Why Understanding How to Get ERC Matters for Your Business

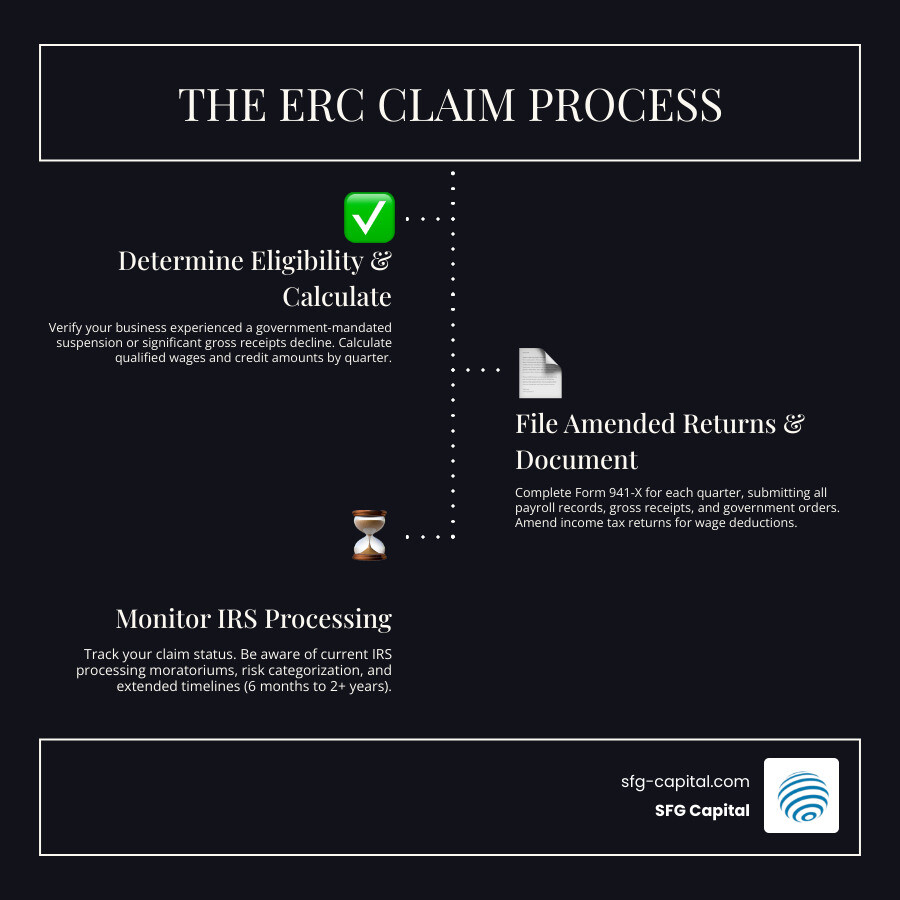

How to get ERC is a critical question for eligible businesses still waiting on their Employee Retention Credit refunds, or for those who filed and are now trying to confirm their claim is supportable. Here is the essential, compliance-first process most employers follow:

- Verify your eligibility – Confirm a government-mandated full or partial suspension of operations, or a significant decline in gross receipts during 2020 or early 2021.

- Gather documentation – Collect payroll records, Form 941 returns, and copies of the government orders (or authoritative local/state mandates) that affected your operations.

- File amended returns – Submit Form 941-X for each applicable quarter, using the correct quarter-specific rules.

- Reduce wage deductions – Coordinate with your tax professional to amend income tax returns (or adjust wage expense deductions) to reflect the ERC, as required.

- Wait for processing – The IRS is working through a large backlog of claims, and timelines can vary widely based on the IRS risk categorization of a claim.

The Employee Retention Credit (ERC) helped businesses keep employees on payroll during the pandemic. Initially worth 50% of qualified wages in 2020, it increased to 70% in 2021. Eligible employers could receive up to $5,000 per employee for 2020 and up to $21,000 per employee for 2021 (for Q1-Q3).

The reality in 2026: ERC is no longer a current-year credit for most employers, so the focus is on handling amended filings, answering IRS questions, and avoiding promoter-driven errors. The IRS imposed a moratorium on claims submitted after September 14, 2023, due to fraud concerns. While processing has partially resumed, claims are categorized by risk, causing significant delays even for legitimate businesses.

