What the ERC Government Program Means for Your Business

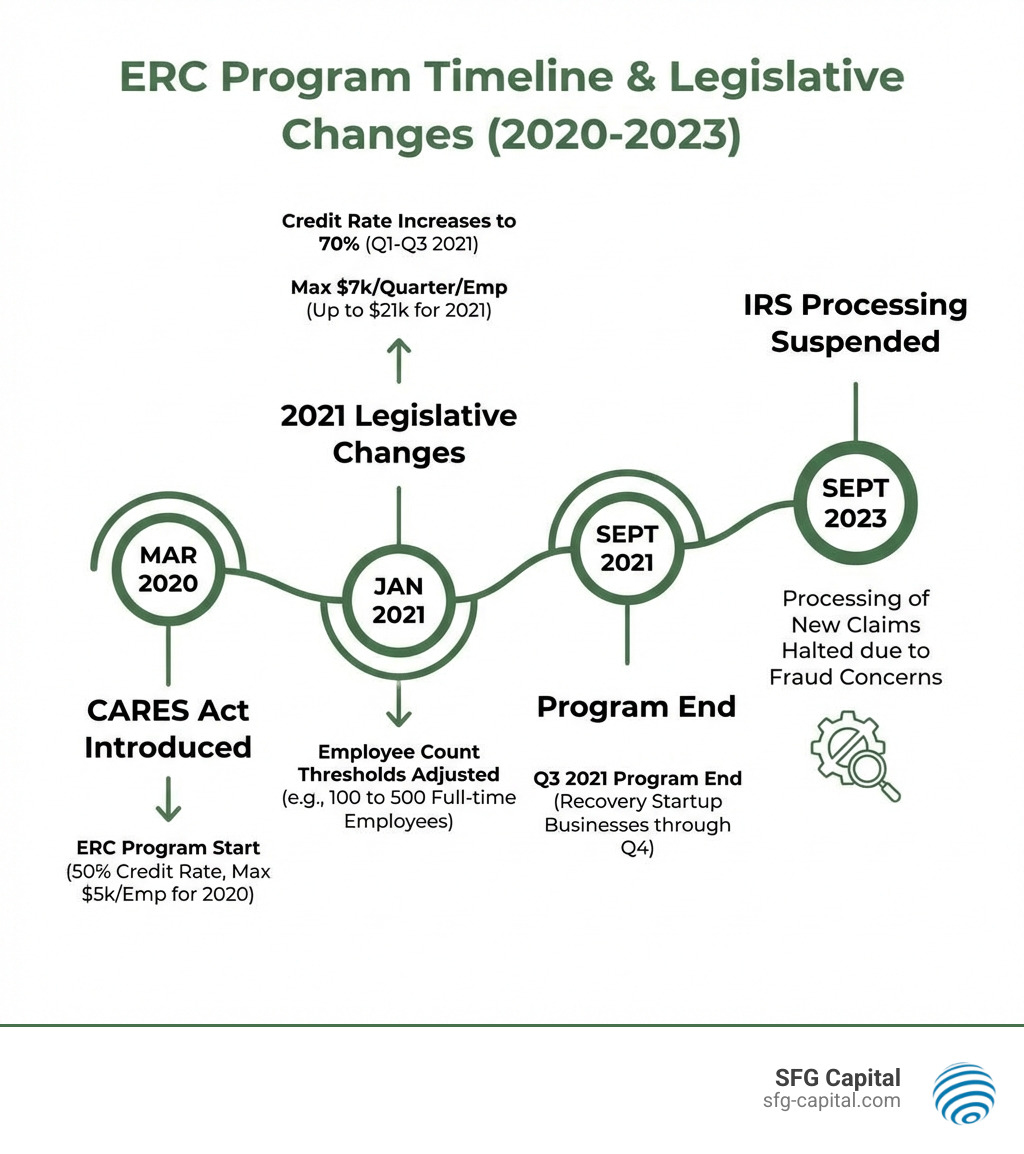

The ERC government program (Employee Retention Credit) is a refundable federal tax credit designed to help businesses that kept employees on payroll during the COVID-19 pandemic. Created under the CARES Act in March 2020 and expanded through the American Rescue Plan, this program offers eligible employers up to $26,000 per employee for wages paid between March 13, 2020, and September 30, 2021.

