What is the Employee Retention Credit and How Can You Access It?

Employee Retention Credit help is available for businesses that kept employees on payroll during the COVID-19 pandemic. This refundable tax credit—not a loan—can put thousands of dollars per employee back into your business, but the complex qualification rules and IRS processing delays have left many eligible employers frustrated and empty-handed.

Quick Answer: What You Need to Know About the Employee Retention Credit

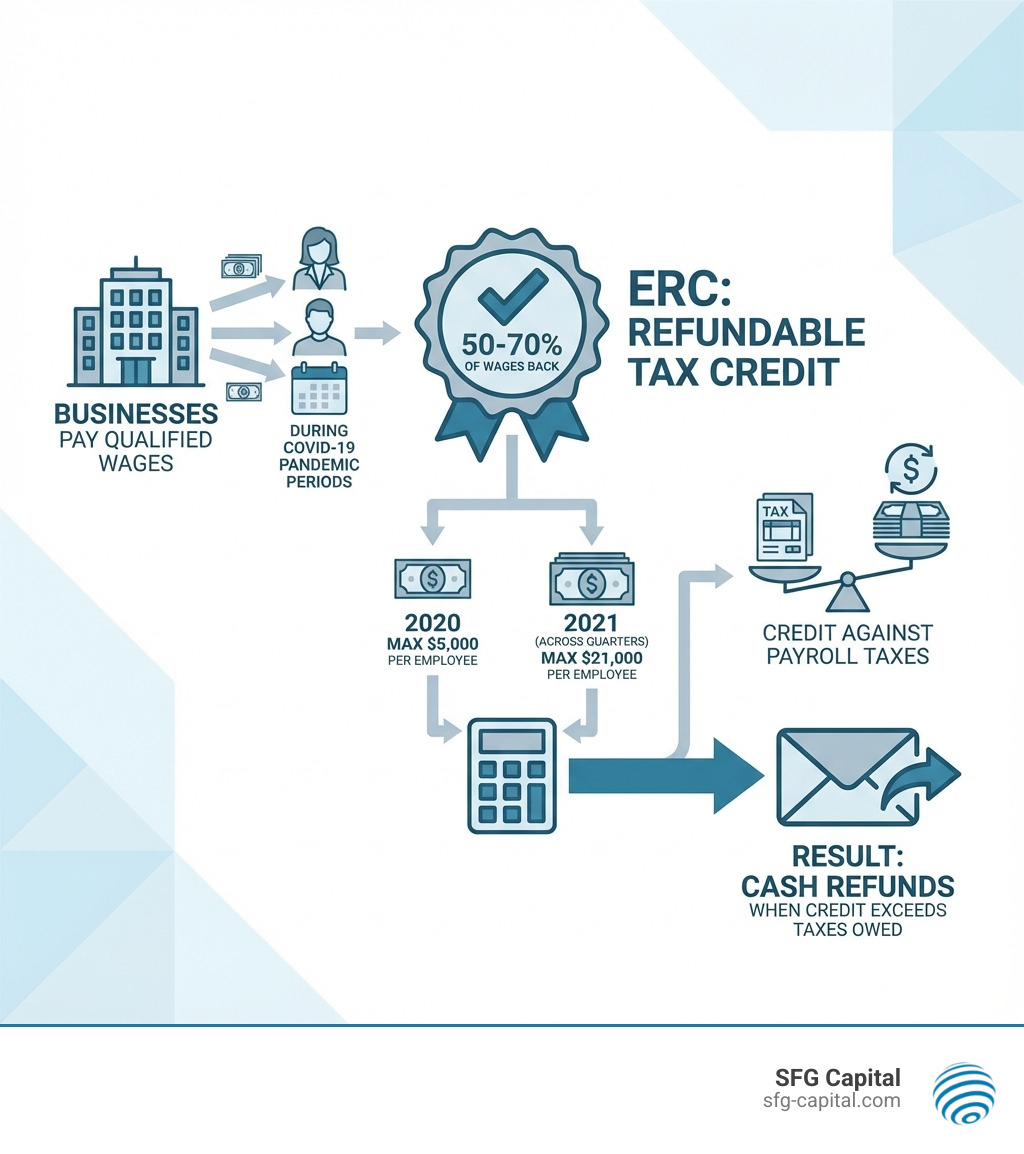

- What it is: A refundable payroll tax credit (not a loan) created by the CARES Act

