Understanding the ERC Funding Process: What Business Owners Need to Know

The erc funding process can feel like navigating a maze with no clear exit. If you’ve already filed your claim or are considering it, you’re likely wondering: What happens next? When will I see my refund? And why is everything taking so long?

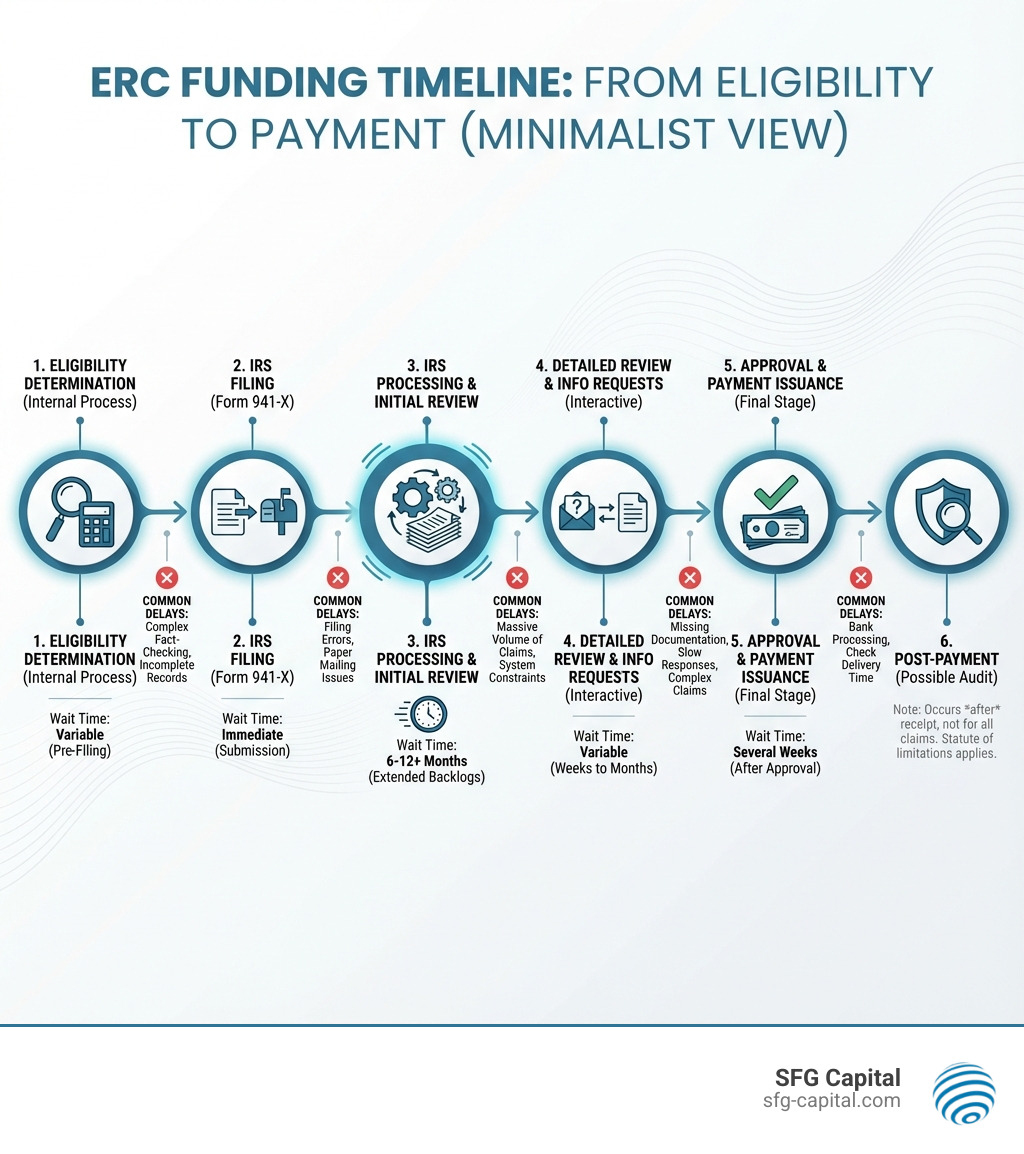

Here’s what to expect after filing your ERC claim:

- IRS receives your amended Form 941-X – Your claim enters the processing queue

- Review period begins – The IRS verifies eligibility and calculations (currently taking 6-12+ months)

- Potential information requests – You may need to provide additional documentation

- Approval and payment – If approved, you receive your refund via check or direct deposit

- Possible audit – Some claims undergo further review even after payment

The reality is stark: the IRS is facing massive backlogs. What was once a 90-day process now stretches well beyond a year for many businesses. Meanwhile, you’re left waiting for funds that could be critical to your operations.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped facilitate over $500 million in ERC transactions, giving me extensive knowledge of every stage of the erc funding process. Having worked with hundreds of businesses navigating these delays, I understand the frustration—and I know the solutions that can help.

First, What Exactly is the Employee Retention Credit (ERC)?

Before we dive deep into what happens after you file, let’s ensure we’re all on the same page about what the Employee Retention Credit (ERC) actually is. Born from the economic turmoil of the COVID-19 pandemic, the ERC was a lifeline for many businesses, including those right here in Travis County. It was designed as a refundable tax credit to encourage employers to keep employees on their payroll during the unprecedented challenges of 2020 and 2021.

Crucially, the ERC is not a loan that needs to be repaid. Think of it as a grant in the form of a tax credit, directly reducing your payroll tax liability. If the credit exceeded your payroll taxes, the difference was refunded to you. This distinction is vital because it means these funds are yours to keep and reinvest in your business, fostering growth and stability in our local economy.

The eligibility criteria for the ERC were established to target businesses genuinely impacted by the pandemic. Generally, employers could qualify if they experienced either:

- A significant decline in gross receipts: This meant a reduction in revenue compared to a prior quarter in 2019. The specific percentage varied between 2020 and 2021.

- A full or partial suspension of operations due to government orders: This applied if a governmental authority, local or federal, limited commerce, travel, or group meetings due to COVID-19, and these limitations impacted your business operations. Many businesses in Austin and surrounding areas faced such orders, from restaurant capacity limits to retail shutdowns.

One common question we encounter is how the ERC interacted with Paycheck Protection Program (PPP) loans. Initially, businesses couldn’t claim both. However, legislation later allowed businesses to claim both, provided the same wages weren’t used for both programs. This change significantly expanded the number of eligible businesses, making it even more important to understand the nuances of the erc funding process.

For a more comprehensive understanding of the ERC’s basics and frequently asked questions, we highly recommend consulting the official IRS guidance: Frequently asked questions about the Employee Retention Credit.

A Step-by-Step Guide to the ERC Funding Process

Once you’ve determined your eligibility and calculated your potential credit, the journey of the erc funding process truly begins. It’s a multi-stage path that requires precision, patience, and often, expert guidance. Let’s walk through it.

Step 1: Gathering Documentation and Determining Eligibility

This is the foundation of a successful ERC claim. Without meticulous record-keeping and accurate calculations, your claim could face delays or even rejection. Our team at SFG Capital understands that for busy business owners in Travis County, diving into years of financial data can feel like a daunting task. However, it’s absolutely critical.

Here’s what you’ll typically need to gather:

- Payroll Records: These are paramount. You’ll need detailed payroll registers, wage reports, and records of any health plan expenses for all relevant quarters in 2020 and 2021. This data allows us to identify and quantify “qualified wages”—the wages eligible for the credit.

- Quarterly Tax Filings (Form 941): These forms, originally filed with the IRS, provide a baseline for your payroll tax liabilities. Your ERC claim will involve amending these.

- Revenue Reports: To prove the “significant decline in gross receipts” eligibility criterion, you’ll need financial statements, P&L statements, or other verifiable revenue reports for the qualifying quarters and their corresponding 2019 comparisons.

- Government Shutdown Orders: If your eligibility hinges on a “full or partial suspension of operations,” you’ll need documentation of the specific governmental orders (federal, state, or local, like those issued by Travis County or the City of Austin) that impacted your business, along with evidence of how those orders affected your operations. This could include reduced hours, capacity limits, or supply chain disruptions.

