Why Your Business ERC Refund Matters More Than Ever

A Business ERC refund can deliver up to $26,000 per W-2 employee to companies that kept workers on payroll during the COVID-19 pandemic. Here’s what you need to know:

Quick Answer: Business ERC Refund Basics

- What it is: A refundable payroll tax credit created under the CARES Act

- Maximum amounts:

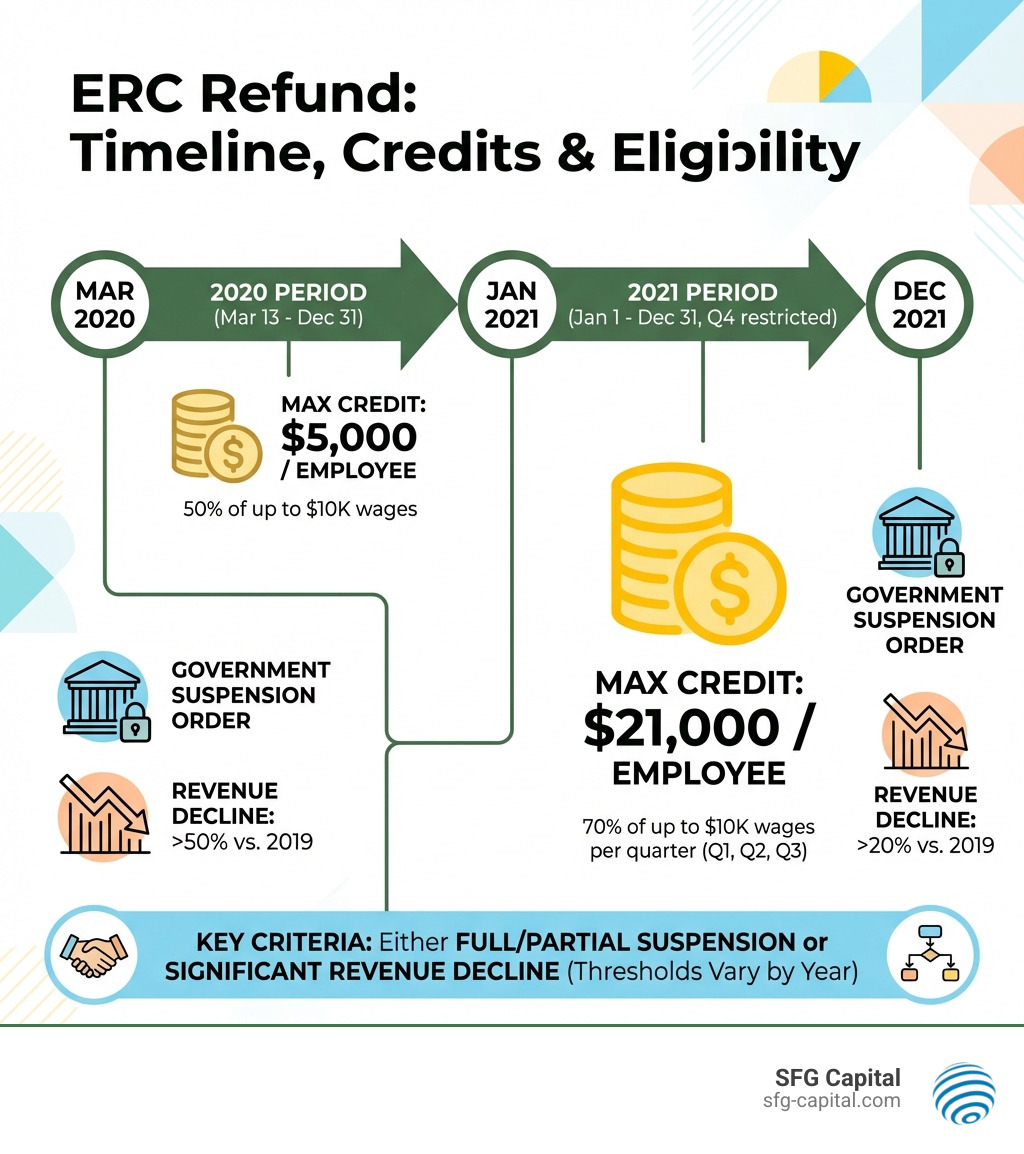

- 2020: Up to $5,000 per employee (50% of first $10,000 in wages)

- 2021: Up to $21,000 per employee (70% of first $10,000 per quarter, Q1-Q3)

- Who qualifies: Businesses that experienced government-ordered suspensions, significant revenue decline (20-50% depending on year), or qualify as Recovery Startup Businesses

- How to claim: File amended payroll tax returns using Form 941-X

- Current status: IRS processing approximately 400,000 claims totaling $10 billion, with delays of 8+ months

The Employee Retention Credit represents one of the most significant pandemic relief programs for small and midsize businesses. Yet many eligible companies either haven’t claimed it or are waiting months—even years—for their refunds while navigating complex IRS guidance and avoiding widespread scams.