- Who qualifies: Businesses affected by government shutdowns OR significant revenue declines during 2020-2021

- Credit amount: Up to $5,000 per employee (2020) or $7,000 per employee per quarter (2021)

- Deadline: April 15, 2025 for 2021 claims; April 15, 2024 for 2020 claims (passed)

- Current status: Program ended September 30, 2021, but you can still claim retroactively

- Key warning: The IRS has paused processing due to fraudulent claims—proper documentation is critical

The Employee Retention Credit was designed to encourage businesses to keep workers on payroll during the pandemic’s economic disruption. Unlike the Paycheck Protection Program (PPP), the ERC is a refundable tax credit that directly reduces your payroll tax liability. If the credit exceeds your tax liability, you receive the difference as a refund.

Here’s the challenge: while the program can deliver substantial financial relief, the IRS is currently processing approximately 400,000 claims worth about $10 billion amid heightened scrutiny of questionable submissions. Many legitimate businesses face months-long delays, complex eligibility questions, and concerns about aggressive promoters making false promises.

This guide cuts through the confusion. We’ll walk you through the two qualification paths, show you how to calculate your credit, and explain the filing process. More importantly, we’ll help you steer the long-term implications, from avoiding scams to preparing for potential IRS audits that can occur for years after the filing deadline.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer over $500 million in ERC claims with a focus on compliance and documentation integrity. My experience in providing Employee Retention Credit help has shown me that most businesses either leave money on the table or risk future penalties by following bad advice from unqualified promoters.

Are You Eligible? The Two Paths to Qualification

Determining eligibility for the Employee Retention Credit can feel like navigating a maze, but it boils down to two primary paths: a government-mandated suspension of operations or a significant decline in gross receipts. You only need to meet one of these criteria for a given quarter to qualify. Let’s break them down.

Who Can Claim the ERC?

The good news is that the ERC was broadly available to a wide range of employers. Most for-profit businesses and tax-exempt organizations were eligible, provided they met the specific criteria. This includes entities of all sizes, from small local shops in Austin, TX, to larger national operations.

Crucially, the rules evolved. Initially, businesses that received Paycheck Protection Program (PPP) loans were barred from claiming the ERC. However, the Consolidated Appropriations Act of 2021 retroactively changed this, allowing businesses to claim both. The key is that you cannot use the same wages for both PPP loan forgiveness and the ERC. We’ll dive deeper into this later.

A special category, called “startup recovery businesses,” also became eligible for the ERC in the third and fourth quarters of 2021, even if they didn’t meet the other two tests. These are businesses that began operations after February 15, 2020, had average annual gross receipts of $1 million or less, and didn’t qualify under the gross receipts or suspension tests.

Path 1: Government Suspension of Operations

This qualification path hinges on whether your business experienced a full or partial suspension of operations due to a government order related to COVID-19. This isn’t just about feeling the pinch of the pandemic; it requires a direct government mandate.

Examples of such orders include:

- A local government order in Travis County requiring non-essential businesses to close.

- A state order limiting the hours of operation for restaurants or reducing seating capacity.

- A federal order restricting travel or gatherings that directly impacted your business.

The suspension must have had more than a “nominal impact” on your business operations. This means the restricted portion of your business must account for at least 10% of your gross receipts or employee hours in 2019. For instance, if a government order forced you to close your dining room but you could still offer takeout, you might qualify if the dining room revenue was significant enough. However, essential businesses or those that could keep their operations largely intact remotely (think a software company whose employees simply shifted to working from home) generally don’t meet this qualification. The IRS, in Notice 2021-20, clarified that the order must have limited the organization’s ability to provide goods and services by at least 10% compared to the same period in 2019.

Path 2: Significant Decline in Gross Receipts

If your business wasn’t directly impacted by a government shutdown order, you might still qualify if you experienced a significant decline in gross receipts. This test compares your quarterly revenue during the pandemic to your revenue in 2019.

- For 2020 claims: Your gross receipts for a calendar quarter must have been less than 50% of your gross receipts for the same calendar quarter in 2019. Once your gross receipts recovered to more than 80% of the comparable 2019 quarter, your eligibility would end after that quarter.

