What is the Employee Retention Credit?

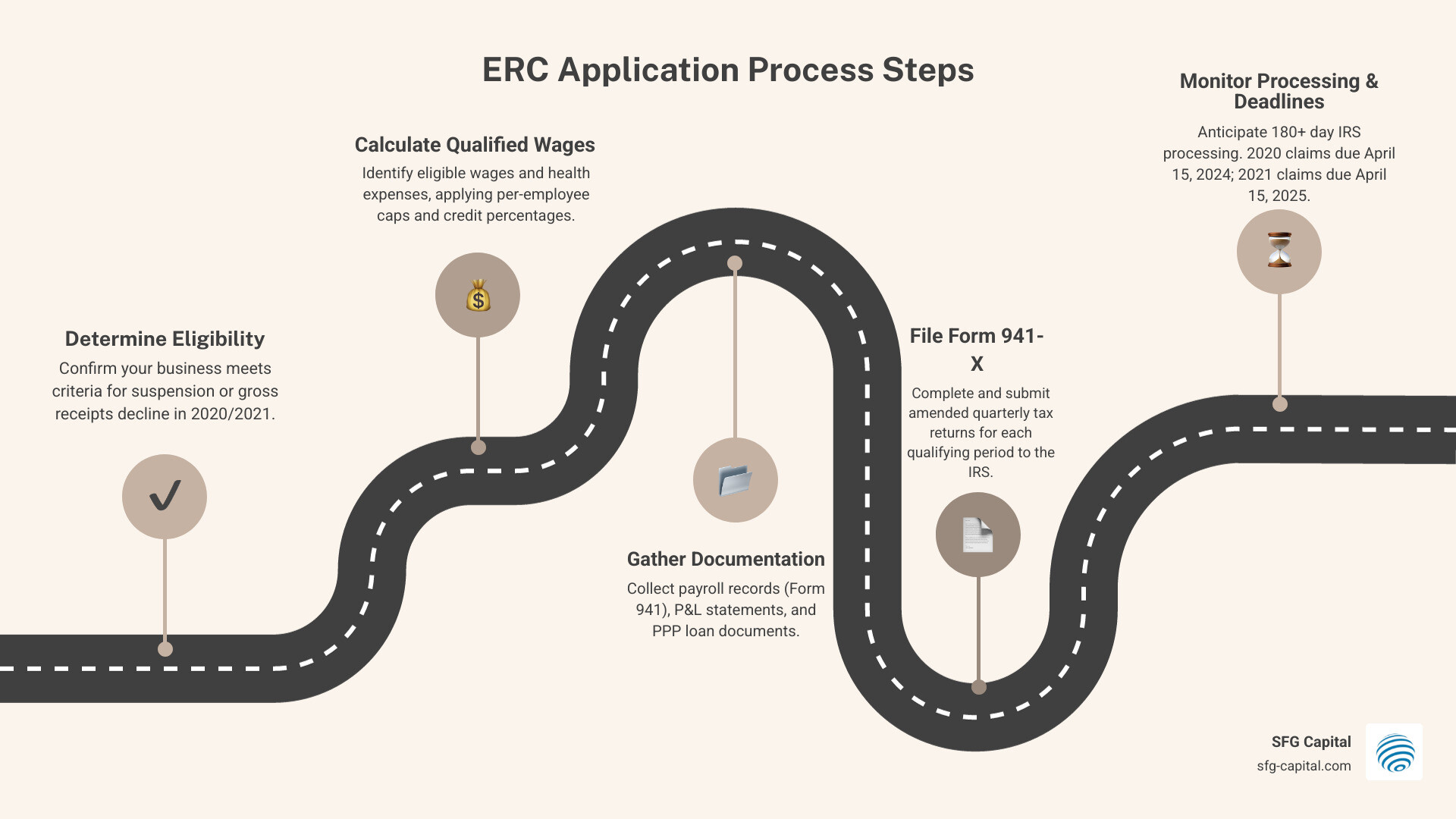

Understanding how to apply for the ERC was a critical task for business owners seeking this valuable COVID-19 relief. The process involved these key steps:

- Determine eligibility based on a government-mandated suspension or a significant decline in gross receipts during 2020 or 2021.

- Calculate qualified wages and health plan expenses based on employee count.

- Gather documentation, including Form 941s, P&L statements, and payroll summaries.

- File Form 941-X, an amended quarterly tax return, for each qualifying quarter.

- Mail forms to the correct IRS processing center.

- Wait for processing, which now often exceeds 180 days due to backlogs.