The challenge is real. The IRS has placed processing moratoriums due to fraud concerns, businesses face confusing eligibility rules around government orders and revenue declines, and unscrupulous promoters have flooded the market with misleading claims. Meanwhile, legitimate businesses that kept their workforce employed during unprecedented economic disruption are stuck waiting for capital they’ve already earned.

New IRS guidance has simplified some aspects of the refund process, particularly around reporting requirements and handling disallowed claims. But the complexity remains daunting for most business owners who simply want to access their entitled funds without risking penalties or audits.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer over $500 million in Business ERC refund transactions, working with qualified tax professionals to ensure compliant claims and faster access to capital. This guide cuts through the confusion to help you understand your options, avoid costly mistakes, and finally receive the refund your business deserves.

Understanding the Employee Retention Credit and Eligibility

The Employee Retention Credit (ERC), sometimes known as the ERTC, is a refundable tax credit designed to encourage businesses to keep their employees on payroll during the economic disruptions caused by the COVID-19 pandemic. It’s not a loan or a grant; it’s a refund of payroll taxes, meaning you don’t have to pay it back. Understanding What is ERC? is the first step toward claiming these valuable funds.

The ERC was established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and has seen several modifications, most notably through the American Rescue Plan. It applies to qualified wages paid to W-2 employees between March 13, 2020, and December 31, 2021.

To be eligible for a Business ERC refund, businesses in Travis County and across the U.S. generally need to meet one of the following criteria for the applicable calendar quarter:

- Full or Partial Suspension of Operations: Your business operations were fully or partially suspended due to a government order limiting commerce, travel, or group meetings because of COVID-19. This could include mandatory shutdowns, capacity restrictions, or even indirect impacts like vendor issues stemming from government orders.

- Significant Decline in Gross Receipts: Your business experienced a significant decline in gross receipts compared to a prior quarter in 2019. The specifics of this test vary by year, as we’ll detail below.

- Recovery Startup Business (RSB): For the third and fourth quarters of 2021, certain businesses that started operations after February 15, 2020, with average annual gross receipts not exceeding $1 million, could qualify as a Recovery Startup Business, even without meeting the other two tests.

The ERC is not available to individuals, and specific rules apply to wages used for other COVID-19 relief programs like the Paycheck Protection Program (PPP). For a detailed look at whether your business qualifies, our team at SFG Capital can help you review The ERC Eligibility Checklist.

Qualifying for the 2020 vs. 2021 Credit

The ERC rules and maximum credit amounts changed significantly between 2020 and 2021. Here’s a breakdown:

For 2020 (March 13 – December 31):

- Credit Amount: The credit was 50% of qualified wages, up to $10,000 per employee for the entire year. This meant a maximum of $5,000 per employee.

- Eligibility: Businesses needed to demonstrate a 50% decline in gross receipts in a calendar quarter compared to the same quarter in 2019, or have experienced a full or partial suspension due to government orders.

- Employee Count: Applied to businesses with 100 or fewer full-time W-2 employees in 2019.

For 2021 (January 1 – September 30, with RSB extending to December 31):

- Credit Amount: The credit increased to 70% of qualified wages, up to $10,000 per employee per quarter. This could result in a maximum of $7,000 per employee per quarter, or up to $21,000 for the first three quarters of 2021.

- Eligibility: The gross receipts decline threshold was lowered to 20% in a calendar quarter compared to the same quarter in 2019 (or the immediately preceding quarter for sequential testing), or a full or partial suspension due to government orders.

- Employee Count: Applied to businesses with 500 or fewer full-time W-2 employees in 2019.

