Understanding the Employee Retention Credit: It’s a Refund, Not a Loan

The Employee Retention Credit loan is a common search term, but it’s based on a fundamental misunderstanding. The Employee Retention Credit (ERC) is not a loan at all—it’s a refundable tax credit that you don’t have to pay back.

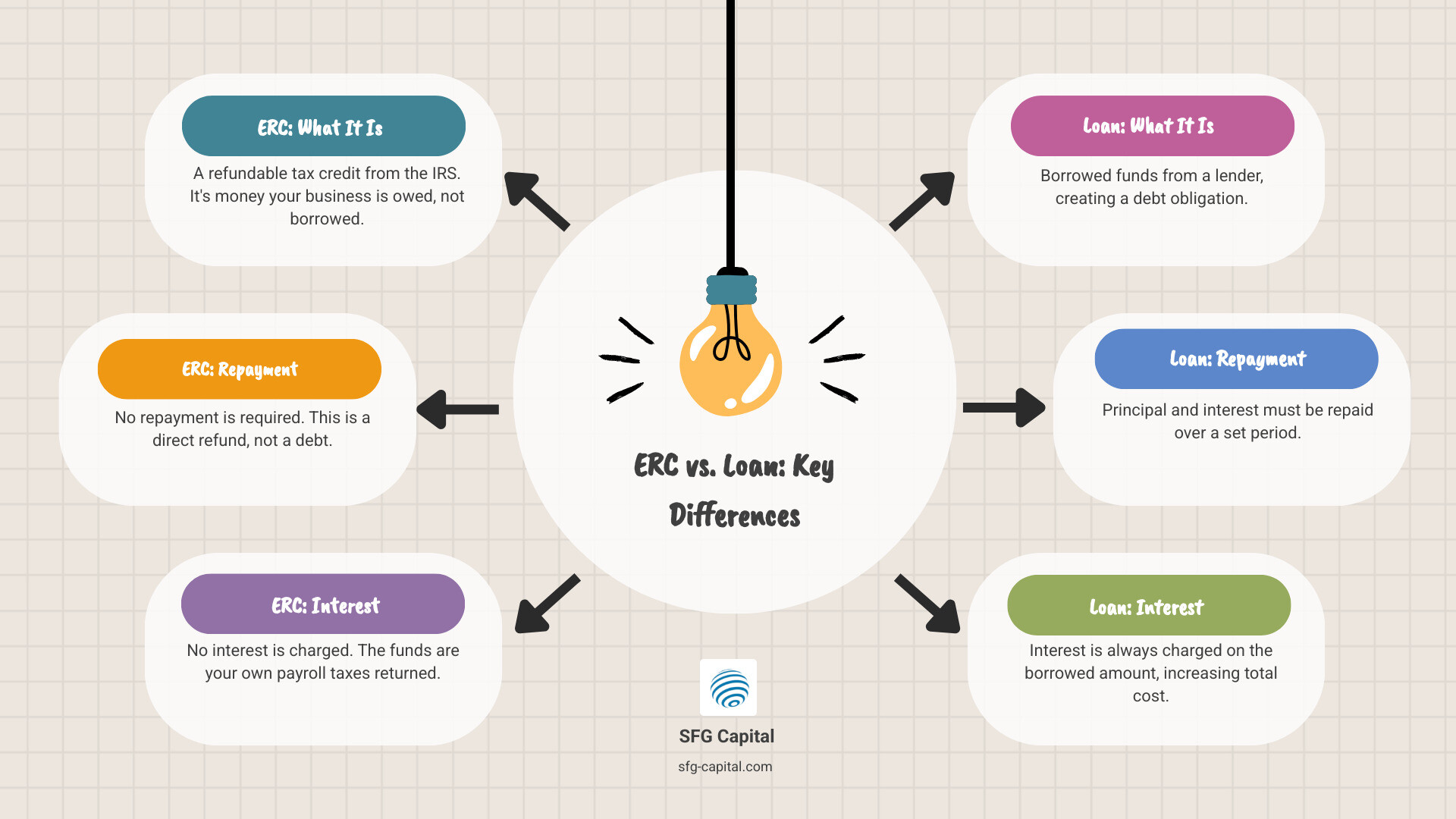

Quick Answer: Key Differences Between ERC and a Loan

| Feature | Employee Retention Credit | Traditional Loan |

|---|---|---|

| Repayment Required? | No | Yes |

| Interest Charged? | No | Yes |

| What It Is | Refundable tax credit/refund from the IRS | Borrowed money |

| Eligibility Based On | COVID-19 business impact (shutdowns, revenue decline) | Creditworthiness |

| Application Process | Amended payroll tax returns (Form 941-X) | Loan application |

The confusion around “Employee Retention Credit loan” comes from two sources. First, the ERC process is complicated and takes time—often up to a year to receive your refund from the IRS. Second, some companies offer advance funding or purchase of your ERC claim while you wait for the IRS, which is a financial transaction but still doesn’t make the ERC itself a loan.

