Why Businesses Are Searching for ERC Tax Credit Experts Right Now

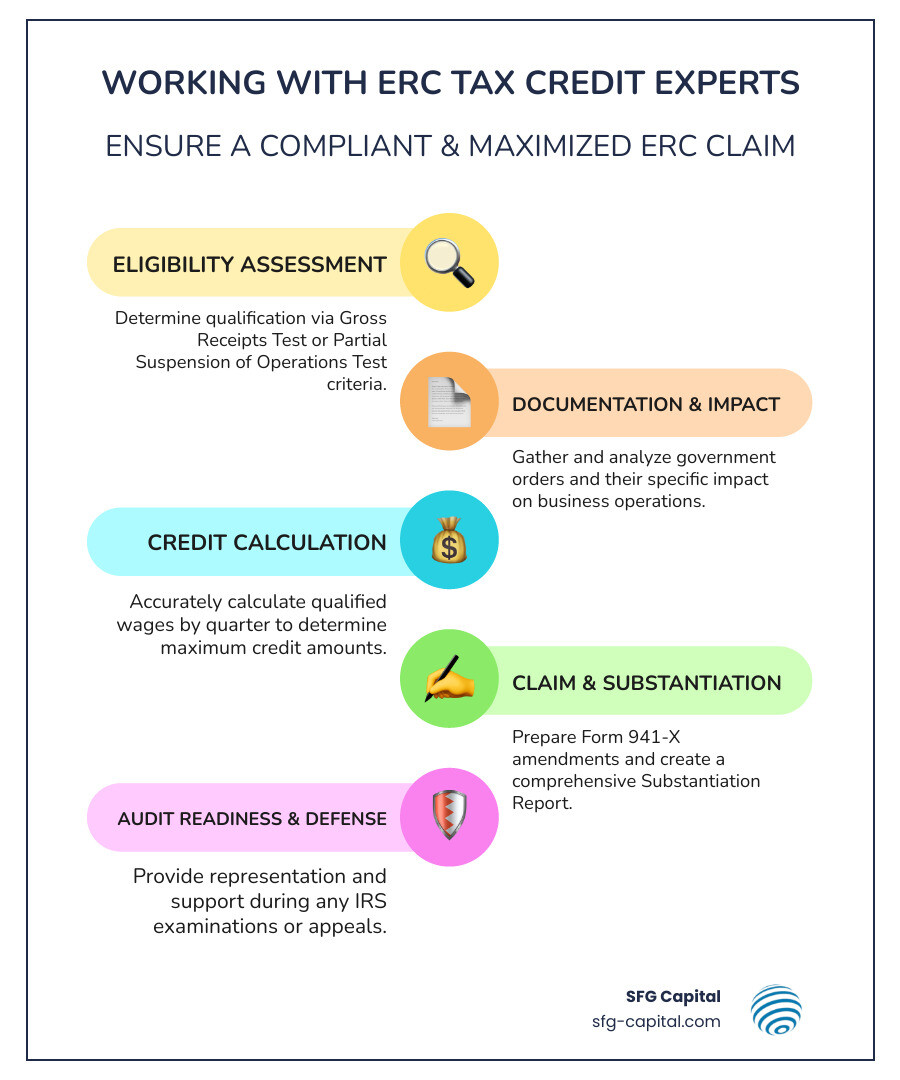

ERC tax credit experts help businesses steer the complex Employee Retention Credit program, maximize refunds, and defend claims against IRS audits. Here’s what top ERC advisors provide:

- Eligibility Assessment – Verify if your business qualified under the Gross Receipts Test or Partial Suspension of Operations Test

- Claim Calculation – Review and confirm maximum credit amounts for 2020 and 2021 qualified wages

- Documentation Support – Prepare comprehensive ERC Substantiation Reports with government order analysis

- Audit Defense – Represent you during IRS examinations, appeals, and litigation if needed

- Expedited Funding – Offer advance funding options for claims still facing long IRS processing delays

The Employee Retention Credit was created under the CARES Act to help businesses keep employees on payroll during the COVID-19 pandemic. Businesses that claimed the Employee Retention Credit for wages paid between March 12, 2020, and January 1, 2022, secured significant refunds—up to $26,000 per employee.

