Understanding the Employee Retention Credit and Who Qualifies

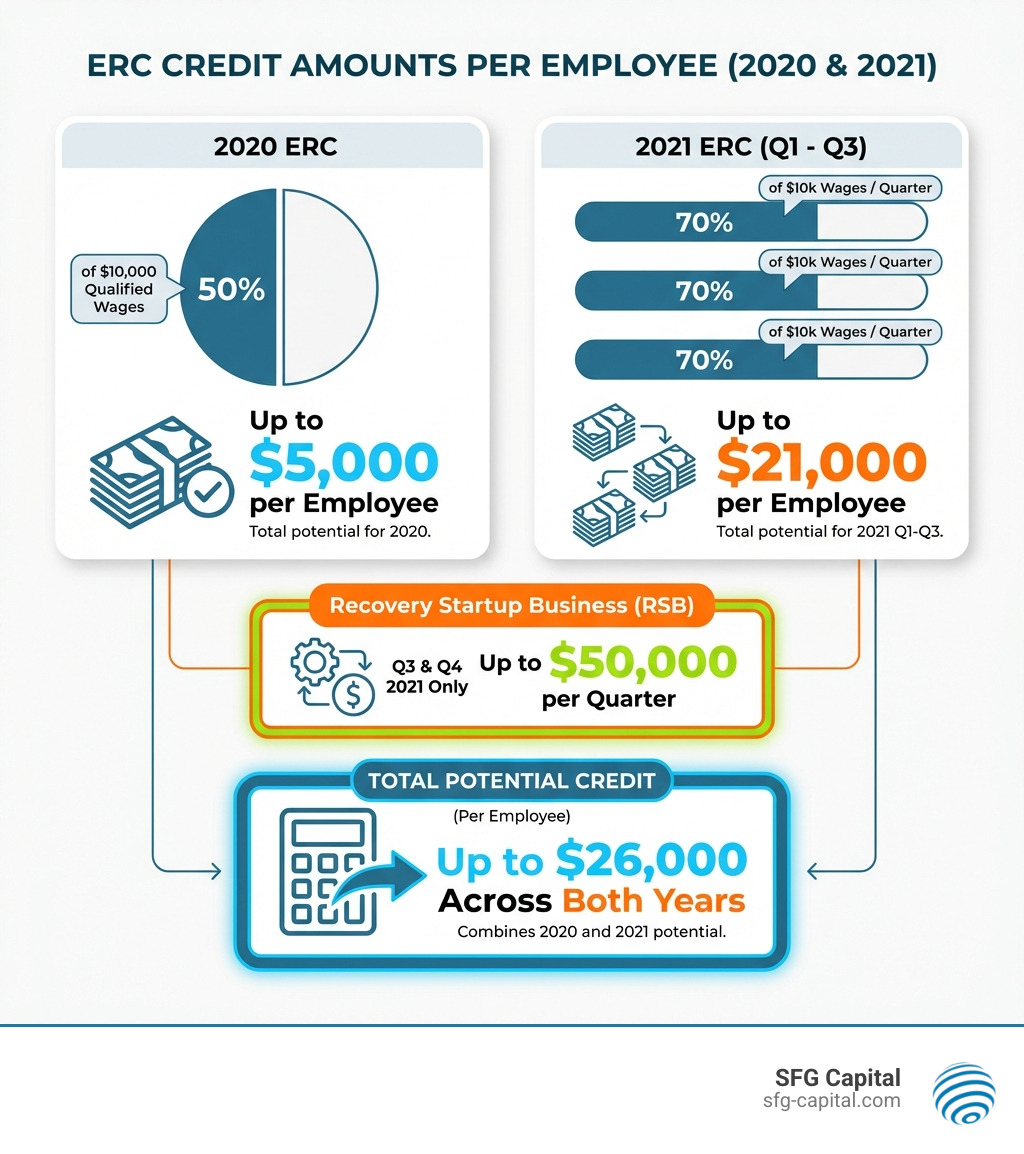

ERC refund requirements determine whether your business can claim a significant tax credit designed to reward employers who kept staff on payroll during the COVID-19 pandemic. The credit was introduced through the CARES Act in 2020 and subsequently expanded, offering eligible businesses up to $26,000 per employee across 2020 and 2021.

Quick Answer: Core ERC Eligibility Requirements

To qualify for the Employee Retention Credit, your business must meet one of these criteria:

Government Order Suspension – Your operations were fully or partially suspended by a COVID-19 government order during 2020 or the first three quarters of 2021.

