Understanding the Employee Retention Credit: A Lifeline for Pandemic-Era Businesses

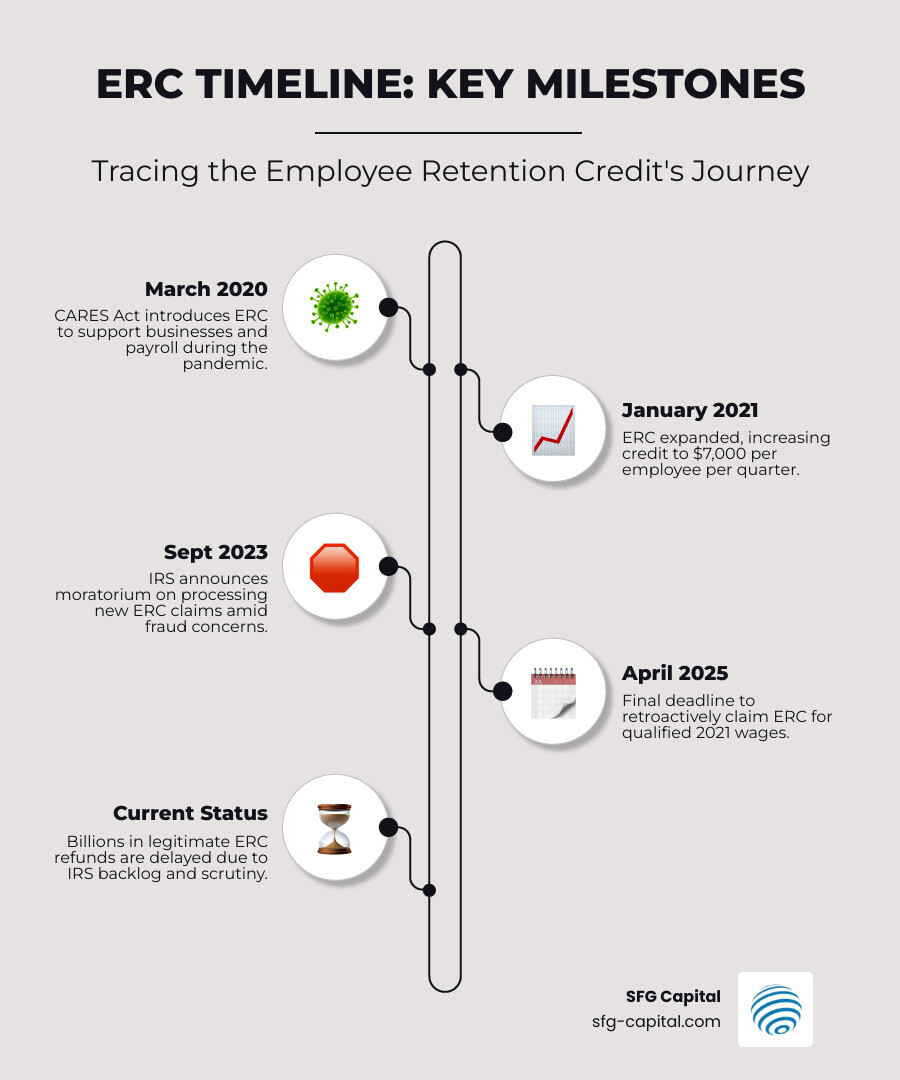

The Employee Retention Credit is a refundable tax credit designed to help businesses that kept employees on payroll during the COVID-19 pandemic. Created under the CARES Act in March 2020, this credit offers eligible employers up to $5,000 per employee for 2020 and up to $21,000 per employee for 2021, depending on when wages were paid and whether the business met specific eligibility requirements.

Quick Facts:

- What it is: A refundable payroll tax credit for businesses affected by COVID-19

- Maximum benefit: $5,000 per employee (2020) or $21,000 per employee (2021)

- Eligibility: Based on government-mandated shutdowns or significant decline in gross receipts

- How to claim: File Form 941-X to amend quarterly payroll tax returns

- Deadline: April 15, 2025 for 2021 wages (2020 deadline has passed)

- Current status: IRS is processing claims slowly due to fraud concerns; approximately 400,000 claims worth $10 billion are in queue

The ERC isn’t entirely new. A similar retention credit existed after Hurricane Katrina in 2005, offering businesses affected by natural disasters a way to recover while keeping workers employed. The COVID-19 version expanded this concept to address the unprecedented economic disruption of the pandemic.

Many business owners are frustrated by the complex eligibility rules, the lengthy IRS processing times, and warnings about fraudulent “ERC mills” that have flooded the market with aggressive marketing. If you’re among the businesses waiting months (or years) for a legitimate refund, you’re not alone.

