Understanding ERC Funding Options in Travis County

ERC funding Travis County refers to the Employee Retention Credit—a federal tax credit for businesses that retained employees during the COVID-19 pandemic. Here’s what you need to know, even now in 2026 as claims and IRS processing continue:

Quick Facts:

- What it is: A refundable tax credit worth up to $26,000 per employee

- Who qualifies: Businesses in Travis County that experienced government shutdowns, supply chain disruptions, or significant revenue decline in 2020–2021

- How to claim now: File (or, if you already filed, verify) amended payroll tax returns (Form 941-X) for eligible quarters that are still within the statute of limitations

- Current challenge: IRS processing delays that, for many businesses, have stretched well beyond 12–18 months

- Local context: Travis County businesses face high operating costs, making this federal relief critical for cash flow in 2026 and beyond

If you’re a Travis County business owner still waiting on your ERC refund—or trying to determine if you can file while the window is still open—you are not alone. The IRS has had a massive backlog, leaving thousands of eligible businesses without the working capital they’ve earned. Meanwhile, local costs—from property taxes to rising operational expenses—continue to squeeze your budget.

This isn’t about European research grants. The Employee Retention Credit is a U.S. tax credit designed to reward businesses that kept workers on payroll during the pandemic—money you’ve already earned, not a loan.

The disconnect is stark. While local government bodies like the Travis Central Appraisal District manage large budgets, individual businesses struggle with delayed federal refunds that could transform their operations.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses access over $500 million in ERC funding by providing compliant funding solutions that don’t require waiting for IRS delays. My work focuses specifically on helping Travis County and nationwide businesses steer the complex ERC process and access their capital faster, even as rules and timelines evolve.

This guide provides a complete checklist for Travis County businesses seeking to claim or expedite their ERC funding in 2026, with practical steps you can take today.

What is the Employee Retention Credit (ERC)?

When discussing ERC funding Travis County, we mean the Employee Retention Credit, a vital COVID-19 relief measure. It’s a U.S. federal tax credit for American businesses, not to be confused with the European Research Council.

The Employee Retention Credit (ERC) is a refundable tax credit established under the CARES Act in March 2020. Its goal was to encourage businesses to keep employees on their payrolls during the pandemic. Unlike a loan, the ERC is a direct credit against certain employment taxes, meaning it’s essentially free money for eligible businesses.

Initially, businesses couldn’t claim both an ERC and a PPP loan. Later legislation changed this, allowing businesses to benefit from both, provided the same wages weren’t used for each.

The core eligibility for the ERC revolves around two main criteria for qualified wages paid between March 13, 2020, and December 31, 2021:

- Experiencing a full or partial suspension of operations due to governmental orders limiting commerce, travel, or group meetings because of COVID-19.

- Experiencing a significant decline in gross receipts during specific calendar quarters compared to 2019.

The credit amount varies. For 2020, it’s 50% of qualified wages up to $10,000 annually per employee (max credit $5,000). For 2021, it increased to 70% of qualified wages up to $10,000 per quarter per employee (max credit $21,000 for the year). The total potential credit is $26,000 per employee.

Even though no new wages can qualify after 2021, in 2026 many businesses can still claim the ERC retroactively for those earlier quarters, as long as they are within the statute of limitations for amending their payroll tax returns.

Who Qualifies for the ERC in Travis County?

Understanding ERC eligibility is paramount for any business seeking ERC funding Travis County. The criteria are specific and require careful assessment.

1. Government Shutdown Orders:

Many businesses in Travis County faced mandated closures or restricted operations due to government orders. This could include:

- Orders to close non-essential businesses

- Capacity restrictions for restaurants, retail, or entertainment venues

- Limitations on public gatherings

- Supply chain disruptions caused by government orders

A “partial suspension” means that a governmental order limited your business’s ability to operate normally, even if you weren’t fully shut down.

2. Gross Receipts Test:

If your business wasn’t shut down by government orders, you might still qualify based on a significant decline in gross receipts.

- For 2020: Your gross receipts for a calendar quarter must have been less than 50% of your gross receipts for the same quarter in 2019.

- For 2021: Your gross receipts for a calendar quarter must have been less than 80% of your gross receipts for the same quarter in 2019.

3. Recovery Startup Businesses:

A special provision for Q3 and Q4 of 2021 allowed “recovery startup businesses” to claim the ERC. To qualify, a business must have:

- Began operations after February 15, 2020

- Have average annual gross receipts not exceeding $1 million

- Have employees

The maximum credit for a recovery startup business is $50,000 per quarter.

