Why Small Business Funding Matters for Every Stage of Growth

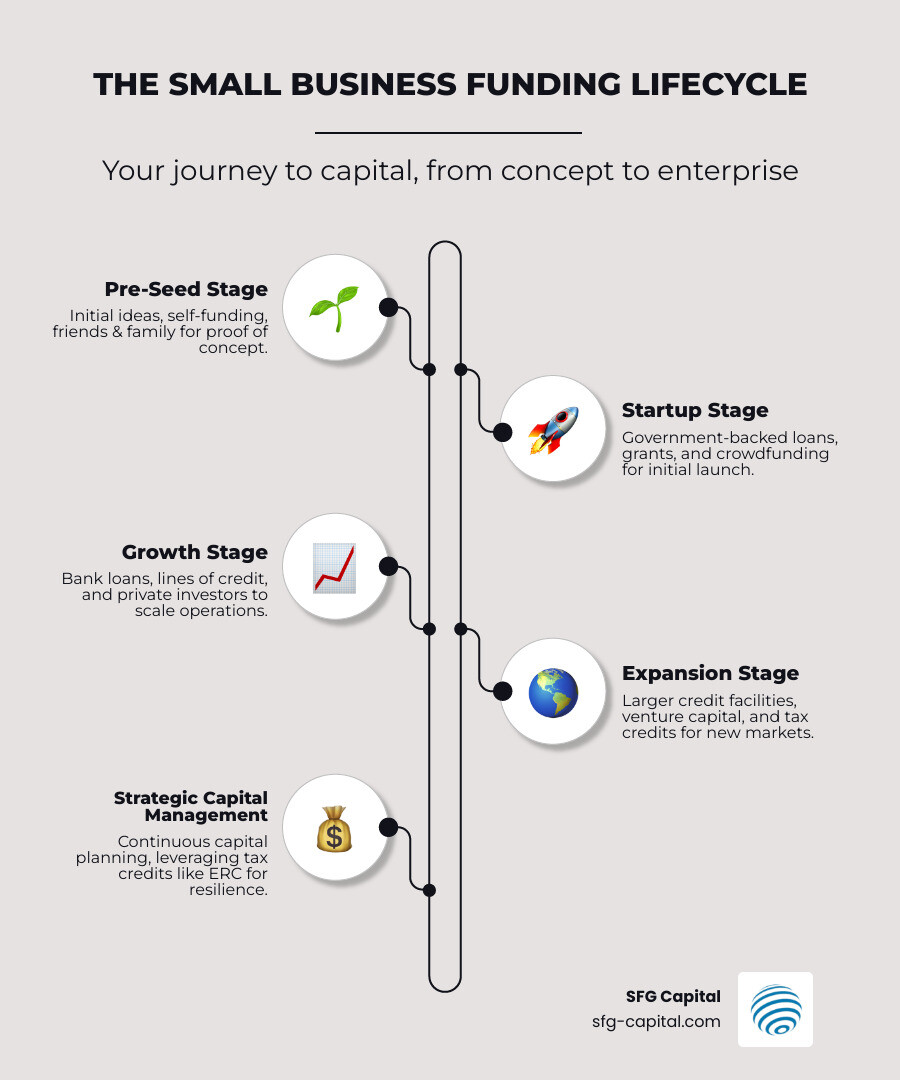

Small business funding is the lifeblood of entrepreneurship—it’s what transforms a great idea into a thriving company. Whether you’re calculating startup costs for your first venture or preparing to expand to new locations, access to capital determines how fast you can move and how far you can grow.

Quick Overview: Main Small Business Funding Options

- Traditional Bank Loans & Lines of Credit – Reliable financing from banks and credit unions with competitive rates

- Government-Backed Loans – Programs like the Canada Small Business Financing Program (CSBFP) and SBA loans that share risk with lenders

- Grants & Targeted Programs – Non-repayable funding for specific demographics (Indigenous, Black, youth entrepreneurs) and purposes

- Private Investment – Angel investors and venture capital in exchange for equity ownership

- Alternative Funding – Crowdfunding, self-funding, and invoice financing for flexible capital access

- Tax Credits – Programs like the Employee Retention Credit (ERC) that provide non-dilutive capital through tax refunds

The challenge isn’t just finding funding—it’s choosing the right type for your business stage, preparing the documentation lenders require, and navigating complex application processes. Many business owners face frustrating delays, especially with government programs, while their growth plans sit on hold.

