What the ERC Payroll Credit Means for Your Business

The ERC payroll credit is a refundable tax credit available to eligible businesses that kept employees on payroll during the COVID-19 pandemic. This credit, established through the CARES Act and later expanded by the American Rescue Plan Act, allows businesses to claim between 50% and 70% of qualified wages paid to employees, depending on the time period.

Quick Answer: ERC Payroll Credit Basics

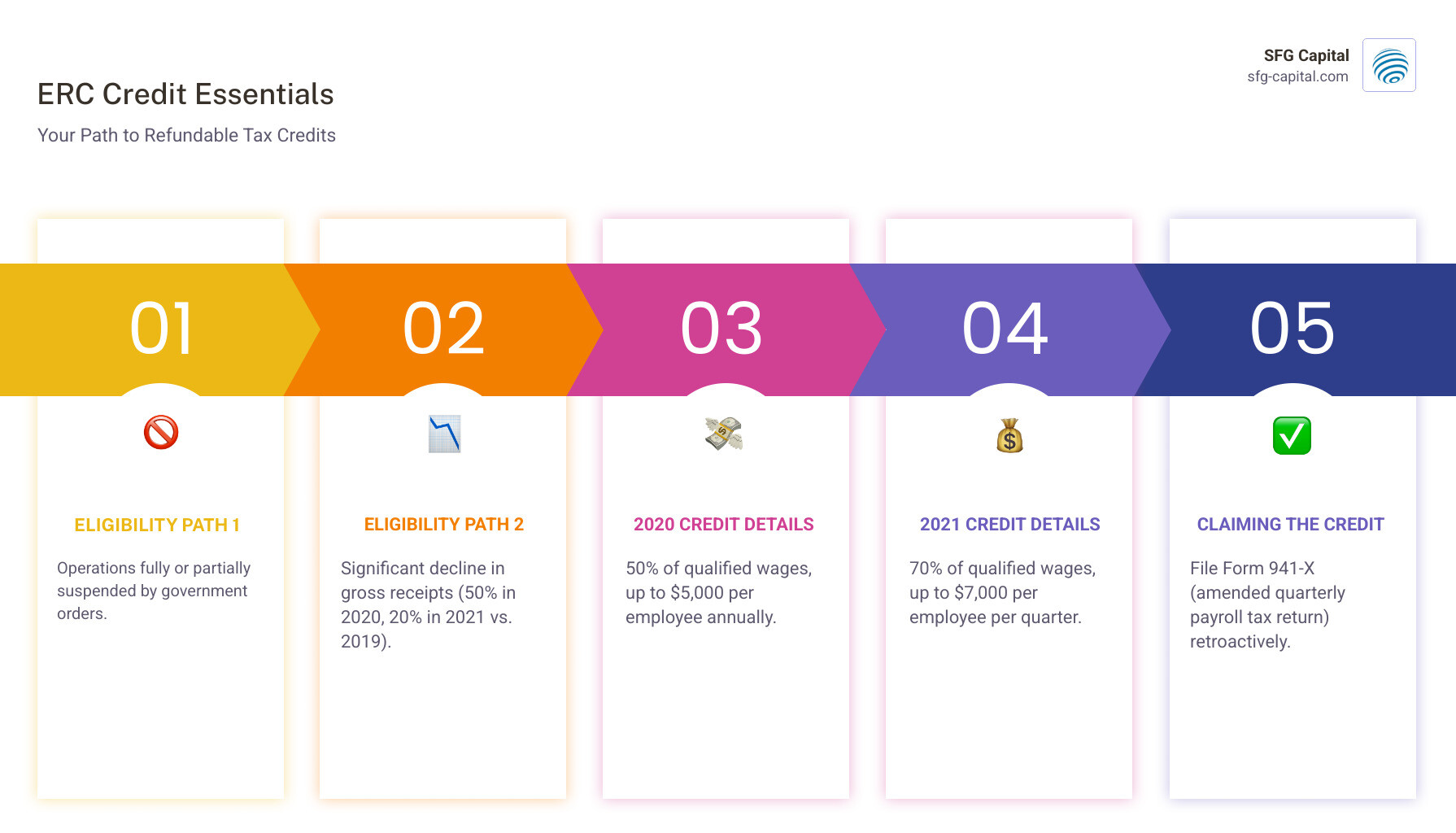

- What it is: A refundable federal tax credit for businesses that retained employees during COVID-19