If you are a business owner in Austin or Travis County, the biggest practical challenge is rarely the math. It is documenting why your business qualifies (and which wages qualify) in a way that would make sense to an IRS reviewer months or years later. That means keeping a clean audit trail for:

- The eligibility trigger (government order or gross receipts decline)

- The specific quarters you are claiming

- Payroll support showing qualified wages and health plan expenses

- PPP forgiveness and other programs so you do not double count wages

I’m Santino Battaglieri. Through SFG Capital, I’ve helped businesses steer how to get ERC claims funded, purchasing over $500 million in claims while maintaining strict compliance. For businesses with valid claims stuck in processing, advance funding or a buyout can create liquidity without waiting for the IRS to finish its review, provided the underlying claim is well documented.

What is the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC) was a refundable tax credit introduced by the CARES Act in March 2020. It incentivized employers to retain staff during economic hardships. Unlike a loan, this was a direct credit against employment taxes. For more fundamentals, explore our page on What is ERC.

Maximum Credit Amounts

The credit evolved significantly between 2020 and 2021.

For 2020, the credit was 50% of qualified wages, capped at $10,000 per employee for the year, resulting in a maximum of $5,000 per employee.

For 2021, it increased to 70% of qualified wages, with the limit raised to $10,000 per quarter. This allowed for a maximum of $7,000 per employee per quarter, or $21,000 for the first three quarters.

| Feature | 2020 ERC | 2021 ERC (Q1-Q3) |

|---|---|---|

| Credit Percentage | 50% of qualified wages | 70% of qualified wages |

| Max Qualified Wages | $10,000 per employee (year) | $10,000 per employee (quarter) |

| Maximum Credit | $5,000 per employee (year) | $7,000 per employee/quarter ($21,000 max) |

Legislative Changes and Evolution

- Consolidated Appropriations Act of 2021: Extended the credit and allowed PPP recipients to claim ERC (on different wages). See the Consolidated Appropriations Act of 2021.

- American Rescue Plan Act (ARPA): Extended ERC through 2021 and introduced “recovery startup businesses.”

- Infrastructure Investment and Jobs Act (IIJA): Retroactively ended the ERC for most as of September 30, 2021. The Infrastructure Investment and Jobs Act (IIJA) impacted the credit’s timeline significantly.

How to Get ERC: Eligibility and Requirements

Eligibility for businesses in Travis County, TX, and nationwide generally follows two paths for wages paid between March 13, 2020, and September 30, 2021:

- Full or Partial Suspension of Operations: Your business was limited by a government order due to COVID-19 (e.g., capacity limits or dining room closures).

- Significant Decline in Gross Receipts:

- 2020: A decline of >50% in a 2020 quarter compared to the same 2019 quarter.

- 2021: A decline of >20% in a 2021 quarter compared to the same 2019 quarter.

Our ERC Eligibility Checklist provides a detailed breakdown.

Recovery Startup Businesses

Businesses started after February 15, 2020, with average annual gross receipts under $1 million, could claim the credit for Q3 and Q4 of 2021, up to $50,000 per quarter. See the IRS Recovery Startup FAQ.

Interaction with PPP and Other Grants

You can benefit from both ERC and PPP, but you cannot “double-dip” by using the same wages for both. Careful allocation is required to maximize benefits while staying compliant. The IRS FAQ provides guidance on this interaction.

The Step-by-Step Process: How to Get ERC Claims Filed

Claiming the ERC generally involves filing Form 941-X to amend previously filed payroll tax returns for the quarters you are eligible. Because ERC rules change between 2020 and 2021 (and because PPP and other relief programs can affect the wage base), it is important to approach the work quarter-by-quarter and keep a clear support file.

- Identify Quarters: Pinpoint eligible quarters in 2020 and 2021 based on either a suspension of operations or a qualifying gross receipts decline.

- Calculate Wages: Determine qualified wages per employee, taking into account full-time employee thresholds and excluding wages used for PPP forgiveness.

- Compute Credit: Apply the correct rate for the year (50% for 2020; 70% for 2021) and the wage caps that apply to that quarter.

- Complete Form 941-X: File a separate form for each quarter. Make sure the adjustments match the originally filed Form 941 amounts and that the explanation section is complete.

- Submit: Mail the forms to the IRS using the correct address for your location and filing method. Keep proof of mailing and a complete copy of what was sent.