The Employee Retention Credit (ERC) is a refundable tax credit from the CARES Act designed to help businesses retain employees during the pandemic. Eligible companies could claim a credit of up to 70% of qualified wages.

The value is significant, with businesses able to claim up to $26,000 per employee for wages paid across 2020 and 2021.

However, the IRS received approximately 3.6 million claims, creating massive processing delays. While the final deadline to file for 2021 claims was April 15, 2025, many businesses now face a long wait for their refund. The application process itself, involving complex calculations and extensive documentation on Form 941-X, proved challenging for many.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer the ERC process and funded over $500 million in claims, providing vital capital while they await their IRS refunds. In this guide, I’ll walk you through the application process so you can understand the claim your business filed and what to expect next.

Understanding ERC Eligibility: Who Can Claim the Credit?

Before you even think about how to apply for the ERC, the first and most crucial step is to determine if your business is actually eligible. This isn’t a “everyone gets a prize” situation; the ERC has specific criteria that must be met. Eligibility is based on your business’s experience during 2020 and 2021, specifically how you were affected by the COVID-19 pandemic.

Generally, to qualify, your business must have experienced one of two primary conditions:

- A full or partial suspension of operations due to a government order limiting commerce, travel, or group meetings due to COVID-19.

- A significant decline in gross receipts during a calendar quarter. The definition of “significant” changed between 2020 and 2021.

There’s also a special provision for “recovery startup businesses” for certain quarters in 2021. These rules are complex and have seen significant modifications since the ERC’s inception. Businesses that received Paycheck Protection Program (PPP) loans can also claim the ERC, but you cannot claim the credit on wages that were paid with forgiven PPP loan funds.

To help you get a clearer picture, here’s a table summarizing the key ERC rules for 2020 and 2021:

| Feature | 2020 ERC Rules | 2021 ERC Rules (Q1-Q3) |

|---|---|---|

| Credit Rate | 50% of qualified wages | 70% of qualified wages |

| Maximum Credit | $5,000 per employee per year | $7,000 per employee per quarter |

| Qualified Wages Cap | $10,000 per employee per year | $10,000 per employee per quarter |

| Gross Receipts Decline | 50% decline in gross receipts compared to the same calendar quarter in 2019 | 20% decline in gross receipts compared to the same calendar quarter in 2019 (or prior quarter in 2021) |

| Employee Count Threshold | 100 full-time employees (for defining qualified wages) | 500 full-time employees (for defining qualified wages) |

| PPP Loan Impact | Cannot claim ERC on wages covered by forgiven PPP loans | Cannot claim ERC on wages covered by forgiven PPP loans |

| Recovery Startup | Not applicable | Special rules for Q3 and Q4 2021 |

Determining if Your Business Qualifies

Let’s dive a little deeper into those eligibility tests.

- Full or Partial Suspension Test: A full suspension (a mandated closure) is straightforward. A partial suspension is more nuanced, requiring a government order that had more than a nominal impact on your operations (a >10% reduction in your ability to provide goods/services). This could include capacity limits, supply chain disruptions from government orders, or closure of certain business lines. This test is often overlooked but can be a powerful way to qualify.

- Gross Receipts Test: This is a numbers game. For 2020, a business qualified for a quarter if its gross receipts were less than 50% of the same quarter in 2019. For 2021, the threshold was lowered to an 80% level (a 20% decline) compared to the same quarter in 2019. For 2021, you could also elect to use the prior quarter’s gross receipts to establish eligibility for the current quarter.

- Special Rules for Recovery Startup Businesses: If your business started after February 15, 2020, and had average annual gross receipts under $1 million, it could qualify as a recovery startup for Q3 and Q4 2021. This status removed the need to meet the other eligibility tests for those quarters. For more details, check out What is ERC Funding?.

- Interaction with PPP Loans: As mentioned, you can’t use the same wages for both PPP loan forgiveness and the ERC. This requires careful tracking to ensure there is no overlap between the wages claimed for each program.

How Employee Count Affects Qualified Wages

Your business size, based on your 2019 average full-time employee count, determines which wages qualify.

- For 2020: If you had 100 or fewer full-time employees, all wages paid to all employees during a qualifying period could be considered qualified wages.

- For 2021: The threshold increased to 500 or fewer full-time employees, with the same rule applying: all wages paid to all employees could qualify.

- For Larger Employers (Over the Threshold): If your business exceeded these thresholds, qualified wages were limited to those paid to employees for not providing services. You could only claim the credit for employees you kept on payroll but who were not working.

The IRS adjusted these rules to better target the credit. As of January 2021, rules changed, expanding the program. Understanding these nuances is key to an accurate claim.

