Why Austin Businesses Need Professional Tax Guidance

Austin tax consultants provide essential services for businesses and individuals navigating complex federal and state tax obligations. Whether you need help with business formation, IRS problem resolution, or maximizing deductions, local tax professionals offer specialized expertise in Travis County regulations and Texas tax law.

Top Austin Tax Consulting Services:

- Business Tax Preparation – S-Corp, C-Corp, partnership, and sole proprietorship support

- IRS Problem Resolution – Audit representation, tax notices, and collection activity assistance

- Tax Planning & Strategy – Entity selection, S-Corp conversion analysis, and deduction maximization

- Property Tax Review – Guidance on reducing property tax obligations

- Bookkeeping & Payroll – Integrated accounting services with customizable payroll solutions

- Specialized Credits – Employee Retention Credit (ERC) and other federal incentives

Austin’s thriving economy creates unique opportunities—but also complex tax challenges. From choosing the right business structure to navigating IRS backlogs, the stakes are high. Missing key deductions or facing compliance issues can cost your business thousands.

Professional tax consultants help you avoid these pitfalls while uncovering savings opportunities you might overlook on your own. They stay current on changing tax laws, handle tedious compliance work, and provide strategic advice that protects your bottom line.

The real value? Peace of mind knowing your taxes are handled correctly—plus more time to focus on growing your business instead of wrestling with tax forms.

I’m Santino Battaglieri, and through my work with SFG Capital, I’ve helped businesses steer complex tax situations including ERC claims and structured funding solutions, working alongside experienced Austin tax consultants to ensure compliance and maximize refunds. My experience managing over $500 million in ERC transactions has shown me how the right tax guidance makes all the difference for Austin businesses facing IRS delays and complex filing requirements.

A Guide to Services Offered by SFG Capital’s Austin Tax Consultants

When you partner with Austin tax consultants, you’re not just getting someone to fill out forms. You’re gaining a trusted advisor who can offer a wide spectrum of services designed to simplify your financial life and optimize your tax position. From handling the annual grind of tax season to navigating complex financial landscapes, these experts are equipped to assist both individuals and businesses in Travis County and beyond.

For Individuals and Families

For individuals and families, taxes can often feel like a puzzle with constantly changing pieces. Our Austin tax consultants offer comprehensive services to ensure your personal finances are managed effectively and compliantly.

- Income Tax Preparation: This is the bread and butter of what many people associate with tax consultants. We carefully prepare and file your federal and state income tax returns, ensuring accuracy and maximizing any eligible deductions and credits. Whether your tax situation is straightforward or involves multiple income streams, investments, or complex deductions, we’re here to streamline the process.

- Tax Planning: Beyond just preparing your annual return, our consultants engage in proactive tax planning. This involves looking ahead, strategizing throughout the year to minimize your future tax liabilities. We help you make informed financial decisions regarding investments, retirement planning, charitable contributions, and major life events (like buying a home or starting a family) to ensure you’re always in the best possible tax position.

- Estate Tax Planning: Planning for the future of your assets is crucial. Our experts can guide you through the complexities of estate tax planning, helping to minimize tax burdens on your heirs and ensure your legacy is preserved according to your wishes. This often involves working with legal professionals to establish trusts and other estate planning vehicles.

- High Net Worth Individual Strategies: For those with substantial assets and diverse income sources, tax strategies become even more intricate. We provide specialized advice custom to high net worth individuals, focusing on advanced investment strategies, wealth transfer, and sophisticated tax-saving opportunities that align with your unique financial goals.

For comprehensive individual tax support, explore our expert tax strategy for individuals.

For Businesses of All Sizes

Austin is a hub for businesses, from budding startups to established enterprises. Regardless of your company’s size or structure, robust tax and accounting support is non-negotiable. Our Austin tax consultants provide essential services that empower businesses to thrive.

- Business Tax Preparation: We handle the preparation and filing of all necessary federal and state business tax returns. This includes critical filings like the Texas Franchise Tax returns for registered LLCs, LLPs, and C Corps. Our goal is to ensure compliance while identifying every available credit and deduction to keep more money in your business.

- S-Corp, C-Corp, Partnership, Sole Proprietorship Support: We’re adept at navigating the unique tax requirements for various business structures. Whether you operate as a solo entrepreneur, a partnership, an S Corporation, or a C Corporation, our consultants provide custom guidance to ensure your taxes are prepared correctly and optimally. For example, we can help S-Corp owners understand deductions for health insurance premiums.