I’m Santino Battaglieri, and I’ve spent years helping businesses steer the Employee Retention Credit process at SFG Capital, where we’ve purchased and funded over $500 million in ERC claims. My goal is to help you understand whether you qualify, how to claim your credit correctly, and what to expect from the IRS review process.

Are You Eligible? Unpacking the ERC Qualification Rules

Determining eligibility for the Employee Retention Credit is often the trickiest part, and it’s where many businesses either miss out on legitimate claims or, unfortunately, make incorrect ones. The IRS has made it clear that proper documentation and understanding of the rules are paramount. Generally, an employer in the United States, including tax-exempt organizations, can qualify for the ERC through one of two primary paths: either experiencing a full or partial suspension of operations due to a government order, or a significant decline in gross receipts. There’s also a special category for “Recovery Startup Businesses” for certain quarters in 2021.

State and local governments and their instrumentalities are generally not eligible for the ERC. However, many tax-exempt organizations, such as churches and schools, can qualify if they meet the criteria. For instance, we’ve seen numerous non-profits, including those in our home base of Travis County, successfully claim the credit.

Full or Partial Suspension of Operations

This qualification path hinges on whether your business operations were fully or partially suspended due to governmental orders limiting commerce, travel, or group meetings due to COVID-19. This isn’t just about being told to shut your doors completely. A “partial suspension” can be more nuanced and often applies to businesses that could remain open but faced significant restrictions.

For a partial suspension to qualify, the governmental order must have had more than a “nominal impact” on your business operations. What does “nominal impact” mean? The IRS generally considers it nominal if the impacted portion of your business accounts for less than 10% of your gross receipts or employee work hours in 2019. If the impact was greater, you might qualify. For instance, a restaurant in Travis County that was forced to limit indoor dining capacity due to a local health order, even if it offered takeout, could be considered partially suspended.

Supply chain disruptions can also play a role. If a governmental order caused a supplier to your business to suspend its operations, and as a result, you couldn’t obtain critical goods or materials, leading to a partial suspension of your own operations, you might also qualify. This requires careful analysis of the specific facts and circumstances. As experts in this area, we often help businesses steer these complex scenarios. You can dig deeper into this aspect with resources like the IRS’s detailed guidance and articles such as “Employee Retention Credit: Navigating the Suspension Test” which can be found here.

Significant Decline in Gross Receipts

This is often the more straightforward path to eligibility, based on comparing your business’s quarterly gross receipts to a prior period. The rules for this test changed between 2020 and 2021.

Here’s a quick comparison:

| Quarter | 2020 Gross Receipts Test | 2021 Gross Receipts Test |

|---|---|---|

| Eligibility Criteria | Gross receipts decreased by at least 50% compared to the same calendar quarter in 2019. | Gross receipts decreased by at least 20% compared to the same calendar quarter in 2019 (or the immediately preceding quarter in 2021, if it was less than 20% of the 2019 comparable quarter). |

| Qualification End | Ends the earlier of the quarter following the quarter in which gross receipts are greater than 80% of the same calendar quarter in 2019, or December 31, 2020. | Ends the earlier of the quarter following the quarter in which gross receipts are greater than 80% of the same calendar quarter in 2019, or September 30, 2021 (unless a recovery startup business). |

| Example (2020) | If Q2 2020 receipts were $40,000 and Q2 2019 receipts were $100,000, you qualify. | Not applicable for 2020. |

| Example (2021) | Not applicable for 2021. | If Q1 2021 receipts were $70,000 and Q1 2019 receipts were $100,000, you qualify. |

Important Note: For 2021, employers could elect to look at the immediately preceding calendar quarter to determine if they met the 20% decline in gross receipts. For example, to determine eligibility for Q1 2021, you could compare Q4 2020 gross receipts to Q4 2019 gross receipts. This “alternative quarter election” provided more flexibility for businesses whose revenue rebounded slowly.

Other Key Eligibility Factors

Beyond the two main paths, several other factors can impact your Employee Retention Credit eligibility:

- Interaction with PPP Loans: Initially, businesses that received Paycheck Protection Program (PPP) loans couldn’t claim the ERC. However, legislation passed in late 2020 (the Consolidated Appropriations Act) retroactively changed this, allowing businesses to receive both. The crucial caveat is that you cannot use the same wages to qualify for both PPP loan forgiveness and the ERC. We’ve helped many businesses in Travis County strategically allocate wages to maximize both benefits. For a comprehensive overview, our “ERC Credit Complete Guide” provides further details here.

