Why Waiting for Your ERC Refund Could Cost Your Business

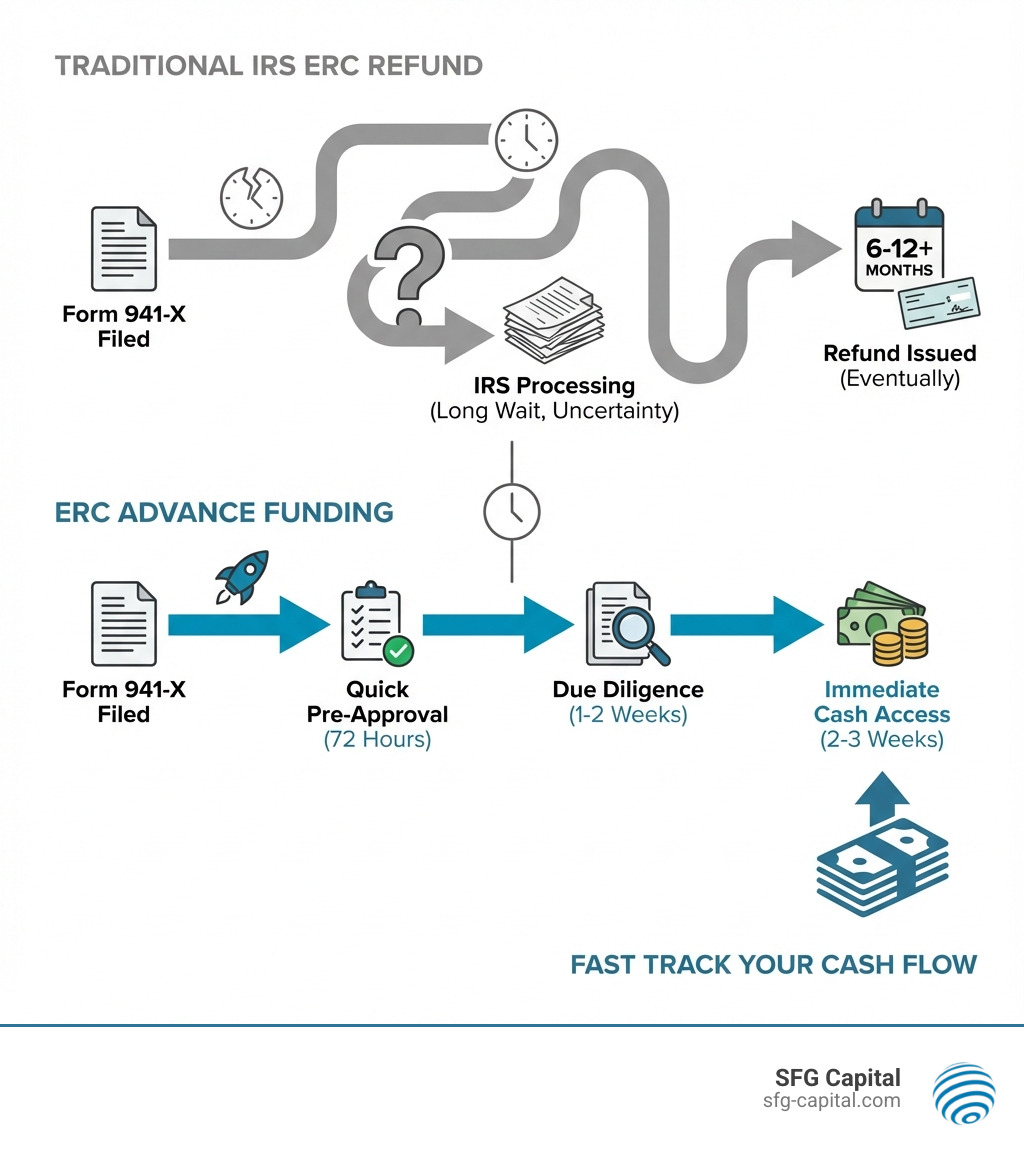

ERC advance funding allows businesses to access their Employee Retention Credit refund in as little as two weeks, instead of waiting 6-12 months (or longer) for the IRS to process their claim. Here’s how it works:

Quick Answer: ERC Advance Funding Overview

- What it is: A financial service where you receive cash now against your pending ERC refund

- How fast: Pre-approval in 72 hours, funding in 1-3 weeks

- How much: Typically 75-90% of your total ERC claim value

- Cost: Discount rate of 15-25% of the advance amount

- Who qualifies: Businesses with filed Form 941-X and minimum claims of $100,000+

If you’ve filed for the Employee Retention Credit, you’re facing a frustrating reality: the IRS is taking months to process refunds. Many businesses have waited a year or more for money they desperately need.

