The Reality of ERC Refund Delays in 2024

If you’re searching for information about erc refund processing time 2024, here’s what you need to know right now:

Current ERC Processing Times (2024-2026):

- Low-risk claims: Processing began September 2024, with refunds being issued through fall 2024 and beyond

- Medium-risk claims: Facing additional scrutiny and audits; timeline uncertain, likely extending into 2025-2026

- High-risk claims: Subject to detailed examination, disallowance, or criminal investigation; processing timeline unknown

- Overall backlog: The IRS estimates it could take until the end of 2025 to complete processing all remaining ERC claims

- Unprocessed claims: Over 597,000 claims remain in the IRS inventory as of early April 2025

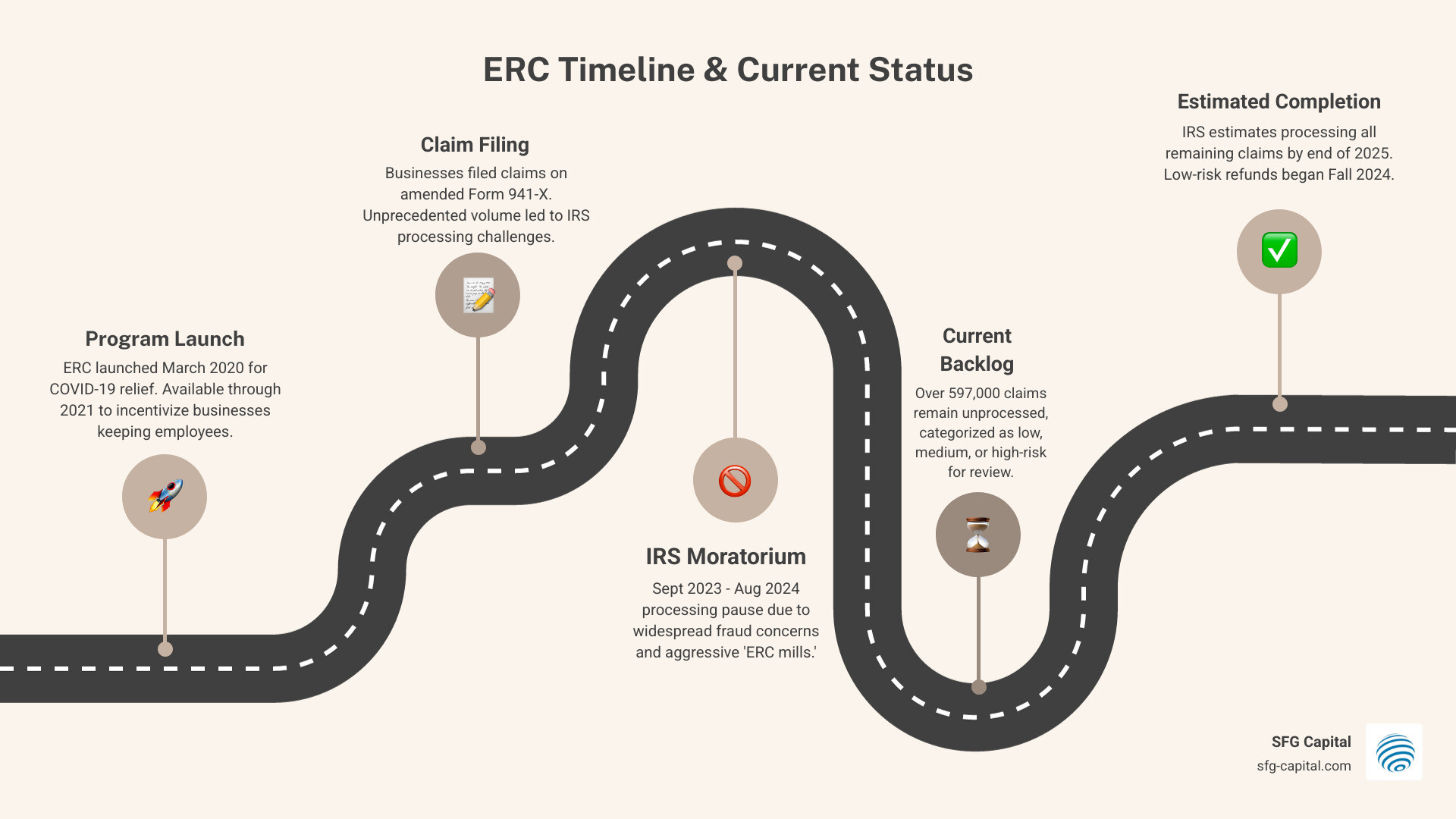

The erc refund processing time 2024 has been significantly impacted by an IRS moratorium that lasted from September 2023 to August 2024. The agency paused processing due to concerns about fraudulent claims driven by aggressive marketing from so-called “ERC mills.” While the IRS lifted the moratorium for claims filed before January 31, 2024, processing times remain unpredictable.

