Understanding the Employee Retention Credit and How It Works

ERC eligibility criteria determine whether your business can claim this valuable pandemic-era tax credit that provided financial relief to employers who retained employees during COVID-19. Here’s what you need to know:

To qualify for the ERC, your business must meet at least one of these criteria:

- Government Order Suspension – Your operations were fully or partially suspended due to a COVID-19 government order

- Significant Decline in Gross Receipts – You experienced a 50% decline in 2020 (compared to 2019) or a 20% decline in 2021 (compared to 2019)

- Recovery Startup Business – You started your business after February 15, 2020, and had average annual gross receipts under $1 million

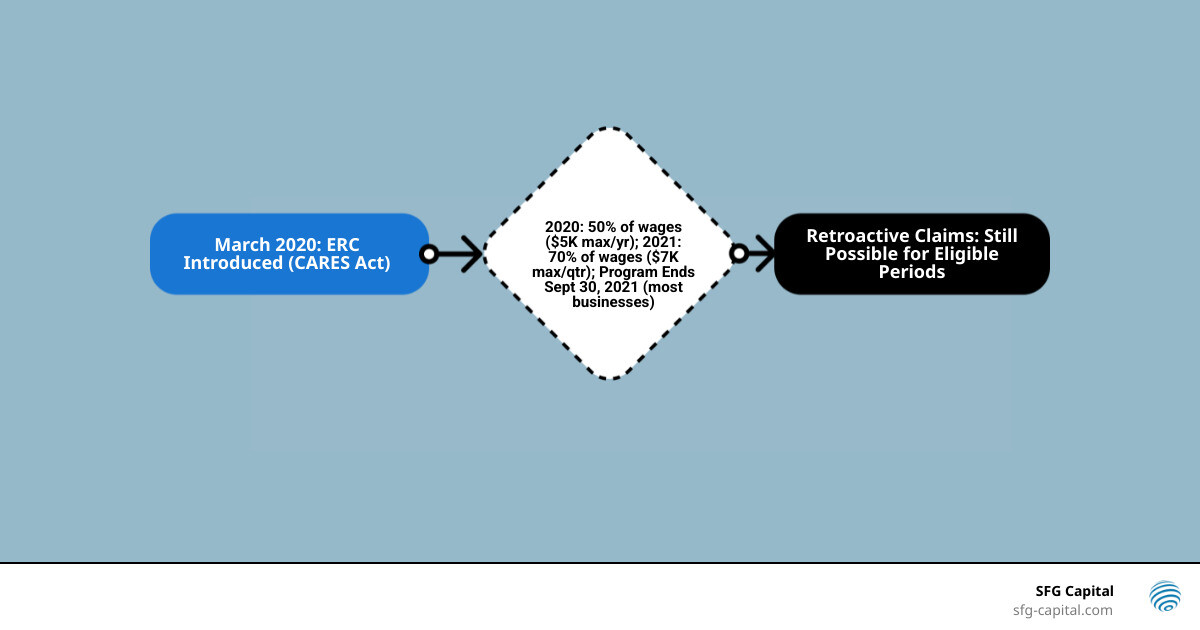

The Employee Retention Credit (ERC) was introduced as part of the CARES Act in March 2020 to incentivize businesses to keep employees on payroll during the pandemic. The credit was worth 50% of qualified wages in 2020 (up to $5,000 per employee) and increased to 70% in 2021 (up to $7,000 per employee per quarter).

While the program officially ended on September 30, 2021 for most businesses, eligible employers can still file retroactive claims for periods when the credit was active. However, the IRS paused processing new ERC claims in September 2023 due to a surge in questionable submissions and concerns from tax professionals about fraudulent “ERC mills” making false promises to businesses.

This creates a challenging situation for legitimate business owners who qualify but face long wait times and complex documentation requirements.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer ERC eligibility criteria and successfully process over $500 million in claims. My experience working with tax professionals and managing ERC transactions has shown me how critical it is to understand these criteria thoroughly and document your eligibility properly.