That’s where ERC advance funding comes in. Instead of letting your cash flow dry up, you can access up to 85% of your expected refund immediately. The funding company purchases your future refund at a discount, giving you working capital today to cover payroll, inventory, or growth opportunities that can’t wait.

Processing times regularly stretch beyond 12 months. Your business shouldn’t have to wait that long to access money it’s already earned.

I’m Santino Battaglieri, and I’ve helped fund over $500 million in ERC advance funding transactions. In this guide, I’ll walk you through how ERC advance funding works, what it costs, and how to avoid common scams.

What is ERC Advance Funding and How Does It Work?

At its core, ERC advance funding is a financial solution that bridges the gap between filing for the Employee Retention Credit (ERC) and receiving your refund check from the IRS. It open ups the value of your ERC refund now, rather than letting it sit in IRS limbo for months.

The Employee Retention Credit was a vital COVID-19 relief measure, but IRS backlogs have led to excruciatingly long processing times of 6 to 12 months or more. ERC advance funding helps businesses access their funds in as little as two weeks.

Here’s how it typically works:

- You’ve Filed Your ERC Claim: Your business has already submitted the necessary amended payroll tax returns (Form 941-X) to the IRS.

- You Apply for an Advance: You approach a trusted funding partner, like us at SFG Capital, and provide details about your filed ERC claim.

- We Review and Offer an Advance: Our team quickly reviews your claim. If approved, we offer an advance on a significant portion of your expected refund – often up to 85% or 90%. Pre-approval can happen in as little as 72 hours.

- You Receive Funds: Once you accept our offer, we provide the cash advance, typically within 1 to 3 weeks, for your immediate business needs.

- We Collect from the IRS: When the IRS issues the refund check, it is directed to us. We keep the advanced amount plus our agreed-upon fee, and any remaining balance is returned to you.

While the IRS once allowed advance payments via Form 7200, this option ended in early 2022. This created a need for private funding companies to provide a lifeline for businesses needing capital without the prolonged wait. For more details on the process, read our guide on Expediting Your ERC Refund: What You Need to Know.

The Key Benefits of Opening Up Your ERC Refund Early

Accessing your ERC refund early isn’t just a convenience; it’s a strategic advantage. For businesses in Travis County, ERC advance funding can profoundly impact operations and growth.

Here are the main benefits:

- Immediate Liquidity: Instead of waiting 6 to 12+ months for the IRS, access your ERC funds in as little as two weeks. This immediate cash injection is a game-changer for maintaining healthy cash flow.

- Bridging Cash Flow Gaps: Many businesses operate on tight margins. An ERC advance provides a crucial buffer against unexpected expenses, seasonal dips, or delayed payments.

- Paying Off Debt: Use the advance to pay down high-interest business loans or lines of credit. This improves your balance sheet, reduces interest payments, and frees up capital.

- Investing in Growth: Don’t let opportunities pass while you wait for your refund. Invest in new equipment, expand services, launch marketing campaigns, or hire key personnel.

- Covering Operational Expenses: Use the funds for essential expenses like payroll, rent, utilities, and inventory, ensuring your business runs smoothly without interruption.

- Mending Struggling Operations: For businesses hit hard by the pandemic, these funds are vital for recovery. An advance provides the capital needed to stabilize and rebuild.

- Employee Retention and Rewards: Accessing funds quickly allows you to reward your team, invest in training, or ensure continued payroll stability.

ERC advance funding transforms a future receivable into immediate, usable capital, ensuring your business can adapt and thrive without being held back by bureaucratic delays. To explore more ways to leverage these funds, check out our article on 5 Ways to Use ERC Funds to Strengthen Your Business.