But defending ERC claims has become increasingly risky. With the filing deadlines now passed, the IRS has fully shifted its focus to enforcement. ERC claims remain at the highest level of internal concern due to widespread fraud, and the agency is aggressively auditing claims, often years after they were filed. Businesses with questionable claims face significant risk.

Unlike general CPAs who handle various tax matters, specialized ERC experts focus exclusively on this complex payroll tax credit. Most bookkeepers and even experienced CPAs lack the niche expertise required to steer the intricate eligibility tests, calculate credits correctly, and prepare audit-proof documentation. As one industry source noted, “The ERC is highly complicated and requires specialized knowledge” that goes beyond typical tax preparation.

The stakes are high. An incorrectly claimed ERC can result in full repayment of the credit plus interest and penalties. In fraud cases, criminal charges are possible. Meanwhile, businesses that legitimately claimed the credit risk losing it without expert audit defense.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer over $500 million in ERC claims by working with experienced ERC tax credit experts who prioritize compliance and documentation integrity. Our approach focuses on conservative risk management and careful eligibility analysis to protect your business while defending legitimate credits.

Understanding the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a refundable payroll tax credit that emerged from the Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law in late March 2020. This vital piece of COVID-19 relief was designed to support businesses during the economic upheaval caused by the pandemic, specifically by encouraging them to keep employees on their payroll. The ERC is not a loan; it’s a direct credit against employment taxes, meaning it does not need to be repaid.

Businesses that maintained employees and paid qualified wages between March 12, 2020, and before January 1, 2022, were eligible for significant ERC benefits. The credit structure was quite generous, offering money for each employee in 2020 and even more per employee for each of the first three quarters of 2021. For a deeper dive into how this funding works, explore our guide on What is ERC Funding?.

What Was the Original Goal of the ERC?

The original goal of the ERC program was straightforward: to provide economic relief to businesses severely impacted by the COVID-19 pandemic. The government recognized that widespread shutdowns and economic uncertainty would lead to mass layoffs, exacerbating an already dire situation. By offering a substantial tax credit, the ERC aimed to incentivize employers to retain their workforce, even if their operations were suspended or their revenue declined. This payroll support was a lifeline for many businesses, helping them weather the storm and keep their teams intact during an unprecedented crisis.

Who is the ERC For?

The ERC was primarily designed for small to medium-sized businesses across various industries. Generally, businesses with W-2 employees that operated during the qualifying periods (March 12, 2020, to January 1, 2022) are the target beneficiaries. Specifically, businesses may have qualified if they employed fewer than 500 full-time employees in 2019 and either:

- Suffered a significant decline in gross receipts, or

- Were impacted by a government order that led to a partial suspension of operations.

This broad eligibility means that a wide range of employers, from local shops in Travis County to larger businesses across Austin, could potentially benefit from this credit.

Navigating Complex ERC Eligibility Requirements

Determining eligibility for the ERC was often where the complexity began. It was not a simple checkbox exercise, which is why working with ERC tax credit experts remains so valuable for audit defense. There were two primary paths to qualification, each with its own nuances and requirements. Additionally, factors like employee count thresholds, the interaction with PPP loans, and what constituted “qualified wages” all played a critical role. Our ERC Credit Complete Guide offers an in-depth look at these historical requirements.

The Two Main Qualification Tests Explained

To have qualified for the ERC, a business must have met one of two main tests:

Gross Receipts Test: This test focused on the business’s revenue.

- For 2020, an employer qualified if their gross receipts for a calendar quarter were less than 50% of their gross receipts for the same calendar quarter in 2019. Eligibility continued until the quarter in which gross receipts were greater than 80% of gross receipts for the same calendar quarter in 2019.

- For 2021, the threshold was lowered. An employer qualified if their gross receipts for a calendar quarter were less than 80% of their gross receipts for the same calendar quarter in 2019. Businesses could also elect to look at the immediately preceding calendar quarter and compare it to the corresponding 2019 quarter to determine eligibility.

Partial Suspension of Operations Test: This test was often more subjective and requires careful documentation. An employer qualified if its operations were fully or partially suspended due to an order from a governmental authority limiting commerce, travel, or group meetings due to COVID-19. Key components for eligibility under this test included:

- An Effective and Involuntary Government Order Limiting Business Operations: This meant a governmental order actually restricted the business’s ability to operate in its normal capacity.

- The Business Was Affected in More Than a Nominal Way: The impact of the government order had to be significant, typically meaning a reduction of at least 10% in gross receipts for that portion of the business, or a reduction of at least 10% of the business’s total hours of service.

