The Long Wait for Your ERC Refund is Over

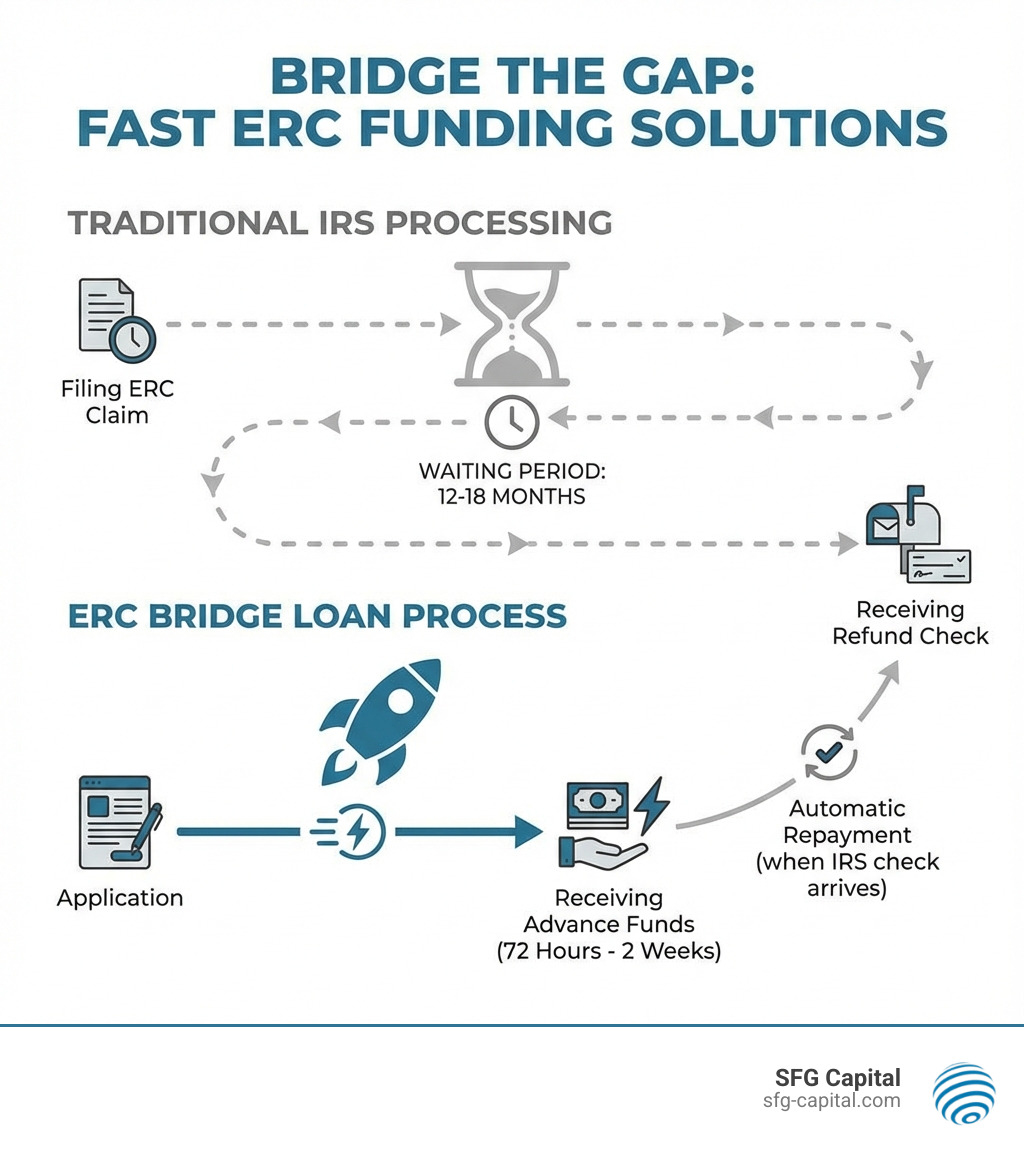

ERC bridge loans are short-term financing solutions that let businesses access a portion of their Employee Retention Credit refund immediately—typically 60-90% of the expected amount—instead of waiting 12-18 months or longer for the IRS.