- Recovery Startup Businesses: As mentioned, RSBs could claim up to $50,000 per quarter for Q3 and Q4 of 2021, totaling $100,000.

| Year | Credit Percentage | Max Wages per Employee | Max Credit per Employee | Gross Receipts Decline | Employee Threshold |

|---|---|---|---|---|---|

| 2020 | 50% | $10,000 (annual) | $5,000 (annual) | 50% | 100 or fewer |

| 2021 | 70% | $10,000 (quarterly) | $7,000 (quarterly) | 20% | 500 or fewer |

These eligibility requirements are complex and highly dependent on your specific business circumstances. For instance, a small business in Austin, TX, might have qualified for the 2020 credit due to a city-mandated shutdown of non-essential businesses, even if their revenue didn’t immediately drop by 50%. The nuances of “partial suspension” can be particularly tricky, and it’s where expert guidance becomes invaluable.

New IRS Guidance on Your Business ERC Refund

The IRS has been actively working to clarify the tax treatment of Business ERC refund claims, especially as they process hundreds of thousands of claims. Recent guidance provides welcome relief and simplification for businesses navigating these waters. This new guidance, outlined in IRS FAQs, directly addresses two common scenarios: how to account for ERC refunds if you didn’t amend your income tax return, and what to do if your ERC claim is disallowed after you’ve already reduced your wage expense. For more details, you can refer to the official IRS FAQs on ERC tax treatment.

At SFG Capital, we understand that Navigating the ERC Program requires staying up-to-date with these changes. This new guidance aims to reduce compliance burdens and offer greater flexibility for businesses.

Simplifying the Business ERC Refund Process

One of the most significant changes addresses businesses that received an ERC refund but did not initially amend their income tax return to reduce their wage expense. Previously, the conventional wisdom was that you’d need to amend the prior year’s income tax return to reflect the reduced wage deduction corresponding to the ERC amount.

Now, the new IRS guidance simplifies this process:

- Reporting ERC Refunds as Income: If you received a Business ERC refund but did not amend your income tax return for the year the wages were paid, you can now report the ERC refund as income in the year it was received.

- Example: If a business in Travis County received a $100,000 ERC refund in 2024 for wages paid in 2021, but didn’t amend its 2021 income tax return, it can now report that $100,000 as income on its 2024 tax return. This eliminates the need to go back and amend a potentially long-closed prior tax year.

This administrative relief makes life much easier for many businesses, allowing them to avoid the complexities and potential penalties associated with amending older returns. It’s a pragmatic approach from the IRS to resolve lingering questions and streamline reporting. You can find more comprehensive information directly from the Employee Retention Credit | Internal Revenue Service pages.

Avoiding the ‘Whipsaw’ Scenario

The term ‘whipsaw’ in tax contexts refers to a situation where a taxpayer is penalized on both sides of a transaction. In the ERC context, this could happen if a business reduced its wage expense in anticipation of receiving the ERC, then the ERC claim was later disallowed. Without proper guidance, the business could face a situation where they lost the credit and had a reduced wage deduction, essentially paying more tax.

The new IRS guidance offers crucial relief here:

- Relief for Disallowed Claims: If your Business ERC refund was disallowed after you had already reduced your wage expense on your income tax return, and you choose not to contest the disallowance, you don’t necessarily need to amend the original income tax return.

- Instead: You can increase your wage expense on your income tax return for the year the disallowance becomes final.

- Example: A business in Austin, TX, claimed an ERC for 2021 and reduced its 2021 wage expense. In 2024, the IRS disallows the claim, and the business doesn’t challenge it. Under the new guidance, the business can increase its wage expense on its 2024 income tax return to account for the previously reduced 2021 wage expense.

This helps avoid the ‘whipsaw’ scenario by allowing businesses to recover the wage deduction in a current tax year, preventing them from being doubly penalized. This is particularly beneficial for businesses where the statute of limitations for amending the original income tax return might be closing or has already passed. It simplifies compliance and provides a clear path forward. For more assistance with these complex situations, our team at SFG Capital provides comprehensive ERC Help.

How to Claim and Track Your Business ERC Refund

Claiming your Business ERC refund involves filing an amended payroll tax return, specifically Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form allows you to correct previously filed Forms 941 (Employer’s Quarterly Federal Tax Return) to reflect the ERC you are claiming.

The process generally looks like this:

- Determine Eligibility: Ensure your business meets the eligibility criteria for each quarter you plan to claim.

- Calculate Qualified Wages: Accurately determine the qualified wages paid to employees during the eligible quarters. Wages used for PPP loan forgiveness cannot also be used for ERC.