- Bookkeeping & Payroll: These are the foundations of sound financial management. Our dedicated team can manage your day-to-day bookkeeping, keeping your finances tidy and ensuring accurate records for tax purposes. We also offer customizable payroll solutions designed to meet your business’s specific needs, alleviating the pains of payroll handling and ensuring your employees are paid accurately and on time. Outsourcing these tasks saves you valuable time and money, allowing you to focus on your core business activities.

- Financial Statements: Accurate financial statements are vital for tracking performance, making strategic decisions, and securing financing. We can assist in preparing clear and comprehensive financial reports that give you a true picture of your business’s health.

- Customizable Payroll Solutions: Every business is unique, and so are its payroll needs. We work with you to implement payroll systems that fit your specific operational requirements, ensuring compliance with all employment tax regulations.

For a deeper dive into how we can support your business, check out our integrated business tax and accounting services.

Specialized Tax Solutions

Sometimes, tax challenges extend beyond routine preparation. Our Austin tax consultants are equipped to handle more complex and specialized situations, offering peace of mind when you need it most.

- Property Tax Review & Guidance: Property taxes in Travis County can be significant. We offer specialized services to help both residential and commercial property owners reduce their property tax burdens. This often involves representing you before county appraisal districts and managing property tax protests. We’ve seen clients save on property taxes simply by contacting consultants, avoiding the need for in-person protests.

- IRS Problem Resolution: Dealing with the IRS can be daunting. Our consultants provide expert representation for individuals and businesses facing IRS concerns. Whether you’ve received a notice, are undergoing an audit, or have unfiled returns, we can help negotiate lasting solutions to your tax issues.

- Audit Representation: Should you face an audit from the IRS or state taxing authorities, having an expert by your side is invaluable. Our professionals can represent you, aggressively advocating to preserve your rights and ensuring the audit process is handled correctly.

- Tax Notices: Receiving a tax notice can be alarming. We can help you understand the notice, determine the appropriate response, and handle all communications with tax authorities on your behalf.

- Collection Activity: If you’re facing collection activity from the IRS or state, our consultants can step in to protect you. We work to negotiate manageable payment plans, offers in compromise, or other resolutions to help you get back on track.

If you’re struggling with IRS issues, don’t hesitate to seek IRS tax issue assistance.

The Strategic Advantage: How SFG Capital’s Tax Consultants Boost Austin Businesses

In Austin’s dynamic business environment, simply complying with tax laws isn’t enough. To truly thrive, businesses need proactive tax strategies. Our Austin tax consultants offer a strategic advantage, helping you make informed decisions that drive growth and maximize profitability.

Entity Selection and Company Formation

The journey of any successful business begins with its foundation: its legal structure. This seemingly technical decision has profound tax implications that can affect your liabilities, operational flexibility, and long-term success.

- Entity Selection: Choosing the right business entity (e.g., sole proprietorship, partnership, LLC, S-Corp, C-Corp) is one of the most critical decisions an entrepreneur makes. It impacts how your business is taxed, your personal liability, and your ability to raise capital. Our consultants provide expert guidance, offering a cost-benefit analysis of various structures to help you determine the best fit for your unique situation.

- Company Formation: Once the optimal structure is identified, we assist with the practical steps of company formation. This includes understanding and fulfilling requirements like the Beneficial Ownership Report (BOIR), a crucial filing for many entities. We ensure your business is established correctly from a tax and regulatory perspective.

- Business Structure Analysis: As your business evolves, its initial structure might no longer be the most advantageous. We conduct periodic analyses to ensure your current structure still serves your long-term goals, recommending changes if they can lead to better tax efficiency or operational benefits.

- Long-term Success Planning: Our role extends beyond mere formation; we help you integrate tax considerations into your broader business plans, budgets, and growth management strategies, especially for family businesses navigating succession or expansion.

To lay a solid foundation for your business, explore our business services.

Proactive Tax Strategy

The best tax strategy is a proactive one. Our Austin tax consultants don’t just react to tax deadlines; we help you plan ahead, identifying opportunities to save and grow throughout the year.