Quick Answer for Businesses Needing Fast ERC Funds:

- What it is: A loan secured against your pending ERC refund

- How much: Up to 90% of your expected refund amount

- How fast: Funds in as little as 72 hours to 2 weeks

- Who qualifies: Businesses with minimum $75,000 ERC claim, credit score 500+, no tax liens

- Cost: Interest rates as low as 2%, or percentage-based fees for buyouts

- Repayment: Automatic when IRS issues your refund, typically within 12 months

If you’ve filed for the Employee Retention Credit (ERC), you know the frustration. The IRS faces massive backlogs, improved compliance reviews, and a processing moratorium that has stretched refund timelines to over a year. This creates a painful cash flow gap—you’re owed money, but can’t access it when you need it most.

ERC bridge loans solve this by providing immediate capital based on your anticipated refund. Instead of waiting 12-18 months, you can receive funds in a few business days. This allows you to cover payroll, invest in equipment, or keep operations running without the financial stress of waiting on the government.

The mechanics are simple: a lender advances a percentage of your ERC refund, and the loan is automatically repaid when the IRS issues your check. While there are fees or interest, many businesses find the cost worthwhile compared to delayed growth or operational disruptions.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses access over $500 million in ERC claims via compliant funding solutions like ERC bridge loans and advances. We focus on helping eligible businesses bridge the gap between filing and funding while maintaining strict IRS compliance.

Understanding ERC Financing: Bridge Loans, Advances, and Buyouts

The Employee Retention Credit (ERC) was a vital CARES Act program supporting businesses that retained employees during the COVID-19 pandemic. While eligible employers could claim up to $26,000 per employee, IRS processing delays of 12-18 months created a need for faster access to these funds. This is where ERC financing options, particularly ERC bridge loans, come into play.

An ERC bridge loan is a short-term loan designed to “bridge” the cash flow gap between applying for the ERC and receiving the IRS refund check. It provides immediate liquidity by using your anticipated refund as security.

While the terms “ERC bridge loan,” “ERC advance,” and “ERC buyout” are often used interchangeably, it’s crucial to understand their differences, as they impact your financial obligations.

- ERC Bridge Loan: This is a traditional loan. You borrow a lump sum based on a percentage of your expected ERC refund and typically make interest-only payments. The loan is repaid automatically from the IRS check, and the business retains ownership of the ERC claim and any accrued IRS interest.

- ERC Advance (or ERC Advance Loan): Often synonymous with an ERC bridge loan, this term can also describe a more flexible arrangement where the ERC claim acts as collateral. If the refund isn’t received in a set timeframe (e.g., 18 months), the advance might convert to a traditional loan.

- ERC Buyout: This is different from a loan. Your business sells its pending ERC refund to a fund at a discount. You receive a lump sum upfront (often 70-90% of the claim), and the buyer assumes the risk and waiting period, collecting the full refund from the IRS. There are no interest payments for your business.

Here’s a table to help clarify the differences:

| Feature | ERC Bridge Loan | ERC Advance (as a sale/buyout) |

|---|---|---|

| Structure | Short-term loan | Sale of future refund |

| Cost | Interest and/or fees | Discounted rate (percentage of refund value) |

| Ownership | Business retains ownership of ERC claim | Buyer owns the ERC claim |

| Repayment | Automatic from IRS refund; interest-only payments until then | None (buyer collects from IRS) |

| IRS Interest | Business typically retains IRS-accrued interest | Buyer typically receives IRS-accrued interest |

| Risk to Business | Repayment obligation if claim is denied/reduced | Less direct risk (claim sold), but may need to return funds if claim is found ineligible or under audit |

| Qualification | Generally requires proof of ERC filing, minimum refund, credit score | Similar to bridge loans, but can sometimes be easier due to no repayment obligation |

Understanding these distinctions is key to choosing the right financing option. We encourage businesses to review resources like What Is An ERC Bridge Loan? for further insights.

Weighing the Pros and Cons of ERC Bridge Loans

Deciding if an ERC bridge loan is right for your business involves weighing its advantages and disadvantages. For many Travis County businesses facing cash flow challenges while awaiting ERC refunds, the benefits often outweigh the costs.

Advantages of ERC Bridge Loans

The main reason businesses seek ERC bridge loans is to bypass IRS processing delays and access a large portion of their refund in days or weeks. This speed offers several advantages:

- Fast Access to Cash: The most impactful benefit. Instead of the IRS’s 12-18 month wait, you could get funds in a few business days after approval, maintaining liquidity and seizing opportunities.

- Business Continuity and Stability: Immediate capital helps cover critical expenses like payroll, rent, and utilities, ensuring your business runs smoothly without disruptions or layoffs.

- Easier Qualification than Traditional Loans: Lenders primarily focus on the validity of your ERC claim, rather than just your business’s financial history or collateral.

