Understanding the ERC Funding Application: What You Need to Know

An ERC funding application typically refers to the Employee Retention Credit, a refundable tax credit for US businesses impacted by COVID-19. It is not a loan but a federal stimulus program worth up to $26,000 per W2 employee for businesses that retained staff during the pandemic.

Although the program covered tax years 2020 and 2021, businesses can still file or correct claims on amended payroll tax returns in 2024, 2025, and beyond, as long as they remain within the statute of limitations for each quarter. That makes understanding the rules today just as important as when the credit was first introduced.

Quick Answer: The Employee Retention Credit (ERC)

- What It Is: A refundable tax credit for businesses that kept employees during COVID-19 hardship periods (2020-2021).

- Credit Amount: Up to $26,000 per qualified employee.

- How to Apply Now: File amended employment tax returns (Form 941-X) with the IRS for eligible 2020 and 2021 quarters.

- Key Requirement: The business must have had W2 employees and experienced either a government-ordered suspension, a significant decline in gross receipts, or qualified as a recovery startup.

This guide focuses exclusively on the Employee Retention Credit for US businesses, not to be confused with grants from the European Research Council or university programs that share the “ERC” acronym.

While the credit offers crucial working capital, the application process is complex, and the IRS is facing a significant backlog. Furthermore, with filing deadlines approaching over the next couple of years and a moratorium on processing many new claims, the need for a precise, compliant application has never been greater. Navigating the rules correctly is essential to secure your funds and avoid scams or future IRS scrutiny.

As Santino Battaglieri, founder of SFG Capital, I’ve helped businesses steer over $500 million in ERC claims. My team focuses on compliant ERC funding application processes, working with tax professionals to ensure every claim meets strict IRS guidelines. We also help businesses access their refunds faster than standard processing times, bypassing the long delays.

Handy ERC funding application terms:

What is ERC Funding? Clarifying the Acronym

For US businesses, especially in Travis County, an ERC funding application refers to the Employee Retention Credit. This is a significant financial lifeline created to reward businesses for retaining employees during the COVID-19 pandemic, and it remains highly relevant today because employers can still file amended claims for past quarters.

The Employee Retention Credit (ERC) for US Businesses

The ERC is a fully refundable tax credit established under the CARES Act. Unlike a loan, it’s a direct credit against employment taxes, providing cash flow to help your business reinvest, expand, or stabilize its finances. This legitimate program offers up to $26,000 per W2 employee for employers who retained staff during hardship periods in 2020 and 2021.

Even though those tax years have ended, many eligible businesses have not yet claimed or have underclaimed their ERC. In 2024 and 2025, business owners in Travis County and across the US are still amending prior payroll tax returns to capture these credits before deadlines expire. For small and medium-sized businesses, this credit can be a game-changer. We’ve seen how it has empowered local businesses in Travis County to recover and thrive. You can learn more in our guide on What is ERC Funding?.

Other “ERC Funding”: European Research Council & University Grants

To avoid confusion, it’s important to note other programs use the “ERC” acronym. The European Research Council (ERC) is a major scientific funding body in the EU supporting frontier research through grants. You can Learn about the European Research Council on their official site. Similarly, some universities offer “Entering Research and Creative Work” (ERC) funding for undergraduate students.

These programs are entirely different from the US tax credit. For the rest of this guide, an ERC funding application refers exclusively to the Employee Retention Credit for US businesses. Our expertise is in helping business owners steer this specific credit.

