Why Small Business Tax Credits Matter More Than Ever

Small business tax credits are dollar-for-dollar reductions in the amount of tax you owe to the IRS, making them one of the most powerful tools for reducing your tax burden. Unlike tax deductions that only lower your taxable income, a tax credit directly cuts your tax bill by the full credit amount—a $5,000 credit means $5,000 less in taxes paid.

Key points about small business tax credits:

- Tax credits reduce your tax liability dollar-for-dollar, while deductions only reduce taxable income

- Credits can be worth thousands to tens of thousands of dollars per employee (e.g., Employee Retention Credit up to $28,000 per employee)

- Many credits are refundable, meaning you can receive money back even if you owe no tax

- Common credits include: Employee Retention Credit (ERC), Work Opportunity Tax Credit (WOTC), R&D tax credit, Small Business Health Care Tax Credit, and paid leave credits

- Most credits require specific IRS forms like Form 3800 (General Business Credit), Form 5884 (WOTC), Form 6765 (R&D), or Form 8941 (health care)

- Credits often have carryforward provisions, so unused amounts can reduce future tax bills

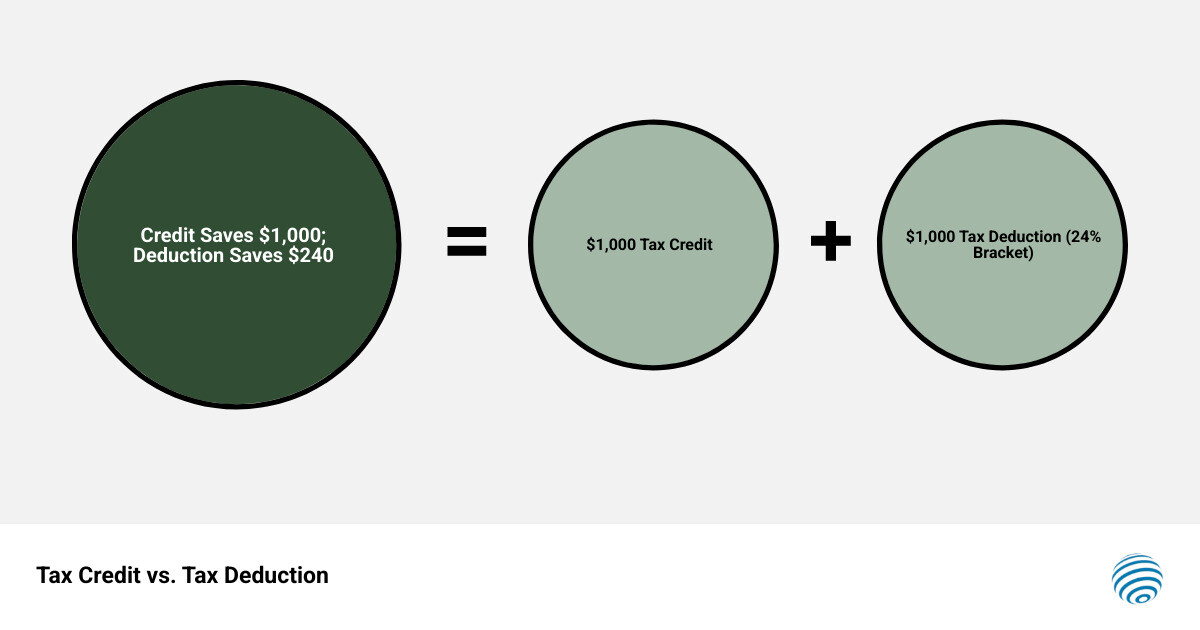

For many small businesses, managing taxes can feel overwhelming—especially when rising costs and tight margins make every dollar count. The difference between a tax credit and a tax deduction is substantial. If you’re in the 24% tax bracket, a $1,000 deduction saves you $240 in taxes. A $1,000 credit saves you the full $1,000. That’s why understanding and claiming available credits is critical for your bottom line.

Unfortunately, many business owners leave money on the table simply because they don’t know these credits exist or find the claiming process too complex. From COVID-19 relief credits like the Employee Retention Credit to ongoing incentives for hiring, research, and employee benefits, there are dozens of opportunities to reduce your tax burden—if you know where to look.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer complex small business tax credit programs, particularly the Employee Retention Credit, having funded over $500 million in ERC claims while maintaining strict compliance with IRS guidance. This guide will walk you through the most valuable credits available, explain who qualifies, and show you exactly how to claim them.

