The Ongoing ERC Backlog Crisis: What Business Owners Need to Know in 2026

ERC refund delays continue to impact thousands of businesses that filed claims during the pandemic era. If you’re still waiting on your Employee Retention Credit refund in 2026, here’s what you need to know:

Current Status of ERC Claims in 2026:

- Remaining Backlog: Hundreds of thousands of claims from 2020-2024 still pending

- Extended Wait Times: Many businesses have been waiting 2+ years for refunds

- Processing Updates: IRS continues working through the backlog from claims filed before the program ended

- Why It Matters Now: Businesses need resolution to close out pandemic-era tax matters and access funds they’re legally entitled to receive

For many businesses, the Employee Retention Credit was supposed to be a financial lifeline during the COVID-19 pandemic. Congress created this refundable tax credit to help businesses keep employees on the payroll during government-mandated shutdowns and economic disruptions that occurred in 2020 and 2021.

But years later, that lifeline remains out of reach for many.

What was meant to provide relief during the pandemic has become a multi-year waiting game. The IRS, overwhelmed by the flood of claims received before the program’s closure and concerned about widespread fraud from aggressive promoters, implemented various processing moratoriums and improved review procedures. The result? Even in 2026, legitimate claims filed years ago remain stuck in limbo, with businesses that followed all the rules still waiting for their rightful refunds.

The impact continues to be real. Businesses are forced to operate without funds they budgeted for years ago, postpone critical investments, or struggle with cash flow issues while waiting for refunds from claims filed during the pandemic. Some have been forced to close their doors because they couldn’t afford to wait any longer.

I’m Santino Battaglieri, and through my work at SFG Capital, I’ve helped businesses steer the complexities of ERC refund delays and access their capital when waiting isn’t an option. Having worked with over $500 million in ERC claims, I’ve seen how these ongoing delays impact real businesses and what can be done about it even years after filing.

Why ERC Refunds Remain Delayed: Understanding the Ongoing Challenges

The persistent ERC refund delays that businesses face in 2026 stem from a complex web of factors that began during the pandemic and continue to affect claim processing today. Understanding these ongoing challenges helps explain why many businesses are still waiting for refunds from claims filed years ago.

The Employee Retention Credit (ERC) was created by Congress as part of the CARES Act to help businesses retain employees during the COVID-19 pandemic. It provided financial relief to businesses that experienced a significant decline in gross receipts or were suspended due to government orders during 2020 and 2021. However, the sheer volume of claims submitted before the program ended, coupled with a surge in aggressive promoters, led to widespread concerns about fraud that continue to affect processing today.

In response to fraud concerns, the IRS took drastic measures that still impact claim processing. The September 2023 moratorium on processing new ERC claims, while aimed at combating fraudulent claims and protecting taxpayers, created a massive backlog that the IRS continues to work through. The agency noted that many claims were submitted based on flawed advice from “ERC mills” that often overstated eligibility or made false promises, requiring extensive review of all pending claims.

Resource constraints within the IRS continue to play a significant role in 2026. The agency, still working with limited resources and aging IT infrastructure, faces the ongoing challenge of processing the remaining complex ERC claims while managing current tax year responsibilities. Modernization efforts are underway, but the backlog from pandemic-era claims remains substantial. As the IRS manages its regular 2026 filing season responsibilities, resources for processing older ERC claims remain limited.

The IRS’s ongoing digitization efforts continue to affect processing times. While crucial for long-term efficiency, the process of converting older paper claims into digital formats adds complexity and time to current processing. This challenge, combined with limited communication from the IRS about specific claim statuses, leaves many businesses still frustrated and uncertain about when they’ll receive refunds from claims filed during the pandemic era. As the IRS Commissioner previously signaled, the agency entered a new phase of ERC work, with additional procedures in place to deal with fraud risk, as highlighted in this news release from the IRS.