Are You Eligible? Key Requirements for the ERC Funding Application

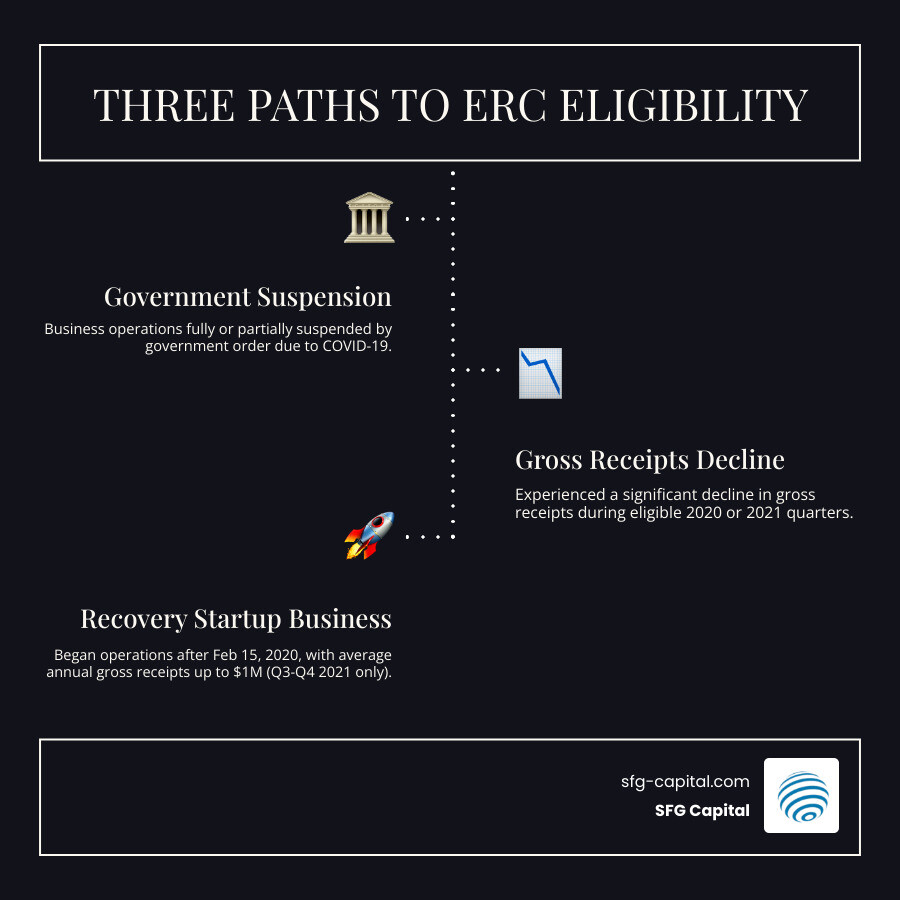

The first step in your ERC funding application is to confirm your business qualifies. Eligibility for the Employee Retention Credit for quarters in 2020 and 2021 is typically met in one of three ways. Even though these are prior-year quarters, you can still use these tests today when preparing or correcting your amended returns.

The Three Paths to ERC Eligibility

Your business may be eligible for a given quarter if it meets one of these criteria:

-

Full or Partial Suspension of Operations: Your business qualifies if its operations were fully or partially suspended due to a government order related to COVID-19. This includes federal, state, or local orders (like those in Austin or Travis County) that limited commerce, travel, or group meetings. The order must have had a more than nominal impact on your business, such as capacity restrictions or supply chain disruptions.

-

Significant Decline in Gross Receipts: This path is based on a drop in revenue compared to 2019.

- For 2020: A quarter qualifies if gross receipts were less than 50% of the same quarter in 2019.

- For 2021: A quarter qualifies if gross receipts were less than 80% of the same quarter in 2019. An alternative election allows you to use the prior quarter’s gross receipts for this test.

-

Recovery Startup Business: This applies to Q3 and Q4 of 2021. A business qualifies if it began after February 15, 2020, had average annual gross receipts under $1 million, and doesn’t qualify under the other two tests.

For a detailed breakdown, see our ERC Credit Complete Guide.

Understanding Qualified Wages and Credit Amounts

Once eligibility is confirmed, you must calculate the credit based on qualified wages.

Qualified Wages: These are wages subject to FICA taxes and qualified health plan expenses. The definition depends on your 2019 employee count:

- Large Employers (over 100 employees for 2020; over 500 for 2021): Qualified wages are only those paid to employees not providing services.

- Small Employers (100 or fewer for 2020; 500 or fewer for 2021): Qualified wages are those paid to all employees during the eligible period.