- S Corp Conversion Analysis: For many growing businesses, converting to an S Corporation can offer significant tax advantages, particularly in reducing self-employment taxes. We perform detailed cost-benefit analyses to determine if an S Corp conversion is the right strategic move for your company, helping you understand the implications and steer the process.

- Maximizing Deductions: Our specialists are experts in identifying every credit and deduction available for your tax situation. This includes common business expenses, but also less obvious opportunities that can significantly reduce your taxable income. We take a “no stone unturned” approach to ensure you’re paying the least amount of income tax allowed by law.

- Tax Compliance: Beyond saving money, ensuring full tax compliance is paramount. We help you steer federal and state tax laws, keeping you informed about changes (like the “One Big Beautiful Bill Act” or other new regulations) and ensuring all filings are accurate and on time. This proactive approach minimizes the risk of audits and penalties.

- Opening up Tax Credits: Tax credits can be a game-changer for businesses, directly reducing your tax liability dollar-for-dollar. We actively seek out federal and state incentives that your business may qualify for, ensuring you don’t leave money on the table.

- Federal & State Incentives: Texas, while not having a state income tax, does have specific business tax considerations like the Franchise Tax. We help businesses understand and leverage all available federal and state incentives, including researching local Austin and Travis County specific tax regulations that might apply to your operations.

- Employee Retention Credit (ERC): This is a prime example of a significant tax credit that has provided immense relief to businesses. At SFG Capital, we specialize in the Employee Retention Credit (ERC) for businesses in Travis County. We understand the complexities of claiming this credit and, crucially, how to expedite your refund. With current IRS delays, we offer advances and buyouts to bypass these bottlenecks, ensuring quick access to your funds. Our performance-based fee structure means we only get paid when you do. If you believe your business might be eligible for this valuable credit, we provide expert claim assistance to help you secure the funds you deserve.

Dive deeper into how ERC can benefit your business with our ERC Credit Complete Guide and find 5 Ways to Use ERC Funds to Strengthen Your Business.

How to Choose the Best Austin Tax Consultants for Your Needs

Choosing the right Austin tax consultants is a critical decision that can significantly impact your financial well-being. It’s not just about finding someone to do your taxes; it’s about finding a partner who understands your unique situation and can provide strategic guidance.

What to Look for in Top Austin Tax Consultants

When evaluating potential tax consultants, consider these key factors to ensure you’re making an informed choice:

- Professional Designations: The credentials of a tax professional speak volumes about their expertise and commitment to their field. Look for individuals with recognized designations such as:

- CPAs (Certified Public Accountants): These professionals have passed a rigorous exam, meet specific education and experience requirements, and adhere to a strict code of ethics. They are highly qualified in accounting and tax matters.

- Tax Attorneys: These individuals are lawyers specializing in tax law, capable of handling complex legal tax issues and representation.

- Enrolled Agents (EAs): EAs are federally authorized tax practitioners who have unlimited practice rights before the IRS. They can represent taxpayers on any matter before the IRS.

- Senior Property Tax Consultants: For property-specific concerns, experts in this field possess specialized knowledge of appraisal district processes and protest strategies.

Leading firms often boast teams of tax professionals that include CPAs, Tax Attorneys, Senior Property Tax Consultants, and Enrolled Agents, with decades of combined experience. This breadth of expertise is a significant indicator of quality.

- Client Reviews & Testimonials: What others say about a consultant can provide valuable insights into their service quality and client satisfaction. Look for firms with strong online reputations and numerous positive reviews on platforms like Google, reflecting positive customer experiences. We believe that leaving a good impression is paramount, and positive reviews are a testament to quality work.

- Staying Current: Tax laws and regulations are constantly evolving. A top Austin tax consultant will demonstrate a clear commitment to ongoing professional development and staying abreast of the latest changes. This means they regularly engage with new tax legislation, understand its implications, and proactively share this knowledge with clients through articles, insights, or direct communication. For instance, some firms actively publish articles on topics like new IRS rules for LLCs, S Corps, Partnerships, or changes in estate tax planning, showcasing their commitment to keeping clients informed.

The Benefits of Hiring Local Austin Tax Consultants

While national firms have their place, there are distinct advantages to partnering with local Austin tax consultants that often translate into more personalized and effective service.

