Why Finding the Right IRS ERC Phone Number Matters for Your Business

The irs erc phone number is often the only lifeline for business owners stuck waiting months or even years for their Employee Retention Credit refunds. If you need to reach the IRS about your ERC claim status right now, here’s what you need to know:

Primary IRS Contact for ERC Refund Status:

- Phone Number: 1-800-829-4933 (IRS Business and Specialty Tax Line)

- International Callers: 267-941-1000

- Hours: Monday through Friday, 7 a.m. to 7 p.m. (local time)

- What to Have Ready: Your EIN, business name and address, Form 941-X submission dates, specific quarters filed, and any IRS notices

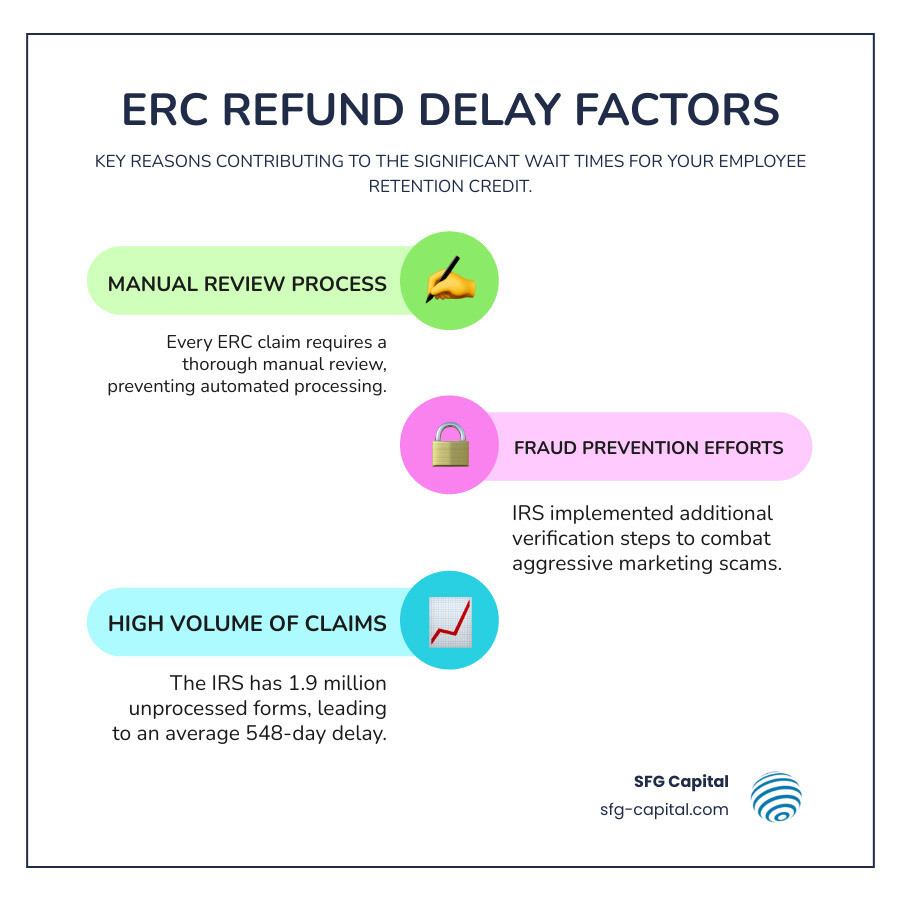

You filed your amended payroll tax returns using Form 941-X months ago—maybe even years ago—and you’re still waiting for your Employee Retention Credit refund. If that sounds familiar, you’re not alone. Hundreds of thousands of business owners are waiting for their ERC refunds, with the average claim sitting in the IRS inventory for 548 days.

The Employee Retention Credit (ERC) is a refundable tax credit created by the CARES Act to help businesses that retained employees during the COVID-19 pandemic. It should have been a financial lifeline. Instead, it’s become a waiting game marked by massive IRS backlogs—as of May 2021, the IRS had approximately 1.9 million unprocessed Form 941s and 941-Xs in the pipeline.

The delays stem from several factors: every ERC claim requires manual review, the IRS has implemented additional verification steps to prevent fraud, and the sheer volume of claims has overwhelmed the system. Unlike regular income tax refunds, ERC refunds are processed separately through the employment tax division, and there’s no online tool to check your status.

