Why Getting ERC Claim Help Matters for Your Business

ERC claim help is essential for businesses navigating this complex tax credit amid IRS backlogs, increased scrutiny, and the risk of costly errors. If you’re seeking assistance with your Employee Retention Credit claim, here’s what you need to know:

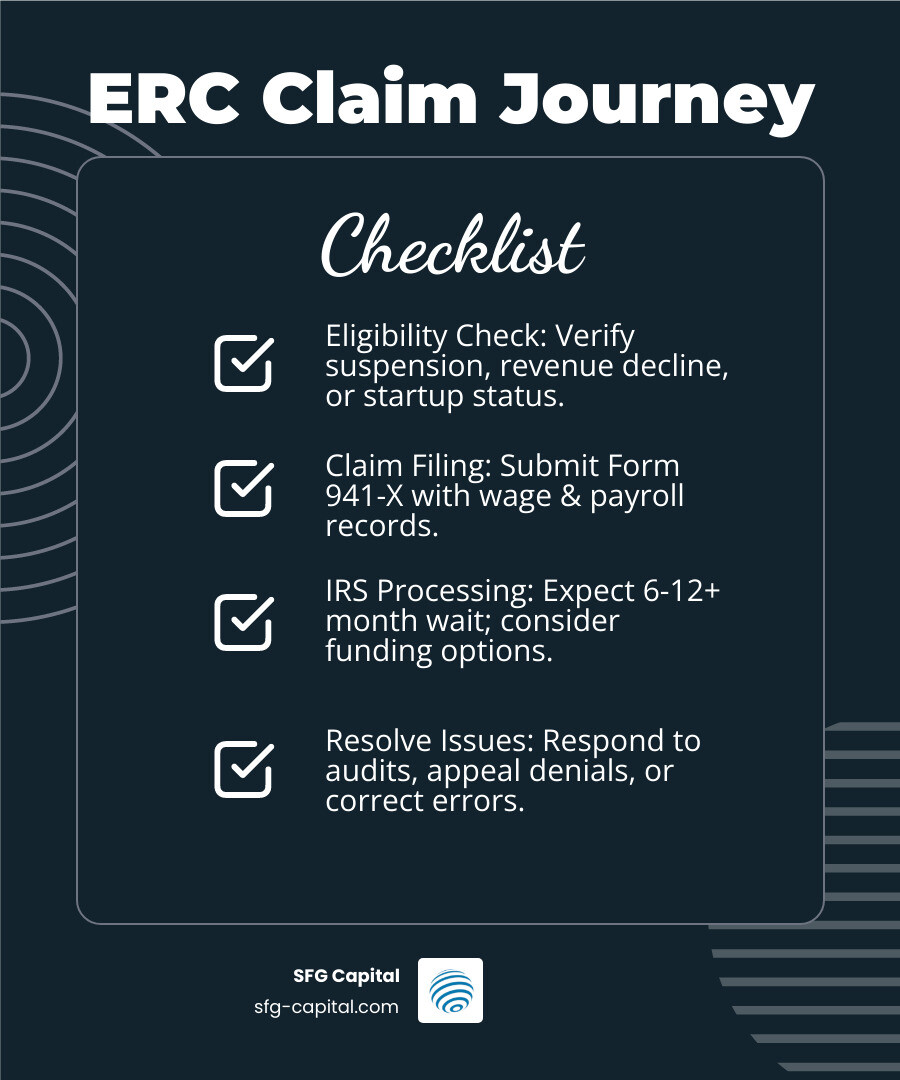

Quick Guide to ERC Claim Help:

- Check Your Eligibility – Verify you meet the requirements (government-ordered suspension, significant revenue decline, or recovery startup status)

- File or Amend Correctly – Submit Form 941-X with proper documentation of qualified wages and eligibility proof

- Correct Mistakes Quickly – Use the IRS withdrawal program or Voluntary Disclosure Program if you filed incorrectly

- Respond to IRS Actions – Appeal denied claims within the two-year window or work with the Taxpayer Advocate Service for delays

- Avoid Scams – Watch for red flags like unsolicited offers, guaranteed eligibility promises, and percentage-based fees

- Get Professional Support – Work with qualified tax professionals who understand the complex eligibility rules and can defend your claim

The Employee Retention Credit was created to reward businesses that retained employees during the COVID-19 pandemic. But what started as relief has become a minefield. The IRS has initiated 301 criminal investigations involving over $3.4 billion in questionable claims, and they’ve identified that 10% to 20% of all ERC claims fall into the highest-risk category. Tens of thousands of claims are being denied.