Quick Overview of the ERC Government Program:

- What it is: A refundable tax credit of 50% (2020) or 70% (2021) of qualified wages

- Maximum credit: $5,000 per employee for 2020, up to $21,000 per employee for 2021

- Eligibility: Businesses that experienced government-ordered shutdowns or significant revenue declines

- How to claim: File Form 941-X (amended quarterly employment tax return)

- Deadline: Claims must be filed within three years of the original return due date

- Current status: IRS suspended processing new claims in September 2023 due to fraud concerns, with approximately 400,000 claims worth $10 billion still pending

Key Eligibility Requirements:

| Period | Revenue Decline Test | Credit Rate | Maximum Per Employee |

|---|---|---|---|

| 2020 | 50% decline vs. 2019 quarter | 50% of wages | $5,000 annually |

| Q1-Q3 2021 | 20% decline vs. 2019 quarter | 70% of wages | $7,000 per quarter |

If you’re a business owner who kept employees during the pandemic, you may be sitting on a significant tax refund—but the path to claiming it has become increasingly complex. The IRS has issued approximately 84,000 disallowance letters and launched 252 investigations into over $2.8 billion in potentially fraudulent claims. This heightened scrutiny means legitimate businesses need to steer the process carefully to avoid penalties while maximizing their rightful refund.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses successfully steer the ERC government program by funding and purchasing over $500 million in qualified claims. My experience working with tax professionals and managing large-scale ERC transactions has given me deep insight into what separates compliant, successful claims from problematic ones.

Understanding the ERC Government Program

Let’s explore the fundamentals of the Employee Retention Credit, often simply called ERC or ERTC. This isn’t just another tax deduction; it’s a robust refundable tax credit designed to provide substantial relief to businesses that managed to keep their teams employed despite the economic turmoil of the COVID-19 pandemic. The core idea behind the ERC government program was simple yet powerful: incentivize employers to retain staff, ensuring a quicker economic recovery once the crisis subsided.

The ERC was initially introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. It was later expanded and modified through subsequent legislation, most notably the Consolidated Appropriations Act of 2021 and the American Rescue Plan Act of 2021. These amendments significantly improved the credit’s value and broadened eligibility for many businesses.

At its heart, the ERC is a credit against certain employment taxes, specifically an employer’s share of social security taxes. What makes it particularly attractive is its “refundable” nature. This means that if the credit amount exceeds a business’s payroll tax liability for a given quarter, the employer receives the difference as a direct refund from the IRS. It’s essentially a grant to lower employment taxes, not a loan that needs to be repaid, provided it’s calculated and filed correctly. For a deeper dive, explore What is ERC? and What is ERC Funding?.

The program was available for qualified wages paid between March 13, 2020, and September 30, 2021. While the program officially ended early in November 2021 with the Infrastructure Investment and Jobs Act (limiting claims to wages paid before October 1, 2021, except for recovery startup businesses), businesses can still retroactively claim the credit by amending prior tax returns. This retrospective claiming period is generally up to three years from the original return’s due date. This makes it crucial for businesses in Travis County and beyond to understand their past eligibility.

Eligibility and Calculation Rules

Understanding who qualifies for the ERC government program and how the credit is calculated can be quite intricate, as the rules evolved over time. The eligibility criteria and credit amounts differ significantly between 2020 and 2021, reflecting the changing landscape of the pandemic and governmental response.

Eligibility Criteria for the ERC Government Program

To be eligible for the ERC, businesses generally had to meet one of two primary criteria during the eligible quarters:

- Full or Partial Suspension of Operations Due to Government Order: If your business operations were fully or partially suspended due to governmental orders limiting commerce, travel, or group meetings due to COVID-19. This could include orders from federal, state, or local authorities. For example, if a restaurant in Austin, TX, was mandated to close its dining room but could offer takeout, that would typically constitute a partial suspension. However, essential businesses or those that could largely keep their operations intact remotely generally did not meet this qualification.

- Significant Decline in Gross Receipts:

- For 2020: A business qualified if its gross receipts for a calendar quarter were less than 50% of its gross receipts for the same calendar quarter in 2019. Eligibility for 2020 ended the quarter after gross receipts exceeded 80% of the comparable 2019 quarter.

- For 2021: The threshold was lowered. A business qualified if its gross receipts for a calendar quarter were less than 80% of its gross receipts for the same calendar quarter in 2019. Businesses could also elect to look at the immediately preceding calendar quarter and compare it to the corresponding quarter in 2019.

Businesses of all sizes and across all industries, including for-profit and tax-exempt organizations (excluding government entities), could qualify. Sole proprietors, however, couldn’t claim the credit for their own wages, but could for their employees. For a detailed breakdown, check out The ERC Eligibility Checklist: Don’t Miss Out.

Maximum Credits for the ERC Government Program

The credit amount also saw significant changes:

- For 2020 (March 13 – December 31): The credit was 50% of qualified wages, up to $10,000 per employee for the entire year. This meant a maximum credit of $5,000 per employee for 2020.

- For 2021 (January 1 – September 30): The credit was increased to 70% of qualified wages, up to $10,000 per employee per quarter. This could result in a maximum credit of $7,000 per employee per quarter, totaling up to $21,000 per employee for the first three quarters of 2021.