Consider John and Kelly’s journey opening an auto repair shop. After calculating their startup costs, they found themselves 60% short of their funding goal. Self-funding got them partway there. An investment firm covered 20% in exchange for equity. A crowdfunding campaign from community supporters added another 10%. But they still faced a 30% gap—until they finded government-backed loans that finally made their business possible.

I’m Santino Battaglieri, and through my work at SFG Capital, I’ve helped businesses access over $500 million in capital, including specialized small business funding solutions like ERC tax credits. I’ve seen how the right funding strategy—and timing—can accelerate growth or provide crucial working capital when cash flow is tight.

Preparing for Funding: Laying the Groundwork for Success

Before you even think about applying for small business funding, you need to ensure your business is ready to present itself in the best possible light. Think of it like preparing for a big job interview—you wouldn’t show up without a polished resume and a clear understanding of your strengths, would you? The same goes for your business. Lenders and investors want to see a clear picture of your past performance, current standing, and future potential. This means carefully preparing a solid business plan, compiling detailed financial history, understanding your creditworthiness, and projecting future growth.

When seeking funding, you’ll need to display financial history statements that clearly outline your revenue, expenses, and profit over time. This shows funders that you understand your business’s financial health. If your business hasn’t had a history of positive growth, don’t despair! You’ll need to explain why more funding will allow your business to turn things around. Perhaps it’s an investment in new technology, a strategic marketing push, or an expansion into a new market. The key is to have a compelling narrative backed by sound reasoning.

Proving financial responsibility is also paramount. A business credit report is your report card in the financial world. We recommend reviewing your business credit file for accuracy before sharing it with any potential funder. Errors can inadvertently hurt your chances. Additionally, performing a business valuation can help determine your company’s current worth, which is especially important if you’re considering equity investments. Finally, creating a robust business forecast, based on intuitive judgment, quantitative analysis, or both, is crucial. This forecast should show projected revenue and expenses, and you must clearly explain how those estimations were arrived at. Transparency builds trust.

Understanding Your Creditworthiness

Your creditworthiness is a critical factor in securing small business funding, whether you’re applying for a traditional loan or seeking government-backed assistance. Both your personal credit score and your business credit history play significant roles. Lenders use these reports to assess your financial management capabilities and the likelihood of repayment.

A strong personal credit score demonstrates your ability to manage personal finances responsibly, which often translates to how you’ll manage your business’s finances. Your business credit history, on the other hand, reflects your company’s payment behavior with suppliers, creditors, and other business partners.

It’s important to remember that even with less-than-perfect credit, funding might still be available. Some programs, particularly those designed for startups or specific demographics, may have more flexible criteria. However, maintaining good credit is always a best practice. Regularly check your credit reports (both personal and business) for inaccuracies and work to improve any areas of weakness. This proactive approach can significantly improve your chances of securing the small business funding you need.

Crafting a Compelling Business Plan

A well-crafted business plan isn’t just a formality; it’s your business’s roadmap and your most powerful tool when seeking small business funding. It tells your story, outlines your vision, and demonstrates your understanding of the market and your path to profitability.

Here’s what a compelling business plan should include:

- Executive Summary: A concise overview of your entire plan, highlighting your business concept, mission, and funding request. This is often the first—and sometimes only—thing a busy lender or investor reads. Make it count!

- Company Description: What does your business do? What problem does it solve? What are its legal structure and unique value proposition?

- Market Analysis: Who are your customers? What’s the size of your market? Who are your competitors, and how will you differentiate yourself in the Austin/Travis County market and beyond?

- Organization and Management: Who’s on your team? What are their qualifications and experience? Highlight the expertise that will drive your business forward.

- Service or Product Line: Detail what you sell, its benefits, and its lifecycle.

- Marketing and Sales Strategy: How will you reach your target customers? What are your sales channels?

- Funding Request: This is where you clearly state how much small business funding you need, how you plan to use it, and how it will help your business achieve its goals. Be specific and realistic.

- Financial Projections: This section includes your historical financial data (if available), along with realistic forecasts for future revenue, expenses, and cash flow. This is where your business forecast comes into play.

- Appendix: Include any supporting documents like resumes, permits, licenses, or letters of intent.

Your business plan should also articulate clear growth goals. Funders want to see that you have a vision for scaling your business and a strategy to get there. A well-researched, clearly articulated business plan shows that you’ve done your homework and are serious about your venture.

Traditional and Government-Backed Small Business Funding

For many businesses in Austin and across the US, traditional and government-backed loans are often the first port of call for small business funding. These options provide structured capital with predictable repayment terms, making them a cornerstone of growth.

