Why IRS ERC Processing Timelines Matter for Your Business

IRS ERC processing has been one of the most challenging aspects of claiming the Employee Retention Credit. For businesses still waiting on funds, understanding the status of their claim and the reasons for delays is crucial.

Here’s a snapshot of the ERC processing landscape:

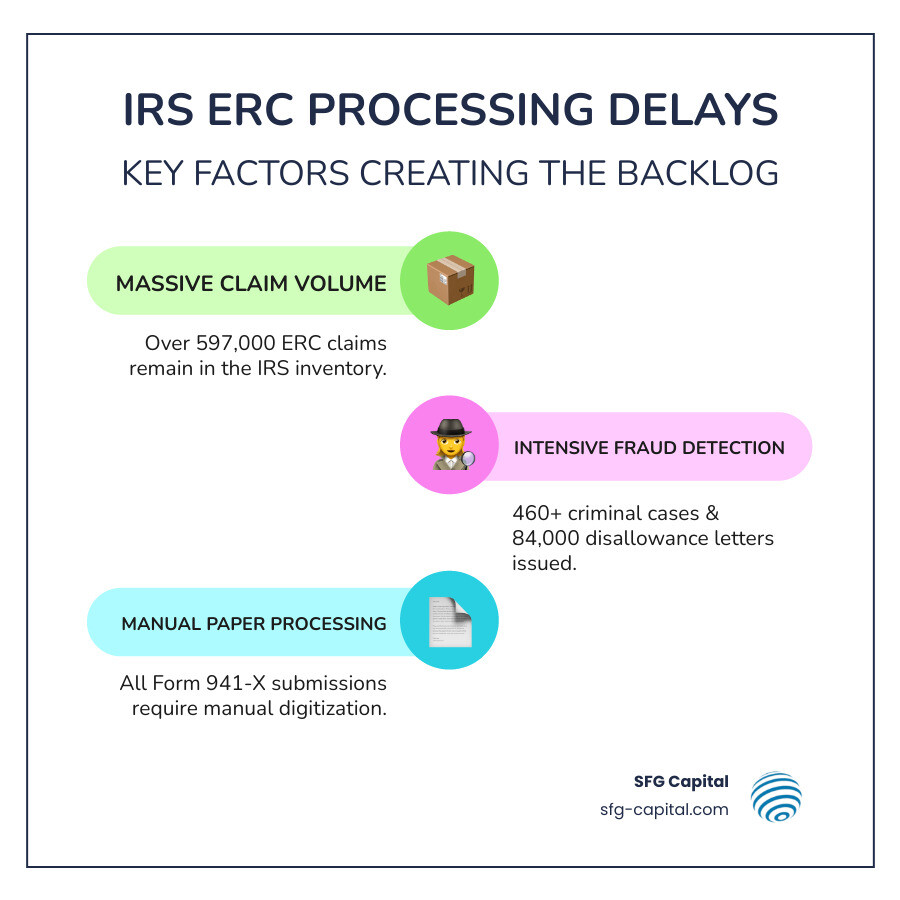

- Massive backlog: At its peak, the IRS faced a backlog of over half a million ERC claims.

- Extended timeline: The IRS projected it would take until the end of 2025 to process all remaining claims, with no specific timeline for individual businesses.

- Intense enforcement: The agency initiated aggressive enforcement, sending tens of thousands of disallowance letters and pursuing hundreds of criminal cases involving billions in potentially fraudulent claims.

- Key delay factors: A claim’s processing time was heavily influenced by its submission date, risk profile, accuracy, and whether it was filed during the processing moratorium (September 14, 2023 – January 31, 2024).

The IRS Commissioner called the ERC “one of the most complex tax administration provisions” ever handled. This complexity, combined with aggressive marketing from “ERC mills” and widespread fraud, created a “perfect storm” that left legitimate businesses waiting months or even years for their refunds.

The massive delays stemmed from the IRS pausing new claims in September 2023 to combat fraud. When processing resumed, it was with a methodical approach to separate legitimate claims from improper ones. This meant thousands of audits and disallowance letters for high-risk claims.

For business owners who filed legitimate claims, these delays created serious cash flow problems. You followed the rules and are still stuck waiting while the IRS works through a backlog created largely by fraudulent promoters.

I’m Santino Battaglieri, and through SFG Capital, I’ve helped businesses steer IRS ERC processing challenges while funding over $500 million in ERC claims. I’ve seen how these delays impact businesses that need their refunds for working capital and understand the realities of waiting for IRS approval.

Current State of Play: The ERC Backlog and IRS Priorities

If you’re a business owner in Travis County still waiting on your Employee Retention Credit (ERC) refund, you’re not alone. The IRS ERC processing landscape has been defined by a significant backlog, intensified scrutiny, and a major effort by the IRS to combat widespread fraud.