The Three Paths to Proving ERC Eligibility Criteria

Navigating the ERC eligibility criteria can feel like a maze, but don’t worry, we’re here to guide you. Essentially, the IRS provides three main pathways for businesses to demonstrate their eligibility for the Employee Retention Credit. Your business in Travis County, or anywhere in the U.S., needed to meet at least one of these conditions during the qualifying periods.

These pathways were established to reflect the different ways businesses were impacted by the COVID-19 pandemic, from direct government mandates to economic downturns. Understanding which path applies to your business is the first crucial step in claiming your rightful credit.

Let’s explore each of these scenarios to help you determine if your business qualifies.

1. Suspension of Operations via Government Order

One of the primary ways to meet ERC eligibility criteria was if your business operations were fully or partially suspended due to a government order. This isn’t just about closing your doors entirely; it encompasses a range of impacts that significantly altered your normal business activities.

A “government order” refers to mandates from federal, state, or local authorities, including those in Travis County, that limited commerce, travel, or group meetings due to COVID-19. This could be anything from a direct shutdown order to restrictions on indoor dining, capacity limits, or even curfews.

The key here is demonstrating a “more than nominal” impact on your business operations. This means the portion of your business affected by the order must have accounted for at least 10% of your gross receipts or employee hours in 2019. For example, if a restaurant in Austin was forced to close its dining room but could still offer takeout, that partial suspension could qualify if the dining room revenue was significant.

Even disruptions to your supply chain could qualify you for the ERC. If a government order prevented your suppliers from delivering critical goods, and you couldn’t find alternative suppliers, leading to a partial suspension of your operations, you might meet the ERC eligibility criteria. Similarly, if capacity restrictions limited the number of customers you could serve, or if your employees couldn’t come to work due to government-mandated lockdowns, these situations could also make you eligible.

It’s important to keep thorough records of any government orders that impacted your business, along with documentation showing the direct effect on your operations. An official IRS eligibility checklist can help you understand the requirements.

2. Significant Decline in Gross Receipts

Another common way businesses met the ERC eligibility criteria was by experiencing a significant decline in gross receipts. This criterion aimed to help businesses that, while not necessarily shut down by a government order, suffered financially due to the economic fallout of the pandemic.

“Gross receipts” generally include all income from your business operations, such as sales revenue, interest, dividends, rents, and royalties. The specific percentage decline required varied between 2020 and 2021.

For 2020, your business qualified if its gross receipts for a calendar quarter were less than 50% of its gross receipts for the same calendar quarter in 2019. Once you met this 50% decline, you continued to qualify until your gross receipts for a subsequent quarter were more than 80% of your gross receipts for the same calendar quarter in 2019.

For 2021, the rules became a bit more lenient. Your business qualified if its gross receipts for a calendar quarter were less than 80% of its gross receipts for the same calendar quarter in 2019. This means a 20% decline was enough to qualify.

The IRS also provided an alternative quarter election rule. For example, to determine eligibility for Q1 2021, you could compare Q4 2020 gross receipts to Q4 2019 gross receipts. This flexibility allowed more businesses to qualify, especially if their revenue decline was more pronounced in the immediately preceding quarter.

Here’s a quick comparison of the gross receipts decline rules:

| Year | Comparison Quarter | Required Decline | Example |

|---|---|---|---|

| 2020 | Current Quarter vs. Same Quarter in 2019 | < 50% | Q2 2020 receipts < 50% of Q2 2019 receipts |

| 2021 | Current Quarter vs. Same Quarter in 2019 (or prior quarter vs. same prior quarter in 2019) | < 80% | Q1 2021 receipts < 80% of Q1 2019 receipts |

This pathway is purely financial, focusing on your business’s revenue performance compared to pre-pandemic levels.

3. Qualification as a Recovery Startup Business

For businesses that didn’t experience a government-mandated shutdown or a significant decline in gross receipts, a third pathway to meeting ERC eligibility criteria emerged for certain periods: the Recovery Startup Business provision. This was introduced by the Infrastructure Investment and Jobs Act (IIJA) and specifically targeted newer businesses.