- Strategic Investment Opportunities: With funds available, you can reinvest in operations, pursue growth, or address immediate needs. Explore Funding Growth: How ERC Can Power Your Business Forward for ideas.

- Retain IRS-Accrued Interest: With a bridge loan, your business typically keeps any interest the IRS accrues on your refund during the waiting period.

Disadvantages or Risks Associated with ERC Bridge Loans

While the advantages are clear, it’s important to understand the potential downsides:

- Cost of Capital (Fees and Interest): This is the main trade-off. You will pay fees and/or interest, meaning the cash you receive is less than the full ERC refund. Rates vary, but some lenders offer interest as low as 2%.

- Risk of Claim Ineligibility or Reduction: If the IRS deems your claim ineligible or reduces the refund amount, your business may have to repay the advanced funds. It’s vital to have a highly compliant ERC claim from the start.

- Lender-Specific Requirements: Lenders have specific criteria, such as minimum ERC refund amounts, minimum credit scores, or a clean record free of tax liens. Not all businesses will qualify.

- Secured Nature of the Loan: These loans are secured against your ERC refund. Depending on the lender, personal guarantees may also be required, adding personal risk.

For businesses in Austin and Travis County, weighing these pros and cons against your cash flow needs is essential. We recommend understanding all terms before committing to any ERC funding solution.

The Application Process: How to Get Your ERC Funds in Days

Securing an ERC bridge loan is a streamlined process, allowing businesses in Austin and Travis County to access funds quickly. At SFG Capital, we make this process as transparent and efficient as possible.

Our Our Process is designed to guide you through each stage, from application to funding.

Who is Eligible for ERC bridge loans?

Eligibility depends on your business’s ERC eligibility and meeting the lender’s criteria. Your business must have a valid, filed ERC claim. This means you met IRS criteria, such as experiencing a significant decline in gross receipts or a suspension of operations due to government orders in 2020 or 2021.

Beyond that, lenders typically require:

- Minimum ERC Claim Amount: Many lenders require a minimum refund of $75,000 or higher.

- Minimum Credit Score: A minimum score of 500-600 is common.

- No Outstanding Tax Liens or Judgments: A clean record is usually required.

- Operating Since February 2020 or Earlier: This ensures your business was established during the ERC period.

Gathering Your Documentation

Having these documents ready will expedite your application for an ERC bridge loan:

- IRS Form 941s and 941-Xs: For each quarter claimed. See IRS form 941 and IRS Form 941-Xs.

- Payroll Data: Supporting qualified wages and health plan expenses.

- Copies of Income Tax Returns: For the previous two to three years.

- Previous Three Months’ Bank Statements: To assess cash flow.

- Identification for All 20% or Greater Shareholders.

- Profit and Loss (P&L) and Balance Sheet: Current financial statements.

- IRS Form W-9 for the Authorized Signer: See IRS Form W-9.

- Copies of Articles of Incorporation and Bylaws, or Operating Agreement.

- Voided Check: For direct deposit.

- IRS Form 8821 and 7216 Consent Forms: These grant the lender permission to speak with the IRS about your claim. See IRS Form 8821 and 7216.

Application Timeline: From Submission to Funding

The bridge loan process is significantly faster than waiting for the IRS.

- Initial Application and Pre-approval: Online applications take minutes, with pre-approval often within 72 hours.

- Final Approval: After document verification, final approval can take from one day to two weeks.

- Funding Timeline: Once you accept the offer, funds are often disbursed the same day or within a few business days.

The entire ERC bridge loan process can take from a few days to a few weeks, a stark contrast to the 12-18 months for ERC refunds. Our goal is to help you get the capital you need quickly. For more insights, check out Expediting Your ERC Refund: What You Need to Know.

Smart Strategies for Your ERC Advance

Once you’ve secured an ERC bridge loan, the next step is to strategically deploy the funds to maximize their impact. This is about empowering growth and stability.

Typical Use Cases for ERC bridge loans

The flexibility of ERC bridge loans means funds can be used for virtually any business purpose. For businesses in Travis County, this allows you to address immediate needs and invest in future growth.

Typical use cases include:

- Covering Operational Expenses: Use funds for essentials like payroll, rent, utilities, and insurance to ensure business continuity.

- Purchasing Inventory: Acquire necessary inventory to prevent stockouts and lost sales.

- Investing in Marketing and Advertising: Fuel campaigns to attract new customers and drive revenue.

- Equipment Purchases and Upgrades: Invest in modern equipment to boost efficiency and productivity.