Gross Receipts Decline – Your business experienced:

- A 50% decline in gross receipts (comparing any 2020 quarter to the same 2019 quarter), OR

- A 20% decline in gross receipts (comparing any 2021 quarter to the same 2019 quarter)

Recovery Startup Business – You started operations after February 15, 2020, with less than $1 million in annual gross receipts (Q3 and Q4 2021 only).

Additional key limitations:

- Employee count matters: 100 or fewer for 2020, 500 or fewer for 2021

- Maximum credits: $5,000 per employee for 2020, $21,000 per employee for 2021

- Wages used for PPP loan forgiveness cannot be claimed for ERC

The challenge isn’t just understanding whether you qualify. The IRS has paused processing many claims due to widespread fraud, and wait times now stretch six to twelve months or longer. Many legitimate businesses face cash flow challenges while navigating complex documentation requirements and changing IRS guidance.

This is where careful navigation becomes critical. The difference between a successful claim and a costly audit often comes down to documentation and understanding the nuances of each eligibility pathway.

As Santino Battaglieri, I’ve guided clients through over $500 million in ERC claims at SFG Capital, helping businesses steer the complex ERC refund requirements while ensuring full compliance with IRS guidance. Throughout this guide, we’ll break down exactly what you need to know to determine your eligibility, file correctly, and avoid the pitfalls that have trapped thousands of businesses.

Breaking Down the Core ERC Refund Requirements

Navigating the ERC refund requirements can feel like deciphering an ancient scroll, but at its heart, the credit was designed to help businesses like yours in Travis County keep their teams employed during unprecedented times. The eligibility criteria are intricate and vary significantly between 2020 and 2021, reflecting the evolving nature of the pandemic and government response.

At a high level, there were three main pathways to eligibility for the ERC:

Each of these pathways has specific conditions that must be met, and it’s not always as straightforward as it seems. For a comprehensive overview, we often refer businesses to the IRS’s official Employee Retention Credit Eligibility Checklist, which provides a good starting point for self-assessment.

Understanding these paths is crucial, especially when considering the interaction with other relief programs like PPP Loans. The key is never to “double-dip” – wages used for PPP loan forgiveness cannot also be claimed for the ERC. This requires careful allocation and documentation.

Navigating the 2020 ERC Refund Requirements

The initial iteration of the ERC, introduced under the CARES Act, laid the groundwork for this vital relief. For qualified wages paid between March 13, 2020, and December 31, 2020, the ERC refund requirements were as follows:

- Credit Amount: We could claim a credit equal to 50% of qualified employee wages.

- Wage Limit: The maximum amount of qualified wages per employee for the entire year was $10,000. This meant the maximum credit per employee for 2020 was $5,000.

- Employee Count: To qualify, businesses generally needed to have 100 or fewer full-time W-2 employees in 2019. This threshold was critical in determining how to calculate qualified wages.

- Gross Receipts Decline: Your business needed to demonstrate a significant decline in gross receipts. Specifically, a quarter in 2020 qualified if its gross receipts were less than 50% of the gross receipts for the same calendar quarter in 2019. Once this 50% threshold was met, you qualified for that quarter and all subsequent quarters until your gross receipts exceeded 80% of the comparable 2019 quarter.

- Government Order Suspension: Alternatively, if your business operations were fully or partially suspended due to a government order related to COVID-19, you could qualify for the period of suspension, regardless of your gross receipts. This was particularly relevant for many Austin businesses affected by local mandates.

- Qualified Wages: For businesses with 100 or fewer employees, all wages paid to employees during the qualifying period (suspension or gross receipts decline) were considered qualified wages, whether the employees were working or not. For larger businesses, only wages paid to employees who were not providing services were qualified.

Understanding the 2021 ERC Refund Requirements

The Consolidated Appropriations Act of 2021 and the American Rescue Plan Act (ARPA) significantly expanded the ERC for 2021, making it even more beneficial for businesses in Travis County. The ERC refund requirements for qualified wages paid between January 1, 2021, and September 30, 2021 (the credit was retroactively eliminated for most businesses for Q4 2021), were improved:

- Credit Amount: The credit amount increased to 70% of qualified employee wages.

- Wage Limit: This was a game-changer! The wage limit was raised to $10,000 per employee per quarter. This meant a potential maximum credit of $7,000 per employee per quarter, leading to a possible $21,000 per employee for the first three quarters of 2021.