When calculating qualified wages, it’s not just about cash payments. It also includes the employer’s share of qualified health plan expenses. The definition of “qualified wages” also depended on the size of the employer:

- For 2020:

- Employers with 100 or fewer full-time employees (based on 2019 average): All wages paid to employees during eligible periods qualified, regardless of whether the employees were actively working or furloughed.

- Employers with more than 100 full-time employees (based on 2019 average): Only wages paid to employees who were not providing services due to the suspension or decline in gross receipts qualified.

- For 2021: The employee limit for qualified wages was increased to 500 full-time employees (based on 2019 average).

- Employers with 500 or fewer full-time employees: All wages paid to employees qualified.

- Employers with more than 500 full-time employees: Only wages paid to employees who were not providing services qualified.

This evolution highlights why businesses need a thorough understanding of the specific rules for each period they are claiming. The potential for up to 7,000 dollars per employee per quarter in 2021 made the ERC government program a lifeline for many. For a complete understanding of how these calculations work, our ERC Credit Complete Guide is an excellent resource.

Claiming the Credit and Managing Deadlines

The process of claiming the ERC government program is primarily done through amending previously filed employment tax returns. For most employers, this means filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form allows businesses to correct errors or claim credits they were eligible for but didn’t initially take.

Employers who are eligible can retroactively claim the ERC for wages paid in 2020 and the first three quarters of 2021. The general statute of limitations for amending tax forms is typically three years from the date the original return was filed or two years from the date the tax was paid, whichever is later. This means:

- For 2020 claims, the deadline to amend is generally April 15, 2024.

- For 2021 claims, the deadline to amend is generally April 15, 2025.

These deadlines are critical, so if you believe you’re eligible, time is of the essence. Our ERC Funding Application: A Step-by-Step Guide to Claiming Your Credit can walk you through the application process.

An important implication of claiming the ERC is its impact on other tax deductions. Since the ERC is a credit against qualified wages, the amount of wages used to calculate the credit cannot also be deducted as a business expense on your income tax return. This means that if you claim the ERC, you will need to reduce your wage expense deduction by the amount of the credit. This often necessitates amending your income tax returns for the years the credit was claimed. It’s a bit like juggling, but we’re here to help you keep all the balls in the air.

Furthermore, a common question arises regarding businesses that also received Paycheck Protection Program (PPP) loans. Initially, businesses couldn’t claim both. However, legislation later allowed businesses to claim both the ERC and PPP loan forgiveness. The key rule, though, is that you cannot “double-dip” – the same wages cannot be used for both ERC calculation and PPP loan forgiveness. This requires careful tracking and allocation of payroll costs. For more on this, see Forgive and Forget: How PPP Loan Forgiveness Impacts Your Employee Retention Credit.

Risks, Scams, and IRS Processing Updates

While the ERC government program has provided vital relief, it has also unfortunately attracted unscrupulous promoters and led to a surge in fraudulent claims. The IRS has been very vocal about these issues, and it’s crucial for businesses to be aware of the risks.

The IRS has identified a significant problem with what they call “ERC Mills” – third-party promoters who aggressively market the credit, often misrepresenting eligibility rules and encouraging businesses to claim the credit when they don’t qualify. As of July 2023, the IRS’s criminal investigation division had begun 252 investigations into over $2.8 billion of potentially fraudulent claims. This is a serious matter, and the IRS is actively pursuing those who abuse the system.

Warning Signs of ERC Scams to Look Out For:

- Unsolicited Contact: Beware of unexpected calls, emails, or texts from promoters you don’t know.

- “Quick” Eligibility: Promoters who claim they can determine your eligibility in minutes without a detailed review of your financial situation.

- Large Upfront Fees or Contingency Fees: Be cautious of those demanding significant upfront fees or basing their fee solely on a percentage of the refund amount.

- “Everyone Qualifies”: Any promoter who tells you that “every business qualifies” for the ERC is likely misrepresenting the facts. Eligibility is complex and depends heavily on your specific circumstances.

- Lack of Detailed Explanation: Promoters who don’t clearly explain the eligibility criteria or the calculation methods.

Due to the “surge of questionable claims,” the IRS took a significant step on September 14, 2023, by ordering an immediate stop to the processing of new ERC claims. This moratorium was put in place to protect taxpayers from scams and allow the IRS to focus its efforts on combating fraud. As of early 2024, the IRS is still processing approximately 400,000 claims worth about $10 billion. They have also issued approximately 84,000 letters informing businesses that their Employee Retention Credit claims have been partially or fully disallowed. This increased scrutiny means that even legitimate claims are facing longer processing times. If you’re currently in The Great ERC Wait: Understanding Your Delayed Employee Retention Credit, know that you’re not alone.

What if you incorrectly claimed the ERC?