Navigating Your Options: Types of ERC Advance Funding

When considering ERC advance funding, you’ll find two main structures: the ERC Advance Loan (or Bridge Loan) and the ERC Buyout. Understanding these distinctions helps Travis County businesses choose the best option for their needs.

| Feature | ERC Advance Loan (Bridge Loan) | ERC Buyout |

|---|---|---|

| Structure | A loan secured by your anticipated ERC refund. | The funding company purchases a portion of your future ERC refund. |

| Repayment | You make interest-only payments until the IRS issues your check, then the principal is repaid. | No monthly payments; the funding company collects the full refund from the IRS. |

| Cost Structure | Interest rate (e.g., as low as 2% for some options) applied to the loan amount. | A one-time discount rate (e.g., 10-25%) applied to the advanced amount. |

| Collateral | Primarily the ERC refund itself; personal guarantees may apply. | The ERC refund itself is effectively sold. |

| Ownership | You retain full ownership of the ERC refund. | You sell a portion of the future refund; the funding company “owns” that portion. |

| Speed | Pre-approval in 72 hours, funding in 1-2 weeks. | Pre-approval in 72 hours, funding in 1-2 weeks (can sometimes be faster than a loan). |

| Credit Score | Minimum credit score of 600 typically required. | Minimum credit score of 500 typically required. |

Understanding the SFG Capital ERC Advance

At SFG Capital, our model aligns with an ERC Buyout or a secured advance with a performance-based fee. We purchase your future refund at a negotiated rate, offering immediate liquidity without the burden of monthly interest payments. The ERC refund itself acts as the primary collateral. While personal guarantees may apply depending on business viability and creditworthiness, our goal is a transparent process. Our compensation is a clear discount on the advanced amount. We handle claims from $25,000 to over $10 million and aim to provide up to 85% of your expected refund value now.

How ERC Advance Funding Differs from Traditional Loans

The distinction between ERC advance funding and traditional business loans is significant.

- Collateral: Traditional loans often require business assets or real estate. For ERC advance funding, the collateral is the future ERC refund itself, making it an asset-based advance.

- Approval Process and Speed: Traditional loans involve a lengthy process. ERC advance funding is designed for speed, with pre-approval in as little as 72 hours and funding within 1 to 2 weeks.

- Credit History Focus: While we consider your business’s financial health (e.g., minimum credit scores of 500-600), our primary focus is the validity and size of your ERC claim. This makes funding more accessible than conventional bank loans.

- Repayment Structure: Traditional loans require scheduled payments. With an ERC buyout, there are no ongoing payments from your business; the funding company collects directly from the IRS.

- Purpose: ERC advance funding is specifically designed to accelerate access to an existing asset (your ERC refund) to solve the problem of IRS delays.

ERC advance funding is not about taking on new debt; it’s about accessing money your business has already earned.

Are You Eligible? The Path to Securing ERC Advance Funding

Securing ERC advance funding is a two-step process: first, confirm your business is eligible for the ERC, and second, meet the requirements for the advance. Getting both right is crucial.

First, Confirm Your ERC Eligibility

This is the most critical step. You must be confident your business legitimately qualifies for the Employee Retention Credit. The IRS is actively scrutinizing claims and has issued warnings about improper applications.

Your business could be eligible for the ERC if it experienced:

- Significant Decline in Gross Receipts: During 2020 or the first three quarters of 2021, compared to a baseline period (typically 2019).

- Full or Partial Suspension of Operations: Due to a government order limiting commerce, travel, or group meetings because of COVID-19.

- Qualified Recovery Startup Business: For the third or fourth quarters of 2021, if your business started after February 15, 2020, and meets certain criteria.

We cannot stress this enough: Work with a reputable tax professional to assess your eligibility. If the IRS disallows an improperly filed claim, your business will be responsible for repaying any advance funds, plus potential penalties and interest. For official guidance, refer to the Official IRS guidance on ERC eligibility.

Requirements for ERC Advance Funding with SFG Capital

Once your claim is filed, our requirements for ERC advance funding are straightforward:

- Filed Form 941-X: You must have submitted your amended payroll tax returns to the IRS.

- Minimum Claim Size: Our advance funding options typically require a minimum ERC refund of $75,000 (for a Buyout) or $100,000 (for a Loan).

- Operational and Solvent Business: Your business must be financially solvent and active.

- Clear Background: Business owners should be free of bankruptcies or felony convictions.

- No Tax Liens or Judgments: The business should have a clear financial standing.

Documents You’ll Need to Apply

To expedite your application, please have these documents ready:

- ERTC Provider’s Report / ERC Calculation Report

- Filed Form 941-X Forms

- Government Issued ID for owner(s)

- Articles of Formation/Incorporation

- Operating Agreement or By-Laws

- 2019-2021 Business Tax Returns

- 2019-2022 Profit & Loss and Balance Sheet

- Most Recent Bank Statement

Providing these upfront helps us process your application quickly.

The Application and Funding Timeline

A compelling reason for ERC advance funding is speed. Unlike the 6-12+ month IRS wait, our process is designed to be swift and efficient because we know every day counts for your business.