The Current State of ERC Refund Delays in 2026

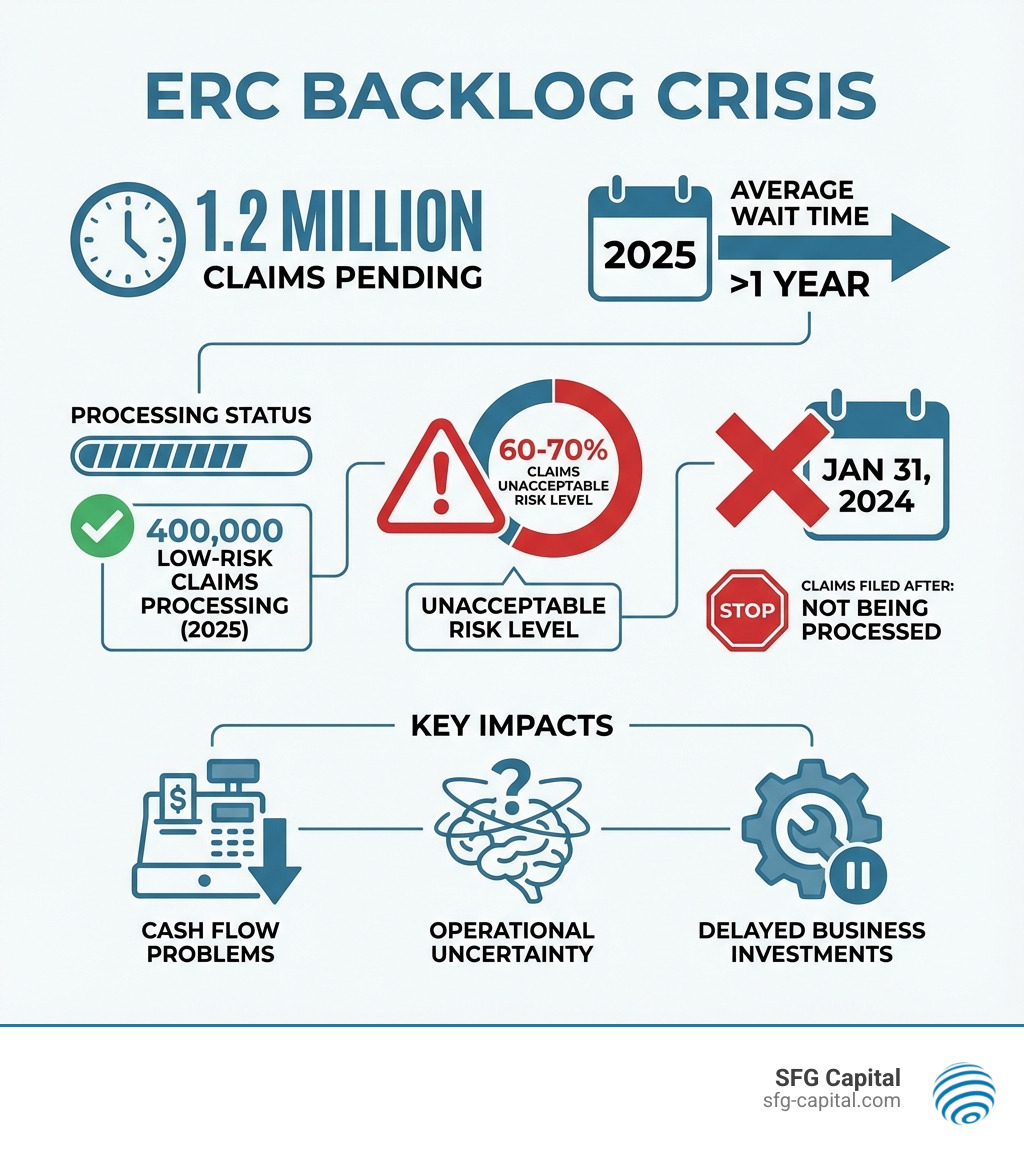

The numbers paint a concerning picture of the ongoing scale of ERC refund delays even years after the program ended. While the IRS has made progress since the initial 1.2 million claim backlog reported in late 2024, hundreds of thousands of legitimate claims remain unprocessed. Many businesses have now been waiting for more than two years to receive their refunds, a wait that continues to strain their financial resources.

