research Council (ERC): This is a European Union (EU) funding organization that supports frontier research across Europe. It provides grants to individual researchers and their teams, focusing on scientific excellence and groundbreaking ideas. This program has no relevance to U.S. tax credits or pandemic relief for U.S. businesses. Researchers managing projects funded by this European entity might need to consult resources like Manage your project, but this is unrelated to the U.S. tax credit.

Comparing the Two ERCs

To avoid any confusion, here’s a clear breakdown of the key differences:

| Feature | US Employee Retention Credit (ERC) | European Research Council (ERC) |

|---|---|---|

| Purpose | COVID-19 relief for retaining employees | Funding for frontier research & innovation |

| Recipient | Eligible US businesses & non-profits | Individual researchers & their teams |

| Fund Type | Refundable payroll tax credit | Research grant |

| Governing Body | U.S. Internal Revenue Service (IRS) | European Union (EU) |

This distinction is crucial, especially when searching for information online. Our discussion, and SFG Capital’s services, are exclusively focused on the U.S. Employee Retention Credit.

Frequently Asked Questions about Using ERC Funds

We’ve covered a lot of ground, but here are some quick answers to common questions about how to use ERC funds.

Do I have to pay taxes on my ERC refund?

The ERC itself is not considered taxable income. However, receiving the ERC does require your business to reduce its deduction for wages on its income tax return by the amount of the credit. This reduction in deductible expenses can effectively increase your business’s taxable income for the year the wages were paid (even if you receive the refund in a later year). It’s essential to work with a tax professional to understand the specific impact on your business’s tax liability.

What’s the difference in credit amounts between 2020 and 2021?

The credit amounts and calculation methods differ significantly between the two years:

- For 2020: The credit is 50% of qualified wages, up to $10,000 per employee for the entire year. This means the maximum credit per employee for 2020 is $5,000.

- For 2021: The credit is more generous, calculated as 70% of qualified wages, up to $10,000 per employee per quarter. This allows for a potential maximum credit of $7,000 per employee per quarter, or up to $21,000 per employee for the first three quarters of 2021.

These differences highlight why a thorough eligibility assessment for both periods is critical to maximize your potential refund.

Can I use ERC funds for personal expenses?

Because the ERC is a tax refund with no spending restrictions, the funds become part of your business’s general cash flow. How you use that cash is ultimately a business decision. While technically you could use general business funds for personal expenses (assuming you’re an owner and it’s properly accounted for as a draw or distribution), it is generally not recommended to view ERC funds as personal windfalls. The spirit of the credit was to support businesses and their employees. Reinvesting in the business—whether through operational improvements, employee benefits, or growth initiatives—is highly recommended for long-term stability and success. Think of it as capital to strengthen your business, which in turn benefits you as the owner.

Conclusion

The Employee Retention Credit offers a powerful financial lifeline for businesses, providing unrestricted funds to foster recovery and growth. While the freedom to use ERC funds is a major benefit, navigating the complex eligibility, claim process, and IRS compliance is crucial. By understanding the rules and planning strategically, you can leverage this credit to its full potential. If you’ve qualified for the ERC but are facing long IRS delays, SFG Capital can help you access your funds now. Learn more about our ERC services and expedite your refund today.