Understanding IRS Refund Processing and When You Can Speed It Up

Expedite IRS refund requests are only granted by the IRS in specific circumstances, primarily when a taxpayer faces documented financial hardship. Here’s what you need to know:

Can You Expedite an IRS Refund?

- Yes, but only in limited cases: The IRS may expedite a refund if you’re experiencing severe financial hardship (imminent eviction, utility shut-off, inability to buy medicine or food)

- Contact the IRS at 1-800-829-1040 to explain your situation and provide documentation

- File Form 911 with the Taxpayer Advocate Service if phone contact is unsuccessful

- Important limitations: The IRS cannot expedite refunds held for EITC/ACTC before February 15th, or refunds offset for non-IRS debts like student loans or child support

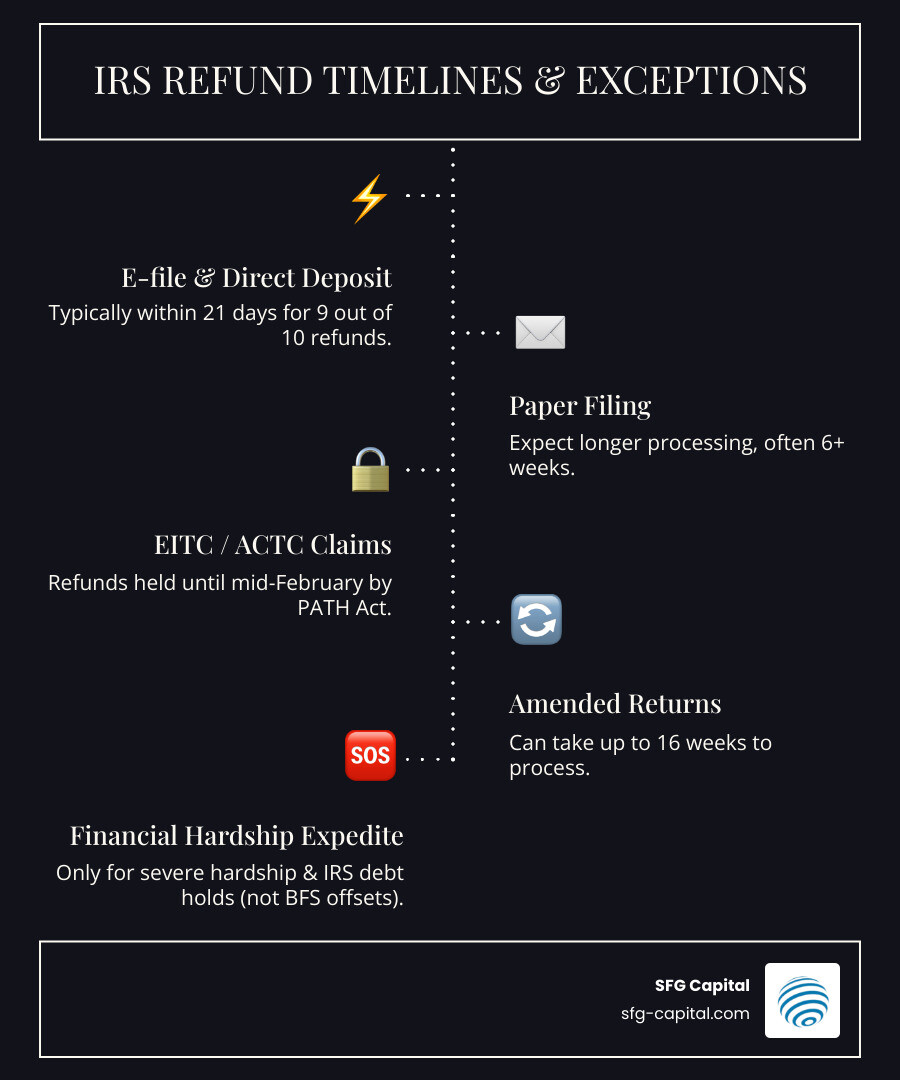

Most taxpayers receive their refunds within 21 days when filing electronically with direct deposit—the IRS issues more than 9 out of 10 refunds in less than 21 days. However, certain situations like claiming the Earned Income Tax Credit, filing errors, or processing backlogs can extend this timeline significantly.

If you’re facing financial difficulty due to a delayed refund, understanding the official IRS process for expedited refunds is critical. The IRS can only expedite refunds held to pay an IRS debt, not refunds offset by the Bureau of the Fiscal Service for other federal debts.