Credit Calculation:

- 2020: 50% of qualified wages, up to $10,000 in wages per employee for the year (max credit of $5,000/employee).

- 2021: 70% of qualified wages, up to $10,000 in wages per employee per quarter (max credit of $7,000/employee per quarter).

PPP Loan Interaction: You can claim the ERC even if you received a PPP loan. However, you cannot use the same payroll wages for both PPP loan forgiveness and the ERC calculation. Careful allocation is required to maximize both benefits, especially if you are reassessing your claim now. Our Employee Retention Credit Specialist Guide offers more insight.

The Step-by-Step Guide to Your ERC Claim

A successful ERC funding application follows a clear, manageable process. Whether you are filing an ERC claim for the first time or correcting a previously filed claim in 2024 or 2025, the steps remain the same. Here is a step-by-step guide to preparing and submitting your claim.

Step 1: Gather Necessary Documentation

A strong ERC funding application is built on thorough documentation. Gather the following to build a robust case for your claim:

- Form 941s: Employer’s Quarterly Federal Tax Returns for all quarters in 2020 and 2021.

- Payroll Reports: Detailed records for 2020 and 2021 showing gross wages and health plan expenses for each employee.

- PPP Loan Documents: All application and forgiveness records if you received a PPP loan.

- Financial Statements: Gross receipts data for all quarters in 2019, 2020, and 2021 to prove a revenue decline.

- Government Shutdown Orders: Copies of any federal, state, or local orders (e.g., from the City of Austin or Travis County) that impacted your business.

Organizing these documents will significantly streamline the process, especially if you are responding to current IRS questions or audits.

Step 2: Calculate Your Potential Credit

Next, accurately calculate your potential credit. This involves identifying eligible quarters, determining qualified wages for each period, and carefully accounting for any PPP loan wage overlap to remain compliant. This calculation is complex, and errors can lead to a reduced refund or an IRS audit years down the road. Expert assistance is invaluable for ensuring accuracy. At SFG Capital, our team works with qualified tax professionals to perform meticulous, compliant calculations. Learn more about our systematic approach on Our Process page.

Step 3: File Your Claim with the IRS

Once calculations are reviewed, you officially submit your ERC funding application by filing an amended employment tax return.

- Use Form 941-X: For each eligible quarter, you must file Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, to amend your original Form 941.

- Meet Filing Deadlines: The window to claim the ERC is closing on a rolling basis as statutes of limitation expire for 2020 and 2021 quarters. Several deadlines fall in 2024, 2025, and 2026, so it is critical to act quickly to avoid missing out.

- Navigating the IRS Moratorium and Scrutiny: In September 2023, the IRS announced a moratorium on processing many new ERC claims to combat fraud. While you can still file, your claim may not be processed until the moratorium is fully lifted. This makes it even more important that your application is flawless and well-documented to withstand heightened IRS scrutiny when processing resumes.

We ensure your ERC funding application is accurately prepared and submitted, giving you peace of mind. For official updates, always refer to the Official IRS ERC guidance.

Navigating Common Challenges: Scams, Delays, and Corrections

Claiming the Employee Retention Credit involves navigating several challenges, from aggressive scams to significant IRS processing delays. These issues have continued into 2024 and are expected to remain relevant as ERC claims are reviewed and audited over the next few years. Understanding these problems is key to a successful ERC funding application.

Avoiding ERC Scams and Aggressive Promoters

The IRS has issued strong warnings about “ERC mills” that mislead businesses. Be vigilant and watch for these red flags:

- Unsolicited calls or emails promising huge, easy refunds.

- Claims of instant eligibility without reviewing your documents.

- Large upfront fees (reputable firms often use performance-based fees).

- Pressure tactics to sign contracts quickly.

- Blanket statements that “every business qualifies.”

- Lack of involvement from qualified CPAs or tax professionals.

The IRS is cracking down on fraudulent claims, and penalties can be severe. Your ERC funding application must be handled with integrity to protect your business from fines, interest, and even criminal charges. This is especially important now, as the IRS devotes more resources in 2025 and beyond to auditing previously filed ERC claims.

