Why Businesses Are Turning to ERC Refund Advances

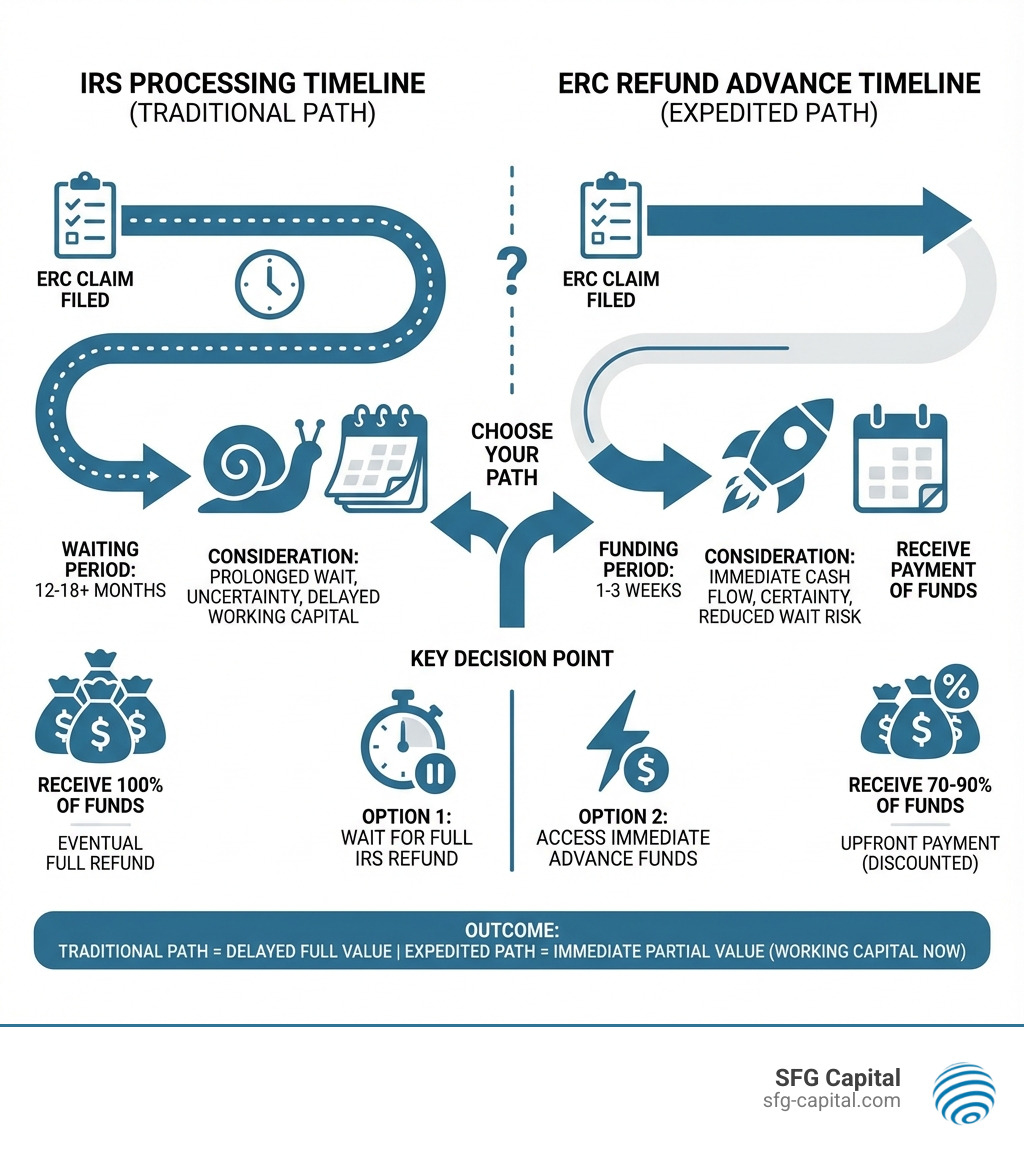

An ERC refund advance lets businesses access their Employee Retention Credit refund immediately, bypassing the 12-18 month (or longer) IRS processing wait. Here’s how it works:

- What it is: You sell your pending ERC refund to a funding provider for immediate cash.

- How much you get: Typically 70-90% of your total claim value, paid upfront.

- Timeline: Funding can arrive in as little as 1-3 weeks after approval.

- Key benefit: Immediate working capital without waiting for the IRS.

- Main tradeoff: You receive less than the full refund amount (the provider takes a discount for assuming the wait and risk).