Small business tax credit terms at a glance:

Major COVID-19 Relief Credits for Businesses

The recent past brought unprecedented challenges for small businesses, but also significant tax relief in the form of federal programs. Designed to help businesses retain employees and manage new health-related mandates, the Employee Retention Credit (ERC) and Paid Leave Credits were lifelines for many. Understanding these programs is crucial, especially as some can still be claimed retroactively.

Understanding the Employee Retention Credit (ERC): A Key Small Business Tax Credit

The Employee Retention Credit (ERC) was a pivotal small business tax credit introduced during the COVID-19 pandemic to encourage businesses to keep employees on their payroll. It offered a refundable tax credit against certain payroll taxes for eligible employers. The rules and benefits evolved significantly between 2020 and 2021, and understanding these differences is key to determining eligibility and maximizing your claim.

How the ERC worked for small businesses in 2020:

For eligible businesses in 2020, the ERC was 50% of qualified wages paid, up to $10,000 per employee for the entire year. This meant a maximum credit of $5,000 per employee. Eligibility was determined if your business experienced a significant decline in gross receipts (a 50% reduction in a calendar quarter compared to the same quarter in 2019) or was fully or partially suspended due to a government order limiting commerce, travel, or group meetings due to COVID-19.

How the ERC worked for small businesses in 2021:

The American Rescue Plan significantly improved the ERC for 2021. The credit amount increased to 70% of qualified wages, up to $10,000 per employee per quarter. This could lead to a maximum credit of $7,000 per employee per quarter, potentially totaling up to $28,000 per employee for the year. Eligibility was also broadened, requiring only a 20% decline in gross receipts during a single quarter compared to the same quarter in 2019 (or the immediately preceding quarter).

Implications for businesses that received PPP loans:

Initially, businesses that received Paycheck Protection Program (PPP) loans were not eligible for the ERC. However, subsequent legislation changed this, allowing businesses to claim both. The crucial caveat is that you cannot use the same wages to qualify for both PPP loan forgiveness and the ERC. Businesses needed to carefully allocate wages to maximize both benefits, often counting additional payroll costs not covered by PPP loans towards the ERC.

The ERC is a complex program, and navigating its rules and claiming process can be challenging. Many businesses, including those in Austin and Travis County, are still working through delayed refunds from the IRS. That’s where we come in. At SFG Capital, we specialize in helping businesses understand their ERC eligibility and can assist in expediting ERC refunds and even provide ERC advance funding to bridge the gap during IRS processing delays. For more detailed information, you can also refer to the IRS’s frequently asked questions about the Employee Retention Credit.

Paid Leave Credits for Sickness and Family Care

Beyond the ERC, the Families First Coronavirus Response Act (FFCRA) introduced Paid Leave Credits, providing another crucial small business tax credit for employers. These credits were designed to reimburse small and midsize businesses (those with fewer than 500 employees) for the cost of providing paid sick leave and paid family leave to employees affected by COVID-19.

Eligibility and Benefits:

Businesses could receive dollar-for-dollar tax credits for wages paid for qualifying leave.

- 2020 Sick Leave Rules: Businesses were required to provide up to 80 hours of paid sick leave. The credit covered 100% of these wages, capped at $511 per day ($5,110 total) for an employee’s own illness or quarantine, or $200 per day ($2,000 total) if caring for someone else or a child due to school/daycare closures.

- 2020 Family Leave Rules: Businesses were required to provide up to ten additional weeks of paid family leave at two-thirds of the employee’s regular wages, capped at $200 per day ($10,000 total) for employees caring for a child whose school or place of care was closed.

The American Rescue Plan extended the availability of these credits through September 2021, allowing businesses to continue claiming up to $5,000 per employee for wages paid during this period. These credits were fully refundable, meaning if the credit amount exceeded the employer’s payroll tax liability, the employer would receive the difference as a refund. This was a significant relief for businesses facing reduced revenue while still needing to support their employees.