The challenges are real: IRS processing delays stretch 6-12 months or longer, aggressive promoters (“ERC mills”) have misled thousands into filing ineligible claims, eligibility tests are complex, and documentation requirements are extensive. Getting it wrong can lead to penalties, interest, and audits.

This is where getting proper ERC claim help becomes critical. Whether you’re filing, correcting an error, or responding to an IRS notice, understanding your options and working with the right partners is key to receiving your credit and avoiding costly compliance issues.

I’m Santino Battaglieri, and I’ve helped businesses steer the ERC landscape by funding over $500 million in claims while maintaining strict compliance. My experience providing ERC claim help shows how proper guidance protects businesses from predatory promoters and IRS actions, ensuring eligible companies receive the relief they deserve.

Understanding the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC), sometimes called the Employee Retention Tax Credit (ERTC), was part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act of March 2020. This pandemic-era tax credit was designed to encourage businesses to keep employees on payroll during the COVID-19 disruptions. Unlike a loan, the ERC is a refundable payroll tax credit, meaning eligible businesses do not have to pay it back and can recover from the pandemic’s financial impact.

Who is Eligible for the ERC?

Determining eligibility for the ERC is often the most complex part of the process, and it’s where expert ERC claim help becomes invaluable. The IRS has provided an Employee Retention Credit Eligibility Checklist to help employers, but the devil is in the details. Generally, businesses in the United States, including those in Travis County, could qualify for the ERC if they meet one of two primary tests for specific periods in 2020 and 2021:

- Full or Partial Suspension of Operations Due to Government Order: If your business operations were fully or partially suspended due to a governmental order limiting commerce, travel, or group meetings due to COVID-19. This means an official order from a federal, state, or local government authority, such as those in Texas, specifically impacted your ability to operate. For example, a restaurant in Austin forced to close its dining room but allowed to offer takeout might qualify as partially suspended.

- Significant Decline in Gross Receipts:

- For 2020: Your business experienced a decline in gross receipts by more than 50% in a calendar quarter compared to the same calendar quarter in 2019.

- For 2021 (Q1-Q3): Your business experienced a decline in gross receipts by more than 20% in a calendar quarter compared to the same calendar quarter in 2019. There was also a “safe harbor” provision allowing employers to use the prior quarter’s gross receipts to determine eligibility for the current quarter.

A third category, Recovery Startup Business, also qualified for the ERC for the third and fourth quarters of 2021. This applied to businesses that began operations after February 15, 2020, and met certain gross receipts and employee thresholds.

Qualified Wages: The credit is calculated based on “qualified wages” paid to employees. For 2020, the credit was up to 50% of the first $10,000 in qualified wages per employee for the year. For 2021, it increased to up to 70% of the first $10,000 in qualified wages per employee per quarter. This includes certain health plan expenses.

PPP Loan Interaction: Initially, PPP loan recipients could not claim the ERC. However, legislation later allowed businesses to claim both, provided the same wages were not used for both programs. This nuance is crucial, and careful tracking of wages is essential to avoid double-dipping.

Understanding these intricate rules is vital. Many businesses believed they qualified based on general information, only to find out later their specific circumstances didn’t meet the strict IRS guidelines. This is precisely why professional ERC claim help is so important.

The ERC Claim and Refund Process: From Filing to Funding

Once eligibility is confirmed, the next hurdle is navigating the claim process itself. It’s not as simple as filling out a single form and waiting for a check.

How to Claim the ERC and What Documentation is Needed

The ERC is claimed by filing an amended employment tax return, Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. This form is used to claim the credit retroactively or to correct a previously filed return.

What documentation is needed to support an ERC claim? The IRS requires robust substantiation. This isn’t a “trust me, bro” situation. You’ll need:

- Payroll Records: Detailed records of qualified wages paid to employees during the eligible quarters. This includes wages subject to Social Security and Medicare taxes, plus qualified health plan expenses.

- Gross Receipts Data: Comprehensive financial statements proving the significant decline in gross receipts for the relevant quarters. This involves comparing 2020/2021 figures against 2019.

- Government Shutdown Orders: Copies of the specific federal, state, or local government orders that led to the full or partial suspension of your business operations. This needs to clearly show how your operations were impacted. For businesses in Austin, TX, this would include orders issued by the City of Austin or Travis County authorities.

