Why the ERC Tax Credit Application Mattered for Your Business

The ERC tax credit application was the gateway to one of the most valuable COVID-19 relief programs available to businesses. This refundable payroll tax credit was designed to put thousands or even millions of dollars back into companies’ hands—but only for those who filed correctly.

A Quick Look at the ERC Application Process

- Determine eligibility – Businesses had to meet either the gross receipts decline test (50% for 2020, 20% for 2021) or have had operations suspended by government order.

- Gather documentation – This included Form 941 payroll records, P&L statements, payroll reports, and PPP loan documents.

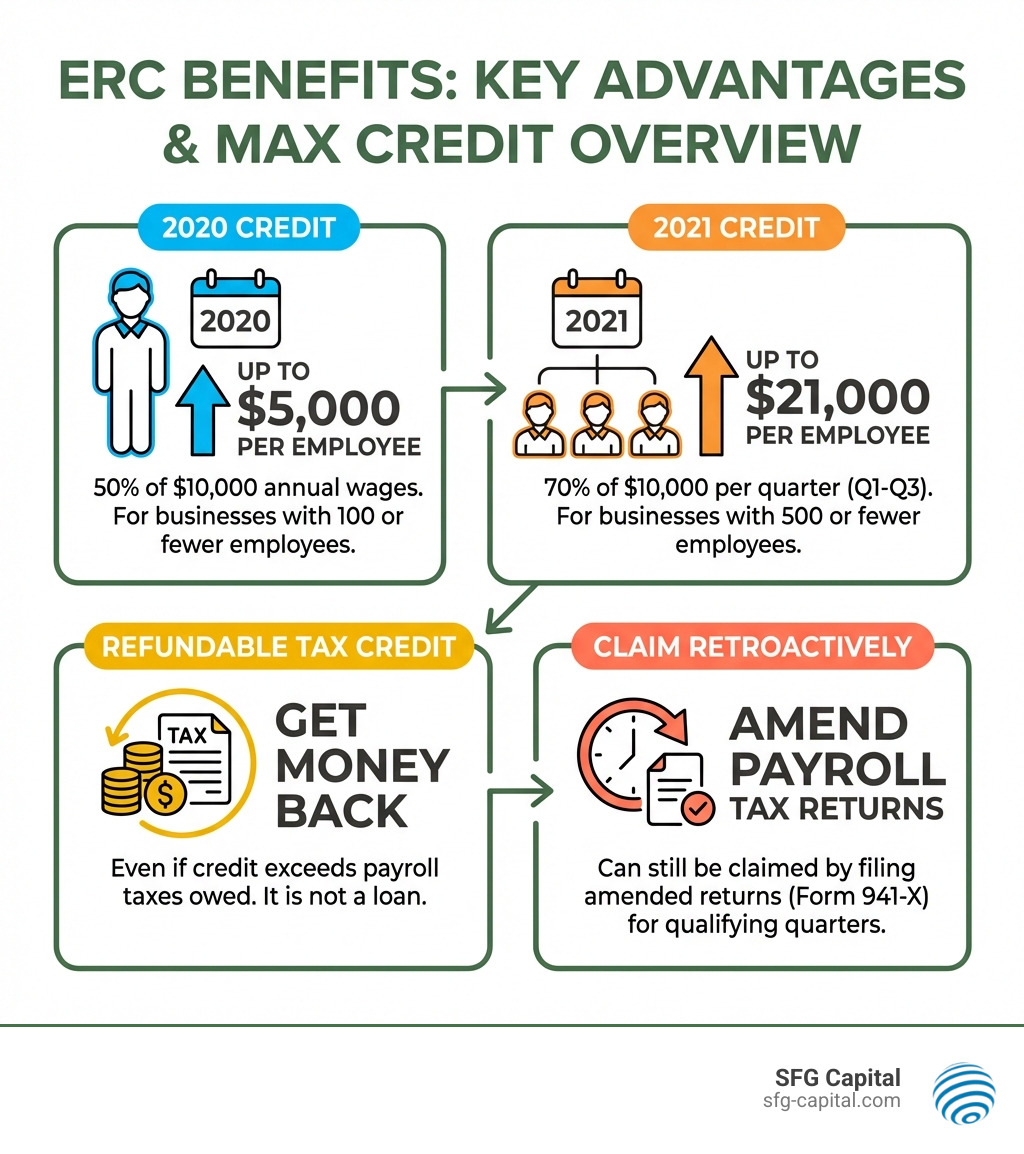

- Calculate the credit – For 2020: 50% of up to $10,000 in wages per employee annually. For 2021: 70% of up to $10,000 in wages per employee per quarter.