Here’s what the ERC actually is: A refundable payroll tax credit created by the CARES Act in March 2020. If your business kept employees on payroll during COVID-19 shutdowns or revenue declines, you can claim back a percentage of the wages you paid them. The credit can be worth up to $26,000 per employee across 2020 and 2021.

The ERC is essentially money you’ve already paid to the IRS coming back to you. When you paid payroll taxes during the pandemic, you were entitled to this credit. Filing for it now means you’re claiming a refund you’re owed—not borrowing money.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer the Employee Retention Credit loan confusion while purchasing and funding over $500 million in ERC claims. Many business owners searching for an “Employee Retention Credit loan” are actually looking for ways to access their refund faster while the IRS processes their claim.

Know your Employee Retention Credit loan terms:

ERC vs. Other COVID-19 Relief: Understanding the Key Differences

When the COVID-19 pandemic hit, the U.S. government rolled out a series of relief programs to help businesses steer the unprecedented economic challenges. Among these were the Employee Retention Credit (ERC) and the Paycheck Protection Program (PPP). While both aimed to support businesses and their employees, they functioned very differently. Understanding these distinctions is crucial, especially when people mistakenly refer to an Employee Retention Credit loan.

The ERC was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act of March 2020, and has since been updated and adjusted by subsequent legislation, including the Relief Act, the American Rescue Plan Act (ARPA) of 2021, and the Infrastructure Investment and Jobs Act (IIJA).

ERC vs. PPP: A Side-by-Side Look

The most significant difference is that the ERC is a refundable tax credit, while the PPP was a loan program. This means PPP funds needed to be repaid unless specific forgiveness criteria were met. The ERC, on the other hand, is a direct refund of employment taxes you’ve already paid, with no repayment obligation if claimed correctly.

Key Differences:

- Nature of the Funds:

- ERC: A refundable tax credit against certain employment taxes. It’s essentially a refund from the IRS.

- PPP: A forgivable loan. While it could be forgiven, it originated as debt.

- Repayment:

- ERC: No repayment required. It’s yours to keep.

- PPP: Repayment was required if forgiveness criteria were not met.

- Purpose:

- ERC: To encourage employers to retain employees during the pandemic’s economic downturn.

- PPP: To help businesses keep their workforce employed during the COVID-19 crisis, primarily covering payroll costs.

- Mechanism:

- ERC: Claimed by filing amended payroll tax returns (Form 941-X).

- PPP: Applied for through banks and other lenders.

The Non-Duplication Rule: Can You Claim Both?

Initially, businesses could not claim both the PPP and the ERC. However, subsequent legislation changed this. We’re happy to report that your business can indeed be eligible for both PPP and ERC! This was a significant update, as it allowed many more businesses to benefit from both relief programs.

However, there’s a critical non-duplication rule: you cannot use the same wages to calculate both your PPP loan forgiveness and your ERC. This means that if you used certain wages to maximize your PPP loan forgiveness, those same wages cannot be used again when calculating your ERC.

We advise our clients in Travis County and beyond to carefully review their payroll expenses. It’s often beneficial to allocate as many non-payroll related expenses as possible to your PPP loan forgiveness application first. This leaves more qualified wages available for your ERC calculation, potentially maximizing your total relief. The IRS has provided clear guidance on this, stating that employers may be able to claim the Employee Retention Credit and have a PPP loan, provided the wages are not double-counted.

| Feature | Employee Retention Credit (ERC) | Paycheck Protection Program (PPP) |

|---|---|---|

| Nature | Refundable payroll tax credit | Forgivable loan |

| Repayment | No repayment required | Repayment required if not forgiven |

| Source | IRS (via payroll tax adjustments/refunds) | SBA (via approved lenders) |

| Primary Goal | Encourage retention of employees | Help businesses keep employees on payroll |

| Claim Method | Amended payroll tax returns (Form 941-X) | Loan application through lenders |

| Wages | Qualified wages paid to employees | Payroll costs (primarily wages) |

| Overlap | Can be claimed with PPP, but not for the same wages used for PPP forgiveness | Can be claimed with ERC, but not for the same wages used for ERC |

| Tax Impact | Reduces wage deduction on income tax return | Loan forgiveness is tax-exempt; interest may be deductible |

| Timeline | Wages paid March 2020 – Sept 2021 (Dec 2021 for Recovery Startup Businesses); claimable retroactively | Loans issued 2020-2021; forgiveness applications closed |

Are You Eligible? Navigating the ERC Qualification Maze

Determining eligibility for the ERC is often the most complex part of the process, and it’s where many businesses get tripped up, sometimes leading them to mistakenly search for an Employee Retention Credit loan. There are specific criteria that must be met for each quarter, and these criteria evolved over time with subsequent legislation. We simplify this maze for our clients in Austin, TX, and across the U.S.