- Credit amount: 50% of qualified wages (2020) or 70% of qualified wages (2021)

- Maximum per employee: Up to $5,000 total in 2020, or up to $7,000 per quarter in 2021

- Who qualifies: Businesses that experienced government-ordered suspension of operations or significant decline in gross receipts

- How to claim: File Form 941-X (amended quarterly payroll tax return)

- Not a loan: This is a refundable credit that does not need to be repaid

The ERC was designed to offset payroll taxes and provide financial relief to businesses struggling during the pandemic. Unlike the Paycheck Protection Program (PPP), the ERC is not a loan—it’s a direct credit against your employment taxes that can result in a substantial refund check from the IRS.

However, navigating the ERC claim process has become increasingly complex. As of May 2025, the IRS has issued approximately 84,000 letters informing businesses that their claims have been partially or fully disallowed. The agency temporarily suspended processing of new claims in September 2023 due to concerns about fraudulent submissions, and the claim period officially ended on April 15, 2025.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer the ERC payroll credit process by purchasing and funding over $500 million in claims while maintaining strict compliance standards. My approach focuses on careful eligibility analysis and documentation integrity to help businesses access their credits efficiently and responsibly.

Understanding the ERC payroll credit: Eligibility and Criteria

The Employee Retention Credit (ERC) was a lifeline for many businesses, including those right here in Travis County, during the unprecedented challenges of the COVID-19 pandemic. But to open up this potential relief, understanding the specific eligibility criteria is paramount. It’s not just about having employees; it’s about how your business was impacted by the pandemic.

Broadly, businesses of all sizes and across all industries, including for-profit and tax-exempt organizations, could qualify for the ERC. This includes entities like churches and independent schools, provided they met the specific criteria. However, state and local governments and their instrumentalities, and self-employed individuals (for their own wages), were generally not eligible. The credit was available to eligible employers that paid qualified wages to some or all employees after March 12, 2020, and before January 1, 2022.

There are two primary ways a business could establish eligibility for the ERC payroll credit for a given calendar quarter:

- Significant Decline in Gross Receipts: Your business experienced a substantial drop in revenue compared to a pre-pandemic period.

- Government-Ordered Suspension of Operations: Your business operations were fully or partially suspended due to government orders related to COVID-19.

It’s crucial to remember that eligibility is determined on a quarter-by-quarter basis. A business might qualify for some quarters but not others, depending on its specific circumstances and the prevailing economic conditions or government restrictions at the time. To ensure you don’t miss out on potential credits, or to verify past claims, we’ve developed The ERC Eligibility Checklist: Don’t Miss Out!.

Significant Decline in Gross Receipts

This eligibility test hinges on a comparison of your business’s quarterly gross receipts. The specific percentage of decline required changed between 2020 and 2021.

- For 2020: A significant decline in gross receipts began during a calendar quarter in which gross receipts decreased by at least 50 percent compared to the corresponding quarter in 2019. Once your gross receipts recovered to more than 80% of the comparable quarter in 2019, your eligibility under this criterion would end for the following quarter.

- For 2021: The threshold was lowered to make the credit more accessible. A significant decline in gross receipts began during a calendar quarter in which gross receipts decreased by at least 20 percent compared to its gross receipts for the same corresponding quarter in 2019. Similar to 2020, eligibility would end once gross receipts exceeded 80% of the corresponding 2019 quarter.

For new businesses that weren’t operational in 2019, specific rules applied to establish a comparable baseline. When calculating gross receipts, you generally follow the rules of your regular accounting method (cash or accrual) as used for income tax purposes, as defined under § 448 for most entities, and § 6033 for tax-exempt organizations. This gross receipts test is often more straightforward for businesses with clear revenue tracking.

