Understanding the Employee Retention Credit: A Critical Lifeline for American Businesses

What is ERC? For U.S. businesses, the term “ERC” refers to the Employee Retention Credit, a refundable tax credit created during the COVID-19 pandemic to help businesses keep employees on payroll. While the acronym can also stand for other things, like the ERC-20 crypto token standard or the European Research Council, this article focuses exclusively on the tax credit that is a critical lifeline for American businesses.

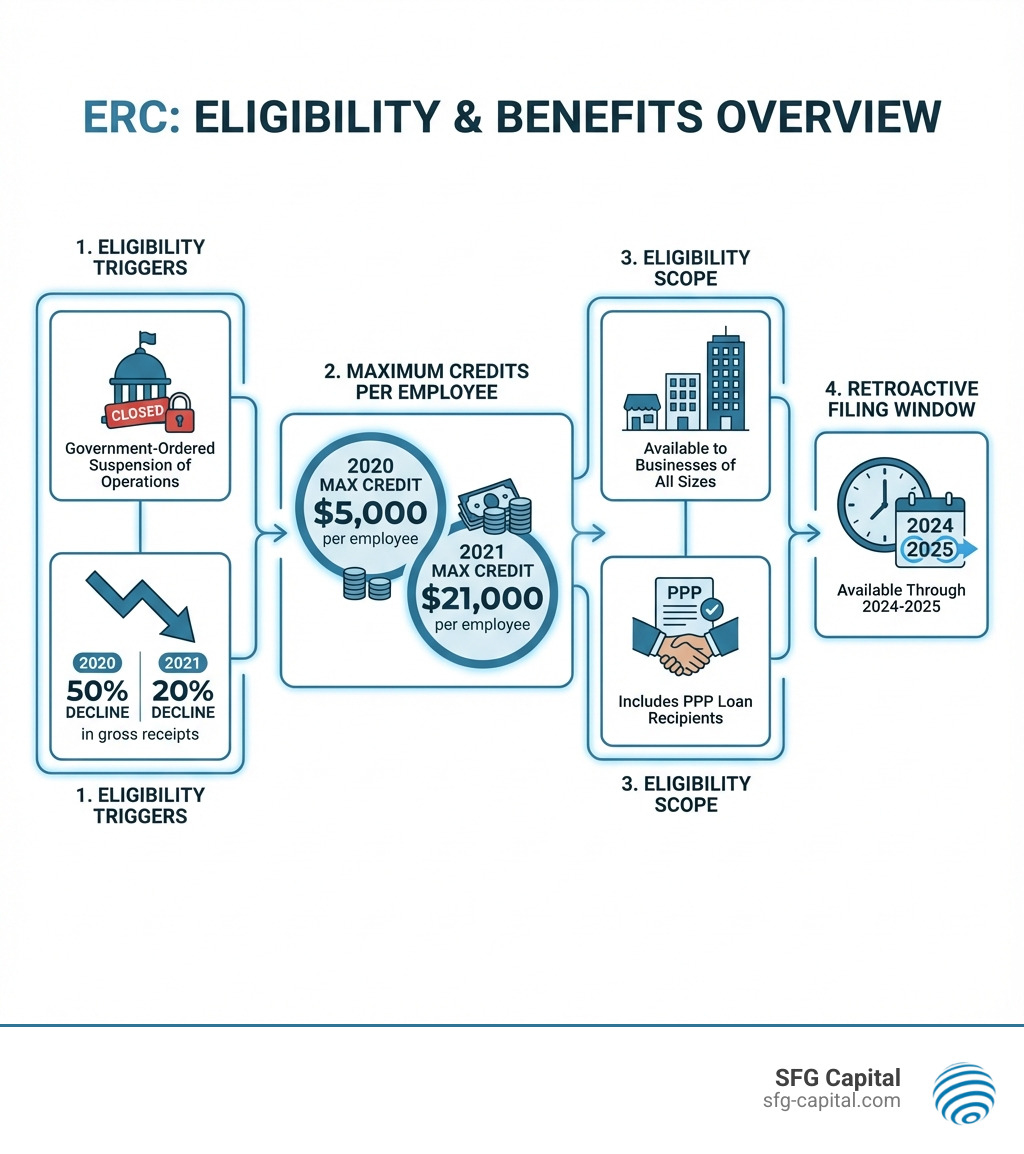

The Employee Retention Credit is a tax credit worth up to $26,000 per employee—not a loan that needs to be repaid. If your business faced government-ordered shutdowns or experienced a significant decline in revenue during 2020 or 2021, you may be eligible for substantial refunds. The credit was designed to incentivize employers to retain workers during the pandemic by reducing payroll taxes.

Unlike the Paycheck Protection Program (PPP), the ERC is not a loan. It’s a dollar-for-dollar reduction in the employment taxes you’ve already paid. Even if you received PPP funding, you can still claim the ERC for eligible wages.