Generally, businesses and tax-exempt organizations qualify if they experienced one of the following during 2020 or the first three calendar quarters of 2021 (or Q4 2021 for Recovery Startup Businesses):

- Full or Partial Suspension of Operations due to a government order related to COVID-19.

- A Significant Decline in Gross Receipts.

- Qualified as a Recovery Startup Business (for Q3 and Q4 2021 only).

Household employers and government entities are generally not eligible for the ERC. Sole proprietors aren’t eligible for the ERC on their own wages, but they can claim it for wages paid to unrelated staff on their payrolls. Non-profit businesses, including 501(c)(3) organizations, religious organizations, and churches, can be eligible if they pay employment taxes on wages.

The number of full-time employees also plays a crucial role in determining which wages qualify:

- For 2020 ERC: Businesses with an average of 100 or fewer full-time employees in 2019 were eligible to claim the credit on all wages paid. For those with more than 100 full-time employees, only wages paid to employees not working due to the shutdown or decline in sales qualified.

- For 2021 ERC: This threshold increased to 500 full-time employees in 2019. Businesses with 500 or fewer full-time employees could apply the wages of all employees.

For a deeper dive into the specific requirements for your business, we recommend reviewing our guide on ERC Funding Requirements.

Government Suspension Test

This test applies if your business operations were fully or partially suspended due to a government order limiting commerce, meetings, or travel because of COVID-19.

- Full Suspension: This is straightforward – if a government mandate forced your business to close entirely.

- Partial Suspension: This is where it gets interesting. If a government order limited your ability to operate, even if you remained open, you might qualify. Examples include:

- Capacity restrictions (e.g., restaurants limited to 50% occupancy).

- Operating hours restrictions (e.g., forced early closure).

- Supply chain disruptions caused by a government order that suspended operations of a critical supplier, leading to your own partial suspension. However, the IRS warns that supply chain issues alone do not qualify unless directly linked to a government order.

- Inability to access equipment or perform services due to government mandates.

Crucially, the order must be from a government authority (federal, state, or local), not just guidance or recommendations. Also, if your business could “keep its operations largely intact” remotely (think essential businesses or those easily transitioned to work-from-home), you might not meet this qualification.

Gross Receipts Decline Test

This test compares your business’s quarterly gross receipts to a prior period, demonstrating a significant financial impact from the pandemic.

- For 2020: To qualify for any quarter in 2020, your gross receipts for that quarter must have been less than 50% of your gross receipts for the same calendar quarter in 2019. Once your gross receipts recovered to more than 80% of the comparable 2019 quarter, your eligibility typically ended after that quarter.

- For 2021: The threshold for gross receipts decline was lowered. To qualify for any quarter in 2021, your gross receipts for that quarter must have been less than 80% (a 20% decline) of your gross receipts for the same calendar quarter in 2019. You could also elect to use the immediately preceding calendar quarter to determine eligibility if it showed the required decline.

It’s important to include all gross receipts, such as total sales, net returns and allowances, amounts received for services, and income from investments. However, PPP loans and the ERC itself should be excluded from gross receipts calculations.

Special Cases: Recovery Startup Businesses

Acknowledging that new businesses also faced immense challenges, the American Rescue Plan Act (ARPA) introduced a specific category for “Recovery Startup Businesses” (RSBs). This allowed certain new businesses to claim the ERC for the third and fourth quarters of 2021, even if they didn’t meet the government suspension or gross receipts decline tests.

To qualify as an RSB, a business must have:

- Began carrying on a trade or business after February 15, 2020.

- Annual gross receipts that do not exceed $1 million.

- Not otherwise been eligible for the ERC under the government suspension or gross receipts decline tests.

The ERC for RSBs is capped at $50,000 per quarter, meaning a maximum of $100,000 for both Q3 and Q4 of 2021. This was a lifeline for many new ventures in Travis County that were just starting out when the pandemic hit.

Claiming Your Credit: The “Employee Retention Credit loan” Application Myth

One of the biggest misconceptions we encounter is the idea of an Employee Retention Credit loan application. Let’s be crystal clear: there is no “application” process for the ERC in the traditional sense of applying for a loan or a grant. Instead, eligible businesses claim the credit by amending their payroll tax returns.