The IRS reported an inventory of over 597,000 unprocessed ERC claims in early 2025, with projections that it could take until the end of that year to clear the backlog. This created a long and uncertain wait for businesses relying on these funds. The agency’s primary challenge was twofold: ensuring legitimate businesses received their credits while aggressively combating the rampant fraud from “ERC mills.” These aggressive promoters encouraged many ineligible businesses to apply, overwhelming the system and slowing down processing for everyone. You can read more about the IRS’s efforts to move forward with ERC claims here.

Understanding the IRS ERC Processing Moratorium and Its Aftermath

On September 14, 2023, the IRS announced a moratorium on processing new ERC claims to combat the surge in questionable applications. This pause allowed the agency to implement better fraud detection systems. When processing resumed, it was with a methodical, prioritized approach:

- Low-risk claims: Claims that appeared legitimate were fast-tracked for payment.

- High-risk claims: These were flagged for closer scrutiny, including audits and potential disallowance.

- Claims filed during the moratorium: Claims filed between September 14, 2023, and January 31, 2024, underwent a more thorough review.

This new approach aimed to get funds to legitimate businesses while preventing billions in improper payments. For businesses in Travis County, understanding this shift is crucial for setting realistic expectations. We explore ways to steer these delays in our guide, The Waiting Game: Understanding and Overcoming ERC Refund Delays.

The IRS’s Fight Against Improper Claims

The IRS engaged in a robust enforcement effort against fraudulent ERC claims. Key actions included:

- Intensified Audits: Thousands of audits were launched to scrutinize eligibility, qualified wages, and claim accuracy.

- Disallowance Letters: The IRS sent tens of thousands of disallowance letters for high-risk claims, preventing billions in improper payments. In total, approximately 84,000 returns received letters partially or fully disallowing their claims.

- Criminal Investigations: The IRS Criminal Investigation (CI) division initiated hundreds of criminal cases involving potentially fraudulent claims worth nearly $7 billion, leading to federal charges and convictions.

- Promoter Penalties: The agency also targeted “ERC mills” that advised businesses to claim ineligible credits, with legislation introducing penalties for promoters who failed to meet due diligence requirements.

For genuinely qualified businesses, this increased scrutiny felt like an unfair hurdle. However, the IRS maintained these measures were essential to protect the tax system. If you’re concerned about your claim’s validity or face an audit, seeking expert guidance is paramount. Our team at SFG Capital is here to help businesses in Travis County understand their options and provide Employee Retention Credit Help.

The Step-by-Step IRS ERC Processing Journey

Understanding the journey your ERC claim takes is key to deciphering the IRS ERC processing timeline. It’s a multi-stage process with many potential delays.