Government-Ordered Suspension of Operations

This criterion is a bit more nuanced and has been a significant point of IRS scrutiny. To qualify under this test, your business must have experienced a full or partial suspension of operations due to a governmental order limiting commerce, travel, or group meetings due to COVID-19.

It’s important to understand what constitutes a “governmental order.” As detailed in Notice 2021-20, these are orders from a federal, state, or local government authority that limit your business activities. This could include:

- Full Suspension: Orders to completely close your business.

- Partial Suspension: Orders that limit your business hours, capacity, or the types of services you can provide. For example, a restaurant ordered to close its dining room but allowed to offer takeout would be considered partially suspended.

- Supply Chain Disruptions: If a governmental order caused a critical supplier to suspend operations, leading to a partial suspension of your business, you might qualify.

However, simply experiencing a decline in customer demand or choosing to voluntarily reduce operations does not qualify. Essential businesses or those that could keep their operations largely intact remotely generally don’t meet this qualification, unless the governmental orders specifically impacted a significant portion of their operations. For instance, a governmental order requiring employees to work from home, if the business could still operate effectively, would likely not qualify. The key is that the governmental order must have had more than a “nominal” impact on your business operations. An impact is considered more than nominal if the portion of your business affected by the order accounted for at least 10% of your gross receipts or total employee hours in 2019.

Calculating Your Credit: 2020 vs. 2021

Once eligibility is established, the next step is to calculate the actual credit amount. The ERC payroll credit calculations changed significantly between 2020 and 2021, offering more generous benefits in the latter year. Understanding these differences is critical for accurate claims.

Calculating Your ERC payroll credit: 2020 vs. 2021

Here’s a breakdown of the key differences:

| Feature | 2020 | 2021 |

|---|---|---|

| Credit Percentage | 50% of qualified wages | 70% of qualified wages |

| Maximum Qualified Wages | Up to $10,000 per employee for the year | Up to $10,000 per employee per quarter |

| Maximum Credit | Up to $5,000 per employee for the year | Up to $7,000 per employee per quarter (totaling up to $21,000 for the first three quarters) |

| Eligibility Period | March 13, 2020 – December 31, 2020 | January 1, 2021 – September 30, 2021 (for most employers) |

| Gross Receipts Decline | 50% compared to same quarter in 2019 | 20% compared to same quarter in 2019 |

For 2020, the credit was equal to 50 percent of qualified wages paid to eligible employees between March 13, 2020, and December 31, 2020. The maximum amount of qualified wages for each employee was $10,000 across all quarters, meaning a maximum credit of $5,000 per employee for the entire year.

For 2021, the credit became much more substantial. It was equal to 70 percent of qualified wages paid between January 1, 2021, and September 30, 2021. For 2021, the qualified wages were limited to $10,000 per employee per quarter. This could result in a credit of up to 7,000 dollars per employee per quarter, potentially up to $21,000 per employee for the first three quarters of 2021 (Q1, Q2, and Q3). The program expired early for most employers on September 30, 2021, with the signing of the Infrastructure Investment and Jobs Act in November 2021.

Qualified wages generally include cash wages subject to FICA taxes, as well as the employer’s share of health insurance costs. For a comprehensive overview, our ERC Credit Complete Guide dives deeper into these calculations.

Impact of Employee Count on Qualified Wages

The size of your business, specifically your average number of full-time employees in 2019, significantly impacted which wages qualified for the ERC.

- For 2020 (Employers with 100 or fewer full-time employees in 2019): If your business had 100 or fewer full-time employees on average in 2019, all wages paid to all employees during an eligible quarter qualified for the credit, regardless of whether the employees were actually working. This was a broad benefit intended to help smaller businesses maintain their entire workforce.

-

For 2020 (Employers with more than 100 full-time employees in 2019): If your business had more than 100 full-time employees on average in 2019, only wages paid to employees who were not providing services due to the suspension or decline in gross receipts qualified. This distinction was designed to incentivize larger businesses to keep furloughed employees on payroll.

-

For 2021 (Employers with 500 or fewer full-time employees in 2019): The legislation in November 2021 increased the employee limit for qualified wages to 500 full-time employees. This meant that qualifying employers with 500 or fewer full-time employees in 2019 could apply the wages of all employees when determining their credit, regardless of whether the employees actually worked.