This distinction is fundamental. While you might be searching for “ERC funding application,” what you’re actually doing is filing an amended tax form to correct prior payroll tax filings. This is why it’s a credit and not a loan.

How to Claim the ERC: Filing Form 941-X

If your business didn’t claim the credit when you filed your original quarterly employment tax returns (typically Form 941), you can still claim it retroactively. The process involves filing an adjusted employment tax return, most commonly Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, for each quarter your business is eligible.

This form allows you to correct errors on a previously filed Form 941, including claiming credits like the ERC. It requires careful calculation of qualified wages and the resulting credit amount for each applicable quarter.

It’s also important to remember that if you file Form 941-X to claim the Employee Retention Credit, you must reduce your deduction for wages by the amount of the credit for that same tax period. This may require amending your income tax return to reflect the reduced deduction.

For a comprehensive walkthrough of the process, our ERC Funding Application: A Step-by-Step Guide to Claiming Your Credit provides detailed instructions.

How the ERC is Calculated

The amount of ERC your business can receive depends on the year and specific quarter, as the rules changed over time. The credit is based on “qualified wages,” which include not only cash payments but also a portion of the cost of employer-provided health care.

- For 2020: The credit was 50% of up to $10,000 in qualified wages paid per employee for the entire year. This meant a maximum of $5,000 per employee for 2020.

- For 2021: The credit was significantly improved. It became 70% of up to $10,000 in qualified wages paid per employee per quarter for the first three quarters of 2021. This could amount to a maximum of $7,000 per employee per quarter, totaling up to $21,000 per employee for the first three quarters of 2021.

Combined, this means the ERC can be as high as $26,000 per employee ($5,000 for 2020 + $21,000 for 2021). Our ERC Credit Complete Guide dives deeper into these calculations.

Deadlines and Timeframes

While the ERC program for most employers ended on September 30, 2021 (due to the Infrastructure Investment and Jobs Act (IIJA)), businesses can still claim the credit retroactively. The deadlines for doing so are tied to the original filing dates of the employment tax returns:

- For 2020 wages: All 2020 Form 941s are considered filed on April 15, 2021. This provides businesses until April 15, 2024, to claim the ERC for wages paid after March 12, 2020, through December 31, 2020.

- For 2021 wages: All 2021 Form 941s are considered filed on April 15, 2022. This provides businesses until April 15, 2025, to claim the ERC for wages paid January 1, 2021, through September 30, 2021 (or through December 31, 2021, for Recovery Startup Businesses).

These deadlines provide a generous window, but given the IRS processing times, we encourage Travis County businesses not to delay.

Navigating Risks, Penalties, and Delays

While the ERC offers a fantastic opportunity for businesses, it’s not without its complexities and potential pitfalls. The IRS is concerned about a large number of improper claims and is closely reviewing tax returns that claim the credit. This means that navigating the ERC process requires careful attention to detail and an understanding of potential risks, which is why searching for an Employee Retention Credit loan might seem appealing as a shortcut, but it won’t bypass the IRS’s scrutiny of your underlying claim.

IRS Scrutiny and Promoters

The IRS has explicitly warned businesses to be wary of aggressive ERC promoters. These promoters often make unrealistic promises, charge large upfront fees, or base their fees on a percentage of the refund, without thoroughly vetting a business’s eligibility. They might claim “every business qualifies” or pressure businesses into claiming the credit even if they don’t meet the strict criteria.

We’ve seen these red flags firsthand. The IRS is actively identifying and auditing questionable claims, which can lead to significant headaches for businesses down the line.

Here’s a list of common ERC promoter red flags:

- Unsolicited Communications: Aggressive calls, emails, or advertisements.

- Guaranteed Eligibility: Claims that you qualify without a detailed review of your specific business situation.

- Large Upfront Fees: Requiring significant payment before any work is done.

- Percentage-Based Fees: Charging a fee based on a percentage of your refund, which can incentivize over-claiming.

- Pressure Tactics: Urging you to sign quickly or suggesting there’s “nothing to lose.”

- Lack of Transparency: Refusal to explain their methodology or provide documentation.

- Ignoring PPP Interaction: Not asking about or properly accounting for PPP loans.

- Ignoring Government Orders: Claiming eligibility based on general economic downturns without a specific government order or gross receipts decline.

Penalties for Incorrect Claims and Disallowance

If an ERC claim is found to be incorrect or ineligible, the consequences can be severe. Businesses may face:

- Repayment: You’ll have to repay the credit received.