Many businesses that kept employees on payroll during the pandemic’s darkest days are still waitingoften for yearsto receive the refunds they’re entitled to. The backlog has created serious cash flow challenges for legitimate claimants, while the IRS works to separate valid claims from fraudulent ones.

As of October 2024, the IRS announced it was processing approximately 400,000 claims representing about $10 billion in eligible credits. However, the agency has also sent out 58,000 rejection letters totaling $6 billion in incorrect claims and initiated 460 criminal cases involving improper ERC claims.

Why the delays? The IRS received an unprecedented volume of ERC claimsmany filed well after the pandemic endedand a significant percentage were determined to be improper or ineligible due to aggressive marketing by promoters who misrepresented eligibility requirements.

I’m Santino Battaglieri of SFG Capital, based in Austin and serving businesses across Travis County and the United States. Having funded over $500 million in ERC claims, I have direct insight into the erc refund processing time 2024 and its challenges. My focus is helping eligible businesses understand their options while the IRS works through its historic backlog.

Current IRS Backlog and ERC Refund Processing Time 2024

The Employee Retention Credit (ERC) was a lifeline for businesses during the pandemic, but the journey to receive the refund has been difficult. The erc refund processing time 2024 is a major concern for businesses in Austin, Travis County, and across the U.S.

The IRS has been struggling with an immense backlog of ERC claims, exacerbated by widespread fraud concerns. Aggressive marketing tactics by “ERC mills” led to a surge of questionable claims, forcing the IRS to take drastic measures. In September 2023, the agency announced a moratorium on processing new ERC claims to implement safeguards and address fraud risk. This move, while necessary, left many legitimate businesses in limbo.

While the moratorium was officially lifted on August 8, 2024, it only applied to claims filed before January 31, 2024. Claims submitted after that date still face significant scrutiny and indefinite delays. The IRS has restarted processing, prioritizing low-risk claims and issuing refunds for approximately 400,000 such claims, representing about $10 billion. This is positive news for some, but highlights the challenges for those in higher-risk categories.

The agency’s anti-fraud efforts are evident: 58,000 rejection letters sent ($6 billion in incorrect claims) and 460 criminal cases initiated. Over 7,300 entities have withdrawn claims totaling $677 million, showing growing awareness of strict eligibility. This focus on compliance means many claims will face extended delays and thorough examination.

The Scale of the ERC Backlog

The numbers paint a clear picture of the challenge. As of early April 2025, a staggering over 597,000 ERC claims remain in the IRS’s inventory. This includes nearly 11,000 unresolved cases submitted through the Taxpayer Advocate Service (TAS). For us at SFG Capital, this means the ultimate timeline rests with the IRS’s capacity.

The IRS acknowledges the monumental task, estimating it could take until the end of 2025 to process all claims. This long wait impacts businesses counting on these funds. The backlog was significantly worsened by aggressive marketing from “ERC mills,” which encouraged ineligible businesses to apply. This flood of dubious submissions has slowed the entire process for everyone, including legitimate claimants.

The IRS Moratorium and Its Aftermath

The IRS moratorium on new ERC claims, which began on September 14, 2023, was a pivotal moment. The pause was a direct response to a surge of questionable claims and an attempt to implement safeguards against fraud.

While necessary, the moratorium caused immense financial strain for businesses. The good news is the partial lifting on August 8, 2024, for claims filed before January 31, 2024, allowing a portion of the backlog to move. However, claims filed after that date still face indefinite delays and heightened scrutiny.

To streamline the process, the IRS also introduced a new consolidated claim process for third-party payers to help resolve incorrect claims more efficiently. However, the overall message is clear: the IRS is taking a much more cautious and thorough approach, which inevitably impacts the erc refund processing time 2024 and beyond.

Factors Influencing Your Wait Time

Waiting for an ERC refund can feel like watching paint dry, but with a lot more at stake. The erc refund processing time 2024 isn’t a one-size-fits-all scenario. Several factors influence how long your business in Austin or Travis County might wait, including claim complexity, documentation quality, filing date, and any involvement with third-party promoters. Understanding these elements helps manage expectations. For a comprehensive overview of the credit itself, check out our ERC Credit Complete Guide.