- For 2021 claims: The bar was lowered. Your gross receipts for a calendar quarter must have been less than 80% (a 20% decline) of your gross receipts for the same calendar quarter in 2019. For 2021, you could also elect to look back to the immediately preceding calendar quarter to determine eligibility. For example, if your Q1 2021 gross receipts were down 20% compared to Q1 2019, you qualify for Q1 2021. If your Q4 2020 receipts were down 20% compared to Q4 2019, you automatically qualify for Q1 2021.

Calculating gross receipts correctly is crucial, as it includes all income from your trade or business, including sales revenue, investment income, and other incidental income, but generally excludes certain items like returns and allowances.

Calculating Your Credit: A Breakdown for 2020 & 2021

Once you’ve established eligibility, the next step is calculating the credit amount. The rules, percentages, and limits changed significantly between 2020 and 2021, reflecting the evolving understanding of the pandemic’s economic impact.

ERC Rules for 2020

The initial version of the ERC, introduced by the CARES Act, applied to wages paid after March 12, 2020, and before January 1, 2021.

- Credit Amount: The credit was equal to 50% of qualified wages paid to each employee.

- Wage Cap: There was an annual limit of $10,000 in qualified wages per employee for the entire year.

- Maximum Credit: This meant a maximum credit of $5,000 per employee for 2020.

A key distinction in 2020 was the employee threshold:

- Small Employers (100 or fewer full-time employees in 2019): Could claim the credit for wages paid to all employees, regardless of whether they were working or not.

- Large Employers (more than 100 full-time employees in 2019): Could only claim the credit for wages paid to employees who were not providing services due to the suspension or decline in gross receipts.

ERC Rules for 2021

The ERC was significantly expanded and improved for 2021 through the Consolidated Appropriations Act of 2021 and the American Rescue Plan Act (ARPA). These changes made the credit much more valuable for businesses.

- Credit Amount: The credit increased to 70% of qualified wages.

- Wage Cap: The $10,000 wage cap became a quarterly limit per employee.

- Maximum Credit: This allowed for a potential credit of up to $7,000 per employee per quarter, meaning up to $21,000 per employee for the first three quarters of 2021 (the period the credit was generally available).

The employee threshold for 2021 also changed:

- Small Employers (500 or fewer full-time employees in 2019): Could claim the credit for wages paid to all employees.

- Large Employers (more than 500 full-time employees in 2019): Could only claim the credit for wages paid to employees who were not providing services.

The Infrastructure Investment and Jobs Act (IIJA) later retroactively ended the ERC for most businesses as of September 30, 2021 (the end of Q3 2021), though “startup recovery businesses” could still claim it for Q4 2021.

What Are Qualified Wages?

Qualified wages generally include cash payments (wages, salaries, and tips) subject to Social Security and Medicare taxes. But there’s a bonus: they also include the employer’s share of qualified health plan expenses. This means the costs of providing medical care to employees, including both the employer and employee portions of the health plan, can be counted towards the credit, provided they are properly allocated.

It’s important to remember the distinction between small and large employers for each year, as this determines whether wages paid to all employees or only non-working employees count toward the credit.

The Nuts and Bolts of Claiming Your ERC

You’ve determined your eligibility and calculated your potential credit – fantastic! Now comes the practical part: actually claiming the money. Since the ERC program has ended, claiming it now involves a retroactive process.

How to Claim the Credit Retroactively

For most businesses, claiming the ERC retroactively means amending previously filed payroll tax returns. The primary form for this is Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

Here’s what that process generally entails:

- Identify Eligible Quarters: Determine which quarters in 2020 and 2021 your business qualifies for the ERC.

- Calculate Credit: Accurately calculate the ERC for each eligible quarter based on qualified wages and health plan expenses.

- Prepare Form 941-X: For each eligible quarter, you will fill out a separate Form 941-X to amend your original Form 941. This form allows you to report the ERC and claim your refund.

- Document Eligibility: This is perhaps the most critical step. You must have robust documentation to support your eligibility (e.g., government orders, gross receipts data, payroll records, health plan costs). Without proper documentation, your claim is vulnerable to IRS scrutiny.

