Understanding Claim Buyouts: From Insurance Settlements to Tax Refunds

A TAS claim buyout refers to a financial transaction where you sell your right to receive a future payment—whether from an insurance claim, legal settlement, or tax refund—in exchange for immediate cash. While the term “TAS” typically relates to the IRS Taxpayer Advocate Service in the context of tax claims, the broader concept of claim buyouts applies across many industries, from selling your totaled vehicle to an insurance company to accessing delayed business tax credits.

Quick Answer: What is a Claim Buyout?

- Definition: Trading a future payment you’re owed for immediate cash today

- Common Types: Insurance settlements, legal claims, tax refunds (including ERC)

- Key Benefit: Immediate liquidity instead of waiting months or years

- How It Works: A third party purchases your claim at a discount and assumes collection risk

- Main Use Case for Businesses: Accessing delayed IRS refunds like the Employee Retention Credit (ERC)

The challenge many businesses face today isn’t whether they’re owed money—it’s when they’ll actually receive it. With over 597,000 ERC claims sitting unprocessed at the IRS as of April 2024, and processing delays stretching 12-18 months or longer, the wait for legitimate refunds has become a critical cash flow problem. As one court noted in a major corporate case, the precise handling of claim notices can mean the difference between receiving your payment and losing it entirely—highlighting why understanding your options matters.

Whether you’re dealing with a damaged vehicle, a business tax refund, or another type of claim, the fundamental principle remains the same: converting an uncertain future payment into certain immediate capital. However, the mechanics, risks, and benefits vary significantly depending on the type of claim and the parties involved.

I’m Santino Battaglieri, and through SFG Capital, I’ve personally overseen the purchase and funding of over $500 million in ERC claims, helping businesses steer the complex intersection of TAS claim buyouts and IRS processing delays. My experience in structured funding has shown me that while claim buyouts offer powerful solutions for businesses trapped in bureaucratic delays, success requires careful due diligence, regulatory compliance, and working with experienced partners who prioritize your long-term business protection.

The Core Principle: How Claim Buyouts Work Across Different Industries

A claim buyout fundamentally involves converting an anticipated future payment into immediate cash. Imagine you’re owed money, but the payment is delayed, uncertain, or tied up in a lengthy process. A third party steps in, offers you a discounted lump sum now, and in return, takes over your right to that future payment. This process transfers the risk of collection and the waiting period from you to the funding company.

This concept isn’t new; it’s prevalent in various sectors. For instance, in insurance, if your car is totaled, you might accept a buyout from your insurer rather than attempting repairs. In legal settlements, plaintiffs sometimes sell a portion of their future settlement for immediate funds. For businesses, especially in times of economic uncertainty or when facing bureaucratic delays, a tax claim buyout can be a lifeline. It’s about leveraging the time value of money, ensuring you have the capital you need today rather than waiting months or even years.

For a deeper dive into how this applies to tax credits, especially the Employee Retention Credit, you can explore What is ERC Funding?.

From Car Insurance to Corporate Finance

The idea of a buyout often conjures images of an auto insurance scenario. If your car suffers significant damage, your insurer might deem it a “total loss.” Instead of repairing it, they offer you a buyout—a lump sum payment—and take ownership of the salvage. You, the policyholder, get immediate funds to replace your vehicle, and the insurer handles the disposal or sale of the damaged car. You might even have the option of “buying back the salvage” if you want to keep the damaged vehicle yourself. This is a straightforward example of trading a claim for immediate cash.

But the principle extends far beyond individual car insurance. In the complex world of corporate finance, particularly within Mergers & Acquisitions (M&A) transactions, the concept of a tax claim buyout takes on a sophisticated form. Here, it relates to how potential tax liabilities or refunds are handled during the sale of a business. Share Purchase Agreements (SPAs) often include detailed tax covenants that protect the buyer from pre-acquisition tax issues. If a buyer finds a tax liability after the acquisition that falls under these covenants, they can make a claim against the seller.

The Importance of Contractual Precision in Claims

When it comes to making claims in M&A, whether for tax liabilities or other breaches of warranties, the devil is truly in the details. Share Purchase Agreements (SPAs) contain specific “notice of claim” obligations that dictate how a buyer must inform a seller about a potential claim. Strict adherence to these terms is paramount, as demonstrated by the UK High Court’s decision in Dodika Ltd & Ors v United Luck Group Holdings Limited. While this case was heard in the UK, its implications for the importance of contractual precision resonate globally for M&A practitioners, including those in the United States.