- Employee Count: The employee threshold was expanded to 500 or fewer full-time W-2 employees in 2019, allowing many more medium-sized businesses to qualify.

- Gross Receipts Decline: The bar for the gross receipts test was lowered to a 20% decline. A quarter in 2021 qualified if its gross receipts were less than 80% of the gross receipts for the same calendar quarter in 2019. Businesses could also elect to use the immediately preceding quarter to compare against the corresponding 2019 quarter.

- Government Order Suspension: Similar to 2020, operations fully or partially suspended by a government order due to COVID-19 could trigger eligibility.

- Qualified Wages: For businesses with 500 or fewer employees, all wages paid to employees during the qualifying period were considered qualified wages. For larger businesses, only wages paid to employees not providing services were qualified.

These updates often meant a substantial increase in potential refunds for our clients. For a deeper dive into the specifics of 2021 eligibility, our ERC Credit Complete Guide offers an exhaustive breakdown.

Special Cases: Recovery Startup Businesses and PPP Loans

The ERC legislation also carved out specific provisions for certain businesses, particularly new ventures and those that participated in the Paycheck Protection Program (PPP).

Recovery Startup Businesses: This was a unique pathway introduced for the third and fourth quarters of 2021 (though the credit was mostly eliminated for Q4). A business could qualify as a Recovery Startup Business if:

- It began operations after February 15, 2020.

- Its average annual gross receipts for the three taxable years preceding the quarter in which the credit is determined did not exceed $1 million.

- It did not otherwise meet the gross receipts decline or government order suspension criteria.

For these businesses, the ERC refund requirements allowed them to claim up to $50,000 per quarter, even if they didn’t experience a shutdown or a decline in gross receipts. This was a fantastic opportunity for many new businesses that emerged in the Austin area during the pandemic.

Interaction with PPP Loans: Initially, businesses could not claim both the ERC and PPP loans. However, subsequent legislation allowed businesses to claim both. The crucial caveat is that the same wages cannot be used for both PPP loan forgiveness and ERC calculation. This means we had to carefully analyze payroll records to ensure no “double-dipping” occurred. For example, if a business used $100,000 in wages for PPP forgiveness, those $100,000 could not also be counted as qualified wages for the ERC. Any remaining wages, however, might still be eligible. This interaction made ERC calculations quite complex, requiring meticulous record-keeping and strategic planning to maximize both benefits.

Understanding how to leverage these credits, especially for businesses that kept their operations going through challenging times, is what we specialize in. It’s not just about meeting the ERC refund requirements on paper; it’s about optimizing your claim within the complex framework of tax law. If you’re wondering how this all translates into actual funds, our guide on What is ERC Funding? can shed more light.

How to Claim Your ERC Refund (Even Retroactively)

Many businesses, especially those focused on simply surviving the pandemic, didn’t claim the ERC when it was first available. The good news is that it’s often not too late! The ERC can be claimed retroactively by filing an amended payroll tax return, typically Form 941-X. This process allows us to go back and correct previous filings to claim the credit you rightfully deserve.

The process involves several key steps, and while it might seem daunting, it’s entirely manageable with the right approach and expertise:

- Determine Eligibility: First and foremost, we must confirm your business’s eligibility for each quarter in 2020 and 2021 based on the criteria we’ve just discussed (government orders, gross receipts decline, or recovery startup status).

- Gather Documents: This is where the detective work begins! We’ll need to compile a comprehensive set of documents, including:

- Original Form 941 payroll tax forms for each quarter.

- Profit and Loss (P&L) statements to verify gross receipts.

- Detailed payroll summary reports showing wages paid, taxes withheld, and employee counts.

- Monthly healthcare statements for employer-paid health insurance costs (which can often be included as qualified wages).

- Documentation related to any PPP loans received, including forgiveness applications, to ensure no wage overlap.

- Records of any government orders that impacted your business operations in Travis County.

- Calculate the Credit: With all the data in hand, we carefully calculate the qualified wages and the resulting credit for each eligible quarter. This calculation can be surprisingly complex, taking into account various exclusions and limitations.

- Complete Form 941-X: This is the official IRS form used to amend previously filed quarterly federal tax returns. We’ll fill out a separate Form 941-X for each quarter you’re claiming the credit. The form requires detailed information about the original return, the changes being made, and the reason for those changes.

