Understanding the Employee Retention Credit: Lessons for Business Tax Strategy

While the window to apply for ERC credit has closed, understanding this historic program remains crucial for businesses navigating tax strategies and pending claims. Here’s what the process involved:

- Determining eligibility – Businesses verified they experienced a government shutdown order, significant decline in gross receipts, or qualified as a Recovery Startup Business

- Gathering documentation – Collecting Form 941 payroll tax forms, profit/loss statements, payroll reports, and PPP documents

- Calculating the credit – Multiplying qualified wages by 50% (2020) or 70% (2021), up to $10,000 per employee

- Filing Form 941-X – Amending quarterly payroll tax returns for each qualifying period

- Processing time – Many businesses are still waiting for refunds, with IRS backlogs extending beyond 12 months

The Employee Retention Credit (ERC) was a refundable tax credit created under the CARES Act in March 2020 to encourage businesses to keep employees on payroll during COVID-19. Unlike a deduction, this credit put cash directly back in businesses’ pockets – even if they owed no taxes.

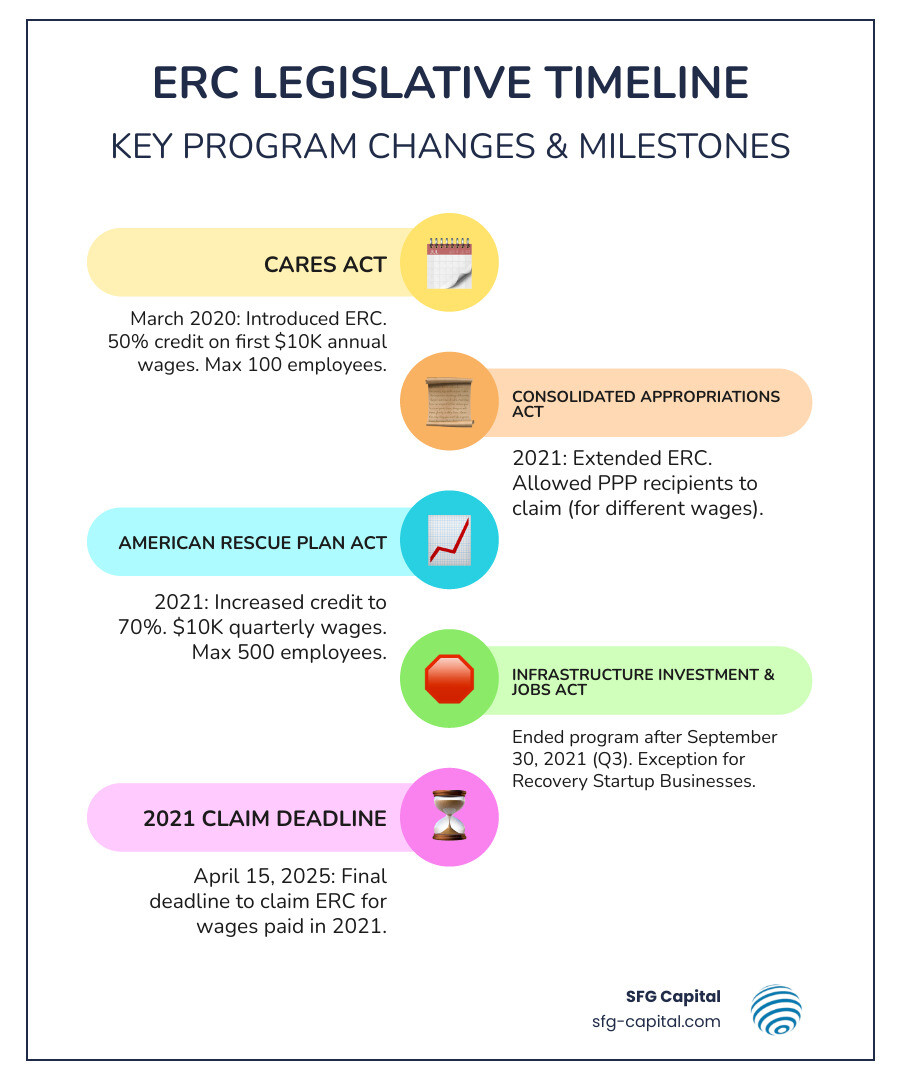

The program evolved through multiple legislative changes. The CARES Act created the credit in 2020. The Consolidated Appropriations Act of 2021 extended the credit and allowed PPP recipients to claim it (for different wages). The American Rescue Plan Act increased the credit rate to 70% and extended it through 2021. Finally, the Infrastructure Investment and Jobs Act ended the program after September 30, 2021, except for Recovery Startup Businesses who could claim through Q4 2021.

The ERC had significant implications for local employers. Many businesses in Austin, Travis County, and across Texas saw revenue swing wildly during capacity limits, supply-chain disruptions, and remote-work transitions. The ERC was designed to stabilize payrolls in exactly these circumstances by turning a portion of wage costs into a refundable tax asset that could be converted to cash.

For example, a Travis County restaurant that retained 25 employees through 2021 could have received hundreds of thousands of dollars in credits if it qualified under the shutdown or gross receipts tests. Even professional services firms, contractors, and startups in the Austin tech corridor may have qualified if they were impacted by government orders or met the Recovery Startup Business rules.

Here’s what’s critical to know now: While the filing deadlines have passed (April 15, 2024 for 2020 wages and April 15, 2025 for 2021 wages), many businesses are still waiting for their refunds. The IRS continues processing hundreds of thousands of claims worth billions of dollars, which means significant delays – often 12+ months – for businesses to receive their refunds.

Those delays can be especially painful for small and mid-sized employers that need liquidity today to cover rent, expand staff, or invest in equipment. That is where funding partners come in.