Calculating your maximum credit can be complex, involving per-employee wage limits, different credit percentages for 2020 versus 2021, and careful aggregation rules for related businesses. It’s not just about adding up wages; it’s about understanding the intricacies of the legislation to ensure you claim every dollar you’re entitled to. This meticulous preparation is what allows us to help businesses like yours open up their full potential. For more on how ERC funds can power your business forward, check out our insights on Funding Growth: How ERC Can Power Your Business Forward.

Step 2: Filing Amended Payroll Tax Returns (Form 941-X)

Once all your documentation is in order and your credit is accurately calculated, the next step in the erc funding process is to formally submit your claim to the IRS. This is done by filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

The purpose of Form 941-X is to correct errors on a previously filed Form 941. In the context of the ERC, it’s used to claim the credit retroactively. You’ll need to file a separate Form 941-X for each quarter you’re claiming the credit. This form requires you to:

- Identify the quarter being amended.

- State the reason for the adjustment (e.g., claiming the ERC).

- Provide the corrected tax liability and credit amounts.

- Explain the changes made.

The importance of accuracy here cannot be overstated. Any discrepancies or errors can lead to significant delays, requests for additional information, or even a full audit. It’s like trying to parallel park a bus in downtown Austin – one wrong move can cause a pile-up. We carefully review each Form 941-X to ensure every detail aligns with IRS requirements, minimizing the risk of issues down the line.

The submission process involves mailing the completed Form 941-X to the IRS. While it sounds simple, ensuring proper mailing addresses and tracking methods are used is part of the detail-oriented approach that keeps the process as smooth as possible. It’s worth noting that there are specific claim deadlines, typically three years from the date you filed your original Form 941 or two years from the date you paid the tax, whichever is later. Missing these deadlines means forfeiting your rightful claim, so acting promptly is crucial.

Step 3: The Waiting Game: Navigating the IRS Review

After diligently preparing and submitting your Form 941-X, you enter what many business owners describe as the most frustrating part of the erc funding process: the waiting game. Due to an unprecedented volume of ERC claims, the IRS is experiencing a massive backlog.

What to expect after submission:

- IRS Backlog: The sheer number of claims has overwhelmed the IRS’s processing capabilities. This isn’t unique to Travis County; it’s a national issue.

- Processing Timelines: While initial estimates suggested a few months, current average wait times for ERC refunds can stretch anywhere from 6 to 12 months, and sometimes even longer. We’ve seen claims take upwards of 18 months to process. It’s enough to make you want to go float the river, just to relax.

- Tracking Your Claim Status: Unfortunately, the IRS doesn’t offer a real-time online tracker for ERC claims. The primary method for checking status is to call the IRS directly, which can involve lengthy wait times. Your best bet is often to rely on professional guidance to interpret any communications from the IRS.

- Potential for Information Requests or Audits: Even after initial processing, the IRS may send letters requesting additional documentation or clarification. This is a critical point where quick and accurate responses are essential. In some cases, a claim might be selected for a full audit, requiring a deeper dive into your records and justification for your ERC eligibility. While audits can be intimidating, if your initial documentation was thorough and accurate, you’ll be well-prepared.

We know that for businesses in Austin and beyond, waiting over a year for significant funds can impact cash flow and growth plans. It’s why we at SFG Capital developed solutions to help bridge this gap, ensuring you don’t have to put your business on hold while the IRS catches up.

Key Considerations for a Smooth Application

Navigating the erc funding process successfully isn’t just about knowing the steps; it’s about understanding the nuances and potential pitfalls. A smooth application is one that anticipates challenges and mitigates risks from the outset.

Avoiding Common Pitfalls in the erc funding process

The ERC, while a fantastic opportunity, came with complex rules that led to many common mistakes. Avoiding these can significantly expedite your refund and prevent future headaches:

- Filing Errors: Simple clerical errors, incorrect quarter dates, or miskeyed information on Form 941-X can send your claim straight to the “needs review” pile, adding months to your wait.

- Miscalculating the Credit: This is perhaps the most frequent pitfall. The credit percentages changed between 2020 and 2021, and there were per-employee wage caps. Incorrect calculations can lead to either under-claiming (leaving money on the table) or over-claiming (triggering an audit and potential penalties).