- Complete Form 941-X: Fill out a separate Form 941-X for each quarter you are amending. This form details the original tax liability, the adjustments being made for the ERC, and the resulting overpayment.

- Submit to IRS: Mail the completed Form 941-X to the IRS.

Once submitted, the waiting game begins. The IRS is currently processing approximately 400,000 Employee Retention Credit claims, totaling about $10 billion. This high volume, coupled with heightened scrutiny for fraud, means significant delays. It’s estimated that it can take over 8 months to receive a refund check. Keeping tabs on your claim can be frustrating, but tools like our ERC Refund Status Check can help you stay informed.

Deadlines for Your Business ERC Refund

While the ERC program ended for most businesses on September 30, 2021 (December 31, 2021, for Recovery Startup Businesses), there are still deadlines for claiming the credit retroactively. These deadlines are tied to the statute of limitations for amending payroll tax returns:

- For 2020 Claims: The deadline to claim the ERC for qualified wages paid in 2020 was April 15, 2024.

- For 2021 Claims: The deadline to claim the ERC for qualified wages paid in 2021 is April 15, 2025.

It’s crucial to be aware of these sunsetting rules. Missing these deadlines means forfeiting your right to claim the credit. If you haven’t claimed your 2021 ERC yet, now is the time to act. For more information on the timeline for receiving your funds, see our guide on How Long Until Your ERC Refund Arrives?.

Implications of Incorrect Business ERC Refund Claims

The IRS has made it clear that they are actively reviewing ERC claims and cracking down on fraudulent or ineligible claims. Incorrectly claiming the ERC can lead to serious consequences, including:

- Repayment: You will be required to repay the entire Business ERC refund amount.

- Penalties and Interest: The IRS may assess substantial penalties and interest on the incorrect claim. Civil penalties can be significant.

- Audits: An incorrect claim can trigger an IRS audit, not just of your ERC claim but potentially of your entire tax history. The IRS sends Letter 6612 to notify businesses of an audit on their ERC claim, which holds any refund until the audit concludes. If your claim is ultimately disallowed, you might receive a Letter 105-C.

- Legal Action: In cases of egregious fraud, criminal charges are possible.

Given these risks, accuracy is paramount. The IRS has even introduced an Employee Retention Credit Voluntary Disclosure Program. This program allows employers who made erroneous claims to resolve their civil tax liabilities by voluntarily repaying 80% of the claimed ERC amount, typically avoiding penalties and interest, provided they meet specific eligibility criteria (e.g., not under criminal investigation). The deadline for this program was March 22, 2024, highlighting the IRS’s urgency in addressing incorrect claims.

If you have concerns about the accuracy of your claim or are facing an audit, seek expert assistance immediately. Understanding Is Your ERC Refund Here Yet? isn’t just about tracking; it’s also about ensuring its legitimacy.

Avoiding Pitfalls and ERC Scams

The allure of a substantial Business ERC refund has unfortunately attracted a host of unscrupulous promoters and scammers. The IRS has consistently placed ERC scams on its “Dirty Dozen” list of tax scams, warning businesses in Travis County and nationwide to be extremely cautious. These scams can lead to businesses claiming ineligible credits, resulting in repayment, penalties, and interest.

The IRS has been very vocal about these issues, providing clear IRS warnings on ERC scams. We’ve seen businesses fall victim to promises of quick money, only to find themselves in hot water with the IRS. It’s truly a shame when legitimate businesses trying to steer complex tax codes become prey for bad actors.

Red Flags of Unscrupulous Promoters

How can you spot a fraudulent ERC promoter? Here are some red flags to watch out for:

- Unsolicited Ads and Calls: Be wary of unsolicited calls, texts, or emails promoting “guaranteed” ERC refunds. Legitimate tax professionals typically don’t cold-call with such aggressive promises.

- “Nothing to Lose” Claims: Promoters who claim you have “nothing to lose” and are automatically eligible without a thorough review of your specific business situation are a huge red flag. ERC eligibility is complex and highly fact-dependent.

- Immediate Eligibility Without Review: If a promoter claims you qualify before discussing your business’s specific financial situation, employee count, or how government orders impacted your operations, run the other way.

- Percentage-Based Fees: While some legitimate firms may charge a percentage of the refund, this is also a common tactic among fraudulent promoters. Be cautious, especially if the percentage seems excessively high or if it’s the only fee structure offered.