The challenge for businesses with pending claims? The IRS is moving slowly due to increased scrutiny of ERC claims, and many businesses that properly filed are stuck waiting for funds they desperately need.

I’m Santino Battaglieri, and through SFG Capital in Austin, TX, I’ve helped businesses that previously applied for ERC credit access over $500 million in claims through compliant advisory services and structured funding solutions. My team works with experienced CPAs and tax professionals to ensure pending claims remain accurate, maximized, and defensible if the IRS comes knocking.

Because the IRS continues to process claims slowly, SFG Capital helps eligible businesses in Travis County and throughout the United States with pending ERC claims bridge the gap between filing and funding with ERC refund advances and buyouts. That means you can turn a pending refund into usable capital now, rather than continuing to wait for the government to pay.

Understanding ERC Eligibility: What Qualified Businesses for 2020 & 2021 Credits

While businesses can no longer apply for ERC credit with new claims, understanding the eligibility criteria remains important for those with pending claims and for learning from this historic relief program. The ERC was designed for businesses that continued to pay employees despite facing significant challenges due to the COVID-19 pandemic. The eligibility criteria hinged on a few key factors: experiencing a government-ordered shutdown, a significant decline in gross receipts, or qualifying as a Recovery Startup Business.

To be eligible, businesses must have operated a trade or business or been a tax-exempt organization that had employees and paid wages to them between March 13, 2020, and December 31, 2021. Household employers, for instance, were not eligible.

In practice, that meant a wide range of employers across Austin and Travis County could potentially have qualified:

- Restaurants, bars, venues and hospitality businesses subject to capacity limits or shutdowns

- Retailers and gyms that had to restrict in-person operations

- Professional service firms (law, accounting, marketing, etc.) whose offices were closed to the public

- Manufacturers and contractors that faced supply-chain disruptions tied to government orders

- Growth-focused startups that began operating during the pandemic and may have qualified as Recovery Startup Businesses

One common question businesses had was about the interaction with the Paycheck Protection Program (PPP). Even if a business received a PPP loan, they could still claim the ERC. The key was that they could not use the same wages for both PPP loan forgiveness and the ERC. The rules were retroactively changed by the Consolidated Appropriations Act, 2021, making it possible for many businesses to benefit from both programs.

Another frequent point of confusion was the gross receipts test. In simple terms, businesses compared their quarterly revenue in 2020 or 2021 to the same quarter in 2019. If the drop exceeded the applicable threshold for that year, they could qualify for that quarter (and often for subsequent quarters as well). For newer businesses that did not exist in 2019, special alternative comparison rules applied.

While the filing deadlines have now passed (April 15, 2024 for 2020 wages and April 15, 2025 for 2021 wages), many businesses in Central Texas that filed claims are still awaiting their refunds. If your business has a pending claim, it’s important to maintain all documentation and be prepared for potential IRS correspondence or audit requests.

Understanding the specific eligibility requirements for 2020 versus 2021 remains vital for businesses with pending claims, as the rules changed significantly between the two years. For reference, the IRS provides resources including the Employee Retention Credit Eligibility Checklist. For detailed insights into ERC eligibility criteria, you can also explore More info about ERC eligibility.

Comparing ERC Rules: 2020 vs. 2021

The ERC program wasn’t static; it evolved. What qualified a business in 2020 might not have been enough in 2021, and vice versa. Here’s a breakdown of the core differences:

| Feature | 2020 Rules | 2021 Rules |

|---|---|---|

| Credit rate | 50% of qualified wages | 70% of qualified wages |

| Per-employee wage limit | Up to $10,000 per year in qualified wages (maximum $5,000 credit) | Up to $10,000 per quarter in qualified wages (maximum $7,000/quarter) |

| Covered quarters | 3/13/2020 through 12/31/2020 | Q1, Q2, and Q3 2021 (Q4 2021 for Recovery Startup Businesses only) |

| Full-time employee limit | Over 100 FTEs = only wages paid to employees not providing services count | Over 500 FTEs = only wages paid to employees not providing services count |

| Gross receipts decline | More than 50% decline vs. same 2019 quarter | More than 20% decline vs. same 2019 quarter |

| Government orders | Full or partial suspension of operations may qualify | Same, but with expanded guidance and examples from IRS |

For employers in Austin and Travis County, these differences were significant. A business that did not meet the high 50% revenue drop threshold in 2020 might still have qualified in 2021 with a 20% decline, especially if it faced prolonged capacity restrictions or customer hesitancy.

Understanding the Recovery Startup Business Category and Historic Deadlines

The Recovery Startup Business (RSB) category was introduced to ensure that newer businesses that began during the pandemic were not left out of relief. Businesses could qualify as an RSB if they:

- Began carrying on a trade or business after February 15, 2020

- Had average annual gross receipts under the applicable threshold

- Did not otherwise qualify for the ERC under the gross receipts or shutdown tests for the relevant quarters

RSBs could generally claim the ERC only for Q3 and Q4 of 2021, and the credit was capped at $50,000 per quarter. Many startups in the Austin metro area, including tech, professional services, and specialty retail, fell into this category if they hired employees and paid wages during those quarters.

Key historic deadlines that have now passed:

- The deadline to amend and claim 2020 ERC wages passed on April 15, 2024

- The deadline to amend and claim 2021 ERC wages, including RSB claims for Q3 and Q4 2021, passed on April 15, 2025

If your Austin- or Travis County-based business has a pending ERC claim that was properly filed before these deadlines, SFG Capital can work alongside your CPA or payroll provider to review your claim status and, if appropriate, line up funding options based on your expected refund while you wait for IRS processing.