- Amend Income Tax Returns: The ERC is a credit against payroll taxes, but it affects your income tax. When you claim the ERC, you must reduce your wage expense deduction on your federal income tax return for the year the credit was generated. This typically means you’ll need to amend your federal income tax returns (e.g., Form 1120-X for corporations, Form 1040-X for individuals, or Form 1065/1120-S with amended K-1s for partnerships/S-corps) for 2020 and/or 2021 to reflect this reduced wage deduction.

Key Deadlines and Time Periods

The ERC was available for qualified wages paid from March 13, 2020, through September 30, 2021, for most employers. As mentioned, the Infrastructure Investment and Jobs Act (IIJA) retroactively ended the ERC for most businesses as of the end of Q3 2021.

Even though the program ended, you still have time to claim it retroactively:

- Deadline for 2020 claims: April 15, 2024 (this deadline has passed).

- Deadline for 2021 claims: April 15, 2025.

It’s important to act within these deadlines. However, the timeline for the ERC doesn’t end once you file. The American Rescue Plan Act extended the IRS’s audit window for the ERC to five years from the date of filing. This means that a claim filed in 2025 could be audited as late as 2030, making meticulous, long-term record-keeping and an audit-proof claim absolutely essential for your business’s future financial health.

Navigating the Risks: Your Guide to Employee Retention Credit Help and Compliance

While the allure of a significant refundable credit is strong, the path to claiming the ERC is fraught with potential pitfalls that extend for years. The IRS has made it clear that they are scrutinizing claims closely, and businesses need to be vigilant not just when filing, but for the entire five-year audit period that follows.

IRS Processing Pauses and Increased Scrutiny

In response to a “surge of questionable claims” and concerns from tax professionals, the IRS has paused ERC processing. This means that even legitimate claims are experiencing significant delays. The IRS is closely reviewing tax returns that claim the credit, with approximately 400,000 claims worth about $10 billion currently in the processing pipeline.

This increased scrutiny highlights the critical importance of ensuring your claim is 100% accurate and fully supported by documentation. Businesses that rush into claims without proper due diligence risk audits, disallowances, and potentially severe penalties and interest that can surface years after the credit has been received.

Finding Legitimate Employee Retention Credit Help

With the IRS’s heightened focus on improper claims, it’s more important than ever to seek Employee Retention Credit help from reputable professionals. Unfortunately, the ERC landscape has attracted numerous unscrupulous promoters making misleading promises.

Here are some warning signs of ERC scams to watch out for:

- Unsolicited Calls or Emails: Be wary of unexpected communications from unknown parties promising easy ERC money.

- Large Upfront Fees: Legitimate professionals typically charge a reasonable fee for their services, not an exorbitant upfront cost.

- Contingency Fees Based on Refund Amount: While some legitimate firms may charge a percentage, be cautious of those charging excessively high percentages (e.g., 25-30% or more), especially if they push for quick, unsubstantiated claims.

- Promises of Guaranteed Eligibility: No legitimate professional can guarantee your eligibility without a thorough review of your specific financial situation and operations.

- One-Size-Fits-All Approach: Beware of promoters who claim “every business qualifies” or apply a blanket approach without analyzing your unique circumstances.

- Lack of Documentation Emphasis: If a promoter downplays the need for detailed documentation or suggests you don’t need to amend income tax returns, run the other way!

Always consult with a trusted tax professional, like a CPA or tax attorney, who understands the complexities of the ERC and prioritizes compliance.

What to Do if You Filed an Incorrect Claim

If you’ve realized your business might have filed an incorrect or ineligible ERC claim, don’t panic! The IRS has provided mechanisms to correct these errors and potentially avoid future penalties.

The IRS newsroom offers help for businesses: steps for withdrawing an Employee Retention Credit claim.

- Withdrawal Process: If you filed an incorrect claim and haven’t yet received the refund (or if you received a check but haven’t cashed or deposited it), you can use the IRS’s withdrawal process. This treats the adjusted return as if it was never filed, potentially saving you from future penalties and interest.

- Amending a Claim: If you need to reduce the amount of your claim or make other adjustments, but a full withdrawal isn’t appropriate (e.g., you were eligible for some credit but overclaimed), you can file another Form 941-X to amend your previous submission.

- Repaying the Credit: If you’ve already received and spent the refund for an ineligible claim, you will likely need to repay it. The IRS is developing specific guidance for this, but it’s best to consult a tax professional to understand your obligations.

What Happens if Your Claim is Disallowed?