That’s where calling the IRS becomes critical—but only if you know the right number to dial and how to prepare for the call.

As Santino Battaglieri, I’ve guided businesses through over $500 million in ERC claims at SFG Capital, and I understand the frustration of navigating the irs erc phone number and the complex refund process. This article will give you the exact contact information, preparation steps, and troubleshooting strategies you need to finally get answers about your refund.

The Correct IRS ERC Phone Number and How to Prepare for the Call

When you’re waiting for a significant sum like an ERC refund, knowing exactly who to call and what to say can make all the difference. For businesses like yours in Austin, Travis County, and across the United States, the primary point of contact for ERC refund status inquiries is the IRS Business and Specialty Tax Line.

The dedicated irs erc phone number for business tax inquiries is 1-800-829-4933. If you’re calling from outside the U.S., the number to dial is 267-941-1000. These lines are generally open Monday through Friday, from 7 a.m. to 7 p.m. local time.

We understand that reaching a human at the IRS can feel like winning the lottery. The IRS itself acknowledges that calling their numbers can result in “extremely lengthy delays.” With hundreds of thousands of businesses collectively waiting for their refunds, the phone lines are often swamped. Patience is truly a virtue here, but preparation is your superpower. We’ve seen how frustrating it can be to spend hours on hold only to realize you don’t have the right information ready.

It’s also important to manage expectations regarding what an IRS agent can tell you. While they can provide some updates, their access to detailed processing information for ERC claims can be limited. The IRS processes ERC claims on Form 941-X, which is separate from individual income tax returns, meaning the “Where’s My Refund” tool you might be familiar with doesn’t apply here. This makes direct phone contact, despite its challenges, the most common way to get an update.

For more general information on how to contact the IRS for business-related questions, you can refer to the IRS telephone assistance contacts for business customers. However, for specific ERC refund status, the 1-800-829-4933 line is your go-to.

What information do I need when using the IRS ERC phone number?

Before you even think about dialing that irs erc phone number, gather all your ducks in a row. Having this information readily available will not only save you time on the call but also help the IRS agent assist you more efficiently. We always advise our clients to have a dedicated “ERC folder” with all relevant documents.

Here’s a comprehensive list of what you’ll need:

- Your Employer Identification Number (EIN): This is crucial for the IRS to identify your business.

- Your Business Name and Current Address: Ensure this matches what the IRS has on file.

- Specific Quarters for which you filed an ERC claim: For example, Q2 2020, Q3 2021.

- The Dates you submitted your Form 941-X (Amended Employer’s Quarterly Federal Tax Return): If you mailed it, include the certified mail date.

- Copies of all Tax Forms Filed related to your ERC claim: This includes your original Form 941s and especially your Form 941-Xs.

- Any IRS Notices or Correspondence you’ve received regarding your ERC claim: Even if it seems minor, it could contain important tracking information.

- Your Business’s Financial Records: Be ready to answer questions about qualified wages, employee counts, and how your business was impacted by government orders or gross receipts decline.

The IRS is dealing with a massive volume of claims, and having your details organized helps streamline the process. For a deeper dive into the credit itself, our ERC Credit Complete Guide provides extensive information.

Understanding Common IRS Responses About Your ERC Status

After navigating the phone tree and waiting patiently, you’ll finally speak to an agent. What they tell you might sound cryptic, but we can help you decode some common IRS responses regarding your ERC refund status:

- “In Process” or “Under Review”: This is a common, albeit vague, response. It generally means your claim has been received and is somewhere in the IRS processing pipeline. It could be waiting for initial review, undergoing manual verification, or sitting in a queue for a compliance check. Given the average 548-day processing time, “in process” can mean a lot of things, most of them involving waiting.

- “Sent to Another Department”: This often indicates that your claim has moved past an initial processing stage and is now with a specialized team. This might be for further eligibility verification, fraud prevention screening, or even just routing to the correct processing center. It’s not necessarily a bad sign, but it doesn’t offer much in the way of a timeline.

- “Check Mailed on [Date]”: This is the golden ticket! If you hear this, it means your refund has been approved and a check has been issued and sent. Make sure to confirm the mailing address on file. If the date has passed and you haven’t received it, you’ll need to move into troubleshooting mode, which we’ll cover next.

IRS agents can only provide limited updates. They typically don’t have access to real-time, granular details about where your specific Form 941-X is sitting or when it will move to the next stage. Their information is often based on broad status codes.