- File Form 941-X – Amended employment tax returns were submitted for each qualifying quarter.

- Mail to the IRS – Forms were sent to the designated IRS processing center.

- Wait for processing – Refund timelines often stretched from 6-9 months, sometimes up to a year or more.

The ERC was not a loan—it was a refundable tax credit created under the CARES Act that did not require repayment. Businesses could claim up to $5,000 per employee for 2020 and up to $21,000 per employee for 2021.

The Challenge Now: Scrutiny and Audits

The filing deadlines for the ERC have passed (April 15, 2024, for 2020 claims and April 15, 2025, for 2021 claims). The IRS is now reviewing existing claims with intense scrutiny due to a wave of improper filings. Businesses that filed incorrect claims face audits, penalties, and interest. The long processing backlog also created serious cash flow challenges for businesses that needed working capital.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer over $500 million in ERC claims by focusing on compliance-driven, methodical approaches. My background in financial services has shown me that the difference between a successful claim and an IRS nightmare is proper documentation, conservative eligibility analysis, and professional guidance, which is more critical now than ever.

Essential ERC tax credit application terms:

Were You Eligible? Understanding the ERC Requirements

Before filing an ERC tax credit application, the most critical step was determining if a business was actually eligible. The Employee Retention Credit (ERC) was designed to reward businesses that kept employees on their payroll during the COVID-19 pandemic. As a refundable tax credit, it could result in a refund even if it exceeded the employment taxes owed. This was a crucial distinction, as it was not a loan and didn’t need to be repaid.

To have qualified for the ERC, a business (including tax-exempt organizations, but excluding state and local governments) must have experienced one of two scenarios during the qualifying periods of 2020 and 2021:

- Full or Partial Suspension of Operations: The business was fully or partially shut down due to government orders limiting commerce, travel, or group meetings because of COVID-19. For example, a restaurant in Austin, TX, forced to limit indoor dining capacity by a Travis County health order might have qualified. However, essential businesses or those that could largely maintain operations remotely generally did not meet this qualification.

- Significant Decline in Gross Receipts: The business experienced a substantial drop in revenue compared to a prior period. The specifics of this test varied between 2020 and 2021.

Eligibility was complex and often nuanced. Reviewing our The ERC Eligibility Checklist: Don’t Miss Out! remains a valuable exercise for confirming the legitimacy of a past claim.

2020 Eligibility Rules

For wages paid between March 13, 2020, and December 31, 2020, a business could qualify if:

- Gross Receipts Test: Its gross receipts for any calendar quarter in 2020 were less than 50% of its gross receipts for the same quarter in 2019. Qualification continued until gross receipts for a quarter exceeded 80% of the same 2019 quarter.

- Government Suspension Test: Its operations were fully or partially suspended due to a government order related to COVID-19, impacting operations by more than 10%.

- Employee Count: It had 100 or fewer full-time employees (based on 2019 averages). If it had more than 100 employees, it could only claim wages for employees not providing services.

- Credit Rate: The credit was 50% of qualified wages, up to $10,000 in wages per employee for the year, for a maximum credit of $5,000 per employee.

2021 Eligibility Rules

For wages paid between January 1, 2021, and September 30, 2021, the rules were more generous:

- Gross Receipts Test: Its gross receipts for a quarter in 2021 were less than 80% (a 20% decline) of the same quarter in 2019. An alternative allowed comparing the immediately preceding quarter to the corresponding 2019 quarter.

- Government Suspension Test: Similar to 2020, its operations were fully or partially suspended due to a government order.

- Employee Count: It had 500 or fewer full-time employees (based on 2019 averages), allowing wages of all employees to be considered.