The IRS’s categorization of ERC claims into risk groups continues to influence processing: claims identified as “High Risk” or showing an “Unacceptable Level of Risk” face the most scrutiny and longest delays. While the agency announced plans in 2024 to process about 400,000 “low-risk” ERC claims totaling approximately $10 billion, many of these remain in process, and higher-risk claims face even longer waits. This move, as detailed in IR-2024-169, provided hope for some, but businesses with claims requiring additional review continue to wait.

For businesses that filed claims before the January 31, 2024 deadline, the wait continues with no clear end in sight. The IRS has not provided updated timelines for processing the remaining backlog, adding to the ongoing uncertainty businesses face in 2026.

How Ongoing Fraud Prevention Measures Continue to Cause Delays

The IRS’s continued focus on fraud prevention remains a significant contributor to ERC refund delays in 2026. While necessary to protect taxpayer money and the integrity of the tax system, these measures continue to create bottlenecks for all remaining claims, including legitimate ones filed years ago.

The agency maintains stringent verification processes and risk-scoring filters to identify potentially improper claims. This means every remaining claim is subject to intense scrutiny, often requiring manual reviews that are time-consuming. The IRS has already sent tens of thousands of rejection letters, disallowing billions in incorrect claims. These rejections often result from detailed reviews uncovering issues that might have been overlooked by less scrupulous ERC promoters.

Beyond denials, the IRS continues enforcement actions on previously processed claims. The IRS continues to issue “recapture letters” (Letter 6577-C) for previously paid ERC refunds, demanding repayment if claims are deemed ineligible upon further review. This signals that even businesses that received refunds might face clawbacks, adding another layer of complexity to the ongoing situation.

An ongoing challenge for some businesses is refund theft from claims that were approved but never received. The Taxpayer Advocate Service has reported thousands of cases where taxpayers did not receive their ERC checks, with some involving stolen checks. This necessitates further investigation by the IRS and the Bureau of the Fiscal Service, adding significant delays and administrative burdens for affected businesses. These robust fraud prevention measures, while crucial, continue to slow down the entire system, leaving many legitimate businesses in a prolonged waiting period even years after filing.

The Ripple Effect: How Delays Impact Your Business

The prolonged ERC refund delays are not just administrative headaches; they have profound and often devastating ripple effects on businesses, particularly those in areas like Austin, TX, that rely on stable cash flow for growth and operations. What was intended as a lifeline has become a source of significant financial stress, impacting everything from daily operations to long-term strategic planning.

The most immediate and critical impact is on cash flow. Businesses, expecting these substantial refunds, often factored them into their financial projections. When these funds do not materialize, it can lead to a severe liquidity crunch. Some businesses struggle to cover operational costs, pay suppliers, or even make payroll, leading to difficult choices.

This uncertainty also disrupts operational planning. It becomes harder to invest in new equipment or expand your workforce when a significant chunk of your expected capital is tied up with the IRS. Many businesses are forced to scale back or postpone investments, which can stall growth. In more severe cases, owners must consider downsizing or layoffs to preserve remaining cash. You can learn more about managing your business finances on our finance blog.

Real-World Consequences for Business Owners

For many business owners, the ERC refund delays have translated into tangible, agonizing consequences. We have seen businesses, particularly small and medium-sized enterprises (SMEs) in Travis County and beyond, facing genuine liquidity crises. Needed investments like replacing aging equipment or funding a new marketing campaign to stay competitive are often put on hold because a promised refund is stuck in IRS processing.

These delays can make it harder to secure additional financing, as lenders may hesitate when a business’s expected cash influx is in limbo. The emotional toll is significant as well. The National Taxpayer Advocate’s report noted that these delays are “harming and frustrating business owners,” forcing some to take out high-interest loans or even close their doors. For more insights into how the IRS’s handling of ERC claims affects businesses, you can refer to the [Taxpayer Advocate Service’s objectives](https://www.taxpayeradvocate.irs.gov/news/directory-entry/objective-11-2025/#:~:text=The%20Employee%20Retention%20Credit%20(ERC,yet%20retained%20employees%20on%20payroll).