Troubleshooting Common Refund Issues

So, you’ve called the irs erc phone number, you’ve got your status, but your check still hasn’t arrived, or the delays are stretching into seemingly endless territory. Don’t worry, we’ve got some strategies for you. The journey to your ERC refund can be a bumpy one, and it’s not uncommon to encounter a few detours.

There are several reasons why your ERC refund might be experiencing further delays beyond the initial backlog. These can include:

- Compliance Screening: The IRS is increasingly focused on rooting out fraudulent or ineligible ERC claims. Your claim might be undergoing additional scrutiny as part of their compliance efforts. This is especially true given the aggressive marketing tactics of some “ERC mills” that promised quick eligibility to businesses that didn’t truly qualify.

- Errors on Form 941-X: Even small mistakes on your amended return can trigger delays. This could be anything from a calculation error to missing information. The IRS will often flag these for manual review, slowing down the process considerably.

- Incorrect Mailing Address: A surprisingly common issue. If the IRS has an outdated or incorrect mailing address for your business, your check could be sent to the wrong place. Always confirm your address when speaking with an agent.

- Identity Verification Issues: Sometimes, the IRS might need to verify your business’s identity or the identity of the person claiming the refund. This can lead to requests for additional documentation.

We know that waiting is hard, especially when your business in Austin or Travis County could greatly benefit from these funds. That’s why understanding these potential roadblocks is key. Our article on Expediting Your ERC Refund: What You Need to Know provides further insights into these delays.

What if My ERC Refund Check Was Mailed But Never Arrived?

If you’ve confirmed with the irs erc phone number that your refund check was indeed mailed, but it never showed up, it’s time to initiate a refund trace. This is a critical step, as a lost check could mean anything from postal delays to theft.

Here’s how to handle a lost ERC refund check:

- Initiate a Refund Trace: You’ll need to fill out and submit Form 3911, Taxpayer Statement Regarding Refund. This form is specifically designed for tracing lost, stolen, or destroyed refunds. While the primary irs erc phone number (1-800-829-4933) can guide you, the research suggests that for general refund traces, you might also be directed to 800-829-1954 (automated) or 800-829-1040 (representative). For ERC, we recommend starting with the business line and following their instructions.

- Cashed Check vs. Uncashed Check:

- If the check was not cashed: The IRS will cancel the original check and issue a replacement. This process can still take several weeks or even months, but at least you know the money hasn’t gone into someone else’s pocket.

- If the check was cashed: This is where it gets a bit more complex. The IRS will forward your claim to the Bureau of the Fiscal Service (BFS). The BFS will provide you with a claim package, including a copy of the cashed check. You’ll need to follow their instructions, which involve verifying the signature on the canceled check. The BFS will review your claim and the signature before determining if a replacement refund can be issued. This review process alone can take up to six weeks. You can find more information about this process on the Bureau of the Fiscal Service website.

Keep copies of everything you submit, and make a note of all dates and names of IRS representatives you speak with.

What Other Steps Can I Take if I’m Still Stuck?

If you’ve played the waiting game, called the irs erc phone number, initiated a trace, and still feel like you’re hitting a wall, we understand your frustration. Sometimes, you need to explore additional avenues.

Here are further steps businesses can take:

- Review Your Forms for Accuracy: Double-check your submitted Form 941-X for any potential errors, no matter how small. Confirm your EIN and mailing address are absolutely correct on all IRS records. Even a typo can cause significant delays.

- Ensure the IRS Has Record of Your Forms: If you mailed your Form 941-X, did you send it certified mail? Keeping copies of certified mailing or submission confirmations can prove invaluable if the IRS claims they never received your forms.

- Contact the Taxpayer Advocate Service (TAS): If you’ve experienced an “undue hardship” due to the delay in your ERC refund, the Taxpayer Advocate Service may be able to help. TAS is an independent organization within the IRS that helps taxpayers resolve problems with the IRS. Undue hardship could include situations where the lack of funds is causing severe financial distress for your business, threatening its ability to operate or meet payroll. You can learn more about their services on the Taxpayer Advocate Service website.

- Seek Professional Assistance: Navigating these complex IRS processes can be daunting. A qualified tax professional or a firm specializing in ERC, like us at SFG Capital, can help. We have experience dealing with the IRS on these matters and can sometimes access information through the IRS transcript system that is not readily available to the general public. Our Employee Retention Credit Help page offers resources and assistance.