In the Dodika Ltd case, the buyer sent a notice regarding a transfer pricing investigation but failed to include sufficient details about the underlying facts and circumstances. The High Court ultimately sided with the sellers, ruling the notice invalid because it did not meet the stringent information requirements outlined in the SPA. This decision highlights several critical legal considerations and potential pitfalls in tax claim buyouts within M&A:

- Level of Detail Required: Purchasers must ensure their tax claim notices are valid and contain the required information. The court emphasized that merely stating the existence of an investigation or issue is insufficient. The notice must detail the specific facts, circumstances, and events giving rise to the claim. This is not just a formality; it serves the purpose of informing the party being claimed against with enough knowledge to understand the basis of the claim.

- Consequences of Invalidity: An invalid claim notice can be fatal to the claim itself. If the notice is deemed invalid and the contractual deadline for notification has passed, the buyer may lose their right to pursue the claim entirely, regardless of its merits.

- Strict Interpretation of SPAs: The High Court’s decision underscores that courts are likely to strictly interpret negotiated documents like SPAs, particularly regarding claim notification provisions. The precise wording in share purchase agreements regarding tax claim notification provisions is incredibly significant. Parties must draft these clauses with extreme care and then abide by them carefully.

- Impact on M&A: This ruling serves as a powerful reminder for all parties in M&A transactions: carefully consider the precise claim notice terms agreed upon in a purchase agreement. Purchasers should err on the side of providing more information than might seem strictly necessary to ensure compliance and avoid invalidation.

As the High Court decision implies, while seemingly harsh on the buyer, it confirms just how important it is for parties to think very carefully about the notice of claim obligations they agree to. For more context on this landmark decision, you can refer to insights regarding the High Court decision highlights importance of claim notices. This rigorous approach to contractual terms ensures certainty and predictability, even if it means a higher bar for claimants.

Understanding a TAS Claim Buyout for Your Business

For businesses in the United States, particularly those dealing with the complexities of federal tax law, a TAS claim buyout often refers to monetizing a tax refund claim that might otherwise be stuck in the IRS’s processing backlog. “TAS” here stands for the Taxpayer Advocate Service, an independent organization within the IRS that helps taxpayers resolve problems with the agency. When businesses face IRS problems or delays with complex tax refunds, a TAS claim buyout can be a vital solution for opening up delayed funds.

The IRS, despite its best efforts, faces significant operational challenges. The National Taxpayer Advocate Erin Collins, in her most recent Annual Report to Congress, identified hiring as one of the 10 most pressing issues. With 63% of the IRS workforce eligible to retire within six years, and attrition rates for customer support representatives at 24% in fiscal year 2023 and 19% in fiscal year 2024, the agency struggles with hiring, training, and retaining workers. This directly impacts its ability to provide adequate service and process tax returns efficiently, leading to prolonged processing delays for refunds.

The potential consequences of an under-resourced IRS for tax filing seasons and tax administration are substantial. As noted in a review of the 2024 filing season, the IRS prioritized boosting its “Level of Service” (largely based on phone call answer rates) at the expense of “greater delays in processing correspondence and amended returns.” This means that while you might get your call answered faster, your refund check could be moving at a snail’s pace. This environment of delays and uncertainty makes TAS claim buyouts a compelling option for businesses seeking immediate liquidity.

For an understanding of the criteria under which the Taxpayer Advocate Service can assist, you can consult 13.1.7 Taxpayer Advocate Service (TAS) Case Criteria.

What is the Taxpayer Advocate Service (TAS)?

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that serves as a voice for taxpayers. Its mission is to ensure that every taxpayer is treated fairly and understands their rights, especially when they’re experiencing financial difficulty or significant delays that the normal IRS channels can’t resolve.

You might contact TAS if you’re facing:

- Significant hardship due to an IRS action.

- Delays of more than 30 days in resolving a tax issue.

- Failure to receive a response or resolution by the date promised by the IRS.