How the IRS Categorizes Your Claim: Low, Medium, and High Risk

To manage the enormous volume of ERC claims, the IRS has adopted a risk-based approach, categorizing claims into low, medium, and high-risk tiers. This classification directly impacts the erc refund processing time 2024 for your claim.

| Risk Category | IRS Criteria (General) | Expected IRS Action | Estimated Timeline |

|---|---|---|---|

| Low-Risk | Clear eligibility based on gross receipts test, minimal red flags, complete and accurate documentation. Often smaller claims. | Automated processing, minimal manual review. | Processing began September 2024, with refunds expected through fall 2024 and into 2025. |

| Medium-Risk | Some complexity, potential for unclear eligibility (e.g., partial suspension claims), or minor documentation issues. | Manual review, potential for information requests or limited audits. | Significant delays, likely extending into 2025 and 2026. These claims are still largely in limbo. |

| High-Risk | Strong indicators of ineligibility, involvement of aggressive promoters, large claim amounts relative to business size, or suspicious patterns. | Detailed examination, comprehensive audits, potential disallowance letters, or even criminal investigation. | Timeline unknown, can be years. High likelihood of disallowance. |

The IRS has been prioritizing the processing of low-risk claims, with approximately 50,000 valid claims being identified and processed first. This means if your claim clearly meets the criteria and is well-documented, you’re likely to see a faster resolution. However, for those in the medium and high-risk categories, the wait will be considerably longer, with many facing audits and potential disallowance letters. The IRS has acknowledged that the criteria for these classifications aren’t always well-defined for the public, which can add to taxpayer uncertainty.

Key Deadlines and Statute of Limitations Impacting Your Claim

Deadlines are a crucial part of the tax world, and the ERC is no exception. While the erc refund processing time 2024 is largely in the IRS’s hands, understanding these dates is vital for taxpayers.

The deadline to file any 2020 ERC claims was April 15, 2024. If you missed this date, unfortunately, you are out of luck for 2020. However, the deadline to file any 2021 Employee Retention Tax Credit (ERC) claims is April 15, 2025. If you believe your business in Austin or Travis County is eligible for the 2021 credit and hasn’t filed yet, time is running out.

Beyond filing deadlines, the statutes of limitations for amended tax returns related to ERC claims pose another layer of complexity. When you claim the ERC, you typically need to amend your income tax returns to reduce your wage deductions by the amount of the credit. If the IRS processes your ERC claim after the statute of limitations for those amended income tax returns has expired, it creates a tricky situation. Under current law, if the IRS denies ERC credits after the 2021 corporate tax return statute expires, there is currently no method for recovering the lost wage deductions. This is a critical concern for businesses, as the IRS’s processing delays can push claims past these statutory windows.

There was hope that legislation like the Tax Relief for American Families and Workers Act of 2024 would address these expiring statutes by extending them, but unfortunately, that bill did not pass. This means businesses must be proactive. If you have a 2021 ERC claim, we strongly recommend filing an amended 2021 tax return before its statute closes to comply with ERC laws. Additionally, consider filing a protective claim before the statute closes. This can safeguard your wage deductions in the event your ERC refund claim is later disallowed by the IRS.

What To Do While You Wait (Or If You’ve Been Denied)

Waiting for an ERC refund is frustrating, and for businesses in Austin and Travis County, these delays can disrupt financial planning. Whether you’re waiting or have received a disallowance notice, it’s crucial to know your options. At SFG Capital, we provide clarity and solutions. For more comprehensive support, explore our Employee Retention Credit Help.

How to Check Your Claim Status and Estimated ERC Refund Processing Time 2024

Unfortunately, there is no online tool for tracking erc refund processing time 2024 like there is for individual tax refunds. This makes the wait more opaque.

However, there are a few limited ways to try and get an update:

- Call the IRS: You can try calling the IRS at 800.829.4933. Be prepared for potentially long wait times. The information they can provide is often limited; they might confirm receipt of your amended payroll tax returns (Form 941-X) or whether a check has been issued, but rarely a detailed timeline for processing. They will not be able to tell you where your claim is in the queue or if it’s been flagged for additional review.

- Contact the Taxpayer Advocate Service (TAS): If you’re experiencing significant financial hardship due to the delay, or if your claim has been pending for an unusually long time without any communication, the Taxpayer Advocate Service (TAS) might be able to help. TAS is an independent organization within the IRS that helps taxpayers resolve problems with the IRS. They have been actively involved in ERC cases, though even their efforts face the broader backlog. As of early April 2025, nearly 11,000 TAS-submitted ERC claims remain unresolved.