The challenge? The IRS is currently processing a massive backlog of claims, creating significant delays. Meanwhile, aggressive “ERC mills” have flooded the market with questionable claims, leading the IRS to temporarily halt processing of new claims in September 2023.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer the ERC and secure over $500 million in legitimate claims. My focus is on compliance-driven strategies that protect businesses while maximizing their rightful refunds.

What is the Employee Retention Credit (ERC)?

The Employee Retention Credit (ERC), also known as the Employee Retention Tax Credit (ERTC), was a key part of the CARES Act passed in March 2020. It was designed as a refundable tax credit to help businesses keep employees on payroll during the economic disruption of the COVID-19 pandemic. By reducing employment taxes, the ERC provided a crucial lifeline for employers to retain their workforce.

The ERC is a direct reduction in employment taxes, not a deduction from taxable income, which makes it highly valuable for a company’s cash flow. For businesses in Travis County and across the U.S., the credit offered a significant opportunity to offset costs, maintain their teams, and prepare for recovery.

Is the Employee Retention Credit a loan?

A common misconception is that the ERC is a loan. To be clear: the Employee Retention Credit is not a loan and does not need to be repaid. The IRS confirms it is a refundable tax credit. If the credit amount is more than the payroll taxes you owe, the IRS sends you a refund for the difference. It’s a grant, not debt, offering direct financial relief. As long as your claim is accurate, you won’t have to pay it back. For more insights, explore our article on Funding Growth: How ERC Can Power Your Business Forward.

Who Qualifies for the Employee Retention Credit?

Determining eligibility for the What is ERC program is about identifying U.S. businesses genuinely impacted by the pandemic. The credit was available to employers who paid qualified wages between March 13, 2020, and September 30, 2021.

Generally, a business in Travis County, TX, or anywhere in the U.S. qualifies if it meets one of two primary tests during the eligible periods:

-

Full or Partial Suspension of Operations: Your business operations were fully or partially suspended due to a government order related to COVID-19. This includes capacity restrictions or limits on operating hours. For example, a restaurant in Austin, TX, forced to close its dining room would likely qualify. However, essential businesses or those that could keep their operations largely intact remotely typically did not meet this qualification.

-

Significant Decline in Gross Receipts: Your business experienced a significant drop in quarterly gross receipts compared to the same quarter in 2019. The required decline percentage changed between 2020 and 2021, as detailed below.

A third category, Recovery Startup Businesses, also qualified for parts of 2021 under different rules.

Crucially, businesses that received Paycheck Protection Program (PPP) loans can still qualify for the ERC, though the same wages cannot be used for both programs. Our team at SFG Capital specializes in helping businesses in Travis County accurately assess their eligibility and steer these nuanced rules.

2020 vs. 2021 Eligibility Rules

The ERC program evolved, with significant changes between 2020 and 2021. Understanding these differences is key to accurately assessing your claim.

| Feature | 2020 Rules (Mar 13 – Dec 31) | 2021 Rules (Jan 1 – Sep 30) |

|---|---|---|

| Gross Receipts Decline | >50% decline vs. 2019 quarter | >20% decline vs. 2019 quarter |

| Credit Rate | 50% of qualified wages | 70% of qualified wages |

| Max Qualified Wages | $10,000 per employee for the year | $10,000 per employee per quarter |

| Max Credit | $5,000 per employee | $21,000 per employee ($7k/qtr) |

| Employee Size Limit | 100 full-time employees | 500 full-time employees |

How to Claim the ERC and Calculate Your Refund

Claiming the Employee Retention Credit requires careful attention to detail, especially given the program’s evolving rules and the IRS’s current scrutiny. For businesses in Travis County, TX, understanding the process is crucial to securing your rightful refund.

First, you need to identify qualified wages. These are wages and certain health plan expenses paid to employees during eligible periods. Since the eligibility periods have passed, businesses must now file a retroactive claim using Form 941-X, the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This amends your previously filed payroll tax returns to claim the credit.

Navigating this process can be challenging, especially since the IRS announced a temporary moratorium on processing new claims in September 2023 to combat fraud. This has created significant IRS processing delays, but legitimate claims are still valid and will be processed. For a deeper dive into managing these delays, check out our insights on Expediting Your ERC Refund: What You Need to Know.

It’s also vital to be aware of the claim deadlines. Businesses can generally amend returns for up to three years. For most 2021 claims, the deadline is April 15, 2025. This means time is of the essence for businesses looking to claim their funds.

Calculating Your Maximum Credit

The amount of ERC you can claim depends on the year and the amount of qualified wages paid. The credit structure was designed to provide significant relief:

-

2020 Calculation: For qualified wages paid between March 13, 2020, and December 31, 2020, the credit was 50% of qualified wages, up to $10,000 in wages for the year. This means a maximum credit of $5,000 per employee for 2020.