Your Proactive Playbook: Navigating the Waiting Game

While the ERC refund delays are largely out of your control, there are proactive steps we can take together to strengthen your position, ensure accuracy, and steer this waiting game more effectively. Our goal is to make sure your claim is as bulletproof as possible, anticipating potential IRS scrutiny.

First and foremost, maintaining accurate and comprehensive documentation is paramount. This includes detailed payroll records, tax filings, employee wage data, health insurance costs, proof of government orders that impacted your business (if applicable), and any other relevant expenses or financial statements. Think of it as building an airtight case for your claim. This meticulous record-keeping will be invaluable if your claim faces an audit or requires further substantiation.

Proactive monitoring of your ERC claim is also essential. While the IRS’s communication can be inconsistent, regularly checking for updates and reviewing any notices you receive is crucial. Ensure your eligibility was correctly determined, and your calculations are spot-on. We’ve seen many businesses fall prey to aggressive ERC promoters who made erroneous claims, leading to current delays and potential future penalties.

A critical aspect of correct calculation involves understanding the interaction between the ERC and other pandemic relief programs, particularly the Paycheck Protection Program (PPP). While later legislation (Consolidated Authorizations Act, 2021) allowed businesses to claim both, it explicitly stated that the same wages could not be used for both PPP loan forgiveness and ERC calculations. Ensuring this was correctly accounted for in your original claim is vital. If you’re unsure about your PPP loan, you can find more information on the SBA website. For more tax tips and strategies, be sure to read our blog.

How to Verify Eligibility and Avoid Common Pitfalls

Verifying your ERC eligibility and avoiding common pitfalls is crucial, especially given the IRS’s increased scrutiny. Many ERC refund delays stem from claims that were improperly filed from the outset. We need to ensure your claim meets the strict IRS criteria.

Here are some key areas to review and common pitfalls to avoid:

- Government Shutdown Orders vs. Supply Chain Issues: Your eligibility based on government orders must be tied to a full or partial suspension of your business operations. Simply experiencing supply chain issues, without a direct government order causing a suspension, often does not qualify. The suspension must have been more than nominal.

- Gross Receipts Test: If you qualified based on a significant decline in gross receipts (50% in 2020, 20% in 2021), ensure your calculations are accurate and that you’ve used the correct comparison periods.

- Recovery Startup Business Rules: For claims in Q3 and Q4 2021 as a Recovery Startup Business, ensure you meet the strict criteria of starting operations after February 15, 2020, and having average annual gross receipts under $1 million.

- Qualified Wages: Only specific wages paid to employees during eligible periods count. For large employers (more than 100 full-time employees in 2019 for 2020 claims, or 500 for 2021 claims), only wages paid to employees not providing services count. Many promoters incorrectly claimed wages for all employees, regardless of services rendered.

- Warning Signs of Fraudulent ERC Promoters:

- Unsolicited Ads & Calls: Be wary of aggressive marketing from unknown firms.

- Quick Eligibility Determinations: Promoters claiming everyone qualifies without a thorough review of your specific situation are a red flag.

- Large Upfront Fees: Reputable professionals typically charge a reasonable fee, not a percentage of your refund or an exorbitant upfront cost.

- Pressure Tactics: Avoid anyone pressuring you to sign quickly or make a claim you’re unsure about.

- Lack of Documentation: A legitimate claim requires extensive documentation; beware of those who say it’s not necessary.

- Claims Based on Broad Industry Impact: Eligibility must be tied to your specific business, not just a general industry downturn.

The IRS provides an ERC eligibility checklist to help businesses understand this complex credit. We recommend a thorough review of your claim against these criteria.

Managing the Tax Implications of ERC Refund Delays

Navigating the tax implications of ERC refund delays can be as complex as the delays themselves. One of the most significant areas of confusion relates to the income tax impact of the ERC, especially when refunds arrive years after the initial claim.