- Aggregation Rules: For businesses with common ownership or related entities, strict aggregation rules apply. Failing to consider these can invalidate your claim or lead to incorrect credit amounts. This is especially relevant for groups of businesses operating across Travis County.

- Supply Chain Disruptions: While a valid basis for a partial suspension claim, proving eligibility based on supply chain disruptions requires specific documentation showing how government orders impacted your suppliers, and how that impact was more than a nominal effect on your business. Many businesses incorrectly claimed this without sufficient proof.

- Incomplete Documentation: Submitting a claim without all the necessary supporting documents (payroll records, revenue reports, governmental orders) is a surefire way to get an information request from the IRS, pausing your claim indefinitely until you respond.

Our expertise helps businesses sidestep these common issues, ensuring your application is robust and compliant from the start.

The Importance of Accurate Documentation

We cannot stress this enough: accurate documentation is the bedrock of a successful ERC claim. Think of it as your bulletproof vest in case of an IRS audit. When the IRS reviews your claim, they’re looking for clear, verifiable evidence that you meet all eligibility criteria and that your credit calculation is precise.

Here’s why it’s so important:

- Creating a Clear Audit Trail: Every piece of information in your claim should be traceable back to original source documents. This includes payroll records, general ledgers, bank statements, and government orders.

- Substantiating Eligibility: If you claimed eligibility based on a decline in gross receipts, you need clear financial statements. If it was due to a full or partial suspension, you need copies of the specific governmental orders and detailed explanations of how they impacted your operations.

- Proving Qualified Wage Calculations: Your payroll records must clearly show the wages paid during the qualifying periods, distinguishing between qualified and non-qualified wages, and demonstrating adherence to per-employee limits.

- Record-Keeping Best Practices: Even after you receive your refund, you should retain all documentation related to your ERC claim for at least four years. This ensures you’re prepared for any future IRS inquiries or audits.

For businesses in Travis County, keeping meticulous records can be a challenge amidst daily operations. That’s where our structured approach comes in, helping you organize and present your documentation in a way that satisfies IRS requirements and streamlines the erc funding process.

Why Expert Guidance Matters for the erc funding process

While it’s theoretically possible to steer the ERC process on your own, the complexities, potential pitfalls, and sheer volume of paperwork often make expert guidance invaluable. For business owners in Austin and throughout Travis County, partnering with specialists can be the difference between a successful, timely refund and a frustrating, drawn-out ordeal.

Here’s why our expert guidance at SFG Capital makes a significant difference:

- Navigating Complex Rules: The ERC legislation evolved over time, with different rules for 2020 and 2021, and intricate interactions with other relief programs like PPP. We stay current with all IRS guidance, ensuring your claim adheres to the latest regulations. This means no missed opportunities, and no unexpected issues.

- Maximizing Your Claim: Our deep understanding of the rules allows us to identify every eligible dollar, ensuring you receive the maximum credit you’re entitled to. This often involves uncovering nuances that general tax preparers might overlook.

- Ensuring Compliance: We help you build an audit-proof claim, complete with robust documentation and clear justifications. This reduces the risk of future IRS inquiries or penalties, giving you peace of mind.

- Saving Time and Resources: Your time is valuable. Outsourcing the complex and time-consuming task of ERC preparation frees you up to focus on what you do best: running and growing your business. We handle the heavy lifting, from documentation review to claim submission.

We pride ourselves on providing comprehensive support throughout the entire erc funding process. To learn more about how our custom services can benefit your business, please visit More info about our services.

Frequently Asked Questions about the ERC Process

We’ve heard countless questions from business owners in Travis County and beyond regarding the erc funding process. Here, we address some of the most common inquiries to provide clarity and empower you with knowledge.

Can I still apply for the ERC?

Yes, for now, you can still apply for the ERC, but the window of opportunity is rapidly closing. The IRS has established specific deadlines for amending payroll tax returns to claim the credit:

- For 2020 claims: The deadline to amend Form 941 for all quarters in 2020 was generally April 15, 2024.

- For 2021 claims: The deadline to amend Form 941 for all quarters in 2021 is generally April 15, 2025.

These dates represent the “lookback period” during which you can retroactively claim the credit. It’s crucial to understand that these deadlines are firm. If you miss them, you forfeit your right to claim the credit for those periods.