-

2021 Calculation: The rules became more generous for 2021. For qualified wages paid between January 1, 2021, and September 30, 2021, the credit was 70% of qualified wages, up to $10,000 in wages per quarter. This translates to a maximum credit of $7,000 per employee per quarter.

When combined, an eligible business could claim up to $5,000 per employee for 2020 and up to $21,000 per employee for 2021 (3 quarters x $7,000). This results in a maximum potential credit of up to $26,000 per employee for the entire program duration. The 2021 rules also expanded the definition of a small employer to 500 full-time employees, allowing more businesses to claim the credit for all employees.

The ERC Universe: Scams, Crypto, and Other Acronyms

The acronym “ERC” can be confusing, as it has different meanings. While our focus is on the Employee Retention Credit, it’s helpful to understand the other uses to avoid confusion.

What is ERC? Beware of Aggressive “ERC Mills”

The ERC’s value has unfortunately attracted scams. The IRS warns against “ERC mills”—promoters making misleading claims to ineligible businesses.

Watch for these red flags:

- Unsolicited calls or emails promising easy money.

- Claims of eligibility without a detailed review of your financials.

- Large upfront fees or fees based on a percentage of the refund.

- Guarantees of a specific refund amount.

Engaging with these promoters can lead to fraudulent claims, resulting in IRS audits, penalties, and repayment of the credit with interest. At SFG Capital, we prioritize compliance, conducting a thorough review for businesses in Travis County, TX, to ensure every claim is legitimate and fully documented, protecting you from these risks.

What is ERC in Crypto? A Quick Look at ERC-20 Tokens

In cryptocurrency, “ERC” refers to ERC-20, a technical standard for creating interchangeable (fungible) tokens on the Ethereum blockchain. This standard allows different tokens to work together seamlessly within the Ethereum ecosystem. It is completely unrelated to the Employee Retention Credit.

Other Meanings of ERC

To avoid confusion, here are a few other contexts where you might see the acronym “ERC”:

- Emergency Risk Communication (ERC): A public health strategy for sharing information during crises.

- European Research Council (ERC): A European Union body that funds scientific research.

- Employer Registration Certificate (ERC): A document for employers in Nova Scotia, Canada, who are hiring foreign workers.

For U.S. businesses, the relevant meaning is the Employee Retention Credit—a valuable tax relief program.

Frequently Asked Questions about the Employee Retention Credit

We know the What is ERC program can be complex. Here are answers to some of the most common questions we receive at SFG Capital.

Is the Employee Retention Credit a loan that needs to be repaid?

No. The Employee Retention Credit is not a loan and does not need to be repaid. It is a refundable tax credit that reduces your payroll tax liability. If the credit is larger than the taxes you owe, the IRS sends you a refund for the difference. It is a grant, not debt.

Can I still claim the ERC if I received a PPP loan?

Yes. An early rule preventing this was changed, allowing businesses to claim both. The key rule is that you cannot use the same wages for both PPP loan forgiveness and the ERC. Our experts can help you properly allocate wages to maximize your claim while staying compliant.

Is it too late to apply for the ERC?

No, but the window is closing. The program is claimed retroactively by amending past payroll tax returns (Form 941-X). The IRS allows amendments for up to three years from the original filing date. For 2021 wages, the deadline is typically April 15, 2025. While the IRS paused processing new claims in late 2023, it’s crucial to file correctly before the deadline. We advise businesses in Travis County to act promptly to review their eligibility.

Conclusion: Secure Your Business’s Future with the ERC

The Employee Retention Credit (ERC) represents a significant, yet often underused, opportunity for businesses in Travis County, TX, and across the U.S. to receive substantial financial relief. We’ve seen how the What is ERC acronym can be confusing, but for American businesses, it primarily signifies a refundable tax credit designed to reward you for keeping your employees on staff during the challenging times of the pandemic.

Despite its complexity and the recent IRS processing delays and warnings about scams, the value of the ERC for eligible businesses remains immense. It’s not a loan, it doesn’t need to be repaid, and it can provide up to $26,000 per employee – a direct infusion of cash that can fuel your business’s growth and stability.

At SFG Capital, we understand the nuances of ERC eligibility, the intricacies of calculating qualified wages, and the precise steps required for accurate retroactive claims. Our expertise is particularly vital in navigating the current environment of IRS scrutiny, ensuring your claim is not only maximized but also fully compliant. We’re dedicated to helping businesses like yours in the Austin, TX area bypass the typical IRS delays by offering advances or buyouts on your legitimate ERC refunds.

Don’t let the complexity or the recent news deter you from claiming what your business rightfully deserves. The opportunity to secure this valuable tax credit is still available, but time is running out for some filing periods. Let us help you open up the full potential of your ERC. Explore how we can assist you by visiting our Our Services page today.