The IRS has provided pathways for employers who believe they may have incorrectly claimed the ERC:

- Claim Withdrawal Process: If you submitted an ERC claim but have not yet received the refund, or if you received a check but have not cashed or deposited it, you may be able to withdraw your claim. This process helps you avoid future penalties and interest.

- Amending Returns: If the withdrawal process is not an option (e.g., you’ve already cashed the refund), you should file an adjusted employment tax return (Form 941-X) to reduce your ERC claim amount or make other necessary changes. If your ERC was disallowed and you had reduced your wage expense on your income tax return for the year the ERC was claimed, you may increase your wage expense on your income tax return in the year the disallowance is final, potentially avoiding the need to amend prior income tax returns.

It’s critical to address incorrect claims promptly. The potential penalties and interest for ineligible ERC claims can be substantial. The IRS has a statute of limitations of five years (extended to six for Q3/Q4 2021 by the One Big Beautiful Bill Act) to audit ERC claims, which is longer than the usual three years for most tax returns. This means the IRS has more time to review and potentially challenge claims. If you need assistance navigating these complexities, resources like Your Guide to Getting ERC Claim Assistance can be incredibly helpful.

Frequently Asked Questions about the ERC

Given the complexities and evolving nature of the ERC government program, many questions frequently arise. Let’s address some of the most common ones.

Can I claim the ERC if I received a PPP loan?

Yes, you can! This was a significant change from the initial rules. Originally, businesses had to choose between the PPP and the ERC. However, subsequent legislation allowed employers to claim both.

The critical caveat is that you cannot use the same qualified wages for both programs. This is often referred to as “no double-dipping.” For example, if you used $100,000 in payroll costs to achieve PPP loan forgiveness, you cannot use that same $100,000 to calculate your ERC. You must identify and allocate non-overlapping wages for each program. This requires careful planning and record-keeping to maximize both benefits without violating IRS rules. The key is to ensure that the wages used for ERC are separate from those used for PPP forgiveness.

What is a Recovery Startup Business?

The term “Recovery Startup Business” was introduced to allow certain new businesses to qualify for the ERC, even if they didn’t meet the gross receipts decline or government shutdown tests. This category applies specifically to the third and fourth quarters of 2021.

To qualify as a Recovery Startup Business, an employer must have:

- Began carrying on any trade or business after February 15, 2020.

- Had average annual gross receipts not exceeding $1,000,000 for the three-taxable-year period ending with the taxable year preceding the calendar quarter for which the credit is determined.

- Had employees (excluding owners and certain family members).

For Recovery Startup Businesses, the maximum credit was capped at $50,000 per quarter for Q3 and Q4 of 2021, even if they didn’t experience a significant decline in gross receipts or a government-mandated suspension. This provided a crucial lifeline for many businesses that launched during the pandemic.

How do I check my ERC refund status?

Unfortunately, the IRS does not have a dedicated online tool specifically for tracking ERC refund statuses, unlike the “Where’s My Refund?” tool for individual income tax returns. This can be frustrating, especially with the current IRS processing delays.

Generally, you can try the following to inquire about your ERC refund status:

- Contact the IRS directly: You can call the IRS business and specialty tax line. Be prepared for potentially long wait times.

- Contact your payroll provider or tax professional: If they submitted the claim on your behalf, they might have specific channels or insights into the status.

- Look for IRS notices: The IRS communicates through mail. You might receive notices like Letter 105-C, which informs you if your claim has been disallowed.

Given the IRS’s processing moratorium and increased scrutiny, waiting times are significantly extended. While we can’t offer a magic button for tracking, our guide Is Your ERC Refund Here Yet? Ways to Track Your Employee Retention Credit provides more detailed strategies for staying informed. Patience is certainly a virtue in this “great ERC wait.”

Conclusion

The ERC government program stands as one of the most significant federal relief efforts for businesses during the COVID-19 pandemic. While the opportunity to claim new ERCs has passed, the ability to retroactively claim this valuable credit for past eligible periods remains open for many businesses. However, the path is fraught with complexity, evolving regulations, and heightened IRS scrutiny, making expert guidance more crucial than ever.

For businesses in Travis County and across the nation, navigating these waters effectively means ensuring strict compliance, meticulous documentation, and a clear understanding of the IRS’s current stance. Given the significant IRS delays and the ongoing fight against fraudulent claims, securing your rightful refund requires a strategic approach.

At SFG Capital, we understand the challenges businesses face in accessing their ERC funds, especially with the IRS’s current processing slowdowns. That’s why we offer specialized ERC Funding Solutions designed to help you bypass these delays. We provide advance funding or buyouts for your qualified ERC claims, allowing you to access your capital much faster. Our performance-based fee structure means we’re invested in your success, ensuring you get the expert claim assistance needed to steer the complexities and secure your rightful credit. Let us help you open up the capital your business deserves.