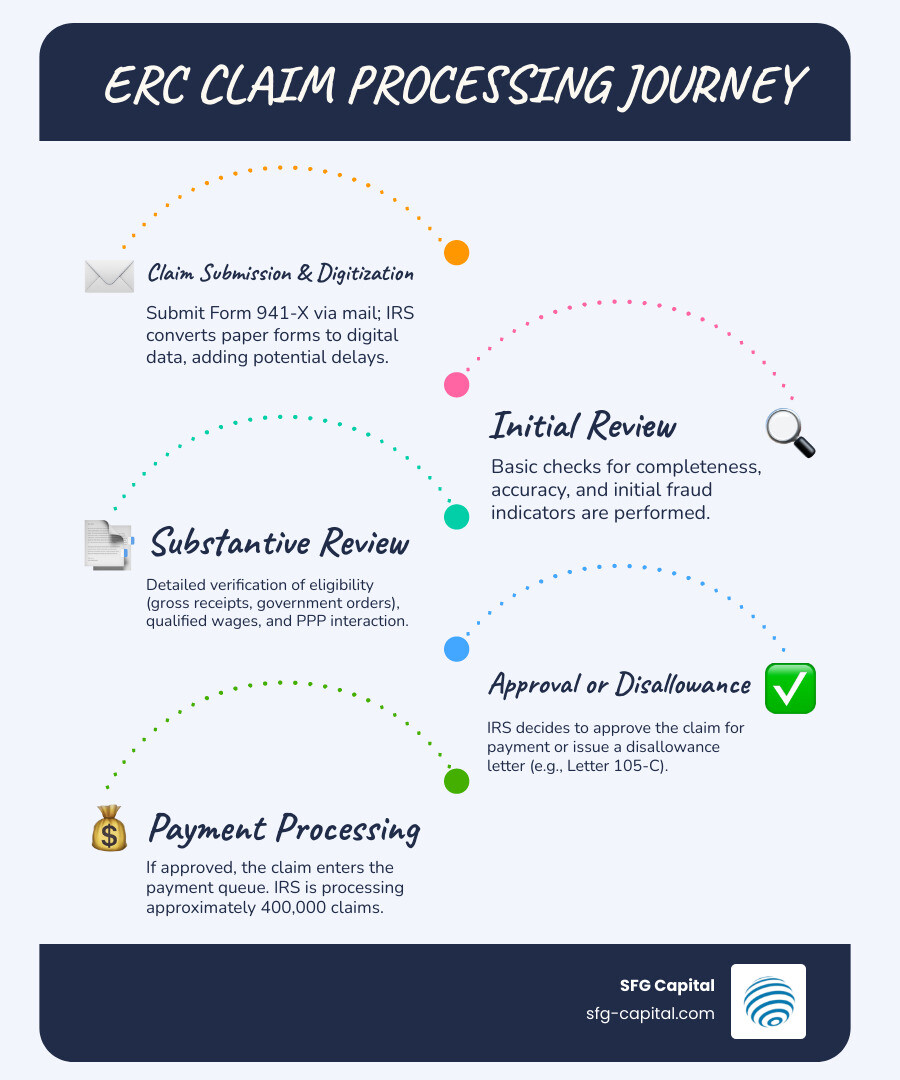

Most ERC claims were filed on paper via Form 941-X. The first hurdle was mail submission and digitization by the IRS, which could add months to the process. Once digitized, a claim entered a multi-stage review:

- Initial Review: Basic checks for completeness and obvious errors.

- Substantive Review: A deep dive into eligibility, including gross receipts tests or government shutdown orders, qualified wage calculations, and interactions with other relief programs like the PPP.

- Approval or Disallowance: The IRS either approved the claim for payment or issued a disallowance letter (like Letter 105-C).

- Payment Processing: Approved claims moved to the payment queue. At one point, the IRS was actively processing a batch of 400,000 claims worth approximately $10 billion.

This complex journey felt like an eternity for many businesses in Travis County. For a deeper dive into accelerating this process, see our insights on Expediting Your ERC Refund: What You Need to Know.

What to Expect During the IRS ERC Processing Review

During its review, the IRS carefully checked several critical aspects of a claim:

- Eligibility Verification: Did the business truly experience a significant decline in gross receipts or a full/partial suspension due to a government order? The IRS required concrete evidence.

- Qualified Wages Calculation: The IRS verified that wages were qualified, within limits, and not used for other programs like PPP loan forgiveness.

- PPP Loan Interaction: A common area of scrutiny was ensuring the same wages were not used for both ERC and PPP loan forgiveness.

- Third-Party Payer Process: The IRS created a consolidated claim process for businesses using third-party payroll providers (PEOs) to help streamline corrections for large numbers of employers.

Any discrepancies or insufficient documentation could lead to significant delays or disallowance, highlighting the importance of a carefully prepared claim.

How Long Does IRS ERC Processing Take?

This is the most frustrating question for business owners, as there was no set timeline. While the IRS worked to accelerate payments for some, individual claims could still take a considerable amount of time.

- 2025 Projection: The IRS projected it could take until the end of 2025 to process the entire backlog, but this was not a guarantee for any specific claim.

- Key Factors: Processing time was heavily influenced by claim accuracy, submission date, and risk profile. Claims with errors or those filed during the moratorium (September 14, 2023, to January 31, 2024) faced longer reviews.

- Individual Variation: Processing times varied wildly, from a few months to over a year. There was no “typical” wait time.

For businesses in Travis County needing immediate access to their ERC funds, waiting until 2025 or beyond was often not feasible. This is where solutions like an ERC Refund Advance can provide a lifeline, allowing you to access a portion of your expected refund now.

Navigating Red Flags: Disallowances, Audits, and Correction Programs

The increased scrutiny in IRS ERC processing meant that even businesses with legitimate claims could encounter red flags, from information requests to full audits or claim disallowances. Understanding how to respond was crucial, as an ineligible claim could lead to penalties, interest, and repayment.

My Claim Was Disallowed: Understanding Letter 105-C

Receiving a Letter 105-C from the IRS officially notifies a business that its ERC claim has been disallowed. This letter explains the reason, such as insufficient documentation or incorrect eligibility.

However, a disallowance is not the final word. Key options include:

- Appeal Rights: You have the right to appeal the decision through the IRS Independent Office of Appeals, a separate body from the division that denied the claim. You can find guidance on how to respond on IRS.gov.