- For 2021 (Employers with more than 500 full-time employees in 2019): For larger employers, the rule remained similar to 2020: only wages paid to employees who were not providing services qualified.

This distinction is a critical element of ERC calculation, and misinterpreting it can lead to incorrect claims.

Interaction with PPP Loans and Other Relief Programs

Initially, businesses that received Paycheck Protection Program (PPP) loans were not eligible for the ERC. However, subsequent legislation changed this, allowing businesses to claim both. This was a significant win for many businesses in Austin and across the country.

The key caveat is that you cannot “double-dip.” Wages used to qualify for PPP loan forgiveness cannot also be used to claim the ERC payroll credit. For example, if you used $100,000 in wages to secure PPP forgiveness, those same $100,000 in wages cannot be counted towards your ERC calculation. This requires careful tracking and allocation of wages. Our guide, Forgive and Forget: How PPP Loan Forgiveness Impacts Your Employee Retention Credit, provides more detailed insights into this complex interaction.

Similarly, wages used for other COVID-19 relief programs, such as Shuttered Venue Operators Grants or Restaurant Revitalization Grants, also cannot be counted as qualified wages for the ERC. It’s essential to ensure there’s no overlap in claimed wages across different federal programs.

Claiming the Credit and Navigating IRS Scrutiny

Claiming the ERC payroll credit isn’t as simple as checking a box. It involves amending past tax returns, careful documentation, and now, navigating a landscape of increased IRS scrutiny.

How to Claim the ERC payroll credit Retroactively

Most businesses that are now claiming the ERC are doing so retroactively, as the program has officially ended. The good news is that businesses can still retroactively claim ERC for up to three years after the original due date of the employment tax return. This means that for wages paid in 2020, claims could generally be filed until April 15, 2024, and for wages paid in 2021, until April 15, 2025.

To claim the ERC, businesses typically file an amended quarterly payroll tax return, specifically Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form allows you to correct overreported taxes on a previously filed Form 941. The IRS instructions for Form 941-X state that you generally have three years from the date you filed your original Form 941 or two years from the date you paid the tax, whichever is later, to correct overreported taxes.

The process involves:

- Determining Eligibility: Re-evaluating your business’s situation for each quarter in 2020 and 2021.

- Calculating Qualified Wages: Accurately identifying and calculating the wages that qualify for the credit, considering all relevant rules and employee counts.

- Completing Form 941-X: Filling out the amended return for each eligible quarter.

- Submitting Documentation: Gathering and maintaining all supporting documents, such as payroll records, governmental orders, and gross receipts data.

For a detailed walkthrough, our ERC Funding Application: A Step-by-Step Guide to Claiming Your Credit can be a valuable resource. It’s important to be thorough, as the IRS is paying close attention to these claims. Once submitted, it’s often The Great ERC Wait: Understanding Your Delayed Employee Retention Credit.

Red Flags and IRS Scrutiny

The IRS has significantly ramped up its scrutiny of ERC claims due to a surge of questionable claims, often driven by aggressive marketing from third-party promoters, sometimes referred to as “ERC Mills.” In fact, the IRS temporarily stopped processing new ERC claims on September 14, 2023, and has increased audits and criminal investigations. As of May 2025, the National Taxpayer Advocate noted that the ERC claim period has closed, and the IRS must now prioritize resolution, communication, and taxpayer protections.

Common red flags and warnings from the IRS include:

- Unsolicited Ads: Be wary of calls, emails, or social media ads promoting “too good to be true” offers.

- “Instant” Eligibility: Promoters claiming you qualify without thoroughly reviewing your specific financial situation and governmental orders.

- Large Upfront Fees: Requiring a substantial fee before any work is done, or fees based on a percentage of the refund.

- Pressure to Claim: Being told that “every business qualifies” or that there’s “nothing to lose.”

- Lack of Documentation: Promoters who don’t emphasize the need for detailed records to support your claim.