- Credit Rate: The credit increased to 70% of qualified wages, up to $10,000 in wages per employee per quarter. This meant a potential claim of up to $7,000 per employee per quarter, totaling up to $21,000 per employee for 2021.

| Feature / Year | 2020 (March 13 – Dec 31) | 2021 (Jan 1 – Sept 30) |

|---|---|---|

| Eligibility Criteria | 50% decline in gross receipts (vs. 2019) OR full/partial government-mandated suspension | 20% decline in gross receipts (vs. 2019) OR full/partial government-mandated suspension |

| Employee Threshold | 100 or fewer full-time employees (FTEs) in 2019 | 500 or fewer FTEs in 2019 |

| Credit Percentage | 50% of qualified wages | 70% of qualified wages |

| Wage Limit (per employee) | $10,000 annual | $10,000 quarterly |

| Maximum Credit (per employee) | $5,000 | $21,000 (for Q1-Q3) |

How ERC Differed from PPP

It was common to confuse the ERC with the Paycheck Protection Program (PPP). They were fundamentally different:

- ERC is a Tax Credit, Not a Loan: Unlike PPP, the ERC was not a loan and did not need to be repaid or forgiven.

- Can Claim Both, But No Double-Dipping: Businesses could participate in both programs. However, the same wages could not be used to qualify for both PPP loan forgiveness and the ERC. Preventing this overlap was critical for avoiding future IRS scrutiny.

A Look Back: The Step-by-Step ERC Application Process

After confirming eligibility, the next phase was the ERC tax credit application itself. This involved amending previously filed payroll tax returns, primarily using IRS Form 941-X. While the process could seem daunting, understanding the steps that should have been taken is crucial for any business now reviewing its claim for accuracy.

We’ve detailed this process in our ERC Funding Application: A Step-by-Step Guide to Claiming Your Credit, but let’s break down the core steps that were involved.

Step 1: Gathering Documentation

The IRS requires extensive documentation. Meticulous record-keeping was essential not only for streamlining the application but also for providing a robust defense in case of an audit.

Here is a list of essential documents that were needed for each claimed quarter:

- IRS Form 941 Payroll Tax Forms: The quarterly federal tax returns for 2020 and 2021 served as the foundation for the amended return.

- Profit and Loss (P&L) Statements: P&Ls for 2019, 2020, and 2021 were crucial for demonstrating the required decline in gross receipts.

- Payroll Summary Reports: These reports provided a detailed breakdown of wages paid to each employee.

- Monthly Healthcare Statements: Employer-paid healthcare costs could be included in qualified wages.

- Payroll Protection Program (PPP) Documents: All PPP loan documentation was needed to ensure wages used for PPP forgiveness were not also claimed for the ERC, preventing “double-dipping.”

- Government Orders: For claims based on a suspension of operations, copies of the specific government orders were required.

Step 2: How the ERC Was Calculated

Calculating the ERC involved careful aggregation of qualified wages and application of the correct credit percentages.

- Tally Qualified Wages: For each eligible quarter, the total qualified wages were identified. This included cash payments and the employer-paid portion of health plan expenses. Wages paid to majority business owners and their relatives generally did not qualify.

- Subtract PPP Wages: Any wages used for PPP loan forgiveness had to be subtracted from the total qualified wages for the ERC calculation.

Apply the Credit Rate:

- For 2020 Quarters: Qualified wages (up to $10,000 per employee for the year) were multiplied by 50%.

- For 2021 Quarters: Qualified wages (up to $10,000 per employee per quarter) were multiplied by 70%.

For example, an eligible employee in Austin, TX, who earned $10,000 in qualified wages in Q1 2021 (not used for PPP) could generate a $7,000 credit for that quarter ($10,000 * 0.70).

Step 3: Completing the Application with Form 941-X

The official ERC tax credit application was made by amending prior quarterly tax returns using IRS Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

Here’s how it was approached:

- One Form Per Quarter: A separate Form 941-X was required for each quarter being amended.

- Follow Instructions Carefully: Following the official IRS 941 X instructions was paramount. The form required entering original and corrected amounts for qualified wages and the ERC.

- Provide Detailed Explanations: The IRS required a detailed description of how corrections were determined. This section was vital for explaining eligibility (e.g., gross receipts decline, government order) and the credit calculation.