I’m Santino Battaglieri, and through my work at SFG Capital, I’ve helped businesses steer complex IRS refund situations, particularly around Employee Retention Credit claims where processing delays have created significant cash flow challenges. Understanding how to expedite IRS refund processing—and when it’s actually possible—can make the difference between financial hardship and stability.

Standard Refund Timelines: What to Expect and What Causes Delays

When you file your tax return, we all eagerly anticipate that refund hitting our bank account. The good news is that for most taxpayers, this process is fairly swift. The IRS aims to issue more than 9 out of 10 refunds in less than 21 days. This 21-day goal is typically met for those who file their tax returns electronically (e-file) and opt for direct deposit. This combination is, without a doubt, the fastest way to receive your refund.

However, not everyone experiences this speedy turnaround, and understanding why can help manage expectations and avoid unnecessary stress.

Factors Influencing Your Refund Timeline

1. Filing Method:

- E-file with Direct Deposit: As mentioned, this is the gold standard for speed. Once your e-filed return is accepted, you can often check its status within 24 hours, and the refund could be in your account within the 21-day window.

- Paper Filing: If you’re old school and prefer to mail in your tax return, expect a longer wait. The IRS advises waiting at least six weeks after mailing your return before contacting them about its status. Processing paper returns simply takes more time due to manual entry and handling.

2. Common Return Errors and Incomplete Information:

The IRS’s systems are designed to flag inconsistencies. If your tax return contains errors, is incomplete, or has discrepancies, it will likely be pulled for additional review. This can significantly delay your refund. Even a small typo can cause a headache, turning that 21-day wait into a much longer one. We always double-check our returns before submission to avoid these common pitfalls.

3. Identity Theft and Fraud Review:

The IRS takes identity theft and refund fraud very seriously. To combat these issues, they have robust systems in place. If your return is flagged for potential identity theft or fraud, it will undergo a more thorough review, which, while necessary, will extend the processing time. This is often an unseen delay, but a critical one for protecting taxpayer funds.

4. The PATH Act and Certain Credits:

A significant factor affecting refund timelines, particularly for many families in Travis County and across the U.S., is the Protecting Americans from Tax Hikes (PATH) Act. This law, enacted in 2015, mandates that the IRS cannot issue refunds before mid-February if your return claims the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). This hold applies to the entire refund amount, not just the portion related to these credits.

So, even if you file your return on January 1st and claim EITC or ACTC, don’t expect your refund to hit your account before mid-February. The IRS typically expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by the first week of March, provided there are no other issues with the tax return and direct deposit was chosen. This measure was put in place to give the IRS more time to detect and prevent fraud involving these refundable credits. It’s a bit of a waiting game, but it’s for a good cause!

How to Genuinely Expedite an IRS Refund: The Financial Hardship Exception

While we all wish for a faster refund, the reality is that the IRS has strict procedures. The term “expedite IRS refund” isn’t thrown around lightly. It primarily applies to situations of severe financial hardship. The IRS may be able to expedite a refund, but only under specific, documented conditions. This is not a general “speed up” option; it’s a lifeline for those truly in dire straits.

The key distinction here is that the IRS can only expedite a refund that they are holding to pay an IRS debt. If your refund is being offset by the Bureau of the Fiscal Service (BFS) for debts other than federal tax debts—like past due student loans, child support, state unemployment compensation, or other federally insured debt—even with a serious financial hardship, the IRS cannot issue you a refund. It’s a tough pill to swallow, but it’s important to understand this limitation upfront.

For more detailed information on various refund hold scenarios, you can visit the Taxpayer Advocate Service’s page on More about refund holds.

What Qualifies as a Financial Hardship?

The IRS defines financial hardship in serious terms. We’re talking about situations where the delay in receiving your refund could lead to significant and immediate harm. Here are the specific types of financial hardship that generally qualify for consideration:

- Imminent Eviction or Foreclosure: If you’ve received an eviction notice from your landlord or a foreclosure notice from your mortgage lender, showing you’re at risk of losing your home.

- Utility Shut-off Notice: If you’ve received a notice that your essential utilities (electricity, gas, water) are about to be disconnected, posing a risk to your health or safety.

- Inability to Buy Necessary Medicine or Food: If you genuinely cannot afford critical medication or basic foodstuffs for yourself or your family.