Bank loans and lines of credit from established financial institutions are widely recognized avenues. Banks typically offer various loan products custom to different business needs, from equipment financing to working capital. A line of credit provides flexibility, allowing you to draw funds as needed up to a certain limit and repay them, much like a business credit card, but often with better terms.

Credit unions also play a vital role. They are member-owned financial cooperatives that often offer competitive interest rates and a more personalized approach. For businesses in early stages, credit unions might offer specialized products and a unique understanding of local economic conditions in Travis County.

Beyond traditional lenders, government-supported loans offer a significant advantage, especially for businesses that might not qualify for conventional bank financing alone. These programs work by having a government agency guarantee a portion of the loan, reducing the risk for the lender. This risk-sharing mechanism encourages banks and credit unions to lend to businesses they might otherwise consider too risky. The key benefit? Increased access to capital for a wider range of small businesses.

The Role of Government-Supported Loan Programs

In the United States, the Small Business Administration (SBA) is the primary federal agency providing support for small business funding. The SBA doesn’t directly lend money but guarantees loans made by approved lenders, making it easier for businesses to get financing. These SBA-backed loans come with various programs custom to different needs, such as the 7(a) loan program (the most common, offering flexible financing for many purposes), CDC/504 loans (for real estate and equipment), and microloans (smaller loans for startups and underserved communities).

These programs are particularly helpful for businesses that might struggle to meet the strict collateral or credit requirements of traditional loans. The SBA’s backing incentivizes lenders to provide capital, helping businesses that might otherwise be overlooked. As John and Kelly finded in their journey, when investors and banks deemed their auto repair shop too risky, SBA-backed loans provided the crucial funds they needed.

Eligibility for SBA loans generally depends on factors like what your business does to receive its income, the character of its ownership, and where it operates. Businesses normally must meet SBA size standards, demonstrate the ability to repay the loan, and have a sound business purpose. It’s good to know that even those with bad credit may qualify for startup funding through specific SBA programs, though terms might vary. We always recommend consulting with lenders for a full list of eligibility requirements specific to their loans.

In addition to standard programs, the SBA also offers disaster loans for businesses and homeowners recovering from declared disasters. These low-interest loans can provide vital financial assistance when the unexpected happens, helping businesses rebuild and recover.

To find these programs, the SBA offers tools like Lender Match, which connects businesses with lenders specializing in SBA loans. You can explore a wide range of government funding programs and resources by visiting the SBA’s funding programs page. For local resources here in Austin, you might also check out AustinTexas.gov small business resources.

Key Steps for Applying for Small Business Funding

Applying for small business funding can feel like a daunting task, but breaking it down into manageable steps makes the process much clearer. Preparation is your best friend here!

-

Gather Your Documents: This is where all your hard work on the business plan and financial preparation pays off. You’ll need:

- Business Plan: Your comprehensive roadmap (as discussed above).

- Financial Statements: Historical profit and loss statements, balance sheets, and cash flow statements, typically for the past 2-3 years.

- Tax Returns: Personal and business tax returns for the past few years.

- Legal Documents: Business licenses, permits, articles of incorporation, and any relevant contracts.

- Personal Financial Statement: A summary of your personal assets and liabilities.

- Credit Reports: Both your personal and business credit reports.

- Collateral Information: Details of any assets you might pledge as collateral for the loan.

-

Complete the Application: Once you have all your documents in order, you can fill out the lender’s application form. Be thorough, accurate, and honest. Any discrepancies can cause delays or outright rejection.

-

Lender Consultation: Don’t hesitate to engage with lenders early in the process. Many banks and SBA resource partners offer free business counseling. They can guide you through their specific requirements, help you understand the types of loans available, and even assist in refining your application. This personalized support can be invaluable, especially for first-time applicants in Travis County.

The goal is to present a clear, compelling, and financially sound case for why your business deserves funding.

Exploring Alternative Funding Avenues

While traditional loans are a staple, small business funding offers a vibrant array of alternative options. These can be particularly appealing for startups, businesses with unique models, or those seeking capital without taking on traditional debt.

Self-funding, also known as bootstrapping, is often where many entrepreneurs begin. This involves using personal savings, credit cards, or borrowing from friends and family. While it offers complete control and avoids debt, it comes with personal risk. As John and Kelly learned, there’s a limit to how much you can self-fund without depleting retirement accounts or other vital personal assets.

Private investors, such as angel investors and venture capitalists, offer capital in exchange for equity—a portion of ownership in your company. This is ideal for businesses with high growth potential, as these investors aren’t just providing money; they often bring valuable experience, networks, and mentorship. The trade-off is giving up a piece of your company and, sometimes, a degree of control.