This test could also extend to supply chain disruptions. If a business experienced a partial suspension due to government orders impacting its suppliers, making it unable to obtain critical goods or materials, it might have qualified. However, eligibility via supply chain disruption requires more stringent and contemporaneous documentation to prove the direct link between the government order, the supply chain interruption, and the business’s operational impact.

For more official guidance, you can find More about the ERC program on the official IRS page.

Key Differences: 2020 vs. 2021 ERC Rules

The ERC program saw significant changes between 2020 and 2021, making it even more challenging to steer without expert guidance. Here’s a quick comparison of the key differences:

| Feature | 2020 Rules | 2021 Rules (Q1-Q3) |

|---|---|---|

| Credit Percentage | 50% of qualified wages | 70% of qualified wages |

| Per-Employee Credit Cap | Up to $5,000 per employee for the entire year | Up to $7,000 per employee per quarter |

| Maximum Credit | Up to $5,000 per employee | Up to $21,000 per employee (for 3 quarters) |

| Employee Count (Full-Time Equivalent) | 100 or fewer FTEs in 2019 for all wages | 500 or fewer FTEs in 2019 for all wages |

| Gross Receipts Decline Threshold | 50% decline compared to same 2019 quarter | 20% decline compared to same 2019 quarter (or prior quarter) |

| Qualifying Period | March 13 – December 31, 2020 | January 1 – September 30, 2021 |

As you can see, the eligibility criteria expanded, and the potential credit amount significantly increased in 2021. This means many businesses that didn’t qualify in 2020 might have qualified in 2021, and vice-versa.

Could You Claim ERC if You Received a PPP Loan?

Initially, businesses that received a Paycheck Protection Program (PPP) loan were prohibited from claiming the ERC. However, legislative changes later removed this restriction, allowing businesses to benefit from both programs. The key was that the same wages could not be used for both credits. This meant a business could not claim ERC for wages that were paid with forgiven PPP loan proceeds.

Navigating this interaction required meticulous record-keeping and careful calculation to ensure non-overlapping wages. Our ERC tax credit experts are adept at untangling these complexities, ensuring businesses maximized both relief opportunities without running afoul of IRS rules. For further assistance, check out our Employee Retention Credit Help.

The Current IRS Landscape: Increased Scrutiny and Delays

The ERC program, while a critical lifeline for many, unfortunately became a magnet for improper claims and outright fraud. With the filing deadlines now passed, the IRS has fully shifted its resources from processing to intense scrutiny and enforcement. This post-deadline landscape means that any business that claimed the ERC, even with a legitimate claim, faces a heightened risk of audit for years to come.

This climate of caution means that if your business has an outstanding claim, or is concerned about a previously filed one, understanding the current environment is paramount. We discuss these challenges further in The Waiting Game: Understanding and Overcoming ERC Refund Delays.

Why the IRS Is Cracking Down on ERC Claims

The IRS’s crackdown is a direct response to the proliferation of aggressive marketing tactics by some less scrupulous ERC preparers, which led to a surge in ineligible claims. Many businesses were advised to claim the credit without proper qualification, often lacking the necessary documentation to support their eligibility. This widespread abuse threatened the integrity of the program.

The IRS is now focused on protecting the program’s integrity and ensuring compliance. They are actively investigating and pursuing those who have engaged in fraudulent ERC claims. For businesses, this translates into a heightened risk of audits, potential repayment of the credit with interest, and steep penalties if claims are found to be incorrect or unsubstantiated. In severe cases of fraud, criminal charges are a real possibility. The IRS has issued strong warnings about these risks, which you can read more about in their IRS warning on improper claims.

The Post-Deadline Era: Audits and Compliance

With the window for filing new claims now closed, the ERC landscape is defined by audits and compliance checks. Here’s what businesses need to know:

- Filing Deadlines Have Passed: The deadline to claim the ERC for 2020 wages was April 15, 2024, and the deadline for 2021 wages was April 15, 2025. No new claims can be submitted.

- Long Audit Window: The IRS has an extended statute of limitations to audit ERC claims—at least five years from the filing date. This means businesses can face scrutiny and potential clawbacks well into the future.

- Ongoing Enforcement: The IRS continues to aggressively pursue improper claims through civil audits and criminal investigations. Businesses that used aggressive preparers or filed without robust documentation are at the highest risk.