To qualify as a Recovery Startup Business, your business must have:

- Begun operations after February 15, 2020. This means you were a relatively new kid on the block when the pandemic hit.

- Had average annual gross receipts (for the three taxable years preceding the quarter in which the credit is claimed, or for the years in existence if less than three) not exceeding $1 million. This cap ensures the credit targeted smaller, emerging businesses.

If your business met these conditions, you could qualify for the ERC for the third and fourth quarters of 2021, even if you didn’t experience a gross receipts decline or a government order suspension. This provision was a lifeline for many new ventures that were trying to find their footing amidst the ongoing economic challenges.

The Recovery Startup Business provision was an exception to the general expiration of the ERC for most other businesses after September 30, 2021. This means even if your business didn’t qualify under the first two criteria for Q3 and Q4 2021, this specific provision might still apply. You can find more info on what the IRS considers a recovery startup business.

Calculating Your Credit: How Much is the ERC Worth?

Once you’ve determined your business meets the ERC eligibility criteria, the next exciting step is understanding just how much credit you could be looking at. The value of the ERC changed significantly between 2020 and 2021, offering more generous benefits in the later year.

The credit amount is based on “qualified wages,” which include not only cash wages but also certain health plan expenses paid by the employer. However, there are per-employee limits that dictate the maximum credit you can claim for any single employee.

It’s crucial to understand these distinctions, as they directly impact the total refund your business could receive. We’ve seen many businesses in Travis County realize substantial credits once they correctly calculate their qualified wages and apply the right year’s rules. For a deeper dive into all the nuances, you can get a complete guide to the ERC credit.

ERC Value in 2020 vs. 2021

The ERC eligibility criteria and credit values evolved, reflecting the changing landscape of the pandemic and the government’s response.

For 2020:

- The credit was equal to 50% of qualified wages paid to each employee.

- The maximum amount of qualified wages per employee for the entire year was capped at $10,000.

- This meant the maximum credit you could receive for any single employee in 2020 was $5,000.

For 2021:

- The credit became more generous, increasing to 70% of qualified wages paid to each employee.

- The maximum amount of qualified wages per employee was capped at $10,000 PER QUARTER.

- This significantly boosted the potential credit, allowing for a maximum of $7,000 per employee per quarter. If your business qualified for all three quarters of 2021 (Q1, Q2, Q3), that could amount to up to $21,000 per employee for that year alone!

This difference is substantial, highlighting why a thorough review of both years is essential when assessing your potential ERC refund.

How Employer Size Affects ERC Eligibility Criteria

The size of your business played a critical role in determining what wages qualified for the ERC, especially when it came to whether you could include wages paid to employees who were actually working. This distinction is one of the more complex aspects of ERC eligibility criteria.

The key thresholds for determining employer size were based on the average number of full-time employees (FTEs) in 2019:

-

For 2020: The threshold was 100 full-time employees.

- Small employers (100 or fewer FTEs): If your business had 100 or fewer FTEs in 2019, all wages paid to all employees during an eligible period qualified for the credit, regardless of whether those employees were providing services or not. This was a huge benefit for small businesses.

- Large employers (more than 100 FTEs): If your business had more than 100 FTEs in 2019, only wages paid to employees not providing services due to a government order or gross receipts decline qualified for the credit. You couldn’t claim the credit for employees who were actively working and generating revenue.

-

For 2021: The threshold was increased to 500 full-time employees.

- Small employers (500 or fewer FTEs): This expanded definition meant more businesses could qualify under the more favorable rules. If your business had 500 or fewer FTEs in 2019, all wages paid to all employees during an eligible period qualified, regardless of whether they were working.

- Large employers (more than 500 FTEs): Similar to 2020, only wages paid to employees not providing services qualified.

This distinction between small and large employers was critical for calculating the final credit amount. For many businesses in Travis County, understanding these employee count rules was paramount to maximizing their ERC claim. Learning how ERC funding can power your business forward involves accurately applying these nuanced rules.

How to Claim the ERC and Steer IRS Delays

If you’ve determined your business meets the ERC eligibility criteria, the next step is to actually claim the credit. This is typically done by filing an adjusted employment tax return, most commonly Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.