- Local Advantage: A local consultant understands the specific economic landscape and regulatory environment of Travis County and the broader Austin area. This familiarity extends to understanding local business trends, property tax nuances, and the specific needs of businesses operating within our community.

- Travis County Knowledge: Local experts are intimately familiar with Travis County’s specific property tax assessment processes and other local ordinances that might impact your business or personal finances. This localized knowledge can be invaluable for navigating property tax protests and understanding regional incentives.

- Texas Tax Law Nuances: While federal tax law applies nationwide, Texas has its own set of tax regulations, such as the Texas Franchise Tax. Local consultants are well-versed in these state-specific nuances, ensuring your compliance and helping you optimize your state tax position.

- Accessibility & In-person Consultations: Being local means easier access for in-person meetings, which can be crucial for complex discussions or simply building a stronger relationship. You can easily visit their offices located right here in Austin. For instance, you might find our Austin office at Four Barton Skyway, 1301 S Mopac Expressway, Suite 430, allowing for convenient face-to-face interactions.

- Personalized Service & Building Relationships: Local firms often pride themselves on building meaningful, long-term relationships with their clients. They take the time to understand your unique goals, challenges, and aspirations, providing a more custom approach than a larger, more impersonal national entity might offer. This focus on personal connection means you’re not just another client; you’re a valued partner.

Understanding a Consultant’s Process and Pricing

Before committing to an Austin tax consultant, it’s wise to understand their operational process and how they structure their fees. Transparency in these areas is a hallmark of a trustworthy firm.

- Engagement Process: A clear engagement process outlines what you can expect from initial contact to ongoing service. It typically begins with an initial consultation, often free, where you can discuss your needs and the consultant can assess how they can help. Following this, there’s an onboarding phase where you provide necessary documentation and information. Our process is designed to be collaborative; we work closely and proactively with our clients. To understand how we approach our client relationships, you can learn about Our Process.

- Technology & Online Services: Leveraging technology is crucial for efficiency and convenience. Many Austin tax consultants use secure client portals for document exchange, offer online meeting capabilities, and provide digital access to your financial information. This allows for seamless collaboration, regardless of your location within Austin or Travis County.

- Data Security: With sensitive financial information being exchanged, data privacy and security are paramount. Reputable consultants employ robust security measures, including encryption for files at rest, dedicated security teams, vulnerability testing, and automated detection of abusive behavior. They also adhere to strict privacy policies, detailing how your personal and financial information is collected, used, shared, and protected. For instance, our privacy practices are designed to protect your data, and we comply with frameworks like the EU-U.S. and Swiss-U.S. Privacy Shield Frameworks, subject to FTC oversight. Any complaints regarding privacy compliance can be reviewed and resolved by JAMS, an independent organization. More details on data privacy compliance can be found here: Information on data privacy compliance.

- Fee Structures: Understanding how consultants charge for their services is essential to avoid surprises. Common pricing models include:

- Fixed Fees: A set price for a specific service (e.g., preparing a personal tax return or a business’s annual taxes). This offers predictability.

- Hourly Rates: Fees based on the time spent by the consultant on your case. This is common for advisory services or complex issues.

- Contingency Fees: Payments are based on the outcome, often a percentage of savings or refunds achieved. This model is particularly common for property tax protests or specialized services like ERC claims, where our performance-based fee ensures we only get paid when you do. Many reputable firms are known for competitive pricing, offering both fixed and contingency fees.

Conclusion: Partner with an Expert and Master Your Taxes

Navigating the intricacies of federal and Texas tax laws can feel like a full-time job. But with the right Austin tax consultants by your side, it doesn’t have to be yours. We’ve seen how expert guidance can transform financial challenges into strategic advantages, offering everything from meticulous income tax preparation for individuals to sophisticated entity selection and proactive tax planning for businesses in Travis County.