- Request Transcripts: You can request a formal transcript from the IRS detailing your account activity. While this won’t give you a processing timeline, it can confirm that your amended return was received and posted to your account.

For more detailed guidance on checking your status, you might find this external resource helpful: How to Check ERC Refund Status.

Responding to a Disallowance Notice (Letter 105-C or 106-C)

Receiving a disallowance letter from the IRS for your ERC claim can be disheartening. The IRS has issued tens of thousands of these letters, including 28,000 disallowance letters for claims totaling $5 billion, and 58,000 rejection letters amounting to $6 billion in incorrect claims. While the IRS states that over 90% of these were validly issued, they also admit up to 10% may have been sent in error. If you receive a Letter 105-C, Claim Disallowed or a Letter 106-C, you have several critical steps to consider:

- Consult a Tax Professional: This is your first and most important step. A qualified tax advisor can help you understand why your claim was disallowed and assess the strength of your case.

- Review the Disallowance: Carefully read the letter to understand the IRS’s stated reasons for disallowing your claim. Gather all supporting documentation for your original claim.

- File a Protest (Administrative Appeal): If you believe the IRS made an error, you can file a protest to administratively appeal the disallowance. While the standard timeframe to request an appeal is often 30 days, the IRS has extended this for some ERC disallowance letters, allowing up to two years. However, acting quickly is always advisable.

- Consider a Refund Lawsuit: If an administrative appeal isn’t successful or isn’t appropriate, you might be able to file a refund lawsuit in U.S. District Court or the Court of Federal Claims. This is a more aggressive step, but it can force the IRS to address your claim on its merits. Importantly, there’s a two-year statute of limitations for filing a lawsuit after the IRS mails a disallowance notice. If you miss this window, you lose your legal right to contest the decision.

- Extend the Statute of Limitations: In some cases, you might be able to execute Form 907 to extend the limitations period, if appropriate, giving you more time to resolve the issue.

- Do Nothing: This is always an option, but it means you forfeit the ERC refund. Unless you’re certain the disallowance is correct and you have no grounds for appeal, we generally don’t recommend this approach.

We’ve seen many businesses caught in this predicament. While the IRS has recently begun issuing guidance for Letter 105-C and Letter 106-C, these efforts came too late for many who were already confused and frustrated.

Options for Potentially Ineligible Claims

In light of the IRS’s heightened scrutiny and concerns about aggressive ERC promoters, many businesses are re-evaluating their eligibility. If you’ve claimed the ERC but now suspect you might not qualify, the IRS has offered pathways to correct these issues and avoid future penalties.

- Withdrawal Program: If you filed an ERC claim and haven’t yet received the refund (or have received the check but not cashed or deposited it), you might qualify for the ERC withdrawal program. By withdrawing your claim, the entire adjusted employment tax return for that period is treated as if it was never filed, and the IRS will not impose penalties or interest. This is a great option for businesses that realize an error before the refund is fully processed.

- ERC Voluntary Disclosure Program (VDP): The IRS launched a second ERC Voluntary Disclosure Program (VDP) that closed on November 22, 2024. This program allowed businesses that received an ERC refund but later determined they were ineligible to repay a discounted amount (85% of the credit) without penalties or interest. While the official deadline has passed, it highlights the IRS’s efforts to provide a resolution path for past errors.

- Amending a Return: If you need to make other changes on your adjusted employment tax return, or if you only need to reduce your ERC claim (not withdraw it entirely), you can’t use the withdrawal process. Instead, you’ll need to amend your return. This applies if you received the refund, but the VDP is not applicable or has passed. Amending your return correctly is crucial to avoid further issues.

Taking proactive steps to address potentially ineligible claims is vital to protect your business from future audits, penalties, and interest. The IRS is actively pursuing criminal investigations related to improper ERC claims, so resolving any doubts about your eligibility is paramount.

Frequently Asked Questions about ERC Refund Delays

Here, we address common questions from businesses in Austin, Travis County, and across the U.S. about the erc refund processing time 2024 and beyond.

How long will it realistically take to get my ERC refund in 2024-2026?

This is the million-dollar question, and unfortunately, there’s no simple answer. The ERC refund processing time in 2024, and looking ahead to 2025 and 2026, varies significantly based on how the IRS categorizes your claim:

- Low-risk claims: For these claims, processing began in September 2024, and refunds are being issued. If your claim falls into this category, you might have received your refund already or can expect it in the coming months.