- Expanding Operations: Support growth efforts like opening new locations or hiring more staff.

- Rewarding Employees: Use funds for bonuses, improved benefits, or training to boost morale and retention.

For more ideas, explore 5 Ways to Use ERC Funds to Strengthen Your Business.

How Repayment Works

The repayment structure for an ERC bridge loan is straightforward and designed to align with your ERC refund’s arrival.

- Secured Against the ERC Refund: The loan is secured by your pending ERC refund, which acts as collateral.

- Automatic Repayment from IRS Check: When the IRS issues your refund check, it is typically directed to the lender for automatic deduction of the loan amount, including principal and interest.

- Interest-Only Payments (Typically): While waiting for the refund, many loans require manageable interest-only payments.

- Loan Term: The term is short, often up to 12 months or “until the refund is issued.”

- Extension Options: Reputable lenders understand IRS delays and often offer extension options, such as for another six months, potentially with an extension fee (e.g., 5%).

Critical Questions to Ask Your Lender

Before committing to an ERC bridge loan, conduct thorough due diligence by asking your prospective lender key questions.

Here are critical questions to ask:

- What is the total cost of the loan, including all fees and interest rates? Ask for a full breakdown of charges and the effective APR.

- What are the exact repayment terms? Understand the payment schedule, loan term, and any prepayment penalties. Ideally, there are “no prepayment penalties or hidden fees.”

- What happens if my ERC claim is denied or reduced by the IRS? Know your obligations if the refund amount changes.

- What happens if my ERC claim is delayed beyond the stated loan term? Inquire about extension options and any associated fees.

- What documentation is required? A clear list upfront helps expedite the process.

- What is the lender’s experience and reputation? Look for lenders with a proven track record.

- Is the loan secured, and what collateral is required? Confirm it’s secured against the ERC refund and clarify if personal guarantees are needed.

- How quickly can I expect to receive the funds? Get a clear timeline for approval and disbursement.

Asking these questions helps you make an informed decision for your business in Austin or Travis County.

Frequently Asked Questions about ERC Advances

We understand that navigating ERC financing can bring up many questions. Here, we address common inquiries from our clients in Austin and Travis County about ERC bridge loans and advances.

How much of my ERC refund can I get in advance?

The percentage of your ERC refund you can receive as an advance typically varies by lender and claim strength. Lenders commonly offer 60% to 90% of the anticipated ERC amount. For a $100,000 ERC refund, you might borrow $60,000 to $90,000. The exact amount depends on the lender’s risk assessment.

Is an ERC advance the same as a PPP loan?

No, an ERC advance loan is not a Paycheck Protection Program (PPP) loan.

- ERC Advance Loans: These are from private lenders, not the government. They are an advance on a tax credit (ERC) your business is already owed by the IRS and are repaid when your refund arrives.

- PPP Loans: These were forgivable, government-backed loans from the SBA, primarily for payroll costs.

Businesses could be eligible for both programs, provided they didn’t use the same payroll expenses for both. An ERC advance loan helps you access an owed tax credit faster, while a PPP loan was direct government assistance.

What happens if my ERC claim is delayed even longer than the loan term?

IRS processing times are unpredictable, and reputable lenders offering ERC bridge loans anticipate this.

- Loan Extension Options: Many lenders offer to extend the loan term, for instance, by an additional six months.

- Extension Fees: An extension may involve a fee, such as a 5% extension fee, and you would continue paying interest.

- Communication is Key: Maintain open communication with your lender about IRS delays. They are often willing to work with you to resolve issues, ensuring your business isn’t penalized by federal backlogs.

Conclusion: Take Control of Your Business’s Cash Flow Today

The Employee Retention Credit is a significant opportunity for businesses in Austin and Travis County, but the prolonged IRS wait can cause financial strain. ERC bridge loans are a vital tool, turning a future asset into immediate working capital.

Don’t let IRS delays dictate your business’s financial health. ERC bridge loans offer a clear path to access your funds in days or weeks, not months. This immediate relief empowers you to cover expenses, invest in growth, or simply maintain a healthy cash flow.

We believe every eligible business deserves to use its ERC funds when needed most. By understanding the options and navigating the process, you can secure your business’s future.

For businesses in Travis County, SFG Capital offers expert assistance in expediting your ERC refunds. We provide compliant, structured funding solutions, including ERC bridge loans and advances, designed to bypass IRS delays. Our performance-based fee structure ensures you get quick access to funds with expert claim assistance. Take control of your cash flow and explore Our Services to learn how we can help.