- Claim Withdrawal and Amendment: For businesses that now question the validity of their claim, the IRS has provided pathways for withdrawal or amendment to mitigate future penalties. Navigating this requires expert guidance.

For businesses in Austin and Travis County facing uncertainty or long waits for their already-filed claims, our team at SFG Capital understands the urgency. We offer solutions to help bridge the gap, which you can learn more about in Expediting Your ERC Refund: What You Need to Know.

Why You Need Specialized ERC Tax Credit Experts

In today’s post-deadline environment of intense IRS scrutiny, the need for specialized ERC tax credit experts is more critical than ever. The focus has shifted from filing claims to defending them. Unlike general accountants or CPAs, our specialists focus solely on the ERC, giving them unparalleled expertise in navigating complex audits and ensuring your claim is fully defensible.

This niche expertise is critical for navigating the intricate payroll tax laws, performing complex calculations, and building a robust defense against potential IRS audits. Our goal is to protect your claim and ensure it is fully defensible. Our Employee Retention Credit Specialist Guide provides more details on what we bring to the table.

General CPA vs. ERC Specialist: What’s the Difference?

The distinction between a general CPA and an ERC tax credit expert is significant, especially in today’s heightened scrutiny environment. Here’s why the difference matters:

- Dedicated Focus: General CPAs manage a wide array of tax services. While competent, they rarely have the time or resources to fully immerse themselves in the constantly evolving, complex legislation surrounding the ERC. An ERC specialist, however, dedicates all their focus to this one credit, becoming true masters of its nuances.

- Deep Legislative Knowledge: The ERC legislation is extensive and has undergone several amendments. Specialists possess deep, up-to-the-minute knowledge of every code section, IRS notice, and FAQ.

- Experience with IRS Audits: ERC experts have direct experience dealing with IRS inquiries and audits specifically related to the credit. They know what the IRS looks for and how to present a claim that stands up to scrutiny.

- Risk Assessment: Our specialists conduct thorough risk assessments of previously filed claims, identifying potential pitfalls and protecting your business from future liabilities.

As one industry expert noted, “Most payroll providers and other professionals do not have the time and resources needed to fully immerse themselves in the complex legislation and other moving parts of the ERTC.” This is why many CPAs even refer their clients to specialized ERC firms. We invite you to learn more about Our Services and how our dedicated team can benefit you.

How ERC Tax Credit Experts Ensure a Defensible Claim

The key to a successful and defensible ERC claim lies in thorough documentation and a clear narrative. This is precisely where specialized ERC tax credit experts excel, particularly through the creation of an ERC Substantiation Report.

An ERC Substantiation Report is a comprehensive document that carefully details your business’s eligibility for the credit. It’s not just a collection of papers; it’s a carefully constructed argument designed to withstand IRS examination. Our reports include:

- Detailed Qualification Analysis: An articulation of your ERC qualification, featuring an in-depth analysis of code sections, the methodology used, and the specific facts of your taxpayer situation.

- Substantive Government Orders and Timelines: A thorough compilation of all relevant government orders that impacted your business operations, complete with timelines and analysis of their direct effect.

- Impact Assessment: A clear explanation of how these government orders led to a partial suspension of operations or how your business experienced a significant decline in gross receipts. This includes analyzing the “nominal impact” criteria for partial suspensions and, for supply chain claims, demonstrating the direct link to government orders.

- Wage Calculations and Allocation: A transparent breakdown of how qualified wages were identified and calculated, ensuring accuracy and compliance with all ERC rules, including interaction with PPP loans and health expenses.

- Document Readiness: A compilation of all supporting documentation, making it easy to present to the IRS in the event of an audit.

With the IRS’s heightened scrutiny, an ERC Substantiation Report is highly recommended. It analyzes the credit through the lens of factors the IRS considers, compiles documentation needed in case of an examination, and gives taxpayers confidence in the legality of their claimed credits. This proactive approach ensures your claim is not only accurate but also audit-ready. You can explore Our Process for more details.

Services Offered Beyond Claim Filing

Our commitment as ERC tax credit experts extends far beyond simply preparing and filing your initial claim. We understand that the ERC journey can be fraught with challenges, especially with increased IRS scrutiny. That’s why we offer a comprehensive suite of services to support our clients every step of the way:

- Audit Representation: Should your ERC claim be selected for an IRS audit, our experts will stand by you, providing full representation and handling all communications with the IRS on your behalf.