- Adjust Income Tax: Reduce wage deductions on your income tax returns for the year the credit relates to, as required under ERC rules. This step is commonly missed and can create follow-up issues later.

Our ERC Funding Application Guide offers more detail.

Documentation Needed

To withstand IRS scrutiny, keep these records in a single organized file per quarter (digital and/or physical). Strong documentation is also helpful if you want to explore ERC advance funding because it supports the validity and size of the claim:

- Payroll Journals: Detailed wage and hour reports by employee and pay period.

- Health Plan Expenses: Employer-paid health plan costs allocable to qualified wages.

- Form 941s: Original quarterly returns and any prior amendments.

- Form 941-X Workpapers: Your calculations showing how you arrived at the credit amount.

- Gross Receipts: Records for 2019-2021 (monthly or quarterly) that tie to your books and tax filings.

- Government Orders: The specific federal, state, or local orders and the dates they applied to your operations (plus internal notes showing the operational impact).

- PPP Documentation: Forgiveness applications, covered periods, and payroll schedules so the same wages are not used for both programs.

Deadlines for Claiming the Credit

Historically, deadlines were commonly described as April 15, 2024 (for many 2020-related amendments) and April 15, 2025 (for many 2021-related amendments), based on the statute of limitations rules that apply to payroll tax returns.

However, legislation passed in 2025 (H.R. 1) prevents the IRS from processing new claims filed after January 31, 2024. This effectively closed the window for most new applications. If you already filed before that cutoff and are waiting, the practical next steps are to:

- Keep your documentation ready in case the IRS requests support.

- Monitor mail carefully for IRS notices (and respond by the stated deadlines).

- Consider professional guidance if you receive a request for information or a proposed disallowance, because timelines to respond can be short.

If you are unsure whether your claim was filed before the cutoff or whether a quarter was properly amended, do not guess. Confirm dates, track submissions, and make sure your records match what was actually filed.

IRS Processing Status and Avoiding Scams

The IRS implemented a moratorium on new claims after September 14, 2023, to combat fraud. As of late 2024, the IRS is processing claims in risk-based groups (high, low, or unacceptable). Approximately 400,000 claims worth $10 billion are being reviewed.

Be vigilant against scams. Use our IRS Eligibility Checklist and Warning and monitor your ERC Refund Status Check.

Best Practices for How to Get ERC Safely

- Avoid Unsolicited Offers: Red flags include aggressive ads or “guaranteed” eligibility.

- Fee Structures: Be wary of large upfront fees or percentage-based fees. Reputable advisors often use flat or hourly rates.

- Seek Reputable Advisors: Consult experienced professionals or ERC Specialists.

Correcting or Withdrawing Ineligible Claims

If you filed an ineligible claim, you have options:

- Withdrawal Process: If unpaid, you can withdraw the claim to avoid penalties.

- Voluntary Disclosure Program (VDP): Programs like the one open through November 22, 2024, allow businesses to repay credits with penalty relief. See IRS VDP details.

- Appeals: If disallowed (Letter 105-C), you can request an administrative appeal.

ERC for Researchers: The European Research Council Grant

The European Research Council (ERC) Grant is unrelated to the U.S. tax credit. It provides funding for scientific research in Europe.

Grants like the ERC Starting Grant support early-career researchers with up to €1.5 million. Research must be conducted at a European host institution. For more, visit the EU Funding Portal or contact a National Contact Point.

Frequently Asked Questions about ERC

Can I get the ERC if I received a PPP loan?

Yes, but you cannot use the same wages for both. You must ensure distinct sets of qualified wages for each program to avoid “double-dipping.”

What is the current status of IRS ERC processing?

The IRS is processing a backlog of 400,000 claims. While the moratorium has partially lifted for claims filed before January 31, 2024, processing remains slow due to high-risk categorization.

What are the penalties for a fraudulent ERC claim?

Penalties include full repayment, interest, accuracy-related penalties (20%), and fraud penalties (up to 75%). Criminal charges are possible in severe cases.

Conclusion

Understanding how to get ERC is vital for Travis County businesses seeking financial relief. While the window for new claims has largely closed, managing pending claims and ensuring compliance remains essential.

At SFG Capital, we help businesses expedite their refunds through advance funding and buyout options, bypassing IRS delays. Our performance-based structure ensures we only succeed when you do.