In the context of IRS staffing challenges, the IRS recently exempted critical tax season staff, including Taxpayer Advocate Service (TAS) personnel, from a voluntary separation incentive program (Deferred Resignation Program or DRP) to ensure smooth operations. This highlights the critical role TAS plays in supporting taxpayers, especially during periods of IRS strain. However, even with dedicated staff, TAS can only intervene under specific case criteria, and its involvement doesn’t always guarantee an expedited refund, especially amidst massive backlogs.

How a TAS Claim Buyout Provides Immediate Capital

For businesses with valid tax refund claims, particularly those facing the notorious IRS processing delays, a TAS claim buyout offers a clear path to immediate capital. Instead of waiting indefinitely for the IRS to process your refund, a funding provider like SFG Capital purchases your verified claim at a discount.

Here’s how it works:

- Claim Validation: We conduct thorough due diligence to verify the legitimacy and value of your tax refund claim. This ensures that your claim meets all IRS requirements and is likely to be paid eventually.

- Funding Offer: Based on our assessment, we provide a funding offer for a portion of your expected refund. This is the immediate cash you receive.

- Funding Agreement: You enter into an agreement where you assign your right to the future tax refund to us.

- Immediate Funds: You receive the agreed-upon cash advance, often within weeks, allowing you to bypass the lengthy IRS delays.

- Risk Transfer: We assume the risk and the waiting game of collecting the full refund from the IRS.

This process is particularly beneficial for claims like the Employee Retention Credit (ERC), which have been subject to unprecedented processing delays. For more on how this type of advance funding works, you can visit ERC Advance Funding.

A Deep Dive: The Employee Retention Credit (ERC) Buyout

The Employee Retention Credit (ERC) was a cornerstone of federal COVID-19 relief, designed to help businesses keep employees on their payroll during the pandemic. Established under Section 2301 of the CARES Act and later expanded, it’s a refundable tax credit against certain employment taxes. For 2020, eligible businesses could claim up to $5,000 per employee. For 2021, the credit increased to $7,000 per employee per quarter, totaling up to $21,000 for the first three quarters.

Businesses in Travis County, TX, and across the U.S. that experienced significant declines in gross receipts or had operations fully or partially suspended due to government orders were eligible. Many businesses, unaware of their eligibility or focused on immediate survival, didn’t claim the ERC on their original payroll tax returns. They later filed amended returns (Form 941-X) to claim the credit retroactively. You can find a comprehensive guide to this credit at ERC Credit Complete Guide.

Why is there a Need for ERC Buyouts?

Despite its crucial role in supporting businesses, the ERC program has been plagued by significant delays and complications, creating an urgent need for ERC buyouts. As of April 2024, over 597,000 ERC claims remained unprocessed by the IRS. This massive backlog stems from several factors:

- IRS Processing Moratorium: In September 2023, the IRS announced a moratorium on processing new ERC claims, citing concerns about potential fraud and abuse. While intended to combat illegitimate claims, this action brought legitimate claims to a standstill, exacerbating delays. The IRS has two years to pursue civil litigation to recover an erroneous refund, extended to five years if induced by fraud or misrepresentation, which adds to their caution.

- Fraud and Abuse Concerns: The IRS has expressed significant concerns about aggressive marketing by third-party ERC promoters, leading to many ineligible businesses filing claims. This has forced the IRS to slow down processing to implement new compliance measures and weed out fraudulent applications.

- Massive Claim Backlog: Even before the moratorium, the sheer volume of claims overwhelmed the IRS. The agency’s staffing challenges, including high attrition and a significant portion of its workforce eligible for retirement, have compounded the problem. This means that while businesses are waiting for their refunds, the IRS is struggling to process them efficiently.

- Impact on Taxpayer Service: The National Taxpayer Advocate has highlighted that the IRS’s focus on improving phone answer rates has come at the cost of processing correspondence and amended returns, including ERC claims. This means businesses are caught in a “waiting game,” unable to access the funds they are legally owed.

This environment of uncertainty and delay makes an ERC buyout a critical financial tool. Businesses simply cannot afford to wait 12-18 months or longer for funds that are rightfully theirs. For more on these delays, read The Waiting Game: Understanding and Overcoming ERC Refund Delays.