- Employee Counts: Documentation of your average number of full-time employees in 2019, as this impacts the definition of qualified wages (especially for larger vs. smaller employers).

Without this detailed documentation, your claim is highly vulnerable to denial or audit. For more in-depth assistance with the financial aspects of your claim, including potential funding solutions, you can find More info about ERC Funding Solutions.

ERC Deadlines and Income Tax Implications

What are the deadlines for claiming or withdrawing an ERC claim?

- Claiming the ERC: Generally, businesses had until April 15, 2024, to amend 2020 claims and until April 15, 2025, to amend 2021 claims. These are the statutory deadlines to file Form 941-X.

- Withdrawing/Disclosing: As you’ll read below, specific deadlines apply to the IRS’s withdrawal and Voluntary Disclosure Programs.

What are the implications of an ERC claim on my income tax return?

This is a critical point many businesses overlook, which can lead to complications if not addressed correctly. The amount of ERC you claim reduces your deductible wage expense on your income tax return for the year the wages were paid. For example, if you claimed ERC for wages paid in 2020, you must reduce your 2020 wage expense deduction by that amount.

If you originally filed your income tax return before claiming the ERC, you must file an amended income tax return to reflect this reduction in wage expense. The IRS explicitly states that if you file an income tax return deducting qualified wages before filing an employment tax return claiming a tax credit, you should file an amended income tax return to correct any overstated wage deduction. You can read more on this important guidance on wage deductions. Failing to do so could lead to further IRS scrutiny.

Dealing with ERC Refund Delays

Many businesses that filed legitimate ERC claims are now caught in what we affectionately call “the waiting game.” How long does it take to get an ERC refund? While the IRS initially processed claims relatively quickly, the surge in claims—and the accompanying fraud—has led to significant delays. The IRS announced a moratorium on processing new claims filed on or after September 14, 2023, and processing times have ballooned to 6-12 months or even longer for many. This can be incredibly frustrating for businesses in Travis County relying on these funds.

How can the Taxpayer Advocate Service (TAS) help with ERC claim delays?

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that helps taxpayers resolve problems with the IRS. If your ERC claim is experiencing significant delays (e.g., over six months) and is causing you financial hardship, TAS may be able to intervene. They act as a liaison, investigating your case and communicating with the IRS on your behalf to expedite the process. The IRS Commissioner has indicated a willingness to work with TAS to help businesses facing hardship due to ERC delays.

For businesses facing immediate cash flow needs due to these delays, options like ERC Refund Advance or ERC Advance Funding are available. Our team at SFG Capital, serving businesses in Travis County and Austin, TX, specializes in providing these solutions to help you bypass IRS delays and access your funds sooner. We understand that waiting months or even years for a promised refund can be detrimental to your business. We also offer comprehensive guidance on The Waiting Game: Understanding and Overcoming ERC Refund Delays.

When You Need ERC Claim Help: Correcting Errors and Responding to the IRS

The IRS has significantly increased its scrutiny of ERC claims, launching a crackdown on fraudulent filings. This includes 301 criminal investigations involving over $3.4 billion and identifying 10% to 20% of claims as high-risk. Tens of thousands of these will be denied. This heightened enforcement makes professional ERC claim help more critical than ever if your claim has issues.

What to Do If You Incorrectly Claimed the ERC

If you’re concerned your business incorrectly claimed the ERC, act swiftly. The IRS offers pathways to correct mistakes, a common issue for businesses misled by aggressive promoters.

The first step is to review your claim’s eligibility and documentation. If you find an error, you have a few options:

- Withdraw the Claim: If you haven’t received the refund yet (or haven’t cashed the check), you might be able to withdraw the entire claim.

- Voluntary Disclosure Program (VDP): If you received the refund but know it was incorrect, a VDP might allow you to repay a discounted amount.

- Amend the Return: If withdrawal or VDP isn’t an option, you’ll need to amend your employment tax return (Form 941-X) to reduce the claim.

For a deeper dive into resolving such issues, refer to the Taxpayer Advocate Service’s guide on Resolving an Improper ERC Claim and our own Employee Retention Credit Specialist Guide.

The ERC Claim Withdrawal and Voluntary Disclosure Programs

Recognizing the widespread issues, the IRS has introduced specific programs to help businesses correct improper claims.

What is the ERC claim withdrawal process and who can use it?

The IRS’s withdrawal program is designed for businesses that filed an ERC claim but have not yet received the refund (or received a check they haven’t cashed) and now believe they were ineligible. Using this program allows you to avoid future penalties and interest that would apply if the IRS later determined your claim was erroneous.