How to Apply for the ERC: A Step-by-Step Guide

Once eligibility was confirmed, the process of how to apply for the ERC involved meticulous calculations, documentation, and filing amended tax returns. The core of the application was amending quarterly payroll tax returns, typically using IRS Form 941-X. This required a deep understanding of qualified wages and proper documentation to support the claim. For a comprehensive overview, refer to our Employee Retention Credit Specialist Guide.

Step 1: Calculate Your Potential Credit Amount

Calculating the ERC is a detailed process that depends on the specific year and quarter.

- Qualified Wages: The credit is based on “qualified wages,” which include cash wages and certain employer-paid health plan expenses, up to a maximum of $10,000 in wages per employee.

- Credit Percentage:

- For 2020: The credit was 50% of qualified wages, for a maximum of $5,000 per employee for the year.

- For 2021: The credit increased to 70% of qualified wages per quarter, for a maximum of $7,000 per employee per quarter (primarily for Q1-Q3).

- Excluding PPP-Covered Wages: Wages used for PPP loan forgiveness cannot be counted as qualified wages for the ERC. This requires careful reconciliation to avoid double-dipping.

- Health Plan Expenses: The employer-paid portion of health plan expenses can be included as part of qualified wages, which is especially useful if an employee’s cash wages are below the $10,000 cap.

Accurately calculating this amount is crucial for maximizing your refund and is a key part of leveraging these funds, as discussed in 5 Ways to Use ERC Funds to Strengthen Your Business.

Step 2: Gather the Necessary Documentation

The IRS requires extensive documentation to substantiate an ERC claim. Having these documents organized before filing was essential.

Here’s a list of the documents needed to support an ERC claim:

- 941 payroll tax forms for each quarter of 2020 and 2021.

- Profit and Loss (P&L) statements for 2019, 2020, and 2021 to prove a decline in gross receipts.

- Payroll summary reports for 2020 and 2021 to detail wages paid per employee.

- Monthly healthcare statements if including these costs in qualified wages.

- All Payroll Protection Program (PPP) documents, including loan and forgiveness applications.

- Documentation of government orders (state, local, or federal) if qualifying under the suspension test.

Step 3: How to Apply for the ERC by Amending Tax Returns

The official method for retroactively claiming the ERC is by filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

Here’s how this crucial step worked:

- Complete a Separate Form 941-X for Each Qualifying Quarter: You must file a unique form for each quarter being amended, specifying the quarter and year.

- Follow the Official IRS Instructions: The 941-X instructions provide line-by-line guidance and are essential for accurate completion.

- Key Sections on Form 941-X: The form requires you to report your original figures, the corrected amounts, and the difference. Part 4 requires a detailed written explanation of how you determined your eligibility and calculated the credit.

- Sign and Mail: The form must be signed by an authorized individual and mailed to the appropriate IRS Submission Processing Center. Using the official Form 941x mailing instructions and sending via certified mail is highly recommended.

This process for a retroactive ERC refund by Form 941-X is your official request to the IRS for the credit your business is owed.

Navigating the Post-Application Landscape

You’ve done the hard work: determined eligibility, calculated your credit, gathered documents, and filed your Form 941-X. Now comes the waiting game, which, frankly, can be the most frustrating part. The IRS has been overwhelmed with ERC claims, leading to significant delays and new procedures.

The IRS received approximately 3.6 million claims, and this massive volume, coupled with concerns about fraud, led to a processing moratorium and significant slowdowns. Claims that once had a 90-day processing goal now often take 180 days or much longer, especially if they face further review. This “waiting game” is a real challenge, and we dive deeper into it in The Waiting Game: Understanding and Overcoming ERC Refund Delays.

Understanding Deadlines and Refund Timelines

Understanding the reality of the timelines is crucial for managing expectations.

- Filing Deadlines: The statutory deadlines to file amended returns for the ERC have passed. The deadline for claims related to 2020 wages was April 15, 2024, and the final deadline for 2021 wages was April 15, 2025. Businesses that filed claims are now in the post-application phase, waiting for the IRS to process the claim and being prepared to respond to any inquiries.

- Current IRS Processing Times: The IRS continues to face a significant backlog. It is not uncommon for businesses to wait 8-12 months or even longer to receive an ERC refund. This extended timeline can create major cash flow challenges.

For businesses in Austin and Travis County facing these delays, solutions exist. Waiting months for a substantial refund can be detrimental. This is why we developed solutions like an ERC Refund Advance to help businesses access their funds sooner. For more strategies, see Expediting Your ERC Refund: What You Need to Know.