To prove such hardship, you’ll need to provide clear, documented evidence. This isn’t just about saying you’re struggling; it’s about showing it with official paperwork. Examples of documents you might need include:

- Eviction or foreclosure notices

- Utility shut-off notices

- Medical bills or prescriptions

- Correspondence from creditors

- Bank statements showing insufficient funds

How to Request to Expedite an IRS Refund

If you find yourself in one of these truly difficult situations and believe your refund is being held by the IRS (not offset by BFS for other debts), here’s how we recommend you proceed:

- Gather Your Documentation: Before you make the call, collect all the necessary documents that clearly demonstrate your financial hardship. This will make your case much stronger.

- Contact the IRS Directly: The most direct route is to call the IRS at 1-800-829-1040. When you get through to a representative, clearly and calmly explain your financial hardship situation. Be prepared to articulate how the delayed refund is causing immediate and significant harm.

- Be Persistent and Polite: The IRS processes millions of returns, and getting through to the right person can sometimes take time. Remain patient and polite, but firm in explaining your urgent need.

- Follow Up: If you don’t hear back within a reasonable timeframe, or if you’re unsure about the status of your request, don’t hesitate to follow up. Keep a record of who you spoke to, when, and what was discussed.

What Limits the Ability to Expedite an IRS Refund?

Even with a legitimate financial hardship, there are specific situations where the IRS’s hands are tied, and they simply cannot expedite IRS refund processing:

- PATH Act Holds Before Mid-February: As we discussed, if your refund involves the EITC or ACTC, the IRS is legally prohibited from issuing it before mid-February, regardless of any financial hardship. Neither the IRS nor the Taxpayer Advocate Service can override this statutory requirement. This is a hard stop.

- Bureau of the Fiscal Service (BFS) Offsets: This is a crucial point. If your refund has been offset to pay debts other than federal tax debts (e.g., past-due student loans, unpaid child support, state unemployment compensation, or other federally insured debts), the IRS cannot release those funds to you. The BFS, not the IRS, handles these offsets, and once the refund is sent to the BFS, the IRS loses control over it. Even with extreme hardship, the IRS cannot intervene in these cases.

- State Tax Obligations: Similarly, if you owe state taxes in Texas or any other state, and your federal refund is being held or offset for that purpose, the IRS generally cannot expedite its release.

It’s a complex system, and understanding these limitations is key to setting realistic expectations when you’re trying to expedite a refund.

Your Ally in Tax Issues: The Taxpayer Advocate Service (TAS)

Sometimes, despite your best efforts, resolving an IRS issue directly can feel like navigating a labyrinth. That’s where the Taxpayer Advocate Service (TAS) comes in. TAS is an independent organization within the IRS that acts as a voice for taxpayers. Their primary mission is to help taxpayers and protect their rights, ensuring that everyone is treated fairly and understands their rights under the Taxpayer Bill of Rights.

We recommend contacting TAS if your tax problem is causing financial difficulty, you’ve tried to resolve your issue directly with the IRS but haven’t succeeded, or you believe an IRS system, process, or procedure isn’t working as it should. They are an invaluable resource for citizens in Travis County and across the nation facing IRS challenges.

You can learn more about how TAS can assist with refund issues, including specific guidance on expediting a refund, by visiting their dedicated page: Information on TAS assistance.

How TAS Can Help with Refund Delays

When you reach out to TAS, they can offer a unique level of support:

- Independent Review: As an independent body, they can review your case from an impartial standpoint, often identifying solutions or avenues that might not be apparent through standard IRS channels.

- Case Assignment: If your situation meets their criteria (typically involving significant hardship or systemic issues), TAS will assign you a caseworker. This advocate will work directly with you and the IRS to resolve your problem.

- Interacting with the IRS on Your Behalf: Your TAS advocate can communicate directly with the IRS offices that are holding your refund, acting as your liaison. This can be incredibly helpful, as they understand the internal workings of the IRS and can often cut through bureaucratic red tape.

- Form 911, Request for Taxpayer Advocate Service Assistance: If you’ve been unable to get help through regular IRS channels, you can formally request TAS assistance by filing Form 911. This form outlines your problem and the relief you’re seeking.

- Resolving Systemic Issues: Beyond individual cases, TAS also works to identify and address systemic problems within the IRS that negatively affect taxpayers. So, by helping you, they might also be paving the way for smoother processes for everyone else down the line.

TAS is there to help when you feel stuck. They are a valuable resource for taxpayers who feel overwhelmed or unheard by the standard IRS processes.