Initially, the IRS clarified in Notice 2021-20 that while the ERC itself is not taxable income, the amount of the credit reduces the deduction for wages on your income tax return for the tax year in which the qualified wages were paid. This means businesses that claimed the ERC after filing their income tax returns were generally advised to file amended income tax returns to reduce their wage deductions.

However, with the massive processing delays, many businesses are receiving their ERC refunds well after the statute of limitations for amending their original income tax returns has expired. The IRS has provided revised guidance on this complex issue. For employers who received their ERC refunds after the statute of limitations for their 2020 or 2021 income tax returns expired and who have not yet amended those returns, there might not be an obligation to amend. Instead, the IRS has suggested that these employers could include the ERC amount in their income for the year the refund is received (e.g., 2025).

This situation creates a tricky dilemma and the application of the “tax benefit rule” is not always straightforward. We strongly advise consulting with a tax professional to analyze your specific facts and circumstances. Making the wrong decision could lead to audits, penalties, or unintended tax consequences. For more detailed insights into business tax strategies, check out our taxes category.

Escalation and Resolution: When Waiting Isn’t an Option

For businesses facing critical cash flow issues due to ERC refund delays, simply waiting for the IRS to catch up might not be an option. Fortunately, there are avenues for escalation and resolution, though each comes with its own set of considerations. These include engaging the Taxpayer Advocate Service (TAS), considering refund litigation, or addressing claim denials through established IRS channels.

The IRS has also provided programs for businesses that realize they submitted ineligible claims. The ERC Voluntary Disclosure Program (VDP) and the option to withdraw ineligible claims are designed to help taxpayers come into compliance and avoid harsher penalties down the line. However, eligibility and deadlines for these programs can be strict. For instance, the VDP for most taxpayers ended on November 22, 2024, with a slightly extended deadline for third-party payers until December 31, 2024. Businesses that submitted ineligible claims and did not participate in these programs could face significant consequences, including repayment of the credit with interest, and potential penalties or audits.

Using the Taxpayer Advocate Service (TAS) for Help

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. While the National Taxpayer Advocate has acknowledged that TAS has not always been effective in expediting stalled ERC claims due to the sheer volume and complexity, it remains a crucial resource, particularly for businesses experiencing significant financial hardship.

When should you consider involving TAS? If your ERC refund delays are causing a financial crisis for your business, or if you’ve tried and been unable to resolve your issue directly with the IRS, TAS might be able to help. They can investigate your case, communicate with the IRS on your behalf, and work to expedite your claim if you meet their criteria for “significant hardship.” This might include situations where you’re facing eviction, business closure, or severe financial distress directly attributable to the delayed ERC refund.

To engage TAS, you typically need to demonstrate that you’ve already attempted to resolve the issue with the IRS through normal channels. While they cannot guarantee a specific outcome or timeline, their intervention can sometimes cut through bureaucratic red tape. We encourage businesses in Travis County facing such hardships to explore this option. You can learn more about how TAS can assist taxpayers on their official website.

Exploring Legal Action and Responding to Denials

When ERC refund delays become unbearable, or if your claim is denied, exploring legal action might become a necessary, albeit complex, step.

If your ERC claim has been pending for more than six months and has a strong legal and factual basis, some businesses are choosing to file a refund lawsuit against the IRS. This can be done in the U.S. Court of Federal Claims or a federal district court. The primary benefit here is that it can potentially expedite the process and bypass the IRS’s internal backlog. However, litigation is not without risks. It can be costly, time-consuming, and there’s no guarantee of success. It’s a decision that requires careful consideration and expert legal advice.

More commonly, businesses will need to respond to a claim denial. The IRS issues a formal denial through Letter 105-C, which outlines the reason for the disallowance and your appeal rights. If you receive a Letter 105-C, it’s crucial to act promptly. You typically have a limited timeframe (often 30 days) to respond to the IRS, providing additional documentation or arguments to support your claim. When responding, you should explicitly request that your case be referred to the IRS Independent Office of Appeals, which offers an administrative review process outside of the examining division.