Therefore, if you believe your business in Travis County is eligible for the 2021 ERC, acting quickly is paramount. Don’t delay in assessing your eligibility and initiating the application process. Each day that passes brings you closer to missing out on significant funds that could benefit your business.

How long does the IRS take to process an ERC claim?

This is, by far, the most frequently asked question, and unfortunately, the answer often comes with a sigh. The current average wait times for the IRS to process an ERC claim are substantial, often ranging from 6 to 12 months or even longer. We’ve seen some claims take 18 months or more to be processed.

Several factors contribute to these significant delays:

- IRS Backlog: The sheer volume of applications has simply overwhelmed the IRS’s processing capacity. They received millions of claims, far exceeding initial estimates.

- Increased Scrutiny: Due to concerns about fraudulent claims, the IRS has implemented stricter review procedures. This means a more thorough examination of each application, which naturally extends processing times.

- Staffing and Resources: Like many organizations, the IRS has faced challenges with staffing and resources, further exacerbating the backlog.

- Complexity of Claims: Each ERC claim is unique. Simple, straightforward claims might move slightly faster, but claims with complex eligibility scenarios (e.g., partial suspension due to supply chain issues) or large credit amounts often require more in-depth review.

These timelines are averages, and individual experiences can vary. While we wish we could speed up the IRS, our focus is on ensuring your claim is perfectly prepared to minimize any additional delays caused by errors or missing information. We know that businesses in Austin and Travis County need these funds to thrive, not just survive.

What happens if my ERC claim is rejected or needs correction?

While our goal is always a smooth, approved claim, it’s wise to understand what happens if your ERC claim is rejected or requires correction. It’s not necessarily the end of the road, but it does require prompt and informed action.

Reasons for rejection or requests for correction can include:

- Incomplete Information: Missing forms, signatures, or supporting documentation.

- Calculation Errors: Discrepancies in how the credit was calculated or wages were counted.

- Eligibility Issues: The IRS may disagree with your assessment of a significant decline in gross receipts or the impact of a government order.

- Fraud Concerns: While rare for legitimate businesses, heightened IRS scrutiny means any red flags could lead to deeper investigation.

If your claim is rejected or you receive a notice from the IRS requesting more information, don’t panic. Here’s the general process:

- Review the IRS Communication Carefully: The IRS will typically send a letter explaining the reason for the rejection or the information they need. Understanding this communication is the first critical step.

- Process for Correcting Errors: If it’s a simple error or missing document, you can often provide the requested information or file a corrected Form 941-X. This might involve resubmitting specific pages or providing additional schedules.

- Resubmission Options: For more complex rejections, you might need to re-evaluate your entire claim, gather additional evidence, and resubmit a fully revised Form 941-X. This is where expert guidance is particularly beneficial, as we can help you understand the IRS’s concerns and craft a compelling, corrected submission.

It’s important to address any IRS communications promptly. Ignoring them can lead to further complications, including final rejections or even audits. With our assistance, you can steer these challenges effectively, giving your ERC claim the best chance of ultimate success.

Conclusion: Take Control of Your ERC Funds

The erc funding process has proven to be a vital lifeline for countless businesses, offering significant tax credits that don’t need to be repaid. However, as we’ve explored, the journey from filing your claim to receiving your refund is far from straightforward, often characterized by frustrating IRS delays and complex requirements.

For business owners in Travis County, the wait for these crucial funds can feel interminable, impacting cash flow, growth opportunities, and overall financial stability. We understand that you need access to your capital sooner rather than later.

That’s precisely where SFG Capital steps in. We specialize in helping businesses like yours steer the intricacies of the erc funding process and, critically, bridge the gap caused by IRS backlogs. Our unique approach focuses on providing advances or buyouts on your pending ERC refunds. This means you don’t have to wait months or even years for the IRS to process your claim; you can access your funds now.

We operate on a transparent, performance-based fee structure, meaning our success is tied to yours. We’re committed to ensuring you receive the funds you’re entitled to, efficiently and with expert support every step of the way.

Don’t let IRS delays dictate the pace of your business’s recovery and growth. Take control of your ERC funds today. To learn more about our streamlined process and how we can help your Travis County business open up its capital sooner, visit Learn more about Our Process.