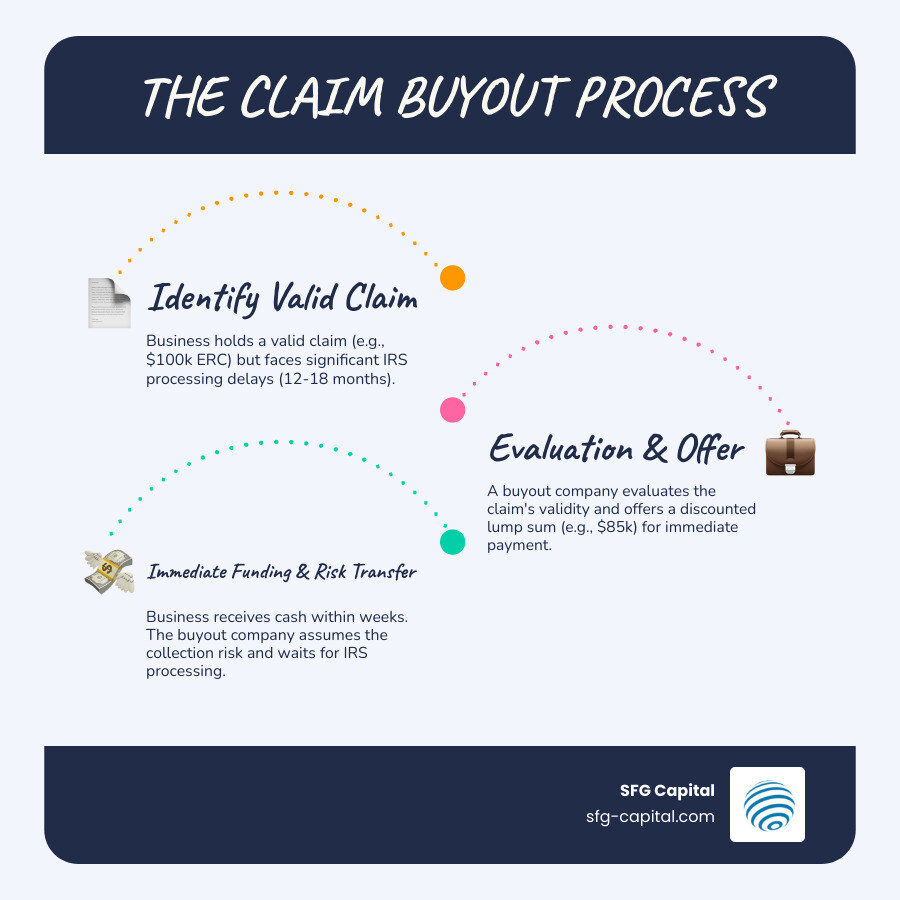

The ERC Claim Buyout Process Explained

For businesses in Travis County, TX, seeking to open up their delayed ERC refunds, the claim buyout process with SFG Capital is designed to be straightforward and efficient:

- Application: You start by providing us with information about your business and your filed ERC claims.

- Claim Validation: Our experts carefully review your ERC documentation to ensure its accuracy and compliance with IRS guidelines. This due diligence is crucial to confirm the validity of your claim and reduce the risk of future IRS challenges. We assess eligibility criteria, qualified wages, and other relevant factors.

- Funding Offer: Once your claim is validated, we present a transparent funding offer. This offer represents an immediate cash advance for a portion of your expected ERC refund, discounted to account for the time value of money and the risk associated with IRS processing.

- Performance-Based Fees: Our fees are performance-based, meaning we only get paid when your claim is successfully processed by the IRS. This aligns our incentives with yours, ensuring we are committed to seeing your refund through.

- Receiving Funds: Upon agreement, we quickly disburse the funds directly to your business. This allows you to access the capital you need to manage cash flow, invest in growth, or address other financial priorities, without waiting for the IRS.

- We Handle the Wait: After funding, we manage the ongoing communication and follow-up with the IRS regarding your ERC claim, taking the burden off your shoulders. We assume the waiting period and the eventual collection of the full refund from the IRS.

Our process is built for speed and clarity, helping businesses steer the complexities of IRS delays. You can learn more about our approach at Our Process.

Navigating Risks and Legalities of a Tax Claim Buyout

While a TAS claim buyout offers significant advantages, it’s crucial to steer the associated risks and legalities carefully. This is especially true for businesses involved in M&A transactions, where tax claims can impact deal structures, indemnity provisions, and escrow arrangements. The complexity of tax law, coupled with evolving legislative landscapes and IRS scrutiny, necessitates thorough due diligence and expert guidance.