Who can use it? You can generally withdraw your claim if:

- You filed an adjusted employment tax return (e.g., Form 941-X) solely to claim the ERC.

- You made no other adjustments on that return.

- You want to withdraw the entire claim.

- The IRS has not yet paid your claim, or you received a refund check but haven’t cashed or deposited it.

How to withdraw? The process varies slightly depending on your situation (e.g., if you’re under audit or have a physical check). Generally, it involves marking your amended return as “Withdrawn,” signing it, and faxing or mailing it to the IRS. If you have an uncashed check, you’ll void it and mail it with your withdrawal request. Detailed instructions are available on the IRS’s page: Withdraw an Employee Retention Credit (ERC) claim.

What is the ERC Voluntary Disclosure Program (ERC-VDP) and who qualifies?

The ERC-VDP is for businesses that already received and cashed an ERC refund but now realize they were ineligible. This program offers a chance to repay a discounted amount and avoid harsher penalties.

Who qualifies? Businesses that meet the following criteria:

- You claimed and received the ERC for which you were not entitled.

- You are not under IRS audit or investigation for the ERC.

- You are not already under criminal investigation related to your ERC claim.

Key terms: Under the VDP, interested taxpayers had to apply by March 22, 2024, and agree to repay 80% of the funds they received. The remaining 20% is forgiven, and the IRS won’t charge interest or penalties. For more information, visit the ERC Voluntary Disclosure Program page.

Responding to a Denied ERC Claim

What happens if my ERC claim is denied?

Receiving a notice of claim disallowance can be disheartening, but it’s not always the end of the road. The IRS issues two main types of disallowance notices:

- Letter 105C: Full disallowance of your ERC claim.

- Letter 106C: Partial disallowance of your ERC claim.

If you receive one of these, it means the IRS believes your claim is incorrect. However, you have rights. Taxpayers always have the right to appeal IRS decisions, even if the notice itself (sometimes due to IRS error) doesn’t explicitly state appeal information.

What are your options?

- Appeal to the IRS Independent Office of Appeals: If you disagree with the denial, you can petition the IRS’s Independent Office of Appeals. This is an administrative process where an impartial officer reviews your case.

- File a Suit: You generally have a two-year window from the date the disallowance notice was mailed to file a suit in U.S. District Court or the U.S. Court of Federal Claims. This is a more formal legal challenge. If this two-year window is approaching and you’re still working with Appeals, you can file a Form 907, Agreement to Extend the Time to Bring Suit, to protect your rights.

Given the complexities, professional ERC claim help is crucial here. A tax professional can help you understand the IRS’s reasoning, prepare a strong appeal, and represent you throughout the process. The Taxpayer Advocate Service offers guidance on How Taxpayers Can Respond to Notices of Claim Disallowance.

Avoiding Scams and Finding a Trusted ERC Partner

Unfortunately, the ERC program attracted aggressive promoters, or “ERC mills,” who promised quick refunds and guaranteed eligibility. This led many unsuspecting businesses in Travis County and across the U.S. to make improper claims. The risks of using these aggressive promoters are significant:

- Penalties and Interest: If your claim is found to be erroneous, you’ll owe back the credit plus penalties and interest.

- Audits: Improper claims are a magnet for IRS audits, which can be time-consuming and costly.

- Criminal Investigations: In severe cases of fraud, businesses and promoters could face criminal charges. As noted, the IRS has initiated 301 criminal investigations already.

- Reputational Damage: Being associated with an improper claim can harm your business’s standing.

Warning Signs of an ERC Scam

To protect your business, recognize the red flags of an ERC scam. The IRS has shared 7 warning signs ERC claims may be incorrect. Here’s a quick list of what to watch out for:

- Unsolicited Calls or Ads: Be wary of unexpected calls, emails, or social media messages promoting ERC services.

- Guaranteed Eligibility: No legitimate professional can guarantee eligibility without a thorough review of your specific financial and operational situation.

- Large Upfront Fees: Promoters demanding significant upfront fees before any work is done, or fees based on a percentage of your refund, should raise a red flag.

- Pressure Tactics: Any pressure to sign documents quickly or make a claim without proper review is a warning sign.

- No Discussion of Your Specific Tax Situation: If a promoter claims “every business qualifies” or doesn’t ask detailed questions about your gross receipts, government orders, or payroll, run!

- Lack of CPA/Attorney Credentials: Ensure the individuals offering ERC claim help are licensed tax professionals (CPAs, EAs, or tax attorneys) with a solid reputation.