Key Deadlines and How to Apply

Claiming ERC funding Travis County involves filing amended payroll tax returns, specifically Form 941-X. This form allows businesses to correct previously filed Forms 941 to retroactively claim the ERC.

The deadlines for claiming the ERC are tied to the statute of limitations for amending payroll tax returns. Generally, this is three years from the date the original Form 941 was filed or two years from the date the tax was paid, whichever is later.

For most businesses, the key deadlines fall in 2024, 2025, and 2026, depending on the original filing dates. That means there is still a limited window in 2026 for many employers to:

- Evaluate their eligibility

- File new Form 941-X claims for eligible quarters

- Correct or strengthen previously filed claims if needed

The importance of accuracy cannot be overstated. The IRS has significantly increased its scrutiny of ERC claims due to widespread fraud. Incorrectly calculated credits, insufficient documentation, or claims made by ineligible businesses can lead to delays, audits, and penalties.

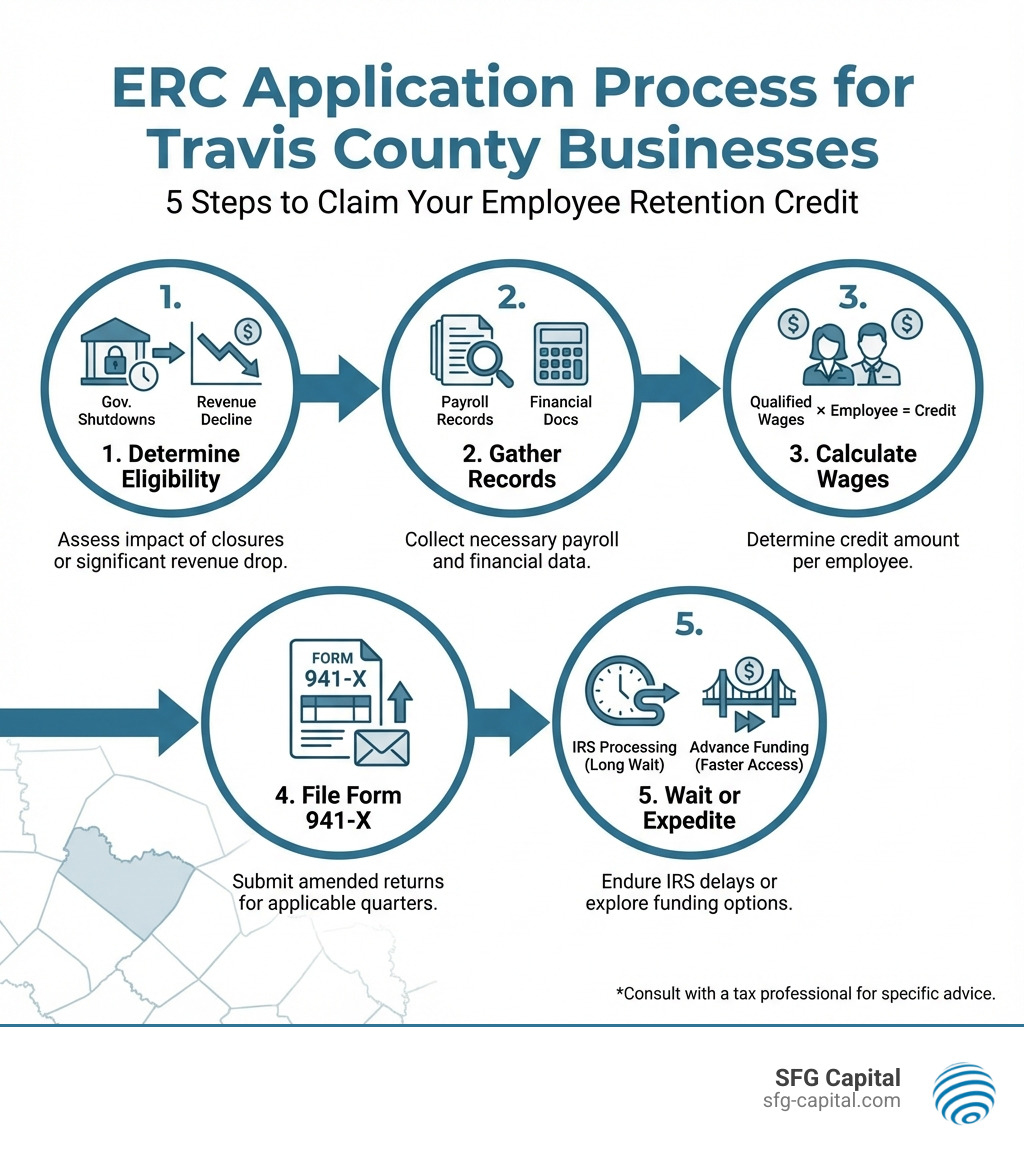

Your Step-by-Step ERC Application Checklist

Navigating the ERC application process can feel like a maze, but with a clear checklist, it becomes much more manageable. Our goal is to simplify this for Travis County businesses seeking their rightful ERC funding Travis County in 2026.