- Submit the Claim: Once completed, the Form 941-X (and any supporting documentation) is submitted to the IRS.

This entire process, from initial eligibility assessment to final submission, requires a keen eye for detail and a deep understanding of tax regulations. Our ERC Funding Process outlines how we guide businesses through these intricate steps, ensuring accuracy and compliance.

Deadlines for Amending Your Return

While it’s possible to claim the ERC retroactively, there are strict deadlines, or “statutes of limitations,” for amending payroll tax returns. These deadlines are generally three years from the date the original Form 941 was filed or two years from the date the tax was paid, whichever is later.

For most businesses, this translates to the following rolling deadlines:

- For 2020 Claims: The deadline to amend Form 941 for any quarter in 2020 was typically April 15, 2024. For example, for Q4 2020 (due January 31, 2021), the amendment deadline was April 15, 2024.

- For 2021 Claims: The deadline to amend Form 941 for any quarter in 2021 is typically April 15, 2025. For example, for Q4 2021 (due January 31, 2022), the amendment deadline is April 15, 2025.

These deadlines are critical. Missing them means forfeiting the opportunity to claim potentially substantial credits. That’s why we always emphasize timely action. Even though these dates might seem far off, the extensive documentation and calculation required mean that starting early is always the best approach.

IRS Updates, Scams, and Correcting Your Claim

The ERC landscape has been a whirlwind, with constant updates from the IRS and, unfortunately, a rise in fraudulent activity. We’ve seen the IRS take significant steps to combat scams and clarify guidance, making it more important than ever for businesses in Austin and Travis County to proceed with caution.

In September 2023, the IRS announced a moratorium on processing new ERC claims, citing an overwhelming number of questionable submissions and concerns about “ERC mills.” These “mills” are aggressive promoters who often make false promises, charge exorbitant fees (sometimes based on a percentage of the refund, which is a huge red flag!), and claim that “every business qualifies” without proper due diligence. They’ve capitalized on the complexity of ERC refund requirements, leading many legitimate businesses to submit erroneous claims.

This processing pause, while frustrating for businesses awaiting legitimate refunds, is a necessary step to protect taxpayers and the integrity of the tax system. We encourage everyone to review the IRS’s official Frequently Asked Questions about the Employee Retention Credit for the latest information directly from the source.

Beyond the processing pause, the IRS has also provided crucial guidance on the income tax effects of the ERC, particularly concerning wage deduction reductions. Understanding this is key to avoiding further tax headaches down the line.

What to Do If You Filed an Incorrect Claim

If you’re reading this and suddenly feel a cold sweat—perhaps you worked with an ERC mill, or you’re just unsure about the validity of your past claim—don’t panic. The IRS has provided pathways for businesses to correct erroneous claims and potentially avoid penalties and interest.

Here are your options:

- ERC Claim Withdrawal Process: This is a lifesaver for many. If you filed an ERC claim and either haven’t received a refund yet, or received a check but haven’t cashed or deposited it, you might be able to withdraw your claim. Withdrawing effectively treats the claim as if it were never filed, preventing future audits, repayment demands, and associated penalties. The process involves submitting a signed withdrawal request, often faxing it to a dedicated IRS line. If you received a check, you’ll need to void and return it. The IRS has detailed instructions on how to Withdraw an Employee Retention Credit (ERC) claim.

- ERC Voluntary Disclosure Program (VDP): For businesses that received and cashed an erroneous ERC refund, the IRS introduced a Voluntary Disclosure Program. This program, which had a deadline of March 22, 2024, allowed eligible employers to come forward, pay back 80% of the claimed credit, and avoid penalties and interest. While the deadline for this specific program has passed, it’s still crucial to consult with a reputable tax professional to discuss your options for correcting an erroneous claim and mitigating potential penalties.

The implications of an incorrect claim can be severe, including repayment of the credit, along with significant penalties and interest. This is why thorough due diligence and working with trusted professionals are paramount.

New IRS Flexibility for Tax Reporting

In a move that brought a sigh of relief to many businesses, the IRS updated its guidance on March 20, 2024, regarding the income tax reporting of ERC refunds. This update provides much-needed flexibility, especially for businesses still awaiting their refunds.