- Medium and high-risk claims: These are facing substantial delays. The IRS is conducting manual reviews, issuing information requests, and initiating audits. For medium-risk claims, the timeline is highly uncertain and could easily extend well into 2025 or even 2026. High-risk claims are subject to the most intense scrutiny, with processing timelines that could stretch for years, often ending in disallowance or legal action.

Overall, the IRS has stated that it could take at least until the end of calendar year 2025 to complete processing of all ERC claims in its inventory. This means many businesses are in for a prolonged wait. For a deeper dive into the prolonged wait, you can read our article on The Waiting Game: Understanding and Overcoming ERC Refund Delays.

Can I do anything to expedite my ERC claim with the IRS?

While the IRS backlog is immense, there are a few avenues you can explore if you’re looking to expedite your ERC claim:

- Financial Hardship Cases: If the delay in receiving your ERC refund is causing significant financial hardship for your business, the Taxpayer Advocate Service (TAS) may be able to prioritize your case. You’ll need to demonstrate the hardship clearly.

- Taxpayer Advocate Service (TAS) Assistance: As mentioned earlier, TAS can intervene on behalf of taxpayers facing unresolved issues with the IRS, including ERC delays. While they can’t guarantee a specific timeline, they can help push your claim through the system.

- Congressional Assistance: In some dire situations, reaching out to your congressional representative might prompt some inquiry into your claim’s status. However, this is usually reserved for extreme cases.

- Refund Lawsuits: For some, particularly those with strong, well-documented claims that have been pending for an unreasonable period, initiating a refund lawsuit in U.S. District Court or the Court of Federal Claims can be a way to force the IRS to address the claim. This is a serious legal step and should only be considered after consulting with legal and tax professionals.

These options don’t guarantee immediate results, but they can sometimes help break through the bureaucratic inertia. For more strategies, our guide on Expediting Your ERC Refund: What You Need to Know offers further insights.

What are the consequences of the IRS processing delays for my business?

The extended erc refund processing time 2024 and beyond presents several critical consequences for businesses:

- Cash Flow Issues: For many businesses, especially small to medium-sized ones, the ERC refund represents a significant injection of capital. Delays can severely impact cash flow, hindering operations, growth plans, or even basic solvency. Businesses that kept employees on payroll during the pandemic often faced incredible odds to stay afloat, and these delays only prolong their struggle.

- Uncertainty and Planning Challenges: The unknown timeline makes it difficult for businesses to plan for the future. Without a clear idea of when (or if) the funds will arrive, making strategic investments, hiring decisions, or even budgeting becomes a guessing game.

- Expiring Statutes of Limitations for Amending Income Tax Returns: This is a particularly insidious consequence. As discussed, claiming the ERC requires reducing wage deductions on your income tax returns. If your ERC claim is processed and potentially denied after the statute of limitations for amending those prior income tax returns has expired, you could lose the ability to recover those wage deductions. This means your business could face a “double hit”—no ERC refund and no deduction for the wages paid.

- Risk of Losing Wage Deductions: The implication of the expiring statutes is that if the IRS denies your ERC credit after the relevant corporate tax return statute has expired, there is currently no method for recovering the lost wage deductions. This is a risk that could leave businesses in a worse tax position than if they had never claimed the ERC.

These delays aren’t just an inconvenience; they can have profound and lasting financial implications for businesses that legitimately qualify for the credit. Understanding how the ERC can power your business forward is key, and we cover this in Funding Growth: How ERC Can Power Your Business Forward.

Conclusion: Navigating the Wait and Accessing Your Funds Sooner

The erc refund processing time 2024 and ongoing backlog remain a challenge for businesses in Austin, Travis County, and nationwide. While the IRS is making progress, the estimated completion date of late 2025 means many still face a long, uncertain wait.

The complexities of claim categorization, the impact of the past moratorium, and the critical deadlines for statutes of limitations all contribute to a frustrating landscape. While patience is a virtue, we understand that for many businesses, waiting isn’t just an inconvenience—it’s a financial burden.

At SFG Capital, we specialize in helping businesses like yours steer these ERC challenges. We offer solutions designed to bypass the prolonged IRS delays, providing ERC advances or buyouts so you can access your funds much sooner. Our performance-based fee structure means we’re aligned with your success, and our expert assistance ensures your claim is handled with the utmost care and compliance.

If your business in Austin or Travis County is tired of the waiting game and needs to open up its ERC funds now, we’re here to help. Don’t let IRS delays hinder your business’s growth or financial stability. Explore your options with us and get the capital you deserve.