- Sign and Mail: After signing the form, it was mailed to the appropriate IRS Submission Processing Center, typically in Ogden, Utah, or Cincinnati, Ohio, per the 941x mailing instructions.

Given the complexities and heightened IRS scrutiny, attempting this process without expert assistance was risky. Miscalculations or errors could lead to delays, audits, penalties, or loss of eligible credits.

Navigating the Post-Application Landscape

After submitting the ERC tax credit application, the waiting period began. This stage tested the patience of many business owners, as the IRS struggled with a significant backlog of ERC claims, leading to extended refund timelines.

What to Expect After Filing

- IRS Processing Centers: Applications joined millions of others at IRS submission processing centers, where sheer volume contributed to delays.

- Claim Review: Due to concerns about improper claims, the IRS began closely reviewing tax returns claiming the credit. This added scrutiny, while a normal part of the process, increased wait times.

- Potential for IRS Inquiries: It was not uncommon for the IRS to send letters requesting additional information. Responding promptly and accurately was crucial to keep an application moving.

- No Real-Time Tracking: Unlike individual income tax refunds, there was no real-time tracking system for ERC refunds, which made the waiting period feel even longer.

Staying Informed While You Wait

Managing the frustrating wait involved several key strategies:

- Timeline Expectations: The wait time for an ERC refund was typically six to nine months, though some businesses reported waiting a year or even longer. Setting realistic expectations was important for financial planning.

- Stay Organized: Keeping copies of all submitted Form 941-X, supporting documentation, and any correspondence with the IRS is invaluable if questions arise or follow-up is needed.

- SFG Capital Support: This is where our expertise truly shines. At SFG Capital, we understand that waiting for a substantial refund can impact cash flow. While we cannot control IRS processing speeds, we provide expert claim assistance throughout this period. We help you prepare for potential IRS inquiries, offer guidance, and keep you informed about broader IRS updates. Our goal is to help you steer this landscape with confidence. For more insights, refer to our guide on Expediting Your ERC Refund: What You Need to Know.

The Risks of Getting It Wrong: ERC Scams and IRS Scrutiny

The Employee Retention Credit was a lifeline for many, but its popularity also attracted unscrupulous actors, leading to a wave of incorrect claims. The IRS took significant steps, including a moratorium on processing new claims in late 2023, to address these “integrity concerns.” This means every ERC tax credit application is now under a microscope, making accuracy and legitimacy more critical than ever.

The risks of an incorrect claim are substantial. Businesses may face:

- Audits: The IRS is actively auditing returns that claim the credit, a time-consuming and stressful process.

- Penalties and Interest: If an audit reveals an incorrect claim, the business may be required to repay the credit with significant penalties and interest.

- “ERC Mills”: These aggressive promoters often promised large refunds without proper due diligence, charging exorbitant fees and leaving businesses vulnerable to IRS action.

We provide Employee Retention Credit Help to ensure our clients avoid these pitfalls.

Warning Signs of an ERC Scam

To protect your business from predatory practices, be vigilant for these warning signs:

- Unsolicited Calls or Ads: Be wary of unsolicited calls, texts, or ads from unfamiliar parties promising easy money from the ERC.

- Promises of Guaranteed Eligibility: No legitimate professional can guarantee eligibility without a thorough review. The claim that “every business qualifies” is a major red flag.

- Large Upfront Fees: Some promoters charged substantial upfront fees before even assessing eligibility.

- Pressure to Sign: Be cautious of anyone pressuring you to sign documents quickly.

- Fees Based on a Percentage of the Refund: While common, be wary if the percentage is excessively high or tied to an inflated, unsubstantiated refund amount.

- Lack of Detailed Explanation: If a promoter can’t clearly explain how your business qualifies, walk away.

Always consult Official IRS guidance on ERC to verify any advice you receive.

What to Do If You Filed an Incorrect ERC tax credit application

The IRS understands that mistakes happened and offers programs to help businesses rectify incorrect claims. It is always better to address an issue proactively.