- Wage Expense Adjustment: A critical consequence of a disallowed ERC is its impact on your tax deductions. You were required to reduce your wage expense deduction when you claimed the ERC. If the credit is disallowed, you can increase that wage expense deduction on your income tax return for the year the disallowance becomes final, often without amending the original return. The IRS provides specific guidance on Understanding your Letter 105 C, Claim Disallowed.

If you receive a Letter 105-C, seek professional advice immediately.

Options for Incorrect or Ineligible Claims

The IRS provided avenues for businesses to proactively correct incorrect or ineligible claims, often to avoid harsher penalties.

- Claim Withdrawal Program: For unprocessed claims, this program allowed businesses to withdraw their submission, preventing future audits, repayment demands, and penalties. It was a successful initiative, with thousands of entities withdrawing claims worth hundreds of millions.

- ERC Voluntary Disclosure Program (VDP): For businesses that had already received and cashed an ineligible ERC refund, the IRS offered a VDP. A second VDP, which closed on November 22, 2024, was available for 2021 tax periods. This program offered significant benefits:

- Repay only 85% of the ERC received.

- Avoid interest and penalties on the improper claim.

- Resolve the corresponding income tax issue without amending prior returns.

- Gain protection from an ERC audit for the resolved periods if paid in full.

This program was an excellent opportunity for businesses to get right with the IRS on favorable terms. For businesses in Travis County facing cash flow issues when repaying an ineligible claim, solutions like ERC Bridge Loans can help facilitate repayment.

Key Dates, Deadlines, and Scams to Avoid

Navigating the IRS ERC processing labyrinth required being aware of critical dates and the ever-present threat of scams. Missing a deadline or falling prey to a fraudulent promoter had significant financial repercussions.

Important ERC Dates and Legislation

The ERC program’s lifecycle was shaped by several key legislative and policy deadlines. Understanding these dates remains important for compliance and audit purposes.

- January 31, 2024: A deadline introduced by the “One, Big, Beautiful Bill” (OBBB) that impacted claims for the third and fourth quarters of 2021 filed after this date.

- November 22, 2024: The closing date for the second ERC Voluntary Disclosure Program (VDP), which offered favorable terms for repaying ineligible 2021 ERCs.

- April 15, 2025: The final deadline for filing new ERC claims for the 2021 tax year, officially closing the application window.

- July 4, 2025: The OBBB-mandated cutoff after which the IRS could not refund certain late-filed claims for Q3/Q4 2021. You can find more details in the FAQs on Employee Retention Credits under ERC Compliance Provisions of the One, Big, Beautiful Bill.

These dates marked the IRS’s efforts to conclude the program while managing compliance.

Warning Signs of an ERC Scam

The lucrative nature of the ERC attracted aggressive promoters and scammers (“ERC mills”) who used misleading tactics. Many businesses in Austin and Travis County were targeted. Here are the classic warning signs to watch for:

- Unsolicited Ads: Aggressive and unsolicited calls, emails, or social media ads promising easy refunds.

- Large Upfront or Contingency Fees: Demands for large upfront payments or excessively high fees based on a percentage of the refund.

- Guaranteed Eligibility: Promises that you qualify without a thorough, individualized review of your financial records.

- “No Risk” Claims: Statements that there’s “nothing to lose” by applying, which is false. An ineligible claim can lead to audits, repayment, penalties, and interest.

- Lack of Due Diligence: Promoters who don’t ask for detailed documentation like payroll data or proof of eligibility.

The IRS has consistently urged businesses to be cautious and consult a trusted tax professional. For a guide on what makes a claim legitimate, see our Employee Retention Credit Specialist Guide. If it sounds too good to be true, it probably is.

Conclusion: Taking Control of Your ERC Timeline

The journey through IRS ERC processing has been a long and winding road for many businesses in Travis County. The IRS’s effort to balance payments with fraud detection resulted in significant delays, with projections to clear the backlog extending through 2025. For many, individual timelines remained unpredictable.

For businesses that needed their ERC funds sooner, relying on the IRS’s schedule created severe cash flow challenges. Waiting for months or years strained operations and hindered growth.

At SFG Capital, we understand these challenges intimately. We specialize in helping businesses in Travis County expedite their Employee Retention Credit refunds. While no one can control the IRS’s speed, we provide immediate financial solutions. Our advances and buyouts are designed to bypass IRS delays, giving you quick access to a significant portion of your expected refund. With a performance-based fee and an expert team, our success is tied to yours.

Don’t let the waiting game jeopardize your business’s financial health. If you’re tired of the uncertainty and need your ERC funds, it’s time to take proactive steps. We are here to help you bridge the gap between your ERC claim and the IRS’s extended processing times.

Learn more about how you can Bypass the wait with ERC Advance Funding and take control of your financial future today.