Receiving a denial letter opens a two-year window from the date of the letter to file a refund lawsuit in court. Appealing through the IRS administrative process does not extend this two-year period, so strategic timing is essential. We strongly recommend consulting with a tax professional experienced in IRS disputes to help you formulate a robust response or evaluate the viability of litigation.

Frequently Asked Questions about ERC Refund Delays in 2026

We understand that the ongoing situation with ERC refund delays raises many questions for business owners still waiting for their pandemic-era claims. Here are some of the most common inquiries we receive:

How long is the current wait for an ERC refund in 2026?

For claims still pending from the 2020-2024 filing period, wait times vary significantly. Many businesses have been waiting more than two years for their refunds. While the IRS has made progress on the initial backlog of 1.2 million claims, hundreds of thousands remain unprocessed. The IRS continues to work through “low-risk” claims first, but has not provided updated timelines for the remaining claims. Since the ERC program ended and no new claims can be filed, the focus is entirely on processing the existing backlog from pandemic-era filings.

What should I do if my ERC claim is denied with a Letter 105-C?

If you receive a Letter 105-C, indicating your ERC claim has been denied or disallowed, you have the right to appeal the decision. You should respond to the IRS within the timeframe specified in the letter (typically 30 days), providing any additional documentation or arguments to support your claim. It is crucial to explicitly request a referral to the IRS Independent Office of Appeals in your response. This allows for an impartial review of your case. You have a two-year window from the date of the Letter 105-C to file a refund lawsuit in federal court, but the administrative appeal process does not extend this deadline. For claims denied in 2024 or 2025, time may be running out to pursue legal action, making prompt response critical. We highly recommend seeking professional guidance to craft your response and steer the appeals process.

Can I do anything to speed up my ERC claim in 2026?

While options remain limited due to the ongoing backlog, you can take several steps to potentially expedite your years-old claim. First, ensure your documentation remains organized, accurate, and ready for review when the IRS requests it. This means maintaining all payroll records, government orders, and financial statements from the pandemic period. Second, if you are facing significant financial hardship directly due to the ERC refund delays, you may qualify for assistance from the Taxpayer Advocate Service (TAS). They can intervene on your behalf, though their success with ERC claims has been mixed. For businesses that cannot afford to continue waiting for the IRS’s uncertain timeline, exploring an ERC advance or buyout remains a viable option to access your capital now.

Conclusion: Taking Control of Your ERC Timeline in 2026

The journey through ERC refund delays continues to challenge businesses nationwide, including those right here in Travis County, years after the pandemic ended. What began as a crucial lifeline during the COVID-19 crisis has evolved into a multi-year waiting game, with many businesses still awaiting refunds from claims filed during 2020-2024. We’ve explored the ongoing reasons behind these delays—from the IRS’s continued work through the massive backlog to its necessary, but time-consuming, fraud prevention measures. We’ve also seen the very real impact these extended delays have on cash flow, operational planning, and the overall stability of businesses.

But while the waiting game continues in 2026, it is not without options. We’ve outlined a proactive playbook, emphasizing the critical importance of maintaining documentation from the pandemic era, understanding the complex tax implications of receiving refunds years after filing, and knowing your rights if your claim faces denial. When passive waiting is no longer viable, avenues like the Taxpayer Advocate Service and, in some cases, legal action before statute of limitations expire, offer pathways for resolution.

For businesses in Travis County that are still waiting for pandemic-era ERC claims and need immediate access to their funds, SFG Capital offers a tangible solution. We specialize in providing ERC advances and buyouts, giving you your capital now so you can finally close this chapter and focus on what matters most: running and growing your business in 2026 and beyond. We understand that years of waiting is unacceptable, and our performance-based fee structure ensures our interests are aligned with yours.

Don’t let the ongoing IRS backlog continue to dictate your business’s future. Take control of your ERC timeline and secure the funds you’re owed from claims filed years ago. Learn more about our ERC solutions and how we can help you finally resolve these long-delayed claims.