- Other COVID-19 Relief Programs: Similarly, wages used for other COVID-19 relief programs, such as Shutter Venue Operator Grants or the Restaurant Revitalization Fund, cannot also be claimed for the ERC. Careful accounting is essential to avoid double-dipping.

- Recovery Startup Businesses: For the third and fourth quarters of 2021, a special rule allowed “Recovery Startup Businesses” to claim the ERC even without meeting the gross receipts decline or suspension tests. To qualify, a business had to begin operations after February 15, 2020, have average annual gross receipts of less than $1 million, and have at least one employee (excluding owners and their family members). This provision was particularly helpful for new businesses that launched during the pandemic.

Calculating Your Credit: A Breakdown for 2020 and 2021

Once you’ve established your eligibility, the next step is to calculate the amount of Employee Retention Credit you can claim. The rules for calculating the credit, including the maximum potential credit and what constitutes “qualified wages,” also changed significantly between 2020 and 2021. It’s like comparing apples and oranges, but we’re here to help you get the full fruit basket!

Calculating the 2020 Employee Retention Credit

For qualified wages paid between March 13, 2020, and December 31, 2020, the rules were as follows:

- Credit Rate: The credit was equal to 50% of qualified wages.

- Annual Wage Limit: The maximum amount of qualified wages per employee that could be counted for the entire year was $10,000.

- Maximum Credit: This meant that for 2020, an employer could claim a maximum tax credit of $5,000 per eligible employee (50% of $10,000).

For example, if your business paid an eligible employee $15,000 in qualified wages during 2020, you could only count $10,000 of those wages, resulting in a $5,000 credit for that employee.

Calculating the 2021 Employee Retention Credit

The rules became much more generous for qualified wages paid between January 1, 2021, and September 30, 2021 (with some exceptions for Recovery Startup Businesses in Q4 2021):

- Credit Rate: The credit was increased to 70% of qualified wages.

- Quarterly Wage Limit: The maximum amount of qualified wages per employee that could be counted was $10,000 per quarter.

- Maximum Credit: This meant an employer could claim a maximum credit of $7,000 per employee per quarter (70% of $10,000). For the first three quarters of 2021, this could amount to a staggering $21,000 per employee ($7,000 x 3 quarters).

So, if your business paid an eligible employee $10,000 in Q1 2021, $10,000 in Q2 2021, and $10,000 in Q3 2021, you could potentially claim $7,000 for each of those quarters, totaling $21,000 for that single employee in 2021!

What Are Qualified Wages?

“Qualified wages” for the Employee Retention Credit generally include wages subject to FICA tax (Social Security and Medicare) and certain qualified health plan expenses paid by the employer. However, there’s a crucial distinction based on the size of your business, specifically the average number of full-time employees in 2019:

- 2020 Rules (100 or fewer employees): If your business had 100 or fewer full-time employees on average in 2019, all wages paid to all employees during the eligible period qualified for the credit, regardless of whether the employees were actually working or not. This was a huge benefit for small businesses.

- 2020 Rules (More than 100 employees): If your business had more than 100 full-time employees on average in 2019, only wages paid to employees who were not providing services due to the suspension or decline in gross receipts qualified. If an employee was working, their wages did not count.

- 2021 Rules (500 or fewer employees): For 2021, the employee threshold was significantly increased. If your business had 500 or fewer full-time employees on average in 2019, all wages paid to all employees qualified, similar to the small employer rule in 2020.

- 2021 Rules (More than 500 employees): If your business had more than 500 full-time employees on average in 2019, only wages paid to employees who were not providing services qualified.

This distinction is vital for accurate calculations. We often help businesses in Travis County determine their employee count correctly and identify which wages are eligible. For more on what constitutes qualified wages and how funding works, you can check out our guide on “What is ERC Funding?” here.

The Claiming Process, Deadlines, and IRS Delays

After determining eligibility and calculating your potential Employee Retention Credit, the next step is to actually claim it. For most businesses, this involves filing an amended payroll tax return. However, it’s crucial to be aware of the deadlines and the current state of IRS processing, which has seen significant delays.

How to File Your Claim

The Employee Retention Credit is claimed by filing an adjusted employment tax return. For most employers, this means filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund. You’ll use this form to amend your original quarterly Form 941 (Employer’s Quarterly Federal Tax Return) for the periods in which you paid qualified wages.

This retroactive claiming process allows businesses that initially missed out on the credit, or became eligible later, to still receive their funds. The Form 941-X effectively corrects your previously filed payroll tax returns, leading to a refund of overpaid taxes. For detailed guidance on this process, the CBIA offers a helpful article on “How to Claim the Employee Retention Credit” here.