Since the ERC program’s active periods have passed, all claims are now “retroactive claims.” This means you’re filing for past quarters. The filing deadlines for these retroactive claims are time-sensitive. Generally, you have three years from the date you filed your original Form 941 for that quarter. This means the window to claim for 2020 periods has now closed, and the deadlines for 2021 quarters are approaching throughout 2024 and early 2025. Acting quickly is crucial if you believe your business is eligible.

Proper documentation is absolutely critical. The IRS demands thorough records to support your claim, including payroll records, quarterly gross receipts data, copies of any relevant government orders, and detailed calculation worksheets. Without this, your claim could be denied or face significant issues down the line.

We understand that navigating these forms and deadlines can be daunting, especially with the IRS’s current processing situation. If you need help with your ERC claim, our team is ready to assist.

The IRS Processing Pause and What It Means for You

In September 2023, the IRS announced an immediate moratorium on processing new ERC claims. This decision came amidst a surge of questionable claims and concerns from tax professionals, including our own, about aggressive “ERC mills” promoting eligibility to businesses that clearly didn’t qualify. The IRS is working through a significant backlog of pre-moratorium claims and has not announced a firm date for when processing of new claims will resume.

This pause means that any new claim submitted will face an indefinite and lengthy delay. This is a protective measure to safeguard taxpayers from scams and allow the agency to implement new compliance and anti-fraud measures. The IRS has paused new ERC processing to protect taxpayers from scams.

For legitimate businesses in Travis County who genuinely qualify, this processing backlog can be incredibly frustrating. Many businesses are relying on these funds, and the wait can impact cash flow and operations. This is precisely where solutions like ERC refund advances come into play. We can help eligible businesses bridge this gap. Learn how to get an ERC refund advance to keep your business moving forward while you await your official IRS refund.

Avoiding Pitfalls: ERC Scams and Incorrect Claims

The IRS’s processing pause underscores a critical point: the ERC program has unfortunately been a magnet for scams and incorrect claims. While the credit offers a legitimate lifeline for many businesses, unscrupulous promoters have exploited its complexity.

The risks of incorrectly claiming the ERC are significant. If your claim is found to be ineligible during an audit, you could face:

- Repayment: You’ll have to pay back the entire credit amount.

- Penalties: Substantial penalties can be levied for incorrect claims.

- Interest: Interest will accrue on the unpaid amount from the date the credit was received.

The IRS is actively cracking down on these issues. They have outlined clear warning signs of ERC scams to help businesses protect themselves:

- Unsolicited Ads: Receiving calls, texts, emails, or even social media messages from companies you don’t know, pushing ERC claims.

- Promises of Guaranteed Eligibility: No legitimate tax professional can guarantee ERC eligibility criteria without a thorough review of your specific business circumstances.

- Large Upfront Fees: Scammers often demand hefty fees before even assessing your eligibility.

- Pressure to Sign: Being pressured to quickly sign documents or accept refund anticipation loans without fully understanding the terms.

- Fees Based on a Percentage of the Refund: While common in some tax services, this can incentivize ERC mills to inflate claims.

- Claims of Universal Eligibility: Being told that “everyone qualifies” or that a business like yours definitely received the credit without any detailed analysis.

- Promoters Urging You to Claim Without Discussing Your Tax Situation: A legitimate expert will always want to understand your full financial picture.

Our advice is always to exercise extreme due diligence. If something sounds too good to be true, it probably is. Work only with reputable tax professionals who prioritize accuracy and compliance. We pride ourselves on helping businesses steer these complexities responsibly. Find an ERC specialist you can trust to ensure your claim is legitimate and properly documented. The IRS has also established a process for businesses to withdraw incorrect ERC claims if they haven’t yet received or cashed their refund check, which can help avoid future audits and penalties.

Frequently Asked Questions about ERC Eligibility Criteria

We often encounter several common questions from business owners in Travis County and beyond when discussing ERC eligibility criteria. Let’s address some of the most pressing ones.