Required Documents for ERC Application:

- Payroll records (Form 941s, wage registers, payroll reports, W-2s)

- PPP loan application and forgiveness documents

- Quarterly gross receipts statements for 2019, 2020, and 2021

- Documentation of government shutdown orders

- Health plan expenses (premiums paid by the employer)

- Employee count for 2019 (full-time equivalents)

Step 1: Eligibility Assessment

Review your business’s operations during 2020 and 2021 to determine if you meet the government shutdown or gross receipts decline tests.

Step 2: Document Gathering

Collect all necessary documentation including detailed payroll records, tax filings, and evidence supporting your claim.

Step 3: Credit Calculation

Calculate the precise ERC amount your business is entitled to, applying correct wage limits, credit percentages, and accounting for any PPP loan interactions.

Step 4: Filing Amended Returns

Prepare and file Form 941-X for each eligible quarter and submit to the IRS.

Gathering Your Documentation

The backbone of a successful ERC claim for ERC funding Travis County is robust documentation. The IRS demands clear evidence to support every aspect of your claim.

- Payroll Records: Detailed payroll registers, Forms 941 as originally filed, wage reports, and W-2 forms for all employees.

- PPP Loan Documents: Application and forgiveness documents to ensure there’s no double-dipping and that allocation is optimized.

- Gross Receipts Data: Comprehensive quarterly gross receipts data for 2019, 2020, and 2021 from profit and loss statements or sales reports.

- Health Plan Expenses: Documentation of employer-paid health plan costs to maximize your credit.

- Government Shutdown Orders: Official documentation of relevant federal, state, or local orders and how they impacted your Travis County business.

Calculating Your ERC Amount

Calculating your ERC amount for ERC funding Travis County requires understanding the changing rules for 2020 and 2021.

- 2020 Calculation: 50% of qualified wages (up to $10,000 per employee for the year), maximum credit of $5,000 per employee.

- 2021 Calculation: 70% of qualified wages (up to $10,000 per employee per quarter), maximum of $21,000 per employee for the year.

The overall per-employee limit across both years is $26,000.

Common Calculation Errors:

- Incorrectly identifying qualified wages: Not all wages count, specifics depend on employer size.

- Misapplying eligibility criteria: Claiming when not truly eligible.

- Failing to properly account for PPP loans: Double-counting wages used for PPP forgiveness.

- Ignoring aggregation rules: Businesses with common ownership must aggregate employees and gross receipts.

- Not updating records: In 2026, the IRS may request documentation years after wages were paid.

These complexities highlight why expert assistance is invaluable when seeking ERC funding Travis County, especially now that the focus in 2026 is on retroactive claims, corrections, and dealing with IRS backlogs.

The Economic Landscape: A Look at erc funding Travis County

Travis County, home to Austin, Texas, boasts a dynamic and growing economy. However, local businesses operate within a unique financial landscape, where local governmental bodies play a significant role in their operational costs, particularly through property taxes. This is where the importance of ERC funding Travis County becomes even more pronounced in 2026 – it offers a federal offset to local financial pressures that have continued well beyond the immediate pandemic period.

The Travis Central Appraisal District (TCAD) is a pivotal player in this landscape. While TCAD is responsible for appraising property values, these appraisals directly translate into the property tax burden for businesses and residents alike. The health of the local economy, therefore, is intrinsically linked to how businesses manage their costs and generate revenue.

Business operating costs in Travis County can be substantial, from rent and utilities to employee wages and, of course, property taxes. When federal relief like the ERC becomes available—and when businesses can still claim or receive refunds in 2026—it provides much-needed liquidity that can help businesses absorb these costs, retain staff, and even reinvest in their future.

Understanding the Travis Central Appraisal District (TCAD)

The Travis Central Appraisal District (TCAD) serves a crucial function in Travis County: it appraises the value of all taxable property within the county. This includes residential, commercial, and industrial properties. The valuations determined by TCAD are then used by various local taxing jurisdictions – such as the county, cities (like Austin), school districts, and special districts – to calculate property tax bills.