Thousands of business owners are stuck in the IRS backlog, waiting 12-18 months or more for ERC claims. This delay ties up essential working capital that could transform their operations today.

The ERC is a valuable COVID-19 relief program, offering up to $26,000 per employee. However, a massive volume of claims created a processing bottleneck, turning this lifeline into a waiting game.

ERC refund advance providers solve this by purchasing your pending claim at a discount. You get immediate access to most of your refund, while they wait for the IRS payment.

I’m Santino Battaglieri of SFG Capital. We’ve helped businesses access over $500 million in ERC refund advance funding, ensuring claims are compliant and capital is delivered quickly. This guide covers everything you need to know to make the right decision for your business.

What is an ERC Refund Advance and How Does It Work?

An ERC refund advance helps businesses bypass the long wait for their Employee Retention Credit (ERC) from the IRS. Instead of waiting for the IRS, you receive an upfront lump sum, typically 70% to 90% of your estimated claim value, in days or weeks.

This isn’t a traditional loan; it’s a purchase of your future refund. The provider buys your credit at a discount, assuming the risk and the wait. You get immediate liquidity, and the provider collects the full refund from the IRS later.

The Core Concept: Accessing Your ERC Refund Sooner

The ERC was a vital COVID-19 lifeline, offering up to $26,000 per employee. However, a massive volume of claims led to a significant IRS backlog, with processing delays stretching to 12-18 months or longer.

For businesses in Travis County, this wait can be detrimental, hindering growth and threatening solvency. An ERC refund advance bridges this gap, allowing our clients in Austin and surrounding areas to put their deserved funds to work immediately.

The Typical Process for Securing an Advance

The process for securing an ERC refund advance is designed for speed:

- Initial Application: Start with a quick online application, often taking just a few minutes, requiring basic business information.

- Submitting Documents: Provide supporting documentation, including your ERC claim forms (941-X), original 941s, P&L statements, business tax returns, and ERC eligibility calculations.

- Due Diligence and Valuation: The provider reviews your documents to verify the claim’s validity and value, ensuring it’s robust.

- Receiving a Term Sheet: Upon approval, you’ll get a term sheet detailing the advance amount, discount, and terms.

- Agreement and Funding: After you accept and sign, funds are deposited into your bank account, often within days or weeks of applying.

Our process can get you an approval decision in 48 to 72 hours, with funds deposited quickly thereafter.

Benefits vs. Risks of an ERC Refund Advance

Deciding on an ERC refund advance means weighing the benefits of immediate cash against the potential downsides and costs.

Main Benefits of Getting an ERC Refund Advance

The primary allure of an ERC refund advance is speed. Here’s why businesses in Travis County and beyond are turning to these solutions:

- Immediate Cash Flow: An advance provides instant liquidity to address urgent needs, manage payroll, cover expenses, or invest in growth without delay.

- Bypassing IRS Delays: An advance sidesteps the 12-18 month IRS processing bottleneck, giving you access to your capital now.

- Reinvesting in Operations: Immediate funds allow you to reinvest in your business, seize opportunities, upgrade technology, or expand your workforce, rather than putting growth on hold.

- Paying Off Debt: Use the funds to pay down high-interest debt, improving your balance sheet and reducing financial pressure.

- No Monthly Payments (in some structures): Many advances are structured as buyouts, not loans, so there are no monthly payments. The provider waits for the IRS.

- Keeping Business Ownership: An advance provides capital without diluting your ownership or control.

Potential Risks and Downsides to Consider

While the benefits are compelling, it’s crucial to understand the potential risks:

- Discounted Payout: You won’t receive the full value of your ERC claim. The provider takes a discount (typically 10-30%) as their fee for the service. You trade a portion of your refund for immediate access.

- Repayment Risk if Claim is Ineligible: This is a significant risk. If the IRS deems your claim ineligible or reduces it after an audit, you may have to return the advance. This can be a substantial financial burden.

- Tax Implications: The advance structure (purchase vs. loan) has tax implications. Consult a tax advisor to understand the effect on your business’s tax liability.

- Vetting Providers: The ERC landscape has many new players. It’s crucial to work with a reputable, transparent firm with a proven track record to avoid predatory practices.

Business owners in Travis County must weigh these factors and understand all terms before committing. We believe in full transparency to help you make the best decision.

Understanding ERC Refund Advance Structures

An ERC refund advance isn’t a one-size-fits-all product. It can be structured in different ways, each with unique characteristics for risk, repayment, and cost. At SFG Capital, we prioritize solutions that ensure your business’s stability.