Can I claim the ERC if I received a PPP loan?

Yes, absolutely! This was a significant change brought about by the Consolidated Appropriations Act of 2021. Initially, businesses couldn’t claim both the ERC and a Paycheck Protection Program (PPP) loan. However, Congress later allowed businesses to claim both.

The key caveat is that you cannot “double-dip.” This means the same qualified wages used to obtain PPP loan forgiveness cannot also be used to calculate your ERC. For example, if you used $100,000 in payroll costs for PPP forgiveness, you must ensure those specific wages are excluded from your ERC calculation. This requires careful planning and precise accounting to avoid issues. Similarly, wages used for other pandemic relief programs, like Shuttered Venue Operators Grants or Restaurant Revitalization Grants, also cannot be included in your ERC calculation.

Did the ERC program expire?

Yes, for most businesses, the ERC program officially expired for wages paid after September 30, 2021. The Infrastructure Investment and Jobs Act (IIJA) retroactively ended the credit for wages paid in Q4 2021, except for one specific category: Recovery Startup Businesses.

Even though the program’s active period has concluded, eligible businesses can still file retroactive claims for periods when the credit was active. However, the filing deadlines are critical. The deadline to file for 2020 tax periods has already passed. For the 2021 tax periods, the deadlines are approaching throughout 2024 and early 2025. It is essential to act quickly to avoid missing the opportunity to claim these valuable credits.

What documentation do I need to support my ERC claim?

Comprehensive documentation is paramount to a successful and defensible ERC claim. The IRS will require evidence for every aspect of your eligibility and credit calculation. Here’s a list of essential documents:

- Payroll Records: Detailed payroll data (Form 941s, payroll registers, W-2s) showing wages paid to each employee during the qualifying periods.

- Quarterly Gross Receipts Data: Financial statements, profit and loss statements, or other records clearly demonstrating your gross receipts for each quarter in 2019, 2020, and 2021.

- Copies of Government Orders: Official government orders (federal, state, or local, including those specific to Travis County) that mandated full or partial suspension of your operations. This includes executive orders, proclamations, or specific guidelines that directly impacted your business.

- Documentation of Impact (for partial suspension): Records showing how the government orders had a “more than nominal” impact on your business (e.g., reduced capacity, supply chain disruptions, inability to access critical goods).

- Health Plan Expenses: Records of amounts paid by the employer for employee health benefits.

- PPP Loan Documentation: Records related to any PPP loans received, including the loan amount, forgiveness application, and documentation of wages used for forgiveness. This is crucial to avoid double-dipping.

- Calculation Worksheets: Detailed worksheets showing how your qualified wages and credit amounts were calculated for each eligible quarter.

- Employee Count Records: Documentation of your average number of full-time employees in 2019 to determine if you were a small or large employer.

Having these documents organized and readily available will significantly strengthen your claim and help you steer any potential IRS inquiries or audits.

Conclusion: Secure Your ERC Refund Without the Wait

Understanding ERC eligibility criteria is a complex but potentially rewarding endeavor for many businesses in Travis County. We’ve outlined the three primary pathways to qualification—government order suspension, significant decline in gross receipts, and recovery startup business—along with the varying credit values and employer size considerations for 2020 and 2021.

While the IRS moratorium on processing new ERC claims has created significant uncertainty and lengthy delays, the opportunity to claim these retroactive credits remains for a limited time. However, the surge in scams and the IRS’s heightened scrutiny mean that accuracy and robust documentation are more critical than ever. Attempting to steer this intricate landscape without expert guidance can lead to costly errors, audits, and significant penalties.

At SFG Capital, we specialize in helping businesses in Travis County efficiently steer the ERC eligibility criteria and secure their rightful refunds. We understand the frustration of IRS delays, which is why we offer solutions like advance funding and buyouts to help you access your capital faster. Our performance-based fee structure ensures our success is tied to yours, providing peace of mind and expert assistance every step of the way. Don’t let the complexity or the wait prevent you from claiming the credit your business deserves.

Get professional help with your Employee Retention Credit claim today!