Is Crowdfunding Right for Your Business?

Crowdfunding has emerged as a popular and accessible way to secure small business funding, especially for innovative products or community-focused ventures. It involves raising small amounts of money from a large number of people, typically through online platforms.

There are different types:

- Reward-based crowdfunding: Backers receive a product, service, or unique experience in exchange for their contribution. This is excellent for testing market demand and building a customer base before launch.

- Equity crowdfunding: Backers receive a small ownership stake in your company. This is more regulated and suitable for businesses with high growth potential seeking to raise larger sums.

- Donation-based crowdfunding: Primarily for charitable causes, less common for for-profit businesses.

Crowdfunding thrives on community support. If your business has a strong local following or a compelling story that resonates with a wider audience, a crowdfunding campaign can be incredibly successful. It’s not just about the money; it’s also a powerful marketing tool that can generate buzz and validate your business idea.

When considering crowdfunding, prepare a captivating campaign, clearly outlining your project, funding goal, and what backers will receive. Platforms like Kickstarter, Indiegogo, and Republic are popular choices.

Tapping into Private Investors and Growth Capital

For businesses with significant growth potential, small business funding from private investors can be a game-changer. These investors, often called angel investors or venture capitalists, provide substantial capital in exchange for equity.

- Angel Investors: Typically wealthy individuals who invest their own money in early-stage startups. They often provide not just capital but also mentorship and industry connections.

- Venture Capitalists (VCs): Firms that invest institutional money in high-growth companies, usually in later stages than angel investors. VCs typically seek a significant return on their investment and often take a more active role in the company’s strategic direction.

The process of securing this type of funding usually involves:

- Pitching to Investors: You’ll need a polished pitch deck and presentation that clearly articulates your business idea, market opportunity, team, and financial projections.

- Business Valuation: Investors will want to understand your company’s worth to determine their ownership stake. This can be a complex process, often involving financial models and industry comparisons.

- Giving Up Equity: This is the critical trade-off. While you gain capital and expertise, you relinquish a portion of your ownership and, potentially, some control over your business decisions.

Finding these investors often involves networking events, introductions from mentors, or specialized platforms connecting startups with capital. For entrepreneurs in Austin, engaging with local startup communities and incubators can be a great way to tap into these networks.

Specialized Funding and Tax Credit Opportunities

Beyond the well-trodden paths of traditional loans and private investment, there’s a landscape of specialized small business funding designed to address specific needs, support diverse entrepreneurs, and leverage tax incentives. These targeted programs can provide significant advantages, often offering non-dilutive capital or more favorable terms.

Many government bodies and non-profit organizations recognize the unique challenges faced by certain groups or industries. As a result, they’ve created programs to foster inclusivity and economic development. These can range from grants that don’t require repayment to loans with lower interest rates or more flexible repayment schedules.

Support for Diverse Entrepreneurs

The US government, through agencies like the SBA, offers various resources and programs specifically designed to support diverse entrepreneurs, including those in Austin and Travis County. These initiatives aim to reduce barriers and provide equitable access to small business funding and resources.

- Women-Owned Businesses: The SBA offers counseling, training, and federal contracting opportunities through its Women’s Business Centers.

- Minority-Owned Businesses: Programs like the 8(a) Business Development program help small disadvantaged businesses compete for federal contracts and provide business development assistance.

- Veteran-Owned Businesses: The SBA provides specific programs, resources, and training for veterans and military spouses looking to start or grow a business.

- Rural Business Programs: While SFG Capital is based in Austin, businesses in surrounding rural areas of Texas can often find support through USDA Rural Development programs, which offer loans and grants for business development in rural communities.

These programs acknowledge that entrepreneurship is a powerful engine for economic growth across all demographics. You can find extensive resources for these and other business types directly on the SBA website.

Leveraging Tax Credits for Small Business Funding

One often-overlooked yet incredibly powerful source of small business funding comes in the form of tax credits. Unlike loans, tax credits don’t need to be repaid, and unlike equity, you don’t give up ownership. They represent a direct reduction in your tax liability or, in some cases, a refund.

A prime example of this is the Employee Retention Credit (ERC). The ERC was a refundable tax credit designed to encourage businesses to keep employees on their payroll during the COVID-19 pandemic. While the program has ended, many eligible businesses are still in the process of claiming their refunds for past quarters.

The challenge? IRS delays. Many businesses have faced prolonged waiting periods for their ERC refunds, sometimes stretching for months or even years. This can create significant cash flow issues, especially for small businesses relying on this capital.