Important Deadlines for Filing

While the Employee Retention Credit program itself largely ended for most businesses on September 30, 2021, the opportunity to claim the credit retroactively extends for several years due to the statute of limitations for amending payroll tax returns.

- Deadline for 2020 Claims: For qualified wages paid in 2020, the deadline to file Form 941-X was April 15, 2024. If you missed this, unfortunately, that window has closed.

- Deadline for 2021 Claims: For qualified wages paid in 2021 (which covers Q1, Q2, and Q3 for most employers, and Q4 for Recovery Startup Businesses), the deadline to file Form 941-X is April 15, 2025. This means there’s still a window of opportunity for many businesses to claim their legitimate credits.

It’s critical to act before these deadlines. Once they pass, you typically lose the ability to claim the credit for those periods.

The Current Status of IRS Processing

We’ve all heard the stories, and unfortunately, we’ve seen it with our clients in Travis County: the IRS is experiencing significant delays in processing Employee Retention Credit claims. In September 2023, the IRS announced an immediate moratorium on processing new ERC claims, citing a “surge of questionable claims” and concerns about fraud. This decision was made to protect taxpayers from scams and allow the IRS to focus on clearing its backlog and conducting compliance checks. You can read more about this in articles like “IRS halts processing of a small business tax break amid ‘surge of questionable claims’” from CNBC here.

While the IRS has indicated they will eventually resume processing claims submitted between September 14, 2023, and January 30, 2024 (as of an August 2024 announcement), the overall processing backlog remains substantial. As of May 2025, the IRS had issued approximately 84,000 letters informing businesses that their ERC claims were partially or fully disallowed, highlighting their increased scrutiny. We’re currently seeing extended wait times, often stretching to many months or even over a year, for refunds to be processed. This “waiting game” can be incredibly frustrating for businesses relying on these funds. For insights into these delays, our article “The Waiting Game: Understanding and Overcoming ERC Refund Delays” offers valuable information here.

Navigating Risks: IRS Warnings and Incorrect Claims

The IRS’s moratorium on processing new claims and its increased scrutiny aren’t just about clearing a backlog; they’re a direct response to widespread issues with fraudulent or incorrect Employee Retention Credit claims. While the ERC can be a legitimate lifeline for businesses, it’s also become a magnet for unscrupulous promoters and erroneous filings, leading to significant risks for taxpayers.

Beware of “ERC Mills” and Fraudulent Promoters

The IRS has been vocal about warning businesses against “ERC mills” – aggressive promoters who often misrepresent eligibility rules and encourage businesses to claim the credit even if they don’t qualify. These promoters frequently appear on the IRS’s “Dirty Dozen” list of tax scams.

Here are some red flags to watch out for:

- Unsolicited Contact: Receiving calls, emails, or texts from unknown parties promoting the ERC.

- Large Upfront Fees or Contingency Fees: Promoters who demand a significant upfront fee or charge a percentage of your refund, especially if they don’t perform a thorough eligibility review.

- Aggressive Marketing: Ads claiming “guaranteed” eligibility or promising unrealistically large refunds.

- No Documentation Review: Promoters who don’t ask for detailed financial records, payroll data, or proof of government orders.

- Oversimplification of Rules: Downplaying the complexity of the eligibility criteria, particularly the partial suspension test.

As Melissa Angell wisely put it in Inc. magazine, “The Employee Retention Credit Is a Great Deal–but Beware ‘ERC Mills'” here. Always consult with a reputable tax professional who understands your business and the intricate tax laws.

Consequences of an Ineligible Claim

The stakes are high if you make an ineligible Employee Retention Credit claim. The IRS is actively increasing audits and criminal investigations related to ERC fraud. As of July 2023, the IRS had 252 investigations into over $2.8 billion of potentially fraudulent claims. If your claim is found to be ineligible, the consequences can be severe:

- Repayment of Credit: You will be required to pay back the full amount of the credit received.

- Penalties and Interest: The IRS can assess substantial penalties and interest on the disallowed amount, which can quickly add up.

- Audits: An ineligible claim can trigger an audit of your entire tax return, not just the ERC portion.

- Criminal Investigations: In cases of deliberate fraud, businesses and individuals can face criminal charges, fines, and even imprisonment.

We understand that mistakes can happen, but the IRS is making it clear that businesses are ultimately responsible for the accuracy of their claims.

How to Correct or Withdraw a Claim

If you’ve realized you made an incorrect Employee Retention Credit claim, or if you were misled by a promoter, the IRS has provided pathways to rectify the situation. It’s always better to self-correct than to wait for the IRS to find an error.