Despite your best efforts, sometimes an ERC claim might be disallowed by the IRS. This typically happens after an audit or review, and you’ll receive an IRS disallowance letter (often Letter 105-C).

- Appeal Process: If you disagree with the disallowance, you generally have the right to an administrative appeal with the IRS Office of Appeals or, in some cases, to pursue legal action.

- Adjusting Wage Expense: A key consideration when an ERC claim is disallowed is how it impacts your income tax returns. As we discussed, claiming the ERC requires reducing your wage expense deduction. If the ERC is disallowed, you effectively didn’t receive the reimbursement you expected for those wages. The IRS, in Notice 2021-49, provided guidance that if your ERC was disallowed, you may increase your wage expense on your income tax return for the year the disallowance becomes final. This means you don’t necessarily need to amend your original income tax return from 2020 or 2021; you can often make the adjustment on a later year’s return. This helps avoid complex amended filings and benefits from expired assessment periods for prior tax years without needing protective claims.

Frequently Asked Questions about the ERC

We often hear similar questions from business owners seeking Employee Retention Credit help. Let’s tackle some of the most common ones.

Can I still claim the ERC if I received a PPP loan?

Yes, absolutely! This is a common point of confusion due to early legislation. The initial CARES Act prohibited businesses from claiming both the PPP loan and the ERC. However, the Consolidated Appropriations Act of 2021 retroactively changed this, allowing businesses to claim both.

The crucial caveat is that you cannot “double-dip.” You cannot use the same wages to qualify for both PPP loan forgiveness and the ERC. A careful wage allocation strategy is required to ensure compliance. This often involves using non-payroll costs or payroll costs beyond those necessary for PPP forgiveness for the ERC, or designating specific wages for each program. Working with a professional to steer this is highly recommended.

Is the Employee Retention Credit a loan that needs to be repaid?

No, and this is a vital distinction! The Employee Retention Credit is not a loan. It is a fully refundable tax credit. This means that if your business correctly claimed the credit, you do not have to repay it, nor do you accrue interest on it. It directly reduces your employment tax liability, and any excess is refunded to you. This is a significant benefit designed to provide direct financial relief, unlike a loan which must be paid back.

Where can I find official IRS resources for the ERC?

When in doubt, always go straight to the source! The IRS provides extensive guidance and resources to help businesses understand the ERC. Here are some key places to look:

- Employee Retention Credit Eligibility Checklist: The IRS offers an interactive Employee Retention Credit Eligibility Checklist that can help you assess your potential eligibility.

- Frequently Asked Questions: The IRS has a comprehensive page of frequently asked questions about the Employee Retention Credit that covers a wide array of topics.

- IRS Notices and Revenue Procedures: For detailed technical guidance, the IRS issues notices and revenue procedures (e.g., Notice 2021-20, Notice 2021-23, Notice 2021-49, Notice 2021-65, and Rev. Proc. 2021-33). These documents provide the intricate rules for different claim periods and scenarios.

Always refer to IRS.gov for the most up-to-date and accurate information.

Conclusion: Secure Your Credit and Your Business’s Future

The Employee Retention Credit offered a lifeline to countless businesses during the COVID-19 pandemic. While the program has ended, the opportunity to claim this significant refundable tax credit retroactively remains a valuable, but complex, undertaking.

We’ve explored the eligibility paths, calculation rules, and the critical steps for claiming your credit. More importantly, we’ve highlighted the long-term risks and the paramount importance of documentation, compliance, and vigilance against scams. The ERC is not just about filing a claim; it’s about being prepared for the five-year audit window that follows.

The final deadline for filing 2021 ERC claims is April 15, 2025. It is crucial to approach this opportunity with caution and precision to secure not only your credit but also your business’s long-term compliance. For businesses in Travis County, Austin, TX, facing IRS processing delays, SFG Capital understands the frustration of waiting for crucial funds. We specialize in providing Employee Retention Credit help by offering advances and buyouts, ensuring you get quick access to your deserved funds with expert, audit-ready claim assistance and a performance-based fee structure.

Take control of your business’s financial future. Whether you believe your business is eligible or you’re struggling with delays, we encourage you to seek reputable assistance to ensure your claim is both maximized and defensible for years to come.

Explore our services to expedite your ERC refund and let us help you open up the capital your business deserves.