Navigating Ineligible Claims and IRS Compliance Programs

The IRS has been vocal about its concerns regarding ineligible ERC claims and aggressive marketing by “ERC mills.” They’ve identified a significant number of claims that may not meet the eligibility criteria, leading to increased scrutiny and processing delays. This is why it’s crucial for businesses to ensure their claim is legitimate.

The IRS has issued warnings about ERC scams, which often feature:

- Unsolicited Advertisements: Getting calls, texts, emails, or even social media ads promising easy money.

- Quick Eligibility Promises: Promoters guaranteeing you qualify without a thorough review of your specific business situation.

- Large Upfront Fees: Charging significant fees before any work is done, sometimes based on a percentage of the refund.

- Pressure to Accept Refund Anticipation Loans: Offering immediate cash for a fee, which can be predatory.

- Claims that “Every Business Qualifies”: The ERC has specific eligibility requirements, and not every business meets them.

If you believe your business may have filed an ineligible claim, or if you’re concerned about the legitimacy of your initial ERC application, the IRS has provided pathways to correct these issues. Our Employee Retention Credit Specialist Guide further details common pitfalls and best practices.

How to Withdraw an Unpaid ERC Claim

If you’ve determined that your business may not have been eligible for the ERC, or if you made an error, and your refund hasn’t been paid yet (or you’ve received a check but haven’t cashed it), the IRS has a specific withdrawal process. This can help you avoid future audits, penalties, and interest.

You can use the ERC claim withdrawal process if:

- You made the claim on an adjusted employment tax return (like Form 941-X).

- You filed it only to claim the ERC, with no other adjustments.

- You want to withdraw the entire amount of the ERC for that period.

- The IRS has not yet paid your claim, or you’ve received a refund check but haven’t cashed or deposited it.

The process for withdrawal is straightforward:

- Make a copy of your submitted Form 941-X.

- Write “Withdrawn.” in the left margin of the copied form.

- Have an authorized person sign and date it in the right margin, including their name and title.

- Fax the signed copy to the IRS ERC claim withdrawal fax line at 855-738-7609. If faxing isn’t possible, you can mail it.

- If you received a check but haven’t cashed it: Prepare the withdrawal request as above, write “Void” on the back of the refund check, include a note stating “ERC Withdrawal” with a brief explanation, make copies of all documents, and mail the voided check with the withdrawal request to the Cincinnati Refund Inquiry Unit.

The IRS will then send you a letter confirming the acceptance of your withdrawal request. This is crucial for your records. For complete instructions and scenarios, refer to the IRS’s official page on Withdraw an Employee Retention Credit (ERC) claim.

What is the ERC Voluntary Disclosure Program (ERC-VDP)?

For businesses that received ERC funds but later determined they were ineligible, the IRS introduced the ERC Voluntary Disclosure Program (ERC-VDP). This program provides a structured way to come forward, repay the credit, and potentially avoid hefty penalties and audits.

The purpose of the ERC-VDP is to allow certain taxpayers who received but were not entitled to any ERC to self-identify and repay that ERC at a discounted rate. Specifically, participants agree to repay 80% of the ERC amount received. In exchange, the IRS agrees not to charge penalties or interest on the repaid amount, and it prevents an employment tax audit for the resolved ERC claim.

To be eligible, generally, your business must not be under criminal investigation, not already under an IRS employment tax audit, and the IRS must not have already identified your noncompliance through other means.

The deadline to apply for the ERC-VDP was March 22, 2024. If you missed this deadline, you are no longer able to participate in this specific program.

What if you didn’t participate in the ERC-VDP and are later found to have an ineligible claim? The penalties can be significant. These may include:

- Failure-to-pay penalties: Can range from 0.5% to 25% of the unpaid tax.

- Failure-to-file penalties: Can range from 5% to 25% of the unpaid tax.

- Accuracy-related penalties: Typically 20% of the underpayment.

- Civil fraud penalties: Can be as high as 75%.

- Trust fund recovery penalties: For willful failure to collect or pay over payroll taxes, this can equal the total amount of tax evaded.

- Criminal charges: In severe cases, tax evasion or filing a false return can lead to substantial fines and imprisonment.