Tracking, Troubleshooting, and Recovering Your Refund

While the focus of this article is on how to expedite IRS refund processing, a crucial part of the refund journey involves proactive monitoring and knowing how to troubleshoot common issues. A little vigilance can go a long way in ensuring your refund arrives as expected. Keeping diligent records of your tax filing, any correspondence with the IRS, and bank account information is always a best practice.

Checking Your Refund Status

The IRS provides excellent tools for tracking your refund, which we strongly encourage everyone to use:

- “Where’s My Refund?” Tool: This online tool on the IRS website is your go-to resource. It’s available at “Where’s My Refund?”. You can typically start checking your refund status within 24 hours after an e-filed return is received, or about four weeks after mailing a paper return. The tool updates once a day, usually overnight, so checking multiple times a day won’t give you new information.

- IRS2Go Mobile App: For convenience on the go, the IRS offers the IRS2Go mobile app, available at IRS2Go mobile app. This app provides the same “Where’s My Refund?” functionality, allowing you to check your status from your smartphone or tablet.

To use either of these tools, you’ll need three pieces of information from your tax return:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your filing status (e.g., Single, Married Filing Jointly).

- The exact whole dollar amount of your expected refund.

Once you enter this information, the tools will show you your refund’s progress through three stages:

- Return Received: The IRS has received your tax return.

- Refund Approved: Your refund has been approved, and a date is provided for when it will be sent.

- Refund Sent: Your refund has been sent via direct deposit or mailed as a paper check.

What If Your Refund is Lost, Stolen, or Sent to the Wrong Account?

It can be incredibly frustrating when your refund doesn’t arrive as expected. Here’s what to do in those scenarios:

- Lost or Stolen Paper Checks: If your paper refund check was mailed and you haven’t received it, or if you believe it was stolen, you can generally file an online claim for a replacement check if it has been more than 28 days from the date the IRS mailed your refund. The “Where’s My Refund?” tool will often provide specific instructions if this applies to your situation. You may need to initiate a refund trace with the IRS, which is a process where they investigate the status of the check.

- Incorrect Direct Deposit Information: Oh, the dreaded wrong numbers! If you accidentally entered an incorrect bank account or routing number on your tax return, the IRS is not responsible for retrieving those funds. Your first step should be to contact your bank or credit union immediately. If they can’t help, you’ll need to file Form 3911, Taxpayer Statement Regarding Refund with the IRS. While the IRS will contact the institution and try to help, they cannot force the bank or credit union to return the funds. This highlights the importance of double-checking all bank details before filing!

In any of these situations, act promptly and follow the IRS’s prescribed procedures.

Conclusion: Navigating Your Refund Process

Navigating IRS refunds can sometimes feel like a puzzle, but with the right knowledge and tools, we can approach it with confidence. While the dream of a magically fast refund is often just that—a dream—we’ve learned that the most reliable path to a timely refund is to:

- File Electronically (E-file): This is consistently the fastest processing method.

- Opt for Direct Deposit: It’s quicker, safer, and more convenient than waiting for a paper check.

- Ensure Accuracy: Double-check every detail on your tax return to avoid errors that can cause significant delays.

- Understand Limitations: Be aware of the PATH Act holds for EITC/ACTC and the strict rules regarding financial hardship, especially the distinction between IRS-held refunds and BFS offsets for other debts.

- Use IRS Tools: Regularly check your status using the “Where’s My Refund?” tool or the IRS2Go app.

- Know Your Allies: If you face genuine hardship or unresolved issues, remember the Taxpayer Advocate Service (TAS) is there to help.

The ability to expedite IRS refund processing is reserved for cases of severe financial hardship where the IRS is holding your refund due to an internal issue or prior tax debt. It’s not a general option for those who simply want their money faster.

For businesses in Travis County and across the U.S. facing delays with the Employee Retention Credit (ERC), we at SFG Capital understand the unique challenges these delays pose to your cash flow. We specialize in helping businesses like yours steer these complex situations. If you’re caught in “the waiting game” for your ERC refund, our specialized solutions can provide crucial liquidity. We offer advances and buyouts to help you bypass IRS delays, ensuring quick access to the funds your business needs. Explore our ERC Funding Solutions to learn more about how we can assist you in getting your money sooner. You can also dive deeper into how we specifically help with ERC Refund Advance options. We’re here to help you turn those pending credits into immediate working capital.