- Large Upfront Fees or Refund Anticipation Loans: Be wary of demands for large upfront fees before any work is done, or offers for “refund anticipation loans” that come with high interest rates and hidden charges.

- Lack of CAF Number: A CAF (Centralized Authorization File) number is a unique IRS identification number for authorized third-party tax service providers. Legitimate ERC providers should possess one. If they can’t provide it, they might not be authorized to represent you before the IRS.

- Ignoring PPP or Other Relief Programs: A promoter who doesn’t ask about your PPP loans or other COVID-19 relief programs might be setting you up for an incorrect claim, as wages used for these programs cannot be double-counted for ERC.

At SFG Capital, we pride ourselves on transparency and ethical practices. We work with qualified tax professionals who perform rigorous due diligence to ensure your eligibility and maximize your legitimate claim. When you’re looking for assistance, make sure you Need ERC Help? Find Top Advisors Here who prioritize your business’s long-term financial health over quick, potentially fraudulent gains. Our guide on Your Guide to Getting ERC Claim Assistance offers more insights.

Frequently Asked Questions about ERC Refunds

We often hear similar questions from business owners in Travis County and beyond who are trying to steer the complexities of the Business ERC refund. Here are some of the most common ones:

Can I claim the ERC if I received a PPP loan?

Yes! Initially, businesses could not claim both the ERC and a Paycheck Protection Program (PPP) loan. However, subsequent legislation, specifically the Consolidated Appropriations Act of 2021, changed this. Businesses can now claim both, but with an important caveat: you cannot use the same wages to calculate both your PPP loan forgiveness and your ERC. This means no “double-dipping” of wages.

For example, if you used $100,000 in wages for PPP loan forgiveness, you would need to identify other qualified wages (if available) to use for your ERC calculation. This requires careful tracking and coordination between the two programs. Our team can help you understand how Forgive and Forget: PPP Impact on ERC affects your claim.

How long does it take to receive the refund check?

This is perhaps the most common and often frustrating question. Due to the massive volume of claims (the IRS is processing about 400,000 claims) and increased scrutiny for fraud, the IRS has implemented a processing moratorium. This has led to significant delays. While the IRS aims to process claims as quickly as possible, many businesses are experiencing waits of 8 months or even longer to receive their Business ERC refund checks.

This delay can be a major challenge for businesses needing capital. It’s why services that offer ERC advance funding or buyouts, like those provided by SFG Capital, have become essential for many businesses in Travis County. We help bridge the gap between your claim submission and the IRS payout. You can learn more about this in The Great ERC Wait.

What should I do if I submitted an ineligible claim?

If you suspect or find that you submitted an ineligible or incorrect Business ERC refund claim, it’s crucial to act promptly to mitigate potential penalties and interest. The IRS offers a claim withdrawal process, especially if the refund has not yet been paid or if you received a check but haven’t cashed or deposited it.

The process involves submitting Form 15434, Application for Employee Retention Credit Voluntary Disclosure Program, or following specific IRS instructions for withdrawal. Successfully withdrawing an ineligible claim can help you avoid future audits, repayment demands, and the assessment of penalties and interest. If the refund has already been received and spent, and you’re no longer eligible for the Voluntary Disclosure Program, you may need to file an amended return and repay the amount with interest. The IRS provides official guidance on the IRS withdrawal process for erroneous claims.

Conclusion

The Business ERC refund remains a vital financial lifeline for many businesses that bravely steerd the challenges of the COVID-19 pandemic. From a logistics company in Texas receiving millions to a small electrical contractor securing a substantial refund, these credits have provided crucial capital. However, the path to claiming these funds is fraught with complexity, evolving IRS guidance, and the constant threat of scams.

Understanding the eligibility criteria, the nuances of the new IRS guidance on tax treatment and disallowances, and the critical deadlines is paramount. Equally important is protecting your business from the predatory practices of unscrupulous ERC promoters.

At SFG Capital, we understand the unique financial landscape of businesses in Travis County, Austin, TX. We specialize in helping you cut through the red tape, ensuring your ERC claim is compliant and maximizing the legitimate refund your business is owed. More importantly, we offer solutions like refund advances and claim buyouts, allowing you to access your capital now, without waiting months or years for the IRS. With performance-based fees and a commitment to expert claim assistance, we ensure you get the funds you need to fuel your business growth.

Don’t let complexity or delays prevent you from accessing the capital your business earned. Explore our services today to learn more about how we can help you with your Business ERC refund.