This is precisely where SFG Capital steps in. We help businesses in Travis County expedite their ERC refunds. We offer advances and buyouts, allowing you to bypass those frustrating IRS delays and access your funds quickly. We operate on a performance-based fee, meaning we only get paid when you do. This not only provides crucial, non-dilutive funding but also ensures you have expert assistance with your claim. Understanding what is ERC funding can open up a significant source of capital for eligible businesses. If you’re currently facing delays with your ERC refund, we can help you turn that waiting game into growth capital.

Frequently Asked Questions about Small Business Funding

We understand that navigating small business funding can bring up a lot of questions. Here are some of the most common ones we encounter:

What are the main types of funding for a small business?

Generally, the main types of funding for a small business fall into four categories:

- Debt Financing: This includes traditional bank loans, lines of credit, and government-backed loans (like SBA loans). You borrow money and agree to repay it, typically with interest, over a set period.

- Equity Financing: This involves selling a portion of your company’s ownership (equity) to investors, such as angel investors or venture capitalists, in exchange for capital.

- Grants: These are non-repayable funds, often provided by government agencies or foundations, usually for specific purposes or to support particular types of businesses or demographics.

- Self-Funding/Bootstrapping: Using your personal savings, assets, or revenue generated by the business itself to fuel growth.

- Alternative Funding: This broad category includes options like crowdfunding, invoice financing, or merchant cash advances.

- Tax Credits: Programs like the Employee Retention Credit (ERC) that provide direct financial benefits through tax reductions or refunds.

The best choice for your business depends heavily on your business stage, credit history, growth potential, and willingness to take on debt or give up ownership.

How do I know which funding option is right for me?

Determining the right small business funding option requires a careful assessment of several factors:

- Your Capital Needs: How much money do you need, and what will you use it for (startup costs, equipment, working capital, expansion)?

- Your Tolerance for Debt: Are you comfortable taking on monthly loan payments and interest?

- Your Willingness to Give Up Ownership: Are you open to sharing control and future profits with investors in exchange for capital and expertise?

- The Stage of Your Business: A startup with no revenue might find grants, crowdfunding, or equity financing more accessible than traditional bank loans. An established business with a proven track record might prefer a bank loan for expansion.

- Your Creditworthiness: Your personal and business credit scores will significantly influence your eligibility for debt financing.

For instance, if you’re a new business in Austin looking for seed capital and have a compelling product idea, crowdfunding or seeking angel investors might be a good fit. If you’re an established business looking to purchase new equipment, an SBA-backed loan or a traditional equipment loan could be ideal.

Can I get funding for my business if I have bad credit?

Yes, it is possible to get small business funding even if you have bad credit, though it can be more challenging. While traditional banks often have strict credit score requirements, other options exist:

- Government-Supported Microloans: The SBA’s microloan program, for example, provides small loans (up to $50,000) through intermediary lenders, often with more flexible criteria and a focus on providing technical assistance.

- Online Lenders: Some online lenders specialize in working with businesses that have lower credit scores, though their interest rates might be higher.

- Crowdfunding: This option relies more on your product’s appeal and community support than your credit history.

- Grants: Since grants don’t need to be repaid, credit history is typically not a primary factor in eligibility.

- Equity Financing: Angel investors and venture capitalists are more interested in your business’s potential for growth and your team than your personal credit score, though a strong business plan is essential.

If you have bad credit, focus on building a robust business plan and strong financial projections. Demonstrating your business’s viability and your understanding of its financial health can help offset a lower credit score.

Conclusion

Navigating the landscape of small business funding can feel like a complex journey, but with the right preparation and understanding of your options, it’s a journey that can lead to significant growth and success. We’ve explored everything from laying the groundwork with a solid business plan and understanding creditworthiness to tapping into traditional bank loans, government-backed programs like those from the SBA, and innovative alternatives like crowdfunding and private investment.

Remember the story of John and Kelly: their journey to fund their auto repair shop was a mix of self-funding, equity investment, crowdfunding, and ultimately, government-backed loans. Their experience highlights the importance of a strategic funding approach—diversifying your sources and understanding which options best fit your business’s stage and needs.

As you plan your next steps, consider all the avenues available. And if your business is eligible for the Employee Retention Credit (ERC) and you’re facing delays in receiving your refund, know that solutions exist. SFG Capital is here in Travis County to help you overcome those IRS delays, providing you with the capital you need to keep your business moving forward. We believe every business deserves the opportunity to thrive.

Ready to explore how the right funding can power your business forward? Visit our page on Funding Growth: How ERC Can Power Your Business Forward to learn more.