Here’s a typical timeline for receiving funds:

- Pre-qualification (Minutes): Provide basic information to start. We can often give you a fast, no-commitment quote within hours.

- Document Submission (Days): Once you move forward, you’ll provide the necessary documents. Your responsiveness here impacts the timeline.

- Due Diligence & Review (1-3 Weeks): Our team thoroughly reviews your ERC claim and business financials to verify everything. We can finalize claims from $25,000 to $10+ million in just 1 to 3 weeks.

- Approval & Offer (72 Hours): After our review, we can provide a pre-approval decision and a detailed offer in as little as 72 hours.

- Funding (Same Day to 1-2 Weeks): Once you accept our offer, funds can be deposited into your account, sometimes the same day or within 1 to 2 weeks.

In summary, our process helps businesses access their funds in as little as two weeks, bypassing the long IRS wait. This expedited capital can be instrumental in powering your business forward. Learn more in our article, Funding Growth: How ERC Can Power Your Business Forward.

Understanding the Costs, Risks, and Red Flags

While ERC advance funding offers incredible benefits, it’s crucial to understand the costs, risks, and red flags. We believe in transparency to help Travis County businesses make informed decisions.

How Providers Make Money: Fees and Discount Rates

Funding companies make money through a discount rate or a one-time fee on the advanced amount. This is the cost of expediting your funds.

- Discount Rates: Our ERC buyout service buys your future refund at rates up to 90% of your claim, implying a discount of 10% on the advanced portion. Other providers might offer up to 85% value (a 15% discount).

- Example Calculation: If your ERC refund is $1,000,000 and you take a $250,000 advance at a 15% discount rate, the fee is $37,500. You would receive $212,500. The remaining $750,000 of your claim is still yours to receive from the IRS after the funder collects their portion.

- Transparency: We believe in clear, upfront pricing. The discount rate is the primary cost, covering our capital, risk, and service.

Potential Risks and Downsides

- Cost vs. Benefit: The main downside is the discount. You must weigh if immediate liquidity outweighs this cost.

- Provider Risk: Choose a reputable provider with a proven track record. Our team has funded over half a billion in transactions.

- Importance of a Valid Claim: The biggest risk is if your initial ERC claim is improper or disallowed by the IRS.

What if the IRS Disallows Your Claim?

This is a critical point. If the IRS reviews your claim after you’ve received an advance and deems it ineligible, you are obligated to repay the advance. Our agreement includes a “clawback” provision. Depending on the terms, personal guarantees may be invoked, making you personally liable. The IRS may also impose its own penalties and interest.

This underscores why ensuring your ERC eligibility before seeking funding is absolutely critical. Prioritize a thoroughly vetted and legitimate ERC claim.

Red Flags and Scams to Avoid

The ERC’s popularity has attracted bad actors. Watch for these red flags:

- Unsolicited Offers and High-Pressure Tactics: Be wary of unexpected calls or ads pressuring you to sign quickly. Reputable firms allow you time to review terms.

- Promises of Guaranteed Approval: No legitimate provider can guarantee approval without a review. Claims that “every business qualifies” are a major IRS warning sign.

- Large Upfront Fees: Legitimate providers charge a discount on the advance, not a large fee just to apply.

- Lack of Transparency: If a provider is vague about fees or terms, walk away. All costs should be clearly outlined in writing.

- Disregarding Your ERC Eligibility: A provider who doesn’t thoroughly review your original ERC claim is a major red flag.

- Excessive Claim Preparation Fees: Some preparers charge an excessive percentage of your total refund for their services. Understand the fee structure for both claim preparation and the advance.

Conclusion: Take Control of Your Business’s Cash Flow Today

The Employee Retention Credit was a lifeline for many businesses, but slow IRS refunds have turned it into a frustrating waiting game. ERC advance funding offers a powerful solution, changing a future receivable into immediate, usable capital.

By opting for an advance, you gain immediate liquidity to pay down debt, invest in growth, or cover operational expenses. It empowers your business to move forward without being constrained by bureaucratic timelines.

While there are costs and risks to consider, choosing a transparent, reputable funding partner like us at SFG Capital ensures you’re making an informed decision. We pride ourselves on providing expert assistance and a straightforward, performance-based fee structure, helping businesses in Travis County access the cash they deserve quickly.

Don’t let your hard-earned ERC refund sit idle. Take control of your business’s cash flow. Explore our ERC funding solutions and see how we can help your business thrive.