Here’s a simplified look at how our ERC refund advance structure might compare to other options:

| Feature | SFG Capital’s ERC Advance (Buyout) | ERC Advance (Loan-like) | ERC Bridge Loan (Traditional) |

|---|---|---|---|

| Structure | Purchase of future refund | Loan collateralized by ERC refund | Short-term loan, often with interest |

| Risk | Buyer assumes most risk | Repayment may be required if ERC denied | Repayment required regardless of ERC outcome |

| Repayment | No direct repayment by seller | Potentially required if IRS doesn’t pay out | Monthly interest/principal payments |

| Cost | Discounted purchase price | Discounted purchase price + potential interest | Interest rates, fees, and origination charges |

| Cash Flow | Immediate lump sum | Immediate lump sum | Immediate lump sum |

| IRS Payment | Goes directly to buyer | Goes to lender to repay loan | Goes to borrower, who then repays loan |

| Ownership | No dilution | No dilution | No dilution |

| Primary Goal | Expedite funds, mitigate IRS risk | Expedite funds, but with borrower risk | Provide short-term capital |

ERC Refund Advance: Key Features

Our preferred structure is often a buyout, where we purchase your anticipated ERC credits at a discount. This approach offers several key benefits:

- Purchase of Future Refund: This is a purchase of your pending tax credit, not a loan. The discounted amount you receive upfront is the purchase price.

- Risk Assumption: In a purchase model, the provider assumes the risk of IRS processing time and, often, the claim’s ultimate payment. However, if your claim is fraudulent or ineligible, you may still be required to repay the advance.

- Simplicity: Once the agreement is signed and funds are sent, your involvement is mostly complete. The provider handles waiting for and collecting from the IRS.

- No Ongoing Interest Payments: As a purchase, there are no monthly interest payments. Your cost is the initial discount on your ERC claim.

How ERC Refund Advances Differ from Traditional Loans

It’s crucial to distinguish an ERC refund advance from a traditional business loan:

- Not Debt: An advance is not considered debt like a traditional loan. You are selling a future asset (your tax credit) for immediate cash.

- No Monthly Payments: Unlike a loan with fixed payments, an advance has none. The provider collects directly from the IRS, not from your monthly cash flow.

- No Dilution of Ownership: An advance is a non-dilutive form of financing that doesn’t require you to give up any equity in your business.

For businesses in Travis County, an ERC refund advance is an attractive option to access funds without the complexities of a traditional loan. More info about our services.

The Application and Eligibility Process for an ERC Refund Advance

The application process for an ERC refund advance is streamlined by reputable providers for speed and efficiency, letting you focus on your business.

Who is Eligible and What are the Common Criteria?

Common eligibility requirements for an ERC refund advance include:

- Valid ERC Claim Filed: You must have already filed your ERC claim with the IRS.

- Minimum Claim Value: Most providers require a minimum claim value, often starting at $75,000, though some programs require $250,000 or more.

- Financially Solvent and Operational Business: Your business must be financially sound and actively operating.

- Operational Since February 2020: Your business must have been operational since at least February 2020.

- Owner Background Check: Owners should be free of bankruptcies or felony convictions. Credit approval may also be required.

Recovery Startup Businesses might not be eligible for certain advance programs. We encourage you to check your eligibility with us directly.

Documentation Typically Required to Apply

To ensure a swift process, have these documents ready:

- Signed 941-X Forms

- Original 941 Forms

- Profit & Loss Statements (2019-2022)

- Business Tax Returns (2019-2021)

- ERC Eligibility Calculations

- Government Issued ID

- Operating Agreement or By-Laws & Articles of Formation/Incorporation

- Most Recent Bank Statement

Having these documents ready can speed up approval to as little as 48-72 hours.

Typical Timeline for Receiving Funds

An ERC refund advance is fast. While the IRS takes 12-18+ months, our process is much quicker:

- Application: Complete the initial online application in minutes.

- Approval: Receive an approval decision within 48-72 hours of submitting documents.

- Funding: After approval, funds can be deposited within 1 to 3 weeks, with some cases funding even faster.

Our streamlined process is designed to deliver funds with speed and confidence. For a deeper dive into our specific steps, please visit Our Process.

Navigating IRS Rules and Finding a Reputable Provider

The ERC and advance options are complex, with increasing IRS scrutiny. Businesses in Travis County must understand the rules and choose a trustworthy partner.

The IRS View on ERC Claims and Advances

The IRS has expressed concerns about fraudulent ERC claims and aggressive marketing, leading to:

- Increased Scrutiny: The IRS is actively reviewing claims and has a moratorium on processing new ones to combat fraud. This unfortunately delays legitimate claims.