Tax Credits for Hiring and Workforce Development

Investing in your workforce isn’t just good for business; it can also lead to substantial tax savings through various small business tax credit programs. These credits incentivize hiring specific individuals or operating in areas that need economic revitalization.

Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) is a federal small business tax credit designed to encourage employers to hire individuals from certain targeted groups who have consistently faced significant barriers to employment. This credit helps businesses reduce their federal tax liability while also promoting a more inclusive workforce.

Criteria and Calculation:

The WOTC offers a credit amount ranging from $2,400 to $9,600 per eligible new hire, depending on the target group and the wages paid in the first year of employment. There are generally 10 worker categories that qualify, including:

- Qualified veterans

- Recipients of Temporary Assistance for Needy Families (TANF)

- SNAP (food stamp) recipients

- Vocational rehabilitation referrals

- Ex-felons

- Supplemental Security Income (SSI) recipients

- Long-term unemployment recipients

To claim the WOTC, employers must first complete Form 8850 to prescreen the new hire and request certification from their state workforce agency within 28 days of the eligible employee starting work. Once certified, you can claim the credit using Form 5884. While the program is currently set to expire on December 31, 2025, it’s still a valuable opportunity for businesses making eligible hires today.

Community-Based Hiring Credits

Beyond general hiring incentives, several small business tax credit programs specifically target economic development in distressed or low-income communities, benefiting businesses in areas like those within Travis County.

Empowerment Zone Employment Credit:

This credit supports businesses located in designated Empowerment Zones, which are economically distressed urban and rural communities. If you operate in such an area and hire employees who also live there, you can claim a credit of up to $3,000 per employee. This credit is designed to stimulate job creation and economic growth where it’s needed most. The empowerment zone designations have been extended through December 31, 2025, meaning businesses can continue to benefit for the foreseeable future. You claim this credit using Form 8844.

New Markets Tax Credit (NMTC):

The New Markets Tax Credit (NMTC) is another powerful small business tax credit that encourages investment in low-income communities. While not a direct hiring credit for businesses, it provides a significant incentive for private investors. The NMTC offers a 39% tax credit over seven years to private investors who fund Community Development Entities (CDEs) that, in turn, invest in businesses and projects located in these areas. This indirectly benefits small businesses by increasing the availability of capital for development and job creation. The NMTC was also made permanent, and the Treasury Department announced changes to its allocations to reflect increased investments in rural and non-metro communities. Investors claim this credit using Form 8874.

State-Specific Hiring Credits: The California Example

While our primary focus is on federal small business tax credit programs and those relevant to our operations in Austin and Travis County, it’s worth noting that many states also offer their own unique hiring incentives. For instance, the California Small Business Hiring Tax Credit, enacted by Senate Bill 1447, provided qualified small business employers a $1,000 corporate or personal income tax credit for each net increase in qualified employees, not to exceed $100,000 per employer. This program had a total fund of $100 million and specific eligibility criteria, including a significant decrease in gross receipts during a particular period.

This example illustrates that local and state governments often provide additional opportunities for tax relief. We highly recommend that businesses in Austin, Travis County, and across the United States investigate any specific hiring or investment credits offered by their respective state and local authorities. These can often complement federal credits and further reduce your overall tax burden.

Rewarding Investment in Your Team and Innovation

Beyond hiring, many small business tax credit programs reward businesses for investing in their employees’ well-being, providing benefits, and fostering innovation. These credits help businesses grow, retain talent, and remain competitive.

Credits for Employee Health and Retirement Benefits

Offering competitive health and retirement benefits can be a significant expense for small businesses, but federal tax credits can help offset these costs.

Small Business Health Care Tax Credit:

This small business tax credit is designed to make offering health insurance more affordable. To qualify, you must:

- Have fewer than 25 full-time equivalent (FTE) employees.

- Pay average annual wages below an inflation-adjusted limit (e.g., $66,600 in 2025).

- Offer a qualifying health insurance plan through the Small Business Health Options Program (SHOP) Marketplace.

- Pay at least 50% of your employees’ premium costs.

Eligible businesses can receive up to 50% of their premium contributions back (35% for tax-exempt employers). We recommend exploring the IRS’s Small Business Health Care Tax Credit page for full details. To claim this credit, you’ll need to file Form 8941, Credit for Small Employer Health Insurance Premiums, and report it on Form 3800, General Business Credit.