- Reporting Income from ERC: Previously, businesses generally had to reduce their wage deductions in the tax year the qualified wages were paid, even if they hadn’t received the ERC refund yet. This often meant amending prior income tax returns and potentially paying income tax on an anticipated credit that hadn’t arrived. The new guidance allows taxpayers to report the required reductions to wage deductions in the year they receive the ERC refund. This means if you’re a Travis County business still waiting on a 2021 ERC refund, you don’t necessarily have to amend your 2021 income tax return to account for it prematurely. You can make the adjustment in the year the refund hits your bank account, simplifying compliance and cash flow management.

- Adjusting for Disallowed Claims: The new guidance also clarifies what happens if an ERC claim is disallowed. If your ERC claim is ultimately denied, and you had previously reduced your wage expense in anticipation of the credit, you can now increase your wage expense on your income tax return for the year the disallowance becomes final. This provides a clear path to adjust your tax liability without necessarily having to amend older returns, which can be cumbersome, especially if the statute of limitations for those prior years is closing.

This flexibility is a significant improvement over the previous IRS guidance (Notice 2021-49), which required a more rigid “tracing” of wage deductions to the year the wages were paid. The updated approach acknowledges the practical realities businesses face and aims to reduce administrative burden.

Frequently Asked Questions about ERC Refund Requirements

We often hear similar questions from businesses in Austin and beyond when they’re trying to understand ERC refund requirements. Let’s tackle some of the most common ones.

Is the ERC refund considered taxable income?

This is a common point of confusion. The ERC itself is a refundable tax credit, not a grant or loan, and therefore isn’t directly included in your gross income. However, it affects your taxable income indirectly. When you claim the ERC, you must reduce your deductible wage expenses by the amount of the credit received. This reduction in deductible expenses increases your business’s taxable profit, effectively making the ERC refund subject to income tax.

For example, if you received a $100,000 ERC, you would reduce your wage deduction by $100,000. This $100,000 becomes part of your taxable income. The new IRS guidance discussed earlier provides flexibility on when you report this reduction, allowing you to do so in the year you actually receive the refund, rather than amending prior year returns.

Can I claim the ERC if my business revenue increased?

Yes, potentially! This is a critical distinction and often misunderstood, leading some businesses to mistakenly believe they don’t qualify. If your business was fully or partially suspended due to a government order related to COVID-19, you may qualify for the ERC even if your revenue did not decline or even if it increased.

The key here is the “government order” test. Did a federal, state, or local government order (like a mandate from the City of Austin or Travis County) limit your commerce, travel, or group meetings due to COVID-19, and did that order impact your business operations by more than a nominal amount? If so, you could be eligible for the quarters that order was in effect, regardless of your gross receipts. This is a common area where ERC mills misguide businesses, claiming eligibility solely based on a broad interpretation of “supply chain issues” without a direct government order. Proper documentation of the specific government order and its impact on your operations is absolutely critical for this pathway to eligibility.

How long does it take to receive an ERC refund from the IRS?

Patience is a virtue, especially when waiting for an ERC refund from the IRS. Due to the massive volume of claims, the IRS processing pause, and increased scrutiny for fraud, wait times have become significantly long. While initial estimates were a few months, we’re now seeing refund checks take six months to a year or even longer to arrive after Form 941-X is filed.

This extended wait can be a major cash flow challenge for businesses that desperately need those funds. The IRS is working through the backlog, but with millions of claims and limited resources, delays are inevitable. It’s why some businesses in Travis County explore options like ERC refund advances to access their capital sooner.

Conclusion: Navigating Your ERC Claim and Accessing Your Funds

The Employee Retention Credit was a vital lifeline for countless businesses, helping them retain employees and weather the economic storm of the pandemic. However, as we’ve seen, the ERC refund requirements are complex, and the landscape has become increasingly challenging with IRS processing delays and heightened scrutiny against fraudulent claims.

Understanding your eligibility, carefully documenting your claim, and being acutely aware of the latest IRS guidance and potential scams are not just best practices—they are necessities. For businesses in Austin and Travis County, securing your rightful ERC refund can mean the difference between struggling and thriving.

We understand that waiting six months to a year or more for a refund check from the IRS is simply not feasible for many businesses. That’s why we at SFG Capital specialize in helping businesses like yours steer these complexities and access your funds when you need them most. We offer solutions designed to help you bypass IRS delays, providing ERC refund advances or buyouts so you can put that capital to work today. Our expert assistance ensures your claim is compliant and robust, safeguarding your business against future IRS inquiries.

Don’t let the complexity or the wait stand between your business and the capital it deserves. Explore how our ERC Funding Solutions can help you open up your ERC refund efficiently and effectively.