TCAD’s role is purely appraisal; it does not set tax rates or collect taxes. Its objective is to ensure fair and accurate property valuations across the county. This process involves a complex methodology that considers market data, property characteristics, and other factors.

The funding for TCAD itself comes from the jurisdictions it serves, proportional to their tax levies. This system ensures that the appraisal district operates independently to provide impartial valuations. These valuations, in turn, directly influence the revenue streams for local services and infrastructure projects. For instance, decisions made by bodies like the Austin City Council, which manages significant public funds, are often supported by the tax base established by TCAD’s appraisals.

TCAD Financial Snapshot and Its Impact on Businesses

Let’s look at some recent financial figures for the Travis Central Appraisal District, as of September 30, 2024, to understand the scale of local financial operations and how they indirectly affect businesses seeking ERC funding Travis County in 2026:

- Ending Fund Balance: $5,081,416. This significant balance indicates a healthy financial position for the district.

- Budget Surplus: TCAD reported a budget surplus of $1,938,260 for the month ended September 30, 2024. This surplus suggests efficient fiscal management.

- Total Revenue: For the same month, total revenue reached $22,817,350.

- Total Expenditures: Total expenditures were $20,707,590.

- Investment Portfolio: TCAD’s investment portfolio had a market value of $11,534,655.17 as of September 30, 2024, with investment income of $131,075.90 for the quarter. The district’s investment strategy focuses on short-term, low-risk instruments like bank deposits and Local Government Investment Pools (LGIPs) such as TexPool and TexPool Prime, yielding a weighted average of 1.85%.

What do these numbers mean for Travis County businesses? While TCAD’s financial health is good, it underscores the substantial property tax revenues generated in the county. These taxes are a fixed and often increasing cost for businesses. A thriving appraisal district means accurate valuations, which support local government services, but also mean consistent property tax obligations for businesses.

This is where ERC funding Travis County acts as a crucial counter-balance. By providing a federal tax credit—even if it is claimed or received years later—it can help businesses manage their local tax burden, free up cash flow, and maintain stability amidst rising operational costs. For many employers still waiting on checks in 2026 or finalizing their claims, ERC funds can be a direct influx of capital that alleviates pressure from local financial obligations, allowing businesses to thrive in the Travis County economic environment.

Why erc funding Travis County is a Lifeline for Local Employers

For businesses in Travis County, the availability of ERC funding Travis County is more than just a tax credit; it’s a lifeline that supports local economic resilience. The unique pressures of operating in a vibrant, yet sometimes costly, urban environment make federal relief programs particularly impactful.

- Offsetting Local Costs: As discussed, businesses in Travis County face significant operating expenses, including property taxes based on TCAD’s appraisals. The ERC provides non-dilutive capital that can directly offset these costs, easing the financial burden and improving cash flow. This is especially critical for small and medium-sized businesses that might operate on tighter margins.

- Reinvesting in Business: With ERC funds—whether received directly from the IRS or accessed early through ERC funding solutions—businesses can do more than just cover expenses. They can reinvest in their operations, whether it’s upgrading equipment, expanding services, or improving employee benefits. This reinvestment stimulates local economic growth and contributes to the overall prosperity of Travis County.

- Employee Retention: The very purpose of the ERC was to incentivize employers to keep their workers. For Travis County businesses, these funds allowed them to continue paying wages, avoid layoffs, and maintain a skilled workforce. Even now, as businesses receive delayed refunds in 2026, these funds can support ongoing employee development and retention efforts.

- Economic Stability: The influx of ERC funds into local businesses contributes to broader economic stability. It helps prevent business failures, supports job creation, and ensures that local commerce remains robust. This stability benefits the entire community, from local suppliers to consumers.

- Navigating Post-Pandemic Recovery: While the pandemic’s height is behind us, many businesses are still navigating its long-term effects, including supply chain issues, evolving consumer behavior, and inflation. ERC funding Travis County provides the capital buffer needed to adapt and recover fully, ensuring these businesses remain a vital part of the county’s economy.

The ERC empowers Travis County employers to not only survive but to continue building resilience and growth in 2026 and the years ahead.

Frequently Asked Questions about the ERC in Travis County

We understand that the ERC can be a complex topic, especially with the nuances of federal regulations and local economic conditions, and the added complexity of retroactive claims in 2026. Here are answers to some of the most common questions we receive from businesses in Travis County:

Can I still apply for the ERC if I received a PPP loan?

Yes, absolutely. Initially, businesses had to choose between claiming the ERC and receiving a Paycheck Protection Program (PPP) loan. However, this rule was changed by the Consolidated Appropriations Act of 2021. Now, businesses can qualify for both programs.