- Vague or Aggressive Marketing: Be suspicious of claims that sound too good to be true, or language that is overly aggressive and dismissive of IRS rules.

How a Professional Can Provide ERC claim help

Working with a trusted tax professional is paramount for navigating the ERC landscape safely. How can a tax professional help with ERC claims? A qualified professional, like our team at SFG Capital, provides comprehensive ERC claim help by:

- Performing Due Diligence: We conduct a rigorous review of your business’s eligibility, ensuring compliance with all IRS rules, far beyond a simple checklist.

- Claim Substantiation: We help you gather and organize all necessary documentation, building a strong, defensible case for your claim.

- Accurate Calculation: We ensure your credit is calculated correctly, maximizing your rightful refund while avoiding errors.

- Navigating Complex Rules: The ERC rules are intricate, especially concerning qualified wages, aggregation rules, and PPP loan interaction. A professional understands these nuances.

- Audit Defense: In the event of an audit, a professional can represent you, respond to IRS inquiries, and defend your claim with proper documentation.

- Correcting Errors: If you’ve already filed an incorrect claim, a professional can guide you through the withdrawal process, the Voluntary Disclosure Program, or amending your returns.

The IRS itself encourages employers to seek out a trusted tax professional who understands the complex ERC eligibility rules, not a promoter or marketer seeking a hefty contingency fee. For more on how we assist businesses in Austin, TX, with their ERC needs, explore What is ERC Funding?.

Frequently Asked Questions about ERC Claim Help

We hear many questions from business owners in Travis County and across the United States regarding the ERC. Here are some of the most common:

Can I still claim the ERC?

Claiming deadlines for most periods have passed (April 15, 2024, for 2020; April 15, 2025, for 2021). However, the IRS placed a moratorium on processing new claims filed on or after September 14, 2023. While some filing deadlines may be open, the IRS isn’t processing new claims. If you haven’t filed, consult a tax professional immediately to understand your limited options.

What happens if I used an ERC mill and now I’m worried my claim is wrong?

If you suspect your ERC claim, filed with the help of an “ERC mill,” might be incorrect, you are not alone. Many businesses find themselves in this predicament. Your best course of action is to:

- Get a Second Opinion: Immediately seek professional ERC claim help from a reputable tax attorney or CPA who specializes in ERC and IRS matters. They can review your original claim and determine its validity.

- Consider the Withdrawal Program: If your claim hasn’t been paid yet (or you have an uncashed check), you may be able to use the IRS’s withdrawal program to avoid penalties and interest.

- Explore the Voluntary Disclosure Program (VDP): If you already received and cashed an ineligible refund, and you applied by the March 22, 2024 deadline, the VDP offered a path to repay a discounted amount. If you missed this deadline, you will need to amend your return and work with a professional on repayment.

Ignoring the issue will only lead to more significant problems down the line, including audits, penalties, and interest.

How long does it take to get an ERC refund?

The short answer is: a long time. The IRS is overwhelmed by the volume of ERC claims, leading to significant backlogs. Pre-moratorium processing was already 6-12+ months, and the moratorium on new claims plus increased scrutiny mean legitimate claims still face considerable delays.

For businesses in Travis County and across the U.S. that cannot afford to wait, there are options for faster funding. Services like ERC Advance Funding or an ERC refund advance can provide immediate access to a portion of your anticipated refund, allowing you to bypass the IRS’s lengthy processing times. This can be a lifeline for businesses facing cash flow challenges due to the delay.

Conclusion

The Employee Retention Credit offered a vital lifeline to businesses during the pandemic, but its complexity has created many challenges. Navigating eligibility rules, documentation, IRS delays, and scams demands careful attention and, often, expert ERC claim help.

The IRS’s increased enforcement and audits underscore the critical importance of accuracy and compliance. Whether you’re proactively reviewing your claim, considering the withdrawal or Voluntary Disclosure Programs, or responding to a denied claim, having a trusted partner by your side is indispensable.

At SFG Capital, we understand the pressures businesses in Travis County and Austin, TX, face. Our mission is to provide expert ERC claim help, ensuring your claim is legitimate and resilient to IRS scrutiny. We help you prepare robust documentation and offer solutions to expedite your refund, letting you access funds without the agonizing wait. Don’t let the complexity of the ERC program become another pandemic-era burden.

Get professional Employee Retention Credit Help today and let us help you secure the relief your business deserves.