Credit for Small Employer Pension Plan Startup Costs:

Encouraging small businesses to offer retirement plans, this small business tax credit helps offset the administrative costs of setting up a new plan. The original credit was worth up to $500, or 50% of your startup costs, and could be claimed for the first three years of your plan.

The SECURE 2.0 Act of 2022 significantly expanded this. Now, eligible employers with 50 or fewer employees can receive a credit up to 100% of qualified startup costs for the first three years of a new retirement plan. Additionally, small businesses that add automatic enrollment to a new or existing retirement plan will receive a separate $500 tax credit per year, for up to three years. You can claim both of these credits with Form 8881. More information is available on the IRS’s Small Employer Pension Plan Startup Credit page.

How the R&D Small Business Tax Credit Fuels Innovation

The Credit for Increasing Research Activities, commonly known as the R&D tax credit, is a powerful small business tax credit that incentivizes innovation across various industries. It’s a commonly missed opportunity for businesses engaged in developing new products, processes, software, or improving existing ones.

How it works:

This credit rewards businesses for qualified research activities that are technological in nature and aim to eliminate uncertainty. While available to businesses of all sizes, it’s particularly valuable for small businesses, especially startups, that might not have a significant income tax liability.

For eligible small businesses (those meeting the gross-receipts eligibility guidelines), a portion of the R&D credit can be used to offset payroll tax liability instead of income tax. This means even if you’re not profitable yet, you can still benefit from the credit. The Inflation Reduction Act (IRA) of 2022 further improved this. For tax years beginning after December 31, 2022, the maximum amount of payroll tax research credit that a qualified small business can elect to apply against payroll tax liability increased from $250,000 to $500,000. It also expanded its application to include the employer’s portion of Medicare tax, in addition to Social Security tax.

To claim the R&D tax credit, you’ll need to file Form 6765, Credit for Increasing Research Activities, with your federal tax return. Small businesses offsetting payroll tax liability will also use Form 8974. The IRS provides comprehensive information on the Qualified small business payroll tax credit for increasing research activities.

Family-Friendly Workplace Credits

Supporting employees with family responsibilities can also lead to valuable small business tax credit opportunities, fostering a more family-friendly work environment.

Employer-Provided Childcare Tax Credit:

This small business tax credit encourages businesses to provide childcare facilities and services for their employees. If you incur qualified childcare expenses, you can claim a credit equal to 25% of those expenses, plus 10% of qualified childcare resource and referral expenditures. This credit is capped at $150,000 per tax year. To claim it, you’ll use Form 8882, Credit for Employer-Provided Child Care Facilities and Services.

Employer Credit for Paid Family and Medical Leave:

This credit incentivizes employers to offer paid family and medical leave to their employees beyond what might be required by state or local law. To qualify, you must have a written policy that offers at least two weeks of paid family and medical leave annually, with a minimum 50% wage replacement, to eligible employees.

The credit amount ranges from 12.5% to 25% of wages paid, depending on the wage-replacement percentage provided, for up to 12 weeks per eligible employee. This credit was made permanent in July 2025. You can claim this credit using Form 8994.

A Guide to Claiming Your Small Business Tax Credit

Navigating small business tax credit can feel like a maze, but with the right information and forms, you can open up significant savings. The key is identifying which credits apply to your business, understanding their specific requirements, and filing the correct IRS forms.

| Credit Name | Purpose | Potential Value | Primary IRS Form |

|---|---|---|---|

| Employee Retention Credit (ERC) | Retain employees during COVID-19 | Up to $28,000 per employee | Form 941-X |

| Work Opportunity Tax Credit (WOTC) | Hire individuals facing employment barriers | $2,400 to $9,600 per eligible new hire | Form 5884 |

| R&D Tax Credit (Payroll Offset) | Incentivize innovation and research | Up to $500,000 against payroll tax | Form 6765, 8974 |

| Small Business Health Care Tax Credit | Help afford employee health insurance | Up to 50% of premiums paid | Form 8941 |

| Small Employer Pension Plan Startup Costs | Encourage offering retirement plans | Up to 100% of startup costs + $500 for auto-enrollment | Form 8881 |

| Employer Credit for Paid Family/Medical Leave | Incentivize paid family/medical leave | 12.5% to 25% of wages (up to 12 weeks) | Form 8994 |

| Disabled Access Tax Credit | Make premises accessible for individuals with disabilities | Up to $5,000 | Form 8826 |

The General Business Credit (Form 3800)

Many of the individual small business tax credit discussed above are actually components of a larger umbrella credit known as the General Business Credit. The IRS’s General Business Credit is a collection of over 30 business credits designed to support various business activities, from investing in renewable energy to hiring specific workers.