The key is that you cannot use the same qualified wages to claim both the ERC and for PPP loan forgiveness. We help businesses carefully review their payroll records to ensure that wages are properly allocated between the two programs, maximizing the benefits from both without any overlap. This often involves a careful analysis of which wages were used for PPP forgiveness and then claiming the ERC on any remaining eligible wages.

In 2026, this analysis is often retrospective—reconstructing how wages were used and ensuring documentation is clear and defensible if the IRS asks questions.

What are the most common mistakes businesses make when filing for the ERC?

When pursuing ERC funding Travis County, we’ve observed a few recurring mistakes that can lead to significant delays, reduced credit amounts, or even IRS scrutiny:

- Incorrect Eligibility Assessment: Many businesses mistakenly believe they don’t qualify or, conversely, claim the credit when they don’t meet the strict government shutdown or gross receipts decline tests. A thorough, documented eligibility assessment is crucial.

- Calculation Errors: The rules for calculating qualified wages, especially when considering different employee counts for 2020 versus 2021, and the interaction with PPP loans, are complex. Mistakes in these calculations are very common.

- Insufficient Documentation: The IRS requires comprehensive records to support every aspect of an ERC claim. Failing to gather and organize payroll records, government orders, and financial statements can lead to claim rejections or audits.

- Ignoring Aggregation Rules: Businesses with common ownership (e.g., related entities) must aggregate their employees and gross receipts for eligibility and credit calculation purposes. Overlooking these rules can lead to incorrect claims.

- Submitting Aggressive or Ineligible Claims: Unfortunately, some unscrupulous “ERC mills” have encouraged ineligible businesses to apply, leading to an increase in IRS crackdowns and a potential for legitimate businesses to be caught in the crossfire if their claims are not robust.

- Not Revisiting Old Claims: In 2026, some businesses find that earlier claims they filed on their own or through a third party are incomplete, overreaching, or poorly documented—but they have not taken steps to correct or shore them up before the IRS reviews them.

Working with experienced professionals can help Travis County businesses avoid these pitfalls and ensure a compliant and accurate ERC claim.

How long does it take to receive an ERC refund from the IRS?

This is perhaps the most frustrating aspect for businesses currently seeking ERC funding Travis County. Due to the overwhelming volume of claims and increased IRS scrutiny, processing times have been notoriously long.

Many businesses have reported wait times of 12 to 18 months, or even longer, to receive their ERC refunds, and some are still waiting on claims they filed prior to 2026. The IRS has announced initiatives to clear the backlog, but delays continue to be common.

These delays can severely impact a business’s cash flow, especially when they are relying on these funds for operational expenses or reinvestment.

This is precisely why services that provide ERC advances or buyouts have become so valuable. They allow eligible businesses to access their earned funds much sooner, bypassing the IRS delays and putting vital capital back into their hands when they need it most.

Conclusion: Expedite Your ERC and Fuel Your Business Growth

The Employee Retention Credit represents a significant opportunity for Travis County businesses to recoup lost revenue and strengthen their financial footing in the wake of the pandemic. For businesses that steerd government shutdowns, sustained revenue losses, or simply kept their teams employed during unprecedented times, ERC funding Travis County is a well-deserved reward.

Even though the qualifying wage periods ended in 2021, 2026 is still a pivotal year. Many employers can:

- File remaining ERC claims for eligible 2020-2021 quarters that are still within the statute of limitations

- Fix or support claims they already filed

- Finally receive delayed refunds the IRS is still processing

However, the journey from eligibility to receiving funds is often fraught with complexities, from meticulous documentation and accurate calculations to the daunting prospect of lengthy IRS processing delays. We’ve seen how these delays can stifle growth and create unnecessary financial stress for local employers.

This is where we come in. At SFG Capital, we specialize in helping Travis County businesses not only steer the intricate ERC application process but also overcome the challenge of IRS backlogs. Our expert claim assistance ensures that your application is accurate and compliant, maximizing your eligible credit. More importantly, we offer solutions like advances and buyouts, providing you with immediate access to your ERC funds without the prolonged wait. Our performance-based fee structure means we only succeed when you do.

Don’t let IRS delays keep your hard-earned capital out of reach. Accessing your ERC funding Travis County quickly can make a tangible difference in your ability to manage local costs, reinvest in your operations, retain valuable employees, and ultimately fuel your business’s growth and resilience.

To learn more about how we can help you expedite your ERC refund and access your capital sooner, visit our services page: https://sfg-capital.com/services/