The IRS has even launched a Voluntary Disclosure Program for employers who may have erroneously claimed the ERC, allowing them to resolve their civil tax liabilities by paying back 80% of the claimed amount. This highlights the seriousness of the IRS’s concerns. We strongly advise working with reputable tax professionals who prioritize compliance and proper documentation over quick, easy refunds. As The Employee Retention Credit Is a Great Deal–but Beware ‘ERC Mills’, it’s crucial to partner with experts who understand the intricacies of the program and can help you steer ERC Funding Requirements with integrity.

What happens if an ERC claim is disallowed? If your claim is disallowed, and you had reduced your wage expense on your income tax return for the year the ERC was claimed, you generally don’t need to amend that prior income tax return. Instead, you can increase your wage expense on your income tax return for the year the disallowance becomes final. This means if your 2021 ERC claim was disallowed in 2024, you could adjust your wage expense on your 2024 income tax return, simplifying the correction process. This is thanks to special statutory rules that treat the ERC as a reimbursement right.

Frequently Asked Questions about the ERC payroll credit

We hear a lot of questions about the ERC payroll credit, especially given its complexity and the recent IRS crackdowns. Let’s address some of the most common ones.

Is the ERC a loan that needs to be repaid?

No, absolutely not! The ERC payroll credit is not a loan, and it does not need to be repaid. It is a refundable tax credit, which means it reduces your employment tax liability. If the credit amount exceeds your payroll tax liability for a given quarter, the IRS sends you the difference as a refund. It’s essentially a grant or subsidy from the government to help businesses retain employees during the pandemic. Our article, Don’t Get Confused: Why the Employee Retention Credit Isn’t a Loan, explains this distinction in more detail. As long as the credit is calculated and filed correctly, companies don’t have to pay it back or incur any penalties.

What is the difference between ERC and ERTC?

There is no difference! ERC and ERTC are simply interchangeable terms for the same program: the Employee Retention Credit (or Employee Retention Tax Credit). You might also hear it referred to as the Employee Retention Payroll Credit. They all refer to the federal program designed to incentivize businesses to keep employees on payroll during the COVID-19 pandemic. So, whether you say ERC or ERTC, we know what you mean!

How does the credit impact other tax deductions?

This is a crucial point that often gets overlooked. When you claim the ERC payroll credit, you must reduce your income tax deduction for wages by the amount of the credit you received. This prevents you from getting a double tax benefit (a credit for the wages and a deduction for the wages).

For example, if you claimed a $50,000 ERC for wages paid in 2020, you would need to reduce your 2020 wage expense deduction on your income tax return by $50,000. This often means that businesses need to amend their income tax returns (e.g., Form 1120-X for corporations or Form 1040-X for individuals reporting business income on Schedule C or E) for the years they claimed the ERC.

This adjustment is required under Section 280C of the Internal Revenue Code. Failure to properly adjust your wage deduction can lead to issues with the IRS. As mentioned earlier, if an ERC claim is later disallowed, and you had already reduced your wage expense, you can often address this adjustment on your income tax return for the year the disallowance becomes final, rather than amending the original year’s return. This flexibility helps taxpayers, especially when the statute of limitations for amending past returns may be approaching.

Conclusion

The ERC payroll credit represented a significant opportunity for businesses to receive financial relief during an incredibly challenging period. While the program has officially ended for new claims, many businesses in Travis County and across the U.S. can still pursue or finalize their retroactive claims. However, the current landscape of increased IRS scrutiny and complex eligibility requirements means that navigating this process requires expertise and diligence.

At SFG Capital, we understand the intricacies of the ERC payroll credit and the importance of compliance. We’ve seen how crucial these funds can be for businesses, and we’re committed to helping our clients access their rightful credits responsibly. Whether you’re looking to understand your eligibility, need assistance with documentation, or are seeking solutions to expedite your refund, we’re here to guide you.

We specialize in providing ERC Funding Solutions through refund advances and buyout options, helping businesses in Travis County bypass IRS delays and access their capital sooner. Our performance-based fee structure ensures that our success is tied to yours, offering expert claim assistance without upfront costs. Don’t let the complexities deter you; with the right partner, you can confidently open up the potential of your ERC payroll credit.