- IRS Appeals: If a claim is denied or partially disallowed, we assist with the appeals process, building a strong case to challenge the IRS’s determination.

- ERC Litigation Support: In rare cases where administrative remedies are exhausted, we can provide support for litigation, including preparing necessary documentation and working with legal counsel if a refund suit is required in federal court.

- Second Opinions on Existing Claims: If you’ve already filed an ERC claim with another provider and have concerns about its accuracy or defensibility, we offer second opinion services to assess its validity and identify potential risks or missed opportunities.

- Claim Withdrawal Assistance: For businesses that suspect their previously filed claim might be incorrect or fraudulent, we can guide you through the IRS’s voluntary disclosure or withdrawal process to mitigate future penalties.

These advanced services highlight the critical difference between a general tax preparer and a specialized ERC tax credit expert. We are here to ensure your business is protected and your legitimate credits are secured, even in the face of complex IRS challenges.

Frequently Asked Questions about Finding ERC Help

We understand you likely have many questions about the ERC and how to find the right expertise. Here are some of the most common questions we encounter:

The ERC filing deadlines have passed. Why do I still need an expert?

Even though new claims can no longer be filed, the risk associated with previously filed claims is at an all-time high. The IRS has a five-year statute of limitations to audit ERC claims, meaning your business could face an examination years from now. ERC tax credit experts are essential for audit defense, reviewing the validity of your original claim, preparing a robust substantiation report, and representing you before the IRS to protect the funds you’ve received.

What are the risks of an incorrectly filed ERC claim?

The risks of an incorrectly filed ERC claim are significant and can have serious consequences for your business. The IRS has made it clear that they are cracking down on improper claims. If your claim is found to be incorrect, you could face:

- Repayment of the Credit: You will likely be required to repay the entire credit amount you received.

- Interest and Penalties: In addition to repayment, the IRS can impose substantial interest and penalties on the incorrect claim.

- IRS Audit: An incorrect claim can trigger a full audit of your business, extending beyond just the ERC.

- Criminal Charges: In cases where fraud is suspected, the IRS is actively pursuing criminal charges against those who knowingly submitted false claims.

Given these severe potential consequences, it is paramount to ensure your ERC claim was accurate, legitimate, and fully substantiated from the outset.

What should I look for in top ERC tax credit experts?

When seeking ERC tax credit experts, especially in a complex and high-stakes environment like the current one, it’s crucial to choose wisely. Here’s what we recommend looking for:

- Dedicated ERC Team: Look for a firm with a team solely focused on ERC. This specialization ensures deep, up-to-date knowledge of the changing regulations.

- Transparent and Performance-Based Fee Structure: A reputable expert should offer clear pricing, ideally a performance-based fee, meaning they get paid a percentage of the credit you receive, aligning their success with yours.

- Clear Process for Substantiation: Inquire about their process for documenting and substantiating claims. They should provide a comprehensive ERC Substantiation Report that details eligibility and calculations, making your claim audit-ready.

- Experience with IRS Audits and Appeals: Given the current IRS scrutiny, choose experts with a proven track record of successfully navigating IRS audits, appeals, and even litigation if necessary.

- Conservative and Compliant Approach: Prioritize experts who emphasize compliance and conservative eligibility assessments over aggressive, “too good to be true” promises. They should focus on maximizing your legal credit, not just any credit.

Conclusion: Secure Your ERC with Confidence

Navigating the Employee Retention Credit program is undoubtedly complex and carries significant risks, but for eligible businesses, the rewards were substantial. Partnering with true ERC tax credit experts ensures your claim is not only accurate and maximized but also fully defensible against potential IRS audits. Without specialized guidance, you risk having your legitimate claim denied on audit or, worse, exposing your business to a full clawback of the credit plus severe penalties and interest.

For businesses in Travis County, Austin, and beyond, our team at SFG Capital is here to help you steer this intricate landscape. We understand the urgency of accessing your rightful funds, especially with the current IRS processing delays. That’s why we offer ERC Refund Advance options, providing you with quick access to your capital while your claim is processed. Don’t let the threat of an audit or ongoing delays jeopardize the vital funds your business has claimed. Work with specialists who prioritize compliance, accuracy, and your business’s peace of mind.