Instead of claiming each credit separately and potentially facing multiple limitations, the General Business Credit consolidates these incentives into a single amount. This streamlines the process and ensures that the total credit doesn’t exceed your tax liability. Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. It may also be increased by the carryback of business credits from later years.

The General Business Credit is generally non-refundable, meaning it can reduce your tax liability to zero, but you won’t get a refund for any excess. However, a significant advantage is its flexibility: unused portions of the credit can often be carried back one year or forward up to 20 years, allowing you to leverage the benefits over time. You typically claim the General Business Credit by using Form 3800 along with the specific forms for each underlying credit. The IRS provides a comprehensive list of business tax credits that fall under this umbrella.

Other Valuable Credits to Explore

Beyond the major credits we’ve covered, several other small business tax credit programs can offer significant savings for specific business activities or investments.

Disabled Access Tax Credit: This credit helps eligible small businesses cover the costs of making their premises more accessible for individuals with disabilities. This includes expenses for removing barriers, providing interpreters, or purchasing accessible equipment. The credit covers 50% of eligible access expenditures between $250 and $10,250, with a maximum credit of $5,000. You can claim this credit using Form 8826, Disabled Access Credit.

Clean Vehicle Credit: While the Qualified Plug-in Electric and Electric Vehicle Tax Credit and Alternative Motor Vehicle Tax Credit have expired for vehicles purchased after December 31, 2021, the federal government now offers the Clean Vehicle Credit for new, qualified plug-in electric vehicles (EVs) and fuel cell electric vehicles (FCEVs) purchased in 2023 or after. This credit can be up to $7,500, depending on the vehicle’s battery capacity and other criteria. The EPA provides a handy calculator to help you estimate your potential credit. Starting in 2024, businesses can even transfer this credit to dealers at the point of sale, effectively reducing the purchase price upfront.

Alternative Fuel Tax Credits: Businesses that invest in alternative fuels or related infrastructure can also benefit from specific tax credits. These include:

- Biodiesel and Renewable Diesel Fuels Credit: Claimed on Form 8864, Biodiesel and Renewable Diesel Fuels Credit.

- Alternative Fuel Vehicle Refueling Property Credit: For property used to dispense alternative fuels, claimed on Form 8911, Alternative Fuel Vehicle Refueling Property Credit.

- Alcohol and Cellulosic Biofuel Fuels Credit: Claimed on Form 6478, Alcohol and Cellulosic Biofuel Fuels Credit.

Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips: This credit is available to employers in the food and beverage industry who pay Social Security and Medicare taxes on tips received by their employees. It allows businesses to claim a credit for the amount of employer Social Security and Medicare taxes paid on tips that exceed the amount needed to satisfy federal minimum wage requirements. You can claim this credit using Form 8846, Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips.

Conclusion

Understanding and leveraging small business tax credit programs is a powerful strategy for optimizing your financial health. These dollar-for-dollar reductions in your tax liability can free up capital for reinvestment, expansion, or simply improving your bottom line. From pandemic relief measures like the Employee Retention Credit to ongoing incentives for hiring, innovation, and employee benefits, the opportunities are vast.

The key to success lies in proactive tax planning and meticulous record-keeping. We encourage you to explore every potential credit that applies to your business activities. While the rules can be complex, the financial rewards are well worth the effort.

At SFG Capital, we’ve seen how crucial these credits can be for businesses, especially when navigating complex programs like the Employee Retention Credit. We specialize in helping businesses like yours in Austin and Travis County expedite their ERC refunds, offering advances and expert guidance to ensure you secure your funds faster and maintain compliance. Don’t leave money on the table—take advantage of every small business tax credit available to you.

Get expert help to expedite your ERC refund and secure your funds faster