For example, when businesses are acquired, existing ERC claims and their associated statutes of limitations can heavily influence M&A negotiations. Buyers will want indemnity provisions from sellers to cover potential clawbacks or issues with pre-acquisition ERC claims. Escrow arrangements, where a portion of the purchase price is held back, are often used to secure these indemnities against future tax liabilities or fraudulent ERC claims. Changes to the statute of limitations, such as a proposed extension to six years, directly impact the duration and amount of these indemnity periods and escrow funds, creating additional uncertainty for both buyers and sellers.

Your Guide to the TAS Claim Buyout and Legislative Risk

The landscape surrounding the Employee Retention Credit (ERC) is dynamic, with proposed legislative changes creating significant uncertainty for employers, even those in Travis County, TX, who have filed legitimate claims. Understanding these risks is critical before engaging in a TAS claim buyout.

- Proposed Denial of Late Claims: Proposed tax legislation could disallow ERC claims filed after January 31, 2024. This retroactive denial has the potential to invalidate bona fide claims made in good faith, creating a major headache for businesses that submitted their applications before this date but after the proposed cutoff.

- Extension of Statute of Limitations: Another proposed change would extend the statute of limitations on assessments relating to the ERC to six years, up from the general three-year period. This significantly prolongs the period during which the IRS can audit and potentially claw back refunds, increasing the uncertainty for employers and impacting the value of claims. The general three-year statute of limitations for 2020 ERC claims expired on April 15, 2024, and for 2021 claims, it will expire on April 15, 2025 (for Q1/Q2) and April 15, 2027 (for Q3). An extension to six years would mean the IRS could audit 2020 claims until April 15, 2027.

- IRS Concerns about Fraud: The IRS has been vocal about its concerns regarding potential fraud and abuse in ERC claims, leading to the processing moratorium and increased scrutiny. This has directly affected claim processing, causing delays even for legitimate claims, as the IRS implements new measures to identify and reject fraudulent applications.

These proposed changes create an environment of employer uncertainty, making the decision to pursue a TAS claim buyout even more strategic. By opting for a buyout, you transfer this legislative and audit risk to the funding provider, securing your capital regardless of future policy shifts or prolonged IRS audits. For ongoing support and guidance on navigating these complexities, our team offers specialized assistance for your Employee Retention Credit Help.

Due Diligence for Your TAS Claim Buyout

Engaging in a TAS claim buyout requires careful due diligence, not just on the part of the funding provider, but also on your end as a business owner. This ensures you choose a reputable partner and understand the implications of the transaction.

Here are key considerations for your due diligence:

- Choosing a Reputable Partner: Select a funding provider with a proven track record, deep expertise in tax financing, and transparency in their terms and fees. For businesses in Travis County, TX, SFG Capital offers local expertise and a strong commitment to client success.

- Understanding the Tax Code: While your funding partner will handle the intricacies, having a basic understanding of the tax code provisions relevant to your claim (like ERC eligibility) helps you evaluate the validity of your claim and the funding offer.

- Claim Accuracy: Ensure your original claim was carefully prepared and accurate. Any inaccuracies can lead to delays or rejection by the IRS, impacting the value of your buyout.

- Specialist Guidance: Work with ERC specialists who can guide you through the process, validate your claim, and ensure compliance. This minimizes your risk and maximizes your chances of a successful buyout.

For detailed guidance and expert support in navigating your ERC claim, consult our Employee Retention Credit Specialist Guide.

Conclusion

From selling an accident-damaged car to monetizing complex tax credits, the concept of a claim buyout offers a powerful financial solution: converting a future, often uncertain, payment into immediate, certain cash. For businesses in Travis County, TX, and across the United States, this strategy has become particularly vital in navigating the protracted delays associated with IRS tax refunds, especially for the Employee Retention Credit (ERC).

We understand that waiting for the IRS to process your legitimate ERC refund can stifle your business’s cash flow and growth. That’s why we at SFG Capital specialize in providing ERC refund buyouts, allowing you to bypass the long waiting game and access the capital you need today. By transferring the risk and the wait to us, you can focus on what you do best: running and growing your business.

Ready to open up your delayed ERC refund and open up crucial cash flow for your business? Contact Us today to learn how we can help.