Overcoming Long IRS Processing Times

Even with a compliant ERC funding application, the wait for your refund can be excruciating. The IRS is facing a massive backlog, with processing times often stretching from six months to over a year. For businesses in Travis County that need capital now, this delay is impractical.

SFG Capital solves this problem. We offer ERC advances and buyout solutions that allow you to access a significant portion of your anticipated refund quickly. Instead of waiting on the IRS, you get immediate capital to grow your business. Learn more about overcoming ERC Refund Delays and how to Expedite Your ERC Refund.

What to Do If You Made a Mistake on Your ERC Funding Application

If you realize your ERC funding application contained errors or you may be ineligible, it is crucial to act promptly to avoid future penalties. The IRS has provided options for taxpayers to correct their claims, and these options remain available as the agency continues reviewing ERC filings.

- Claim Withdrawal Process: If your claim has not yet been paid (or you received a check but haven’t cashed it), the IRS has a specific process to withdraw the claim. This can help you avoid penalties and interest if you were misled by a promoter or made an honest mistake.

- Correcting Paid Claims: If you’ve already received a refund but now realize the amount was incorrect, you may need to file another amended Form 941-X to repay the erroneous portion.

- Seek Professional Guidance: Navigating corrections is complex, and the IRS is expected to keep scrutinizing ERC claims through at least 2026. If you suspect an error, seek advice from a reputable tax professional immediately. Our team at SFG Capital can help you review your claim and guide you through the correction process. Contact Us for assistance and peace of mind.

Frequently Asked Questions about the ERC Application

Here are answers to some of the most common questions about the ERC funding application that business owners are still asking today as they file or review claims for past quarters.

Can I claim the ERC if I received a PPP loan?

Yes. While you cannot use the same payroll wages to qualify for both PPP loan forgiveness and the Employee Retention Credit, you can claim both programs. Careful wage allocation is required to legally maximize both benefits, even when preparing amended returns now. We help businesses in Travis County steer this complex interaction to ensure compliance.

How long does it take to receive the ERC refund from the IRS?

Due to a significant backlog and a moratorium on processing many new claims, IRS wait times for ERC refunds can be extensive, often six months to a year or longer. This situation has persisted into 2024 and may continue while the IRS focuses on fraud review and additional scrutiny. This long delay is why many businesses seek alternative funding. Our ERC advances and buyout solutions at SFG Capital bridge this gap, providing you with capital much faster than waiting for the IRS.

Is the ERC grant considered taxable income?

No, the ERC itself is not taxable income. However, it does have tax implications. The amount of the credit you receive reduces your deductible wage expenses on your federal income tax return for that same year. This reduction in deductions will likely increase your business’s taxable income. It is important to consult with your tax advisor to understand the specific impact on your tax liability, especially if you are amending prior-year income tax returns now to align with your ERC claim.

Conclusion: Secure Your ERC Funds and Strengthen Your Business

The ERC funding application process is complex, but the potential refund of up to $26,000 per employee remains a vital lifeline for businesses that retained staff during the pandemic. Even though the covered periods are 2020 and 2021, many companies in 2024 and 2025 are still filing first-time or corrected claims before deadlines expire. Success requires careful navigation of eligibility rules, accurate calculations, and a compliant filing that can withstand IRS scrutiny.

Challenges like ERC scams and the significant IRS processing backlog make professional guidance essential. For businesses in Travis County and across the US, securing these funds is about strengthening your future. You can explore 5 Ways to Use ERC Funds to Strengthen Your Business to see the possibilities.

At SFG Capital, we simplify this journey. We provide expert assistance to ensure your ERC funding application is accurate and compliant, protecting you from future audits. More importantly, our ERC advance and buyout solutions let you bypass the frustrating IRS delays and access your funds now.

You’ve earned this credit based on what your business did in 2020 and 2021. Don’t let complexity, uncertainty, or long wait times stop you from securing it today. Explore Our Services to see how we can help turn your ERC funding application into the working capital your business needs to thrive in the years ahead.