- Penalties: Significant penalties can be assessed for incorrect claims.

- Interest: Interest will accrue on the underpaid taxes.

- Audits: An incorrect claim can trigger an IRS audit, not just for the ERC but potentially for other tax matters.

The IRS has even established a withdrawal program for employers who submitted an ineligible claim but haven’t yet received payment or cashed their refund check. This allows businesses to avoid future audits, repayment demands, penalties, and interest. If your claim is disallowed, and you disagree, you do have the option to request an administrative appeal.

What Happens if an ERC Claim is Disallowed?

If your ERC claim is disallowed, and you had reduced the wage expense on your income tax return for the year the ERC was claimed, you may, in the year your claim disallowance is final, increase your wage expense on your income tax return by the same amount that it was reduced when you made your claim. This means you don’t necessarily have to amend prior year income tax returns, which can be a complex process. This adjustment process helps prevent the need for protective claims for years where the statute of limitations for amended returns is closing.

The IRS views a claimed ERC as a “right or reasonable expectation of reimbursement.” If that reimbursement (the ERC) isn’t received, you can treat it similarly to other expected reimbursements that might have prevented a business expense deduction in the year it was paid or incurred.

The Waiting Game: IRS Delays

Even for correctly filed claims, the IRS is experiencing significant backlogs. We’ve seen that it can take up to a year, or even longer, to receive refund checks from the IRS after filing your amended 941-X payroll tax return. This delay can be challenging for businesses that need immediate working capital. Many businesses in Travis County are looking for solutions to address these delays, which is where services like ours come in. We understand that waiting is hard, and we’ve built solutions to help manage The Waiting Game: Understanding and Overcoming ERC Refund Delays.

Frequently Asked Questions about the Employee Retention Credit loan

We often hear questions that include the term “Employee Retention Credit loan.” Let’s clear up these common confusions with straightforward answers.

Is the Employee Retention Credit a loan I have to pay back?

No, absolutely not! The Employee Retention Credit is not a loan. It is a refundable tax credit, which means it’s essentially a refund from the IRS that you receive for employment taxes you’ve already paid. It’s a grant, not debt, and therefore, it does not have to be paid back, assuming your claim was legitimate and correctly filed. Think of it as money the government owes you, not money you owe the government.

How is the Employee Retention Credit loan amount calculated?

Again, there’s no “Employee Retention Credit loan” amount, but rather a credit amount. The calculation depends on the year:

- For 2020: The credit was 50% of up to $10,000 in qualified wages per employee for the year, maxing out at $5,000 per employee.

- For 2021: The credit was 70% of up to $10,000 in qualified wages per employee per quarter for the first three quarters, leading to a potential maximum of $7,000 per employee per quarter, or $21,000 for the year.

The total maximum credit can be up to $26,000 per employee across both years. Qualified wages include both part-time and full-time employee wages and a portion of health care costs. Independent contractors (1099s) and their compensation are not eligible.

Can I still get an Employee Retention Credit loan if I got a PPP loan?

You can still claim the Employee Retention Credit even if you received a PPP loan, but there’s no “ERC loan” involved. The key rule is that you cannot use the same qualified wages for both your PPP loan forgiveness application and your ERC calculation. We recommend strategically allocating expenses to maximize both benefits. For example, prioritize using non-payroll costs for PPP forgiveness to free up more wages for your ERC claim. This allows your business to benefit from both crucial COVID-19 relief programs.

Conclusion: Secure Your ERC Funds Without the Wait

It’s clear that the Employee Retention Credit loan is a misnomer. The ERC is a valuable refundable tax credit, not a loan, designed to reward businesses that kept their employees on payroll during the unprecedented challenges of the COVID-19 pandemic. It doesn’t need to be repaid, and it can provide substantial funds for eligible businesses.

However, the process of claiming the ERC is complex, and the IRS is currently facing significant delays in processing these claims. For businesses in Travis County and across the U.S. that need access to their funds sooner rather than later, waiting up to a year or more for the IRS to process a refund can be a major challenge.

That’s where SFG Capital steps in. We understand the financial pressures businesses face and the frustration of waiting for funds you’re rightfully owed. We specialize in providing ERC advance funding and buyouts, allowing you to access your ERC funds quickly, often within days, rather than months or years. We handle the complexities, allowing you to focus on what you do best: running your business.

Don’t let the IRS delays hold back your business’s growth or financial stability. If you’re looking for a way to expedite your ERC refund and gain immediate working capital, we can help.

Learn more about our ERC funding process and how we can help your business in Austin, TX, and beyond turn your Employee Retention Credit into immediate cash flow.