The IRS strongly encourages businesses to rectify incorrect claims. Even if you missed the VDP, you can still consider withdrawing an unpaid claim or amending your employment tax returns to correct errors. For detailed FAQs on the program, visit the Frequently asked questions about the Employee Retention Credit Voluntary Disclosure Program.

Frequently Asked Questions about the IRS ERC Phone Number

We know you have questions, and we’ve gathered some of the most common ones regarding the irs erc phone number and getting through to the IRS.

What is the best time to call the IRS ERC phone number to avoid long waits?

Ah, the eternal question! While there’s no magic bullet, we’ve found that timing can significantly impact your wait time. Based on our experience and IRS recommendations for business lines:

- Early Morning: Try calling right when the lines open at 7 a.m. local time. Many people call later in the day, so getting in early can give you a head start.

- Mid-Week: Tuesdays, Wednesdays, and Thursdays tend to have shorter wait times than Mondays and Fridays. Mondays are often swamped with weekend backlog, and Fridays see a rush before the weekend.

- Avoid Peak Times: Lunch hours (12 p.m. – 2 p.m. local time) and late afternoon are generally the busiest.

Be prepared for a wait regardless. Have your documents ready, a comfortable chair, and perhaps a good podcast!

Can I check my ERC status online instead of calling?

Unfortunately, no. Unlike personal income tax refunds, there is no online tool like “Where’s My Refund?” available for checking the status of your Employee Retention Credit. ERC claims are processed through the employment tax system, which does not have a public-facing online tracking system.

This means that calling the irs erc phone number (1-800-829-4933) remains the primary and often only direct way for businesses to get an update on their refund status. We know, it’s not ideal, but it’s the reality of the current ERC processing environment.

What are my options if I can’t get through on the phone?

If you’re consistently running into roadblocks trying to reach the IRS via the irs erc phone number, don’t despair. You still have options:

- Contact the Taxpayer Advocate Service (TAS): As mentioned earlier, if you’re experiencing severe financial hardship due to the delay, TAS can intervene on your behalf. This is not for general status checks but for genuine hardship cases.

- Engage a Tax Professional: A qualified tax professional, especially one experienced in ERC claims, might have alternative ways to communicate with the IRS or access your tax transcripts. While they can’t necessarily “speed up” the IRS, they can often steer the system more effectively, providing you with clearer information and guidance.

- Consider Alternative Funding Solutions: For businesses in Austin and Travis County facing critical cash flow needs due to the IRS delays, waiting isn’t always an option. We at SFG Capital specialize in providing ERC Bridge Loans and other funding solutions. We can offer advances or buyouts on your pending ERC refund, providing you with immediate capital while you wait for the IRS to process your claim. This allows you to bypass the frustrating wait and access your funds when you need them most.

Conclusion: Your Path to Receiving Your ERC Funds

The journey to receiving your Employee Retention Credit refund can be long and challenging, marked by significant IRS backlogs, manual reviews, and the occasional lost check. We’ve seen hundreds of thousands of businesses, including many right here in Austin and Travis County, steer this waiting game.

Remember the key steps:

- Always use the correct irs erc phone number for businesses: 1-800-829-4933.

- Prepare thoroughly before you call, having all your business and ERC claim information at your fingertips.

- Understand common IRS responses and what they mean for your refund’s status.

- Be proactive if your check is mailed but never arrives, by initiating a refund trace with Form 3911.

- If you suspect an ineligible claim, use the IRS withdrawal process or, if applicable, the now-closed ERC-VDP to avoid future penalties.

- Don’t hesitate to seek help from the Taxpayer Advocate Service for undue hardship or a trusted tax professional for expert guidance.

Patience and persistence are undoubtedly essential virtues when dealing with the IRS. However, we understand that for many businesses, waiting months or even years for a promised refund is simply not feasible. Cash flow is the lifeblood of any business, and prolonged delays can stifle growth and create unnecessary stress.

That’s why we at SFG Capital are committed to helping businesses like yours bridge the gap. We offer ERC Refund Advance and funding solutions designed to get you the capital you need now, without having to wait for the IRS. We work on a performance-based fee, ensuring that our success is tied to yours.

If you’re tired of waiting and need to access your ERC funds today, don’t let the IRS backlog hold your business back. We invite you to Explore Your ERC Funding Solutions with us. Let us help you bypass the wait and keep your business thriving.