- Withdrawal Program: The IRS introduced a Withdrawal Program for businesses to withdraw ineligible claims without penalty if the refund hasn’t been received.

- Voluntary Disclosure Programs: The IRS also offered programs like the Second ERC Voluntary Disclosure Program for businesses to repay ineligible funds at a discount, highlighting the focus on compliance.

- Importance of a Valid Claim: The IRS’s main concern is the validity of the underlying ERC claim. An ineligible claim can invalidate your advance agreement, potentially requiring you to return the funds. A properly prepared claim is essential before seeking an advance.

Key Considerations Before Pursuing an ERC Refund Advance

Before pursuing an ERC refund advance, consider these critical points:

- Urgency for Capital: If you can wait 12-18+ months for the full payout, do so. If immediate liquidity is critical for growth or paying debts, the cost of an advance may be worthwhile.

- Understanding Fees: Be clear on the advance percentage and the total discount or fees. This is your cost for the service and should be transparent and in writing.

- Verifying Claim Validity: This is critical. Ensure your ERC claim is fully compliant with IRS guidelines before seeking an advance. Have a tax professional review it if there’s any doubt.

- Consulting a Tax Advisor: Always consult your CPA or tax advisor to understand the financial and tax implications for your business.

How to Vet a Reputable ERC Refund Advance Provider

Choosing the right ERC advance provider is paramount. Here’s what to look for in a reputable partner:

- Transparency: A reputable provider is upfront about all fees, terms, and risks, with no hidden clauses. They should clearly explain how the advance works and what happens if a claim is denied.

- Clear Contracts: The terms should be detailed in a written contract. A provider who avoids this or rushes you is a red flag.

- Experience and Track Record: Look for providers with a proven history in commercial financing. For example, we have over 10 years of experience and have retrieved billions from COVID-19 relief programs. Ask for case studies.

- Performance-Based Fees: Reputable providers often tie their compensation to the success of your claim.

- No High-Pressure Sales Tactics: Be wary of aggressive marketing, unrealistic promises, or pressure to sign quickly. A trustworthy partner allows you to make an informed decision.

- ERC Expertise: Ensure the provider deeply understands ERC regulations or partners with experts who do.

Choosing the right partner is a critical decision. We pride ourselves on guiding Travis County businesses with integrity. You can learn more about our commitment to our clients at About Us.

Frequently Asked Questions about ERC Refund Advances

Here are answers to common questions about an ERC refund advance.

Is an ERC advance a loan?

No, an ERC refund advance is typically structured as a purchase of your future tax refund at a discount. You are selling a future asset for immediate cash, not borrowing money. There are no monthly payments; the provider collects directly from the IRS.

Can I get an advance on only a portion of my ERC claim?

Generally, no. While you might only want to advance a portion of the value, the agreement usually covers the entire claim. This is because the IRS cannot split a refund payment to be sent to different addresses, so the provider must take assignment of the full claim to collect payment.

You can, however, choose to advance only a portion of the value. For instance, on a $1 million claim, you could advance $250,000. The fee would apply only to that portion. After the provider is repaid, the remaining funds from the IRS would be directed to you.

What happens if the IRS denies my ERC claim after I get an advance?

This is a primary risk, and the outcome depends on your agreement’s terms:

- True Purchase/Buyout Model: In this model, the provider assumes the risk of denial. If the IRS denies the claim, you typically would not have to repay the advance. This model may have a higher discount rate to cover the provider’s risk.

- Contingent Repayment Model: Many structures include clauses requiring you to repay the advance if the IRS denies your claim due to ineligibility, fraud, or errors. In this case, you would have to return the advanced funds.

It is vital to understand the “what if” clauses in your agreement regarding an IRS denial, reduction, or audit. This is why we stress working with a reputable provider and having your claim vetted by tax professionals beforehand.

Conclusion: Is an ERC Advance Right for Your Business?

For many Travis County businesses, the ERC refund advance is a powerful tool to bypass the long wait for IRS refunds. Immediate capital can help businesses overcome challenges, invest in the future, and maintain stability.

This guide covered the mechanics of an ERC refund advance, its benefits (immediate cash flow) and risks (discounted payouts, repayment obligations). We also covered eligibility and the importance of choosing a transparent provider.

The decision depends on your unique needs. If you have an urgent need for capital, a valid ERC claim, and accept the trade-off of a discounted payout for speed, an advance could be a game-changer. It empowers your business to move forward instead of waiting on the IRS.

If you’re ready to see how an ERC refund advance can benefit your Austin business, we invite you to make an informed decision and take control of your capital.