- ERC Claim Withdrawal Process: If you submitted an ERC claim that hasn’t been paid yet, or if you received a refund check but haven’t cashed or deposited it, you might be able to use the IRS’s ERC claim withdrawal process. This allows you to withdraw the claim and avoid future issues, including penalties and interest.

- Amending Returns with Form 941-X: If the withdrawal process isn’t an option (e.g., you’ve already cashed the refund), you can file an amended Form 941-X to reduce the amount of the credit claimed or make other necessary changes. This will typically result in you owing the IRS money back. Instructions for Form 941-X are available directly from the IRS here.

- Impact on Income Tax Deductions: When you claim the ERC, you must reduce your wage expense deduction on your income tax return by the amount of the credit. If your ERC claim is later disallowed, and you had reduced your wage expense, you may increase your wage expense on your income tax return for the year the disallowance is final. This can often be done in a later tax year, avoiding the need to amend prior income tax returns.

Frequently Asked Questions about the Employee Retention Credit

We’ve heard a lot of questions about the Employee Retention Credit over the years. Here are some of the most common ones we encounter, particularly from businesses in Travis County.

How does the ERC affect my business’s income tax return?

When your business claims the Employee Retention Credit, it’s crucial to understand its impact on your income tax return. The IRS requires that you reduce your wage expense deduction by the amount of the credit for the tax year in which the qualified wages were paid. This reduction effectively increases your business’s taxable income for that year. For example, if you claimed a $50,000 ERC for wages paid in 2020, your 2020 income tax return’s wage expense deduction would need to be reduced by $50,000. This is an important consideration for pass-through entities, as it can impact the Qualified Business Income (QBI) deduction.

What records do I need to keep to support my ERC claim?

Maintaining meticulous records is non-negotiable for supporting your Employee Retention Credit claim and protecting your business in the event of an IRS audit. We advise our clients in Travis County to keep the following documents for at least four years:

- Payroll records: Detailed records of all wages paid to employees, including dates, amounts, and employee names.

- Gross receipts reports: Quarterly income statements showing your gross receipts for 2019, 2020, and 2021 to substantiate any decline in revenue.

- Copies of relevant government orders: Documentation of any federal, state, or local governmental orders that led to a full or partial suspension of your operations.

- Documentation of operational impacts: Evidence of how those government orders or gross receipts declines specifically impacted your business operations (e.g., reduced capacity, supply chain disruptions, inability to operate certain business lines).

- Qualified health plan expenses: Records of employer-paid health insurance premiums for employees.

- FTE counts: Documentation of your average number of full-time employees in 2019 to determine which wage rules apply.

- PPP loan documentation: If applicable, records related to your Paycheck Protection Program loan, including the loan amount, forgiveness application, and how wages were allocated between PPP and ERC.

Can I claim the ERC if I also received a Paycheck Protection Program (PPP) loan?

Yes, absolutely! This is one of the most common misconceptions. Initially, the law prevented businesses from claiming both the Employee Retention Credit and a Paycheck Protection Program (PPP) loan. However, the Consolidated Appropriations Act, signed into law in late 2020, retroactively changed this rule. Now, businesses can indeed benefit from both programs.

The key is that you cannot use the same wages for both PPP loan forgiveness and the ERC. You need to carefully track and allocate your qualified wages to ensure there is no double-dipping. For instance, if you paid $100,000 in wages and used $60,000 for PPP forgiveness, the remaining $40,000 could potentially be eligible for the ERC, assuming all other eligibility criteria are met. We often help businesses in Travis County steer this allocation to maximize their benefits from both programs.

Conclusion: Securing Your Credit and Moving Forward

The Employee Retention Credit was a significant relief measure that helped countless businesses in the United States, including many here in Travis County, steer the unprecedented economic challenges of the COVID-19 pandemic. While the claiming period for most businesses has passed, the opportunity to file for 2021 wages remains open until April 15, 2025.

Understanding the complex eligibility criteria, correctly calculating the credit, and carefully documenting your claims are paramount to securing your rightful refund and avoiding potential issues with the IRS. As we’ve discussed, the IRS is currently scrutinizing claims more closely than ever due to a surge in fraudulent filings. This makes due diligence and expert guidance more critical than ever.

Navigating the IRS’s extended processing times can be incredibly challenging for businesses that need access to their funds now. For businesses in Travis County facing these long waits, services like ours at SFG Capital can provide an advance on your expected refund, helping you access your funds faster and put them to work for your business.

We encourage you to consult with a reputable tax professional to ensure your claim is accurate and compliant. If you’re looking for solutions to bridge the gap during IRS refund delays, explore our “ERC Funding Solutions” here.