What to Do If Your Claim is Delayed, Disallowed, or Incorrect

What if your claim gets stuck, is rejected, or you realize you made a mistake? You have options.

- Withdrawing an Incorrect Claim: If you submitted a claim and later realized it was inaccurate, the IRS offers a special withdrawal process for unpaid claims. This is a valuable opportunity to avoid future audits, repayment, interest, and penalties. If accepted, the claim is treated as if it were never filed.

- Responding to a Disallowance Notice: If the IRS disallows your claim (e.g., with Letter 105-C), you generally have 30 days to appeal. If you believe your claim is valid, it’s crucial to respond promptly with supporting arguments and documentation.

- Amending Income Tax Returns: A common issue arises if you reduced your wage expense deduction on your income tax return in anticipation of an ERC refund that was later disallowed. You may be able to amend your income tax return (e.g., Form 1120-X or 1040-X) to reclaim that wage expense deduction. This is a complex area where professional guidance is highly recommended.

- Potential Penalties for Improper Claims: The IRS is serious about compliance. An incorrect claim may need to be repaid with interest and penalties, highlighting the importance of accuracy from the start.

For businesses needing immediate liquidity while navigating these challenges, ERC Bridge Loans can provide a lifeline, offering funds against your pending ERC refund.

Avoiding Pitfalls: ERC Scams and Compliance

The ERC program, despite its good intentions, unfortunately attracted many bad actors. The IRS has issued strong warnings about ERC scams and aggressive promoters, often called “ERC mills.” These companies often made unrealistic promises, charged exorbitant fees, and pushed ineligible businesses to claim the credit.

It’s vital for businesses in Austin and Travis County to be aware of the warning signs:

- Unsolicited Ads or Calls: Be wary of unsolicited communications guaranteeing eligibility or a specific refund amount.

- Quick Eligibility Checks: A promoter claiming you’re eligible in minutes without a detailed financial review is a major red flag.

- Large Upfront or Contingency Fees: Fees based on a high percentage of the refund (25% or more) can incentivize promoters to inflate claims, putting you at risk.

- High-Pressure Tactics: Scammers often pressure you to sign documents immediately.

- Claims That Everyone Qualifies: The ERC is not for every business. Any promoter claiming otherwise is misleading you.

- Lack of Professional Oversight: If a firm lacks CPAs or tax attorneys, or refuses to sign the amended returns they prepare, proceed with extreme caution.

The IRS advises that if something sounds too good to be true, it probably is. You can learn the warning signs of ERC scams directly from the IRS. Ensuring compliance is about protecting your business’s financial integrity. For reliable support, our Employee Retention Credit Help services are designed to steer these complexities safely.

Ensuring Your Claim is Safe and Compliant

To protect your business and ensure your ERC claim is legitimate, follow these best practices:

- Work with Reputable Professionals: If you used a third-party provider, ensure they are reputable tax professionals (CPAs or tax attorneys) with a proven track record. A legitimate provider conducts thorough due diligence.

- Understand Your Eligibility: Having a basic understanding of the ERC rules empowers you to spot red flags in the claim that was filed on your behalf.

- Maintain Proper Documentation: Keep all your supporting documents organized and accessible. This is your proof if the IRS audits your claim.

- Trust Official IRS Guidance: Always refer to the official IRS guidance and forms. The IRS website is the only definitive source of information.

The goal is to secure the credit you’re rightfully owed, not to gamble with your business’s financial future.

Conclusion: Secure Your Credit Before It’s Too Late

The Employee Retention Credit represents a significant opportunity for businesses in Austin, Travis County, and across the United States that persevered through the pandemic. It’s a testament to your resilience. However, as we’ve explored, understanding how to apply for the ERC was a journey fraught with complexities and potential pitfalls.

While the filing deadlines have passed (the final one being April 15, 2025, for 2021 claims), the journey is not over for many. Navigating IRS processing delays—which can stretch to 180 days or longer—and handling potential audits are the new challenges. A defensible eligibility position and proper documentation are more critical than ever to avoid the headaches of audits, repayment demands, and penalties.

At SFG Capital, we specialize in making the post-application ERC process as straightforward and secure as possible. We understand the unique challenges faced by local businesses in Travis County and are committed to ensuring you receive the funds you’re entitled to. Beyond expert claim assistance, we offer ERC Advance Funding to bridge the gap between filing and receiving your refund, providing crucial liquidity without the agonizing wait for the IRS.

Don’t let the complexity or the waiting game jeopardize the credit your business has earned. Reach out to us today to discuss your filed claim and learn more about Our Services. Let us help you secure your funds and steer the final steps of the ERC process.