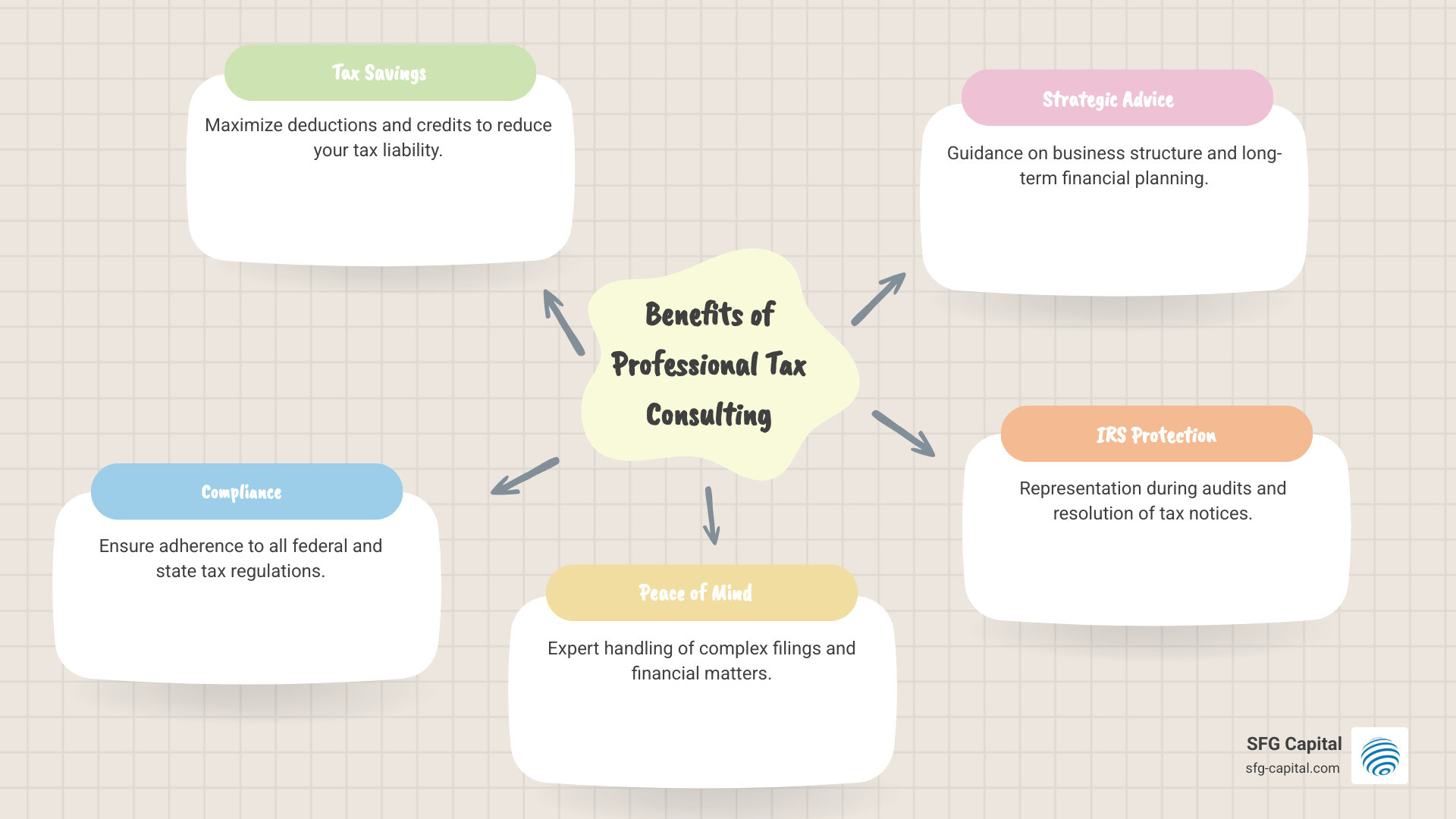

The key benefits of working with seasoned professionals are clear: you gain invaluable peace of mind, ensure unwavering compliance, open up significant tax savings through maximized deductions and credits, and receive strategic advice custom to your unique goals. This allows you to reclaim your time and focus on what truly matters: growing your business or enjoying your life.

At SFG Capital, we are particularly passionate about helping Travis County businesses with specialized needs, such as expediting Employee Retention Credit (ERC) refunds. We understand the frustration of IRS delays and offer innovative solutions like advances and buyouts, coupled with our performance-based fee structure, to ensure you get your funds quickly and efficiently. Our commitment is to provide the expert claim assistance you need, helping you bypass those waiting games and put your funds to work.

Don’t let complex tax obligations hold you back. Partner with an expert and master your taxes. For more insights on securing your ERC funds, read Expediting Your ERC Refund: What You Need to Know. Ready to take control of your tax situation and explore how we can help? Get the Employee Retention Credit Help you need today!