- ERC Claim Withdrawal Program: If you submitted an ERC tax credit application that you now believe was incorrect and the IRS has not yet paid it, you may be able to withdraw the claim. This allows you to avoid future audits, repayment demands, penalties, and interest.

- Amending an Incorrect Claim: If you’ve already received and cashed an incorrect refund, you may need to amend your tax returns again to repay the ineligible funds. This complex process should be handled by a reputable tax professional.

- Voluntary Disclosure Program (Closed): The ERC Voluntary Disclosure Program was a specific initiative for employers who had received an ERC refund they were not eligible for. This program closed on March 22, 2024. If you missed this deadline, the Claim Withdrawal Program or amending your return with professional guidance are your primary options.

The IRS urges taxpayers to review their claims and resolve incorrect ones. Seeking assistance from a trusted tax professional is the best way to steer these situations.

Frequently Asked Questions about the ERC

With the filing deadlines passed, many questions about the ERC tax credit application process have shifted. Here are some of the most common ones we encounter today.

What were the deadlines for claiming the ERC?

The deadlines to file an amended return were based on the statute of limitations, which is typically three years from the date the original payroll tax return was filed.

- For 2020 Claims: The deadline was April 15, 2024.

- For 2021 Claims: The deadline was April 15, 2025.

As these dates have passed, it is no longer possible to submit a new claim for the Employee Retention Credit. The focus for businesses now shifts to compliance and audit defense for claims that were already filed.

Is it too late to apply for the ERC?

Yes, the deadlines for filing an ERC tax credit application for both 2020 and 2021 have passed. The IRS is no longer accepting new claims.

While you can no longer apply, the ERC is far from over for many businesses. The IRS has significantly increased its scrutiny and audit activity surrounding these claims. If you have already filed, your primary concern should now be ensuring your claim is accurate, well-documented, and ready to withstand a potential IRS review. Maintaining organized records is more critical than ever.

Where can I find trusted assistance with an existing ERC claim or audit?

Given the complexity of the ERC rules and the intense IRS scrutiny, seeking trusted professional assistance for an existing claim is a wise decision, especially if you are facing an audit.

Look for:

- Reputable Tax Professionals: CPAs, tax attorneys, and specialized tax credit consultants with deep experience in ERC regulations and IRS audit procedures.

- Proven Experience: Choose professionals with a track record of successfully defending ERC claims.

- Transparency: A trustworthy expert will be transparent about their fees and the audit defense process.

- Compliance-First Approach: The best assistance prioritizes accuracy and compliance to protect your business.

Our team at SFG Capital embodies these qualities. We specialize in the ERC and are dedicated to guiding businesses in Travis County through the post-filing landscape. We help you organize documentation, prepare for inquiries, and defend your claim with a focus on compliance and accuracy. Our Employee Retention Credit Specialist Guide offers further insights into what to look for in a trusted partner.

Conclusion

The Employee Retention Credit was a powerful opportunity for businesses in Travis County to recover from the financial impacts of the pandemic. While the ERC tax credit application window has closed, the journey is not over for the thousands of businesses that filed a claim.

The landscape has now shifted from application to compliance. The IRS is keeping a close eye on past claims, making due diligence and accuracy more important than ever. For businesses that filed, the focus must be on audit readiness and defending the legitimacy of their claim.

The key takeaways for businesses today are clear:

- Documentation is Your Defense: Thoroughly organized eligibility proof, calculations, and supporting documents are your best defense in an audit.

- Proactive Correction is Wise: If you suspect your claim was incorrect, addressing it proactively is better than waiting for the IRS to find it.

- Expert Guidance is Invaluable: Navigating an IRS audit or correcting a past filing requires specialized expertise.

At SFG Capital, we believe that businesses that worked hard to retain employees deserve the credits they were rightfully entitled to. We are here to provide the expert guidance and support you need in this new, post-filing phase. With our compliance-driven approach and dedication to businesses in Austin, TX, we help you steer the complexities of an audit, ensuring your claim is robustly and accurately defended.

Don’t let the threat of an audit create uncertainty. Let us help you confidently secure the capital you’ve earned, protecting your business for the future.

Ready to ensure your ERC claim is audit-proof